U.S. Stationary Air Compressor Market Size, Share, Trends, Industry Analysis Report

By Product (Reciprocating, Rotary/Screw, Centrifugal), By Operation Mode, By Lubrication, By Range – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5845

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

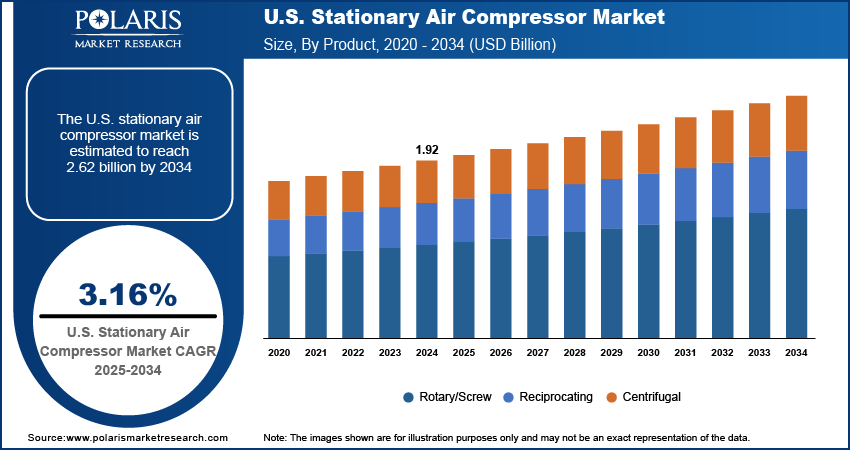

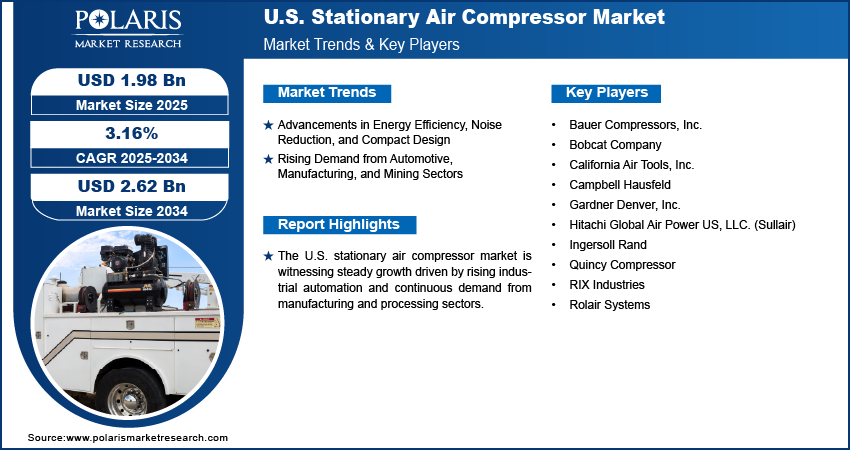

The U.S. stationary air compressor market size was valued at USD 1.92 billion in 2024, growing at a CAGR of 3.16% from 2025 to 2034. The market growth is driven by the rising demand for stationary compressors, providing cost-effective solutions for short-term needs.

Stationary air compressors are non-portable systems installed in a permanent location to provide reliable air power for machinery and production processes. The demand for stationary air compressors is gaining momentum in the U.S. due to the increasing pace of industrialization and construction activities. According to a report from the WHO in December 2023, there has been a 2.3% expansion across global industrial sectors. Also, a March 2025 UNEP report found global building floor space grew by 5 billion square meters, 2% between 2022 and 2023, reaching over 260 billion square meters, reflecting 2.2% growth since 2020. There is a rising need for efficient, mobile air compression solutions to support on-site operations as economies expand and manufacturing bases diversify. These compressors enable the smooth execution of tasks such as drilling, nailing, and painting, making them essential on construction sites and in the industrial sector, where flexibility and reliability are crucial. The convenience of portability allows businesses to reduce operational downtime and improve productivity, further reinforcing their adoption in emerging industrial landscapes.

To Understand More About this Research:Request a Free Sample Report

The rise in infrastructure development and urbanization boosts growth opportunities. Urban expansion projects such as residential and commercial building developments, road construction, and public utility installations require consistent and adaptable pneumatic conveying systems, which stationary compressors effectively provide. The need for compact, efficient, and durable equipment grows as urban planning increasingly incorporates smart cities initiatives and rapid development agendas. This rising urban footprint creates a favorable environment for these air compressors, as they offer operational flexibility across diverse terrains and project scales, making them a strategic tool in modern infrastructure execution.

