Hereditary Testing Market Size, Share, Trends, Industry Analysis Report

: By Technology (Cytogenetic, Biochemical, and Molecular Testing), Sample Type, Disease Type, and Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 118

- Format: PDF

- Report ID: PM1774

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

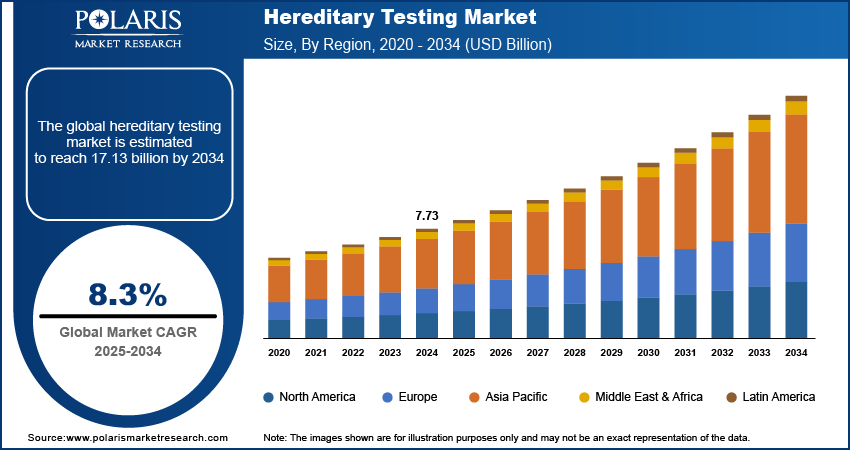

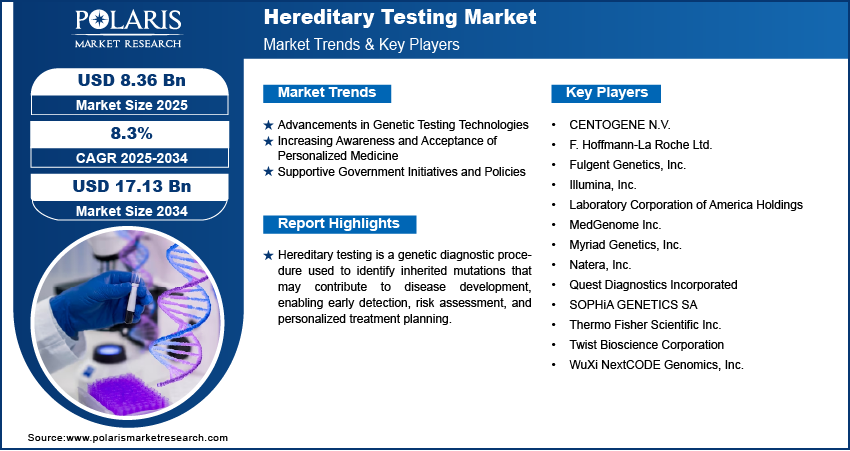

The hereditary testing market size was valued at USD 7.73 billion in 2024, growing at a CAGR of 8.3% during 2025–2034. Increased regulatory support for genetic testing and the expansion of precision medicine initiatives are the key factors fueling market expansion.

