U.S. DNA manufacturing Market Size, Share, Trends, Industry Analysis Report

By Type (Plasmid DNA, Synthetic DNA), By Grade, By Application, By End Use – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5838

- Base Year: 2024

- Historical Data: 2020-2023

Overview

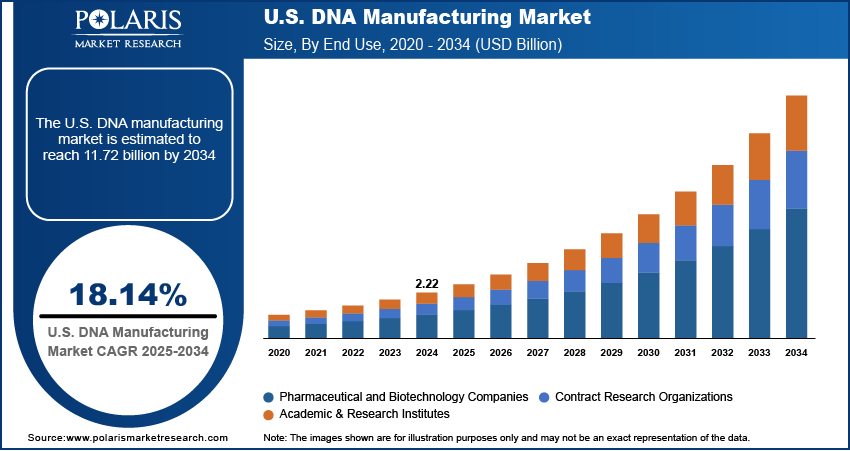

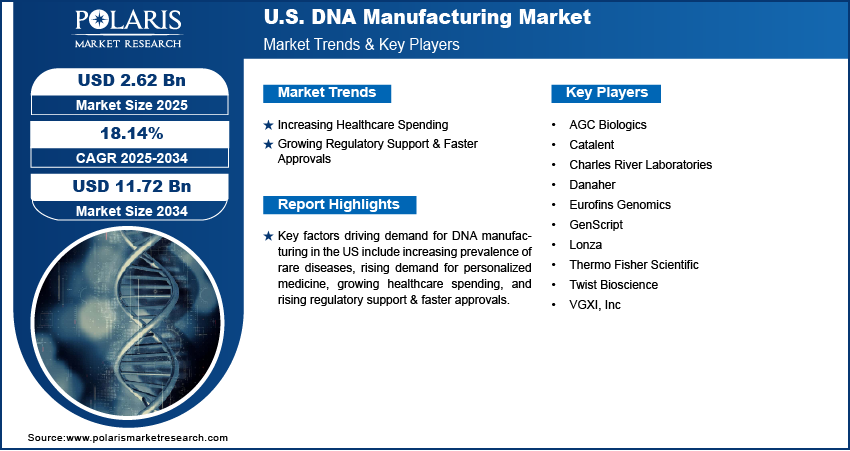

The U.S. DNA manufacturing market size was valued at USD 2.22 billion in 2024, growing at a CAGR of 18.14% from 2025 to 2034. Key factors driving demand for DNA manufacturing in the US include the increasing prevalence of rare diseases, rising demand for personalized medicine, growing healthcare spending, and upsurging regulatory support and faster approvals.

DNA manufacturing refers to the artificial production of DNA molecules, especially plasmid DNA (pDNA), which plays a critical role in biotechnology, medicine, and research. The process involves creating DNA constructs used for genetic manipulation, gene expression, gene editing, and protein production. The scalability and optimization of DNA manufacturing processes are crucial to meet the growing demand for novel therapeutic modalities and vaccines, which rely heavily on high-quality plasmid DNA production.

The increasing prevalence of rare diseases in the US is driving the DNA manufacturing industry growth in the country. The Food and Drug Administration (FDA), in its report, stated that over 7,000 rare diseases affect more than 30 million people in the US Biopharmaceutical companies in the country are actively developing genetic treatments, including gene therapies and DNA-based vaccines, to address growing rare disease conditions. This increase in gene therapies and DNA-based vaccines development is fueling the need for customized manufactured DNA, such as plasmid and synthetic DNA, to design targeted gene therapy interventions. Therefore, as the number of diagnosed rare disease cases grows in the US, companies accelerate clinical research and therapeutic development, which, in turn, increases the requirement for high-quality DNA, leading to market growth.