Industry Dynamics

Advancements in Energy Efficiency, Noise Reduction, and Compact Design

Advancements in energy efficiency, noise reduction, and compact design are driving the U.S. stationary air compressor market opportunities, by improving product functionality and user convenience. Manufacturers are increasingly focusing on developing compressors that consume less power, produce lower noise levels, and are more space-efficient to meet the evolving expectations of end users across sectors. For instance, in October 2023, Kaishan USA launched the KROF series, a two-stage oil-free rotary screw air compressor. The system delivers ISO 8573-1 Class 0 air via intercooling and after cooling, meeting purity demands for sensitive applications. These improvements reduce operational costs and allow for wider applicability in noise-sensitive and confined environments such as residential construction zones or indoor industrial settings. The integration of lightweight materials and smart technologies supports easier handling, transportation, and on-site usage, thereby making modern compressors more attractive to a broader range of users and applications.

Rising Demand from Automotive, Manufacturing, and Mining Sectors

The rising demand from the automotive, manufacturing, and mining sectors is accelerating the adoption of stationary air compressors. These industries rely heavily on pneumatic tools and systems for tasks such as painting, tire inflation, assembly line operations, and drilling, which require reliable and mobile sources of compressed air. In particular, stationary compressors allow greater flexibility and mobility in field operations and maintenance activities, which is critical in sectors such as mining and heavy machinery. The need for high-performance, trans stationary compressors continues to grow as these industries expand and modernize, reinforcing their value as an essential component of industrial productivity and operational efficiency.

Segmental Insights

Product Analysis

The U.S. stationary air compressor market segmentation, based on product, includes reciprocating, rotary/screw, and centrifugal. The rotary/screw segment dominated the market in 2024 due to its ability to deliver continuous, high-pressure air output with superior efficiency. These compressors are particularly favored in demanding industrial and construction environments where consistent operation is essential. Their lower maintenance requirements, higher energy efficiency, and quieter operation compared to reciprocating models have made them the preferred choice for large-scale and commercial applications. The robust design and better adaptability to varying load conditions further contribute to the widespread adoption of rotary/screw compressors across diverse end use sectors.

Operation Modes Analysis

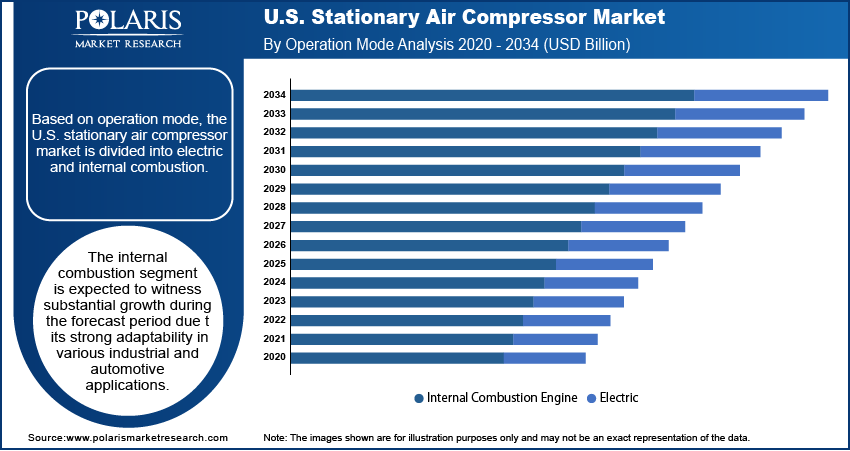

The segmentation, based on operation modes, includes electric and internal combustion engines. The internal combustion engine segment is expected to witness substantial growth during the forecast period due to its strong adaptability in various industrial and automotive applications. Despite the growing focus on cleaner technologies, internal combustion engines (ICEs) continue to offer high power density, proven reliability, and ease of integration across legacy systems. In sectors such as agriculture, mining, and construction, ICE-based systems remain indispensable owing to their capability to operate in off-grid environments where electric alternatives are less viable. Furthermore, ongoing advancements in fuel efficiency and hybridization strategies are helping extend the lifecycle of ICEs. This blend of traditional utility and modern optimization is expected to maintain demand and boost steady expansion in the segment.

Lubrication Analysis

The U.S. stationary air compressor market segmentation, based on lubrication, includes oil free and oil filled. The oil free segment is expected to witness fastest growth during the forecast period due to the rising demand in industries that require clean, contaminant-free air, such as food processing, pharmaceuticals, and electronics. Oil-free compressors eliminate the risk of oil contamination in end products, assuring compliance with strict quality and hygiene standards. Their low maintenance needs and growing compatibility with precision applications further increase their appeal. The shift toward oil-free technologies is expected to accelerate rapidly as sustainability and product purity gain priority in industrial processes.

Power Range Analysis

The segmentation, based on power range, includes up to 20 kW, 21–50 kW, 51–250 kW, 251–500 kW, and over 500 kW. The 20 kW segment is expected to witness fastest growth during the forecast period owing to its optimal balance between compact size and operational output. It is highly suitable for diverse applications in stationary and mobile platforms. This power range is increasingly favored in sectors such as commercial vehicles, off-road equipment, and light industrial machinery, where energy efficiency and performance must be achieved without excessive weight or complexity. The rising adoption of modular and scalable energy systems is also propelling demand in this category, especially in emerging markets with space and budget constraints. Additionally, technological improvements in miniaturization and power electronics are making 20 kW systems more efficient and accessible, accelerating their uptake across various end-use industries.

Key Players and Competitive Analysis

The U.S. stationary air compressor market is experiencing dynamic shifts driven by technological advancements and sustainable value chains, with players such as Atlas Copco and Ingersoll Rand focusing on competitive positioning through energy-efficient designs. Latent demand and opportunities in construction, manufacturing, and emerging sectors such as renewable energy fuel revenue growth. Industry trends highlight a rise in oil-free compressors for eco-sensitive applications, while supply chain disruptions challenge production scalability. Developed markets dominate adoption, but emerging markets show high potential due to infrastructure growth. Strategic investments in IoT-enabled compressors and hybrid models are reshaping future development strategies, with SMEs increasingly adopting compact, cost-effective units. Expert insights highlight expansion and partnership ecosystems to address economic and geopolitical shifts. Competitive intelligence reveals consolidation via joint ventures while disruptive technologies such as AI-driven maintenance gain traction.

A few key players are Bauer Compressors, Inc.; Bobcat Company; California Air Tools, Inc.; Campbell Hausfeld; Gardner Denver, Inc.; Hitachi Global Air Power US, LLC. (Sullair); Ingersoll Rand; Quincy Compressor; RIX Industries; and Rolair Systems.

Key Players

- Bauer Compressors, Inc.

- Bobcat Company

- California Air Tools, Inc.

- Campbell Hausfeld

- Gardner Denver, Inc.

- Hitachi Global Air Power US, LLC. (Sullair)

- Ingersoll Rand

- Quincy Compressor

- RIX Industries

- Rolair Systems

Industry Developments

March 2024: Hitachi Global Air Power US launched the Sullair TS 190-260 Series, a two-stage rotary screw air compressor line. The series achieves top-tier efficiency, verified by CAGI's third-party standards.

March 2023: ELGi North America launched the GP35FP stationary compressors expanding its portable lineup to nine models (35–900 CFM), with the D185T4F.

April 2023: Kaishan USA launched the KRSL series of low-pressure rotary screw air compressors. Featuring the patented SKYv airend, these plug-and-play units operate at 25–45 psig, serving diverse industrial applications.

U.S. Stationary Air Compressor Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Reciprocating

- Rotary/Screw

- Centrifugal

By Operation Mode Outlook (Revenue, USD Billion, 2020–2034)

- Electric

- Internal Combustion Engine

By Lubrication Outlook (Revenue, USD Billion, 2020–2034)

- Oil Free

- Oil Filled

By Power Range Outlook (Revenue, USD Billion, 2020–2034)

- Up to 20 kW

- 21–50 kW

- 51–250 kW

- 251–500 kW

- Over 500 kW

By End Use (Revenue, USD Billion, 2020–2034)

- Manufacturing

- Oil & Gas

- Semiconductor & electronics

- Home Appliances

- Healthcare/Medical

- Food & Beverage

- Energy

- Others

U.S. Stationary Air Compressor Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.92 billion |

|

Market Size in 2025 |

USD 1.98 billion |

|

Revenue Forecast by 2034 |

USD 2.62 billion |

|

CAGR |

3.16% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries and segmentation. |

FAQ's

The market size was valued at USD 1.92 billion in 2024 and is projected to grow to USD 2.62 billion by 2034.

The market is projected to register a CAGR of 3.16% during the forecast period.

A few of the key players in the market are Bauer Compressors, Inc.; Bobcat Company; California Air Tools, Inc.; Campbell Hausfeld; Gardner Denver, Inc.; Hitachi Global Air Power US, LLC. (Sullair); Ingersoll Rand; Quincy Compressor; RIX Industries; and Rolair Systems.

The rotary/screw segment dominated the market in 2024.

The oil free segment is expected to witness the fastest growth during the forecast period.