Pneumatic Conveying Systems Market Share, Size, Trends, Industry Analysis Report

By Operation (Dense Phase Conveying, Dilute Phase Conveying); By Technology; By End-Use; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 119

- Format: PDF

- Report ID: PM4463

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

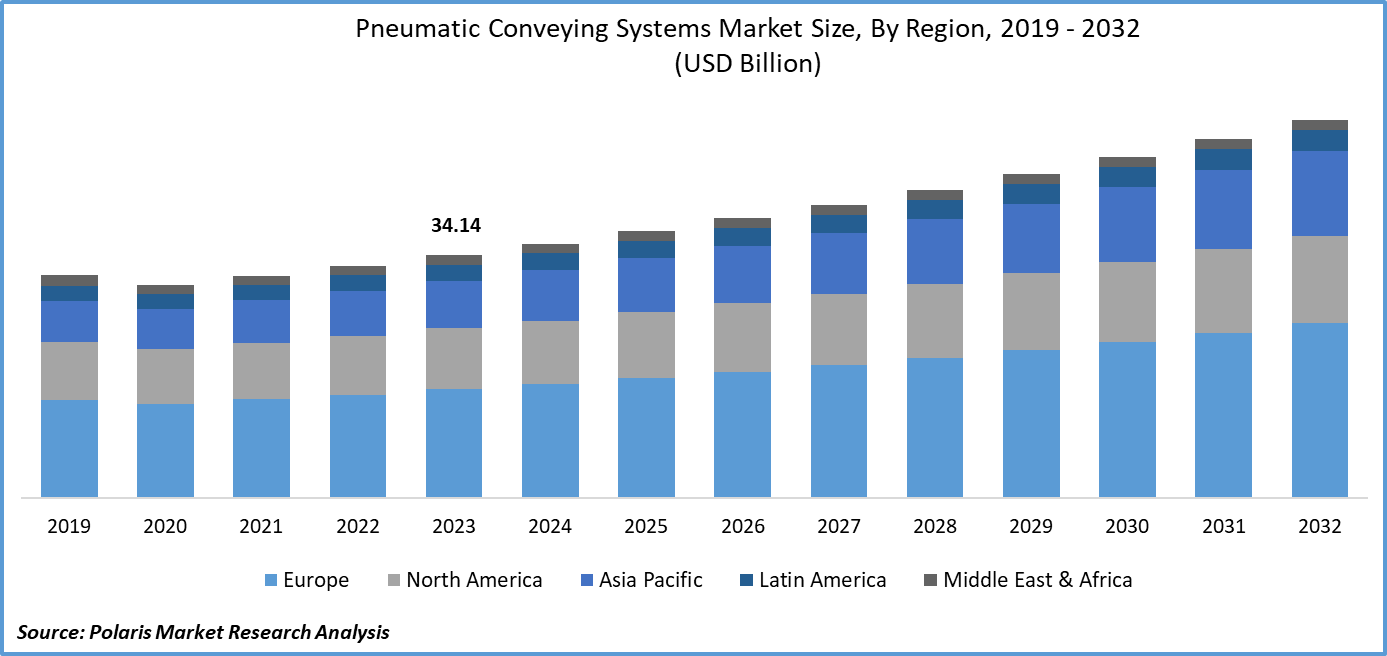

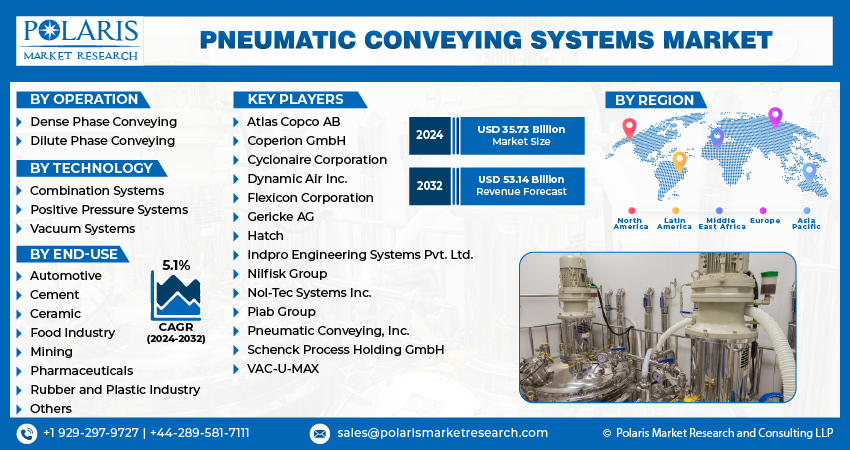

Pneumatic Conveying Systems Market size was valued at USD 34.14 billion in 2023. The market is anticipated to grow from USD 35.73 billion in 2024 to USD 53.14 billion by 2032, exhibiting a CAGR of 5.1% during the forecast period

Industry Trends

Pneumatic conveying systems are a type of material handling system that uses compressed air or gas to move goods, powders, or granular materials through a pipe or tube. These systems are commonly used in industries such as food processing, pharmaceuticals, and automotive, where the transportation of fine particles or sensitive materials requires a clean, efficient, and controlled environment. The process of pneumatic conveying involves the movement of materials through a pipeline using a combination of pressure differential and airflow. The material is fed into the system through an intake point, where it is picked up by a stream of compressed air or gas and carried through the pipeline to its destination.