To Understand More About this Research: Request a Free Sample Report

The U.S. DNA manufacturing market growth is driven by the increasing demand for personalized medicine. Personalized medicine uses a patient’s unique genetic profile to develop customized therapies, requiring customized DNA sequences or molecules for diagnostics, gene editing, and drug development. Companies producing personalized CRISPR-based treatments, CAR-T cell therapies, and mRNA vaccines depend heavily on high-quality manufactured DNA to create these advanced medical solutions. Therefore, as the demand for personalized medicine in the US increases, the market also surges.

Industry Dynamics

Increasing Healthcare Spending

Increasing healthcare spending in the US is driving hospitals, research institutions, and biotech companies to invest more in mRNA vaccines and diagnostics that rely on synthetic DNA. The American Medical Association, in its article, stated that health spending in the US increased by 7.5% in 2023 to $4.9 trillion or $14,570 per capita. Additionally, rising healthcare funding is fueling wider adoption of gene therapies, CRISPR-based treatments, and next-generation sequencing, all of which require high-quality, customized, manufactured DNA. Therefore, the US DNA manufacturing market is growing rapidly with the rising healthcare spending.

Growing Regulatory Support and Faster Approvals

Agencies such as the FDA are streamlining the approval pathways for gene therapies, mRNA vaccines, and CRISPR-based treatments. This is driving biotech companies to bring these innovative treatments and vaccines to patients faster, increasing the need for high-quality, customized manufactured DNA. Regulatory support is also giving DNA manufacturers confidence to invest in large-scale production. Additionally, government incentives for advanced therapies are encouraging more startups and pharmaceutical firms to develop DNA-dependent treatments such as mRNA vaccines, leading to the US DNA manufacturing market expansion.

Segmental Insights

Type Analysis

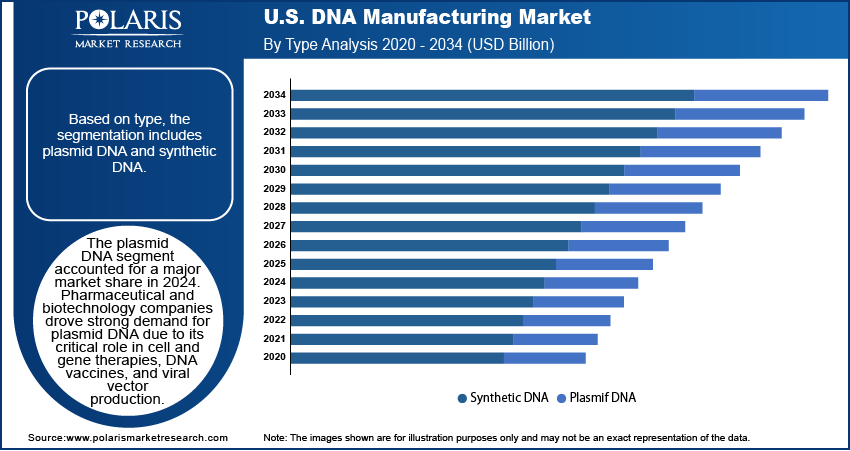

Based on type, the U.S. DNA manufacturing market segmentation includes plasmid DNA and synthetic DNA. The plasmid DNA segment accounted for a major market share in 2024. Pharmaceutical and biotechnology companies drove strong demand for plasmid DNA due to its critical role in cell and gene therapies, DNA vaccines, and viral vector production. These applications require high-quality, GMP-grade plasmid DNA for clinical and commercial use, which prompted increased investments in manufacturing capacity and quality control systems. The growing development of gene therapies and the expansion of mRNA-based vaccine platforms, such as those used during the COVID-19 pandemic, further fueled the need for plasmid DNA.

Grade Analysis

In terms of grade, the segmentation includes GMP grade and R&D grade. The GMP grade segment held a larger market share in 2024 due to increasing demand for high-quality synthetic DNA in therapeutic applications, including mRNA vaccines and therapeutics, gene therapies, and cell-based treatments. The rise in clinical trials for advanced biologics and stringent regulatory requirements contributed to the dominance of GMP-grade DNA. Companies prioritized compliance with FDA and EMA guidelines, ensuring the safety and efficacy of DNA-based therapeutics, which solidified the segment’s dominant position. Additionally, the rapid expansion of personalized medicine propels the adoption of GMP-grade DNA.