Key Insights

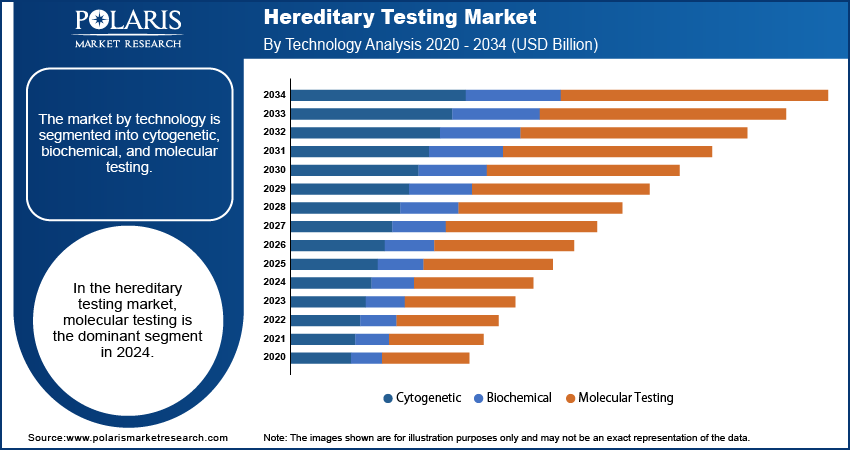

- The molecular testing segment dominated the market in 2024. The rapid adoption of molecular techniques primarily drives the segment’s leading market share.

- The ovarian cancer segment is witnessing significant growth. This is primarily due to the growing recognition of genetic predispositions associated with ovarian cancer, which has increased the demand for genetic testing services.

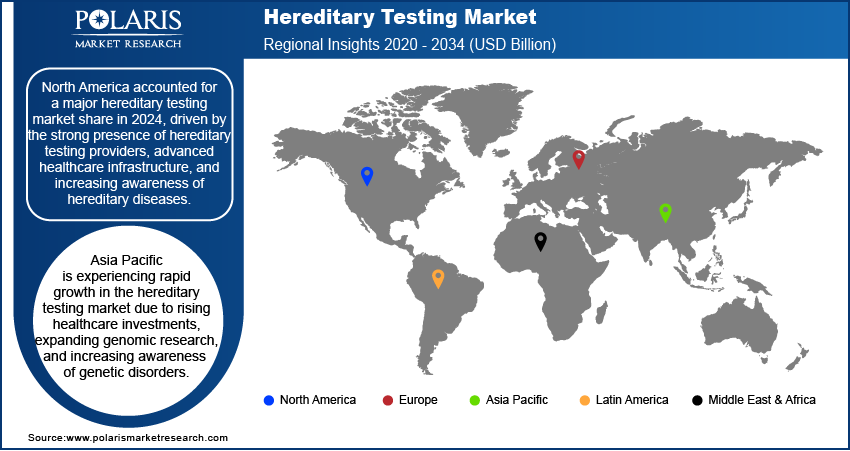

- North America accounts for the largest share of the global market. The regional market dominance is driven by its advanced healthcare infrastructure and growing awareness of hereditary diseases.

- Asia Pacific is witnessing rapid growth, owing to rising healthcare investments and the expansion of genomic research.

Industry Dynamics

- Rapid advancements in genetic testing technologies, which have improved the accuracy and cost-effectiveness of genetic analyses, are driving market growth.

- Growing awareness about the benefits of personalized medicine has led to increased acceptance and demand for hereditary testing.

- The rising integration of artificial intelligence (AI) in genetic analysis is expected to provide several market opportunities in the coming years.

- Ethical and privacy concerns associated with hereditary testing may present market challenges.

Market Statistics

2024 Market Size: USD 7.73 billion

2034 Projected Market Size: USD 17.13 billion

CAGR (2025-2034): 8.3%

North America: Largest Market in 2024

AI Impact on Hereditary Testing Market

- AI accelerates genomic data analysis, identifying hereditary risk factors with greater accuracy and efficiency.

- Machine learning models detect rare genetic variants that conventional testing methods may overlook.

- AI-powered platforms enable personalized risk assessments, guiding targeted prevention and treatment strategies.

- Continuous AI learning enhances predictive models, improving the reliability and scope of hereditary testing over time.

To Understand More About this Research: Request a Free Sample Report

The hereditary testing focuses on genetic testing for inherited conditions, enabling early disease detection, risk assessment, and personalized treatment strategies. Key drivers of market growth include the increasing prevalence of genetic disorders, rising awareness of the benefits of early disease detection, and advancements in next-generation sequencing technologies.

The growing adoption of direct-to-consumer genetic testing and the integration of artificial intelligence in genetic analysis are notable trends shaping the market. Additionally, regulatory support for genetic testing and the expansion of precision medicine initiatives are further contributing to market expansion.