The global pneumatic conveying systems market size is expected to experience significant growth during the forecast period, driven by increasing demand from various end-use industries such as food and beverages, pharmaceuticals, and chemicals. The rise in automation and technological advancements in manufacturing processes have led to a growing need for efficient material handling systems, which has fueled the adoption of pneumatic conveying systems. In addition, the ability of these systems to handle fragile and sensitive materials with care and maintain their quality has made them an attractive option across several industries.

Nevertheless, the market growth is hindered by the high initial investment costs and energy consumption, which are major concerns for end-use companies. Another challenge faced by the industry is the availability of alternative conveyancing methods, such as mechanical conveyors, which can provide lower upfront costs and simpler maintenance procedures. Despite these challenges, the market is expected to grow at a significant rate. Increasing emphasis on workplace safety and ergonomics has led to a shift towards automated material handling solutions, which has created opportunities for pneumatic conveying system providers. Also, the development of new technologies, such as advanced sensing and monitoring systems, and the integration of Industry 4.0 principles into pneumatic conveying systems will continue to enhance their efficiency and reliability, making them more appealing to end-users.

To Understand More About this Research: Request a Free Sample Report

Key Takeaways

- Europe dominated the market and contributed over 33% of the share in 2023

- By operation category, the dilute phase conveying segment accounted for the dominating pneumatic conveying systems market share in 2023

- By technology category, the vacuum system segment is expected to register a significant CAGR over the pneumatic conveying system industry forecast period

- By end-use category, the food industry segment was the dominating sector in terms of pneumatic conveying systems market share in 2023

What are the Market Drivers Driving the Demand for Pneumatic Conveying Systems Market?

The Growing Emphasis on Automation Within the Industries Drives Market Growth

The increasing focus on automation across various industries is a significant driver of market growth. Automation enables businesses to simplify their operations, reduce labor costs, and enhance efficiency, which has led to a rising demand for advanced conveyancing solutions that can integrate with automated production lines and processes. Pneumatic conveying systems are well-suited to meet this need, as they offer a reliable, efficient, and cost-effective means of transporting materials and products within industrial facilities. As companies continue to adopt automation technologies to increase production and gain economies of scale to stay competitive, the demand for pneumatic conveying systems is expected to grow, particularly in sectors such as food industries, pharmaceuticals, and manufacturing.

Which Factor is Restraining the Demand for Pneumatic Conveying Systems?

The High Cost of Implementation Hinders Market Growth

The high cost of implementation is a significant restraining factor for the market, as the initial investment required to install a pneumatic conveying system is high. The cost of purchasing and installing the necessary equipment, such as blowers, compressors, and tubing, can be substantial for small-scale businesses. In addition, the installation process is complex and time-consuming, requiring specialized labor and expertise, which further adds to the overall cost.

Further, the ongoing operating costs, including energy consumption and maintenance expenses, create hurdles to the adoption of these systems. These factors make it difficult for companies to justify the investment in a pneumatic conveying system, particularly when compared to other methods of material handling that seem less expensive upfront. As a result, the high cost of implementation limits the adoption of pneumatic conveying systems, thereby hindering the growth of the market.

Report Segmentation

The market is primarily segmented based on operation, technology, end-use, and region.

|

By Operation |

By Technology |

By End-Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Category Wise Insights

By Operation Insights

Based on operation analysis, the market is segmented into dense phase conveying and dilute phase conveying. The dense phase conveying segment held the largest pneumatic conveying systems market share in 2023 due to its ability to handle a wide range of materials, including those that are difficult to convey using other methods. Dense phase conveying uses a high-pressure air stream to move particles or objects through a pipe, allowing for efficient and reliable transportation over long distances. This method is particularly useful for handling materials such as powders, granules, and irregularly shaped objects, which can be difficult to convey using other pneumatic conveying methods.

Also, dense phase conveying systems are often more energy-efficient than other methods, which helps reduce operating costs and minimize environmental impact. Overall, the adaptability and efficiency of dense phase conveying make it an attractive option for a variety of industries.

By Technology Insights

Based on technology analysis, the market has been segmented on the basis of combination systems, positive pressure systems, and vacuum systems. The vacuum systems segment is anticipated to grow with a significant CAGR over the pneumatic conveying system industry forecast period, driven by increasing demand for efficient and hygienic material handling solutions in several industries. Pneumatic conveying systems are an essential component of these industries' production processes since the use of vacuum technology in pneumatic conveyors enables the gentle handling of materials, reduces the risk of contamination, and allows for precise control over the flow of materials.

Also, advancements in vacuum technology have led to the development of more energy-efficient and environmentally friendly systems, further driving their adoption in several industries. Thus, the growth of the vacuum systems segment is expected to positively impact the market, as it provides customers with a wider range of options for efficient and sustainable material handling solutions.

By End-Use Insights

Based on end-use analysis, the market has been segmented on the basis of automotive, cement, ceramic, food industry, mining, pharmaceuticals, rubber and plastic industries, and others. The food industry segment accounted for the highest revenue share of the market in 2023 because the food industry is one of the largest and most widespread industries globally, with a wide range of products that require efficient transportation.

Pneumatic conveying systems are particularly well-suited for this purpose since many food products have specific requirements for temperature, humidity, and other environmental conditions during transportation, which pneumatic conveyors can easily maintain. Pneumatic transport systems are highly suitable for use in the food industry as they can be easily cleaned, thus meeting the stringent hygiene requirements of the sector. All these advantages make pneumatic conveying systems an attractive option for food manufacturers, leading to their high adoption rate and revenue share in the market.

Regional Insights

Europe

The European region dominated the global pneumatic conveying systems market share in 2023, accounting for a significant share of the total market revenue. This is because of several factors, including the presence of well-established industries such as food and beverage, pharmaceuticals, and automotive manufacturing, which are major users of pneumatic conveying systems. Also, the region has a strong focus on automation and technological advancements, leading to increased adoption of advanced pneumatic conveying systems that offer improved efficiency, safety, and cost savings. The presence of global players in the region, such as Flexicon Corporation, Pneu-Con, and Gericke AG, has contributed to the growth of the market in Europe.

Asia Pacific

The Asia Pacific region is expected to witness substantial growth in the market over the forecast period because of the thriving pharmaceutical industry in the region. The increased production of biosimilars and vaccines in developing nations, coupled with the government's initiatives to promote better healthcare facilities, has resulted in a rise in the number of facilities dedicated to the production of pharmaceuticals. This shift in the pharmaceutical manufacturing sector from developed to developing regions has created ample growth opportunities for the market in the Asia Pacific region.

Competitive Landscape

The pneumatic conveying systems market is a diverse and competitive industry with several key players competing for market share. The major companies involved in this market include Flexicon Corporation, Atlas Copco AB, Nilfisk Group, and Cyclonaire Corporation. These companies engage in various activities such as product development, mergers and acquisitions, partnerships, and geographical expansion to strengthen their position in the market.

Some of the major players operating in the global market include:

- Atlas Copco AB

- Coperion GmbH

- Cyclonaire Corporation

- Dynamic Air Inc.

- Flexicon Corporation

- Gericke AG

- Hatch

- Indpro Engineering Systems Pvt. Ltd.

- Nilfisk Group

- Nol-Tec Systems Inc.

- Piab Group

- Pneumatic Conveying, Inc.

- Schenck Process Holding GmbH

- VAC-U-MAX

Recent Developments

- In November 2020, Hatch launched PneuCalc 7.0.0, all-in-one software that enables engineers and practitioners who work with pneumatic conveying systems to design and troubleshoot both pressure and vacuum systems efficiently.

- In March 2020, Gericke USA, a process equipment manufacturer, launched the Pulse-Line PTA PL dense phase pneumatic conveying system.

- In December 2021, Piab introduced the piFLOWam vacuum conveyor developed specifically for additive manufacturing. The pillow is made of stainless steel and withstands material temperatures up to 140°F (60°C).

Report Coverage

The Pneumatic Conveying Systems market report emphasizes key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, operation, technology, end-use, and their futuristic growth opportunities.

Pneumatic Conveying Systems Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 35.73 billion |

|

Revenue Forecast in 2032 |

USD 53.14 billion |

|

CAGR |

5.1% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Operation, By Technology, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The Pneumatic Conveying System Market report covering key segments are operation, technology, end-use, and region.

Pneumatic Conveying Systems Market Size Worth USD 53.14 Billion By 2032

Pneumatic Conveying Systems Market exhibiting a CAGR of 5.1% during the forecast period

Asia Pacific is leading the global market

key driving factors in Pneumatic Conveying System Market are growing emphasis on automation within the industries