Application Analysis

Based on application, the segmentation includes cell & gene therapy, vaccines, oligonucleotide-based drugs, and others. The cell & gene therapy segment dominated the market share in 2024 due to increasing advancements in CRISPR-based gene editing, CAR-T cell therapies, and viral vector production. The increasing prevalence of genetic disorders and cancers, coupled with strong investments in regenerative medicine, pushed demand for high-purity synthetic DNA as a critical raw material. Regulatory approvals for sickle cell disease treatments further contributed to the segment’s dominance. Additionally, biopharma companies expanded their manufacturing capabilities to meet clinical and commercial-scale needs, which propelled reliance on DNA for viral vector and mRNA vaccine development.

End Use Analysis

Based on end use, the US DNA manufacturing market segmentation includes pharmaceutical and biotechnology companies, academic & research institutes, and contract research organizations. The contract research organizations segment is projected to grow at a robust pace in the coming years, owing to the growing trend of outsourcing in drug discovery and clinical trials. Pharmaceutical companies are increasingly partnering with CROs to reduce costs and leverage specialized expertise in synthetic biology and genomics. The rise of personalized medicine and the complexity of novel modalities, such as oligonucleotide therapies, are expanding the role of CROs in process development and analytical testing. Furthermore, the flexibility and cost-efficiency of outsourcing DNA manufacturing for preclinical and early-stage research are projected to drive the segment growth in the coming years.

Key Players and Competitive Analysis

The U.S. DNA manufacturing market is highly competitive, driven by increasing demand for synthetic DNA in biotechnology, pharmaceuticals, diagnostics, and synthetic biology. Key players such as Thermo Fisher Scientific, Twist Bioscience, and GenScript dominate the market with their advanced oligonucleotide synthesis platforms, high-throughput capabilities, and custom DNA services. Thermo Fisher Scientific leverages its extensive distribution network and integrated life sciences solutions to maintain a strong position in the country, while Twist Bioscience is known for its silicon-based DNA synthesis technology, enabling cost-effective, large-scale production. Firms such as Eurofins Genomics, Lonza, and Charles River Laboratories are competing by offering specialized services, including GMP-grade DNA for therapeutics and vaccines.

A few major companies operating in the US DNA manufacturing industry include AGC Biologics, Bionova Scientific, Catalent, Charles River Laboratories, Danaher, Eurofins Genomics, GenScript, Lonza, Thermo Fisher Scientific, Twist Bioscience, and VGXI, Inc.

Key Players

- AGC Biologics

- Bionova Scientific

- Catalent

- Charles River Laboratories

- Danaher

- Eurofins Genomics

- GenScript

- Lonza

- Thermo Fisher Scientific

- Twist Bioscience

- VGXI, Inc.

Industry Developments

May 2025: Aldevron, a global company in the production of DNA, RNA, and protein, announced the manufacture of the personalized CRISPR gene editing drug product to treat an infant with urea cycle disorder (UCD).

June 2024: Bionova Scientific, an Asahi Kasei Medical's subsidiary, announced the launch of a new business line providing services for plasmid DNA. It also revealed that it is establishing a dedicated facility for this purpose in Texas, US

U.S. DNA manufacturing Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Plasmid DNA

- Synthetic DNA

- Gene Synthesis

- Oligonucleotide Synthesis

By Grade Outlook (Revenue, USD Billion, 2020–2034)

- GMP Grade

- R&D Grade

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Cell & Gene Therapy

- Vaccines

- Oligonucleotide-Based drugs

- Others

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Pharmaceutical and Biotechnology Companies

- Academic & Research Institutes

- Contract Research Organizations

U.S. DNA manufacturing Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.22 Billion |

|

Market Size in 2025 |

USD 2.62 Billion |

|

Revenue Forecast by 2034 |

USD 11.72 Billion |

|

CAGR |

18.14% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 2.22 billion in 2024 and is projected to grow to USD 11.72 billion by 2034.

The market is projected to register a CAGR of 18.14 % during the forecast period.

A few of the key players in the market are AGC Biologics, Bionova Scientific, Catalent, Charles River Laboratories, Danaher, Eurofins Genomics, GenScript, Lonza, Thermo Fisher Scientific, Twist Bioscience, and VGXI, Inc.

The plasmid DNA segment dominated the market share in 2024.

The contract research organizations segment is expected to witness the fastest growth during the forecast period.