Market Dynamics

Advancements in Genetic Testing Technologies

The market has experienced significant growth due to rapid advancements in genetic testing technologies. Innovations such as next-generation sequencing (NGS) have enhanced the accuracy, speed, and cost-effectiveness of genetic analyses, making hereditary testing more accessible. These technological improvements have facilitated the detection of a broader range of genetic mutations, thereby expanding the scope of hereditary testing applications. The integration of NGS has enabled comprehensive screening for various genetic disorders, contributing to the market expansion.

Increasing Awareness and Acceptance of Personalized Medicine

There is a growing recognition of the benefits of personalized medicine, which tailors healthcare based on individual genetic profiles. This awareness has led to increased acceptance and demand for hereditary testing as individuals and healthcare providers seek to understand genetic predispositions to various conditions. The ability to identify genetic risks allows for proactive health management and personalized treatment plans, thereby driving the adoption of hereditary testing services. This trend reflects a shift towards more individualized healthcare approaches, further propelling the market growth.

Supportive Government Initiatives and Policies

Government initiatives and policies have played a crucial role in promoting the adoption of hereditary testing. Supportive regulations, funding for genetic research, and public health campaigns have increased the availability and acceptance of genetic testing services. For example, the Genetic Information Nondiscrimination Act (GINA) in the United States prohibits discrimination based on genetic information in health insurance and employment, encouraging individuals to pursue genetic testing without fear of discrimination. Such policies have created a favorable environment for the growth of the market.

Market Segment Insights

Market Assessment by Technology

The market segmentation based on technology, includes cytogenetic, biochemical, and molecular testing. The molecular testing was the dominant segment in 2024. This dominance is attributed to the widespread adoption of molecular techniques, such as next-generation sequencing and polymerase chain reaction, which offer high accuracy and efficiency in detecting genetic mutations. The integration of artificial intelligence and machine learning algorithms into molecular testing platforms has further enhanced data interpretation and variant classification, contributing to the segment's growth.

Market Evaluation by Sample Type

The hereditary testing market is segmented by sample type into tumor tissue, bone marrow, saliva, blood, and others. The blood segment held the largest market share in 2024 due to the reliability and ease of collection associated with blood samples, which provide a rich source of DNA essential for accurate genetic analysis. The established protocols and widespread acceptance of blood-based testing in clinical and research settings further contribute to its prominence.

Saliva segment is gaining traction as a non-invasive alternative, offering convenience and ease of collection without compromising the quality of genetic material. Advancements in collection and stabilization techniques have enhanced the viability of saliva for genetic testing, making it a popular choice for both clinical diagnostics and direct-to-consumer genetic testing services. This trend reflects a growing demand for saliva samples in hereditary testing.

Market Outlook by Disease Type

The market segmentation based on disease type, includes hereditary cancer, lung cancer, colorectal cancer, ovarian cancer, prostate cancer, breast cancer, melanoma, sarcoma, and others. The breast cancer testing dominated the market share in 2024. This prominence is due to the high prevalence of breast cancer and the availability of well-established genetic tests, such as BRCA1 and BRCA2 mutation analyses, which are instrumental in assessing individual risk profiles. The widespread implementation of these tests in clinical practice highlights their critical role in early detection and personalized treatment planning.

Ovarian cancer segment is experiencing significant growth within the market. The increasing recognition of genetic predispositions associated with ovarian cancer has led to a surge in demand for genetic testing services. Advancements in genetic research have identified key mutations linked to ovarian cancer risk, prompting healthcare providers to incorporate genetic testing into standard care protocols.

Regional Analysis

By region, the report covers North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America accounted for a major market share in 2024, driven by the strong presence of hereditary testing providers, advanced healthcare infrastructure, and increasing awareness of hereditary diseases. The region benefits from well-established regulatory frameworks that support the adoption of hereditary testing in clinical practice. Additionally, government initiatives promoting precision medicine and early disease detection contribute to market growth. The high demand for hereditary cancer testing, supported by reimbursement policies and advancements in genetic sequencing technologies, further drives the market revenue. The presence of major market players and ongoing research collaborations also play a significant role in the widespread adoption of hereditary testing across North America.

Europe has a well-developed hereditary testing market, supported by strong healthcare systems and favorable government policies. Countries such as Germany, France, and the UK have integrated hereditary testing into routine medical care, promoting early disease detection and personalized treatment plans. The presence of key industry players, research institutions, and government-funded genomic initiatives has further driven the adoption of hereditary testing. Additionally, growing public awareness and increasing accessibility to genetic screening services contribute to market expansion in the region.

Asia Pacific is experiencing rapid growth in the market due to rising healthcare investments, expanding genomic research, and increasing awareness of genetic disorders. Countries such as China, Japan, and India are investing in precision medicine initiatives and genetic testing infrastructure, leading to wider adoption of hereditary screening. The growing middle-class population and advancements in diagnostic technologies are further driving demand for hereditary testing. Additionally, government support and initiatives promoting genetic research are helping improve the accessibility and affordability of these services in the region.

Key Players and Competitive Analysis Report

Several key players are actively contributing to advancements in genetic diagnostics. Myriad Genetics, Inc. specializes in molecular diagnostic tests for various hereditary conditions. Illumina, Inc. provides sequencing and array-based solutions for genetic analysis. Natera, Inc. focuses on non-invasive prenatal testing and oncology diagnostics. Laboratory Corporation of America Holdings offers a comprehensive range of laboratory services, including genetic testing. F. Hoffmann-La Roche Ltd. develops innovative solutions in molecular diagnostics. Quest Diagnostics Incorporated provides diagnostic information services, including genetic testing. CooperSurgical, Inc. offers products and services for women's health, including genetic screening. Agilent Technologies, Inc. supplies instruments and tools for genetic analysis.

Thermo Fisher Scientific, Inc. offers a wide range of genetic testing solutions. Twist Bioscience specializes in DNA synthesis and genetic testing. SOPHiA GENETICS offers data-driven solutions for genomic analysis. Fulgent Genetics focuses on comprehensive genetic testing services.

These companies are actively engaged in developing and offering a wide array of genetic testing services, including hereditary cancer testing, non-invasive prenatal testing, and carrier screening. Their efforts are contributing to the growth and innovation within the market.

Myriad Genetics, Inc., established in 1991 and headquartered in Salt Lake City, Utah, specializes in genetic testing and precision medicine. The company offers a range of molecular diagnostic tests aimed at assessing the risk of hereditary cancers, guiding treatment decisions, and evaluating disease progression. Their product portfolio includes the MyRisk Hereditary Cancer Test, BRACAnalysis CDx, and GeneSight Psychotropic Test, among others. Myriad Genetics is committed to advancing health and well-being by providing insights that empower individuals and healthcare providers to make informed decisions.

MedGenome Inc. is a major genomics-driven research and diagnostics company founded in 2013, with its headquarters in Foster City, California, and operations primarily focused in India and South Asia. The company is recognized for its innovative approach to genetic testing and research, offering over 1,300 genetic tests across diverse disease categories such as oncology, inherited diseases, reproductive health, infectious diseases, and preventive wellness. MedGenome operates the largest College of American Pathologists (CAP)-accredited Next Generation Sequencing (NGS) lab in South-East Asia, equipped with advanced platforms like Illumina’s NovaSeq and HiSeq X. This infrastructure enables the sequencing of over 350,000 genomes and exomes annually, providing unparalleled precision and accuracy in genetic diagnostics.

List of Key Companies

- CENTOGENE N.V.

- F. Hoffmann-La Roche Ltd.

- Fulgent Genetics, Inc.

- Illumina, Inc.

- Laboratory Corporation of America Holdings

- MedGenome Inc.

- Myriad Genetics, Inc.

- Natera, Inc.

- Quest Diagnostics Incorporated

- SOPHiA GENETICS SA

- Thermo Fisher Scientific Inc.

- Twist Bioscience Corporation

- WuXi NextCODE Genomics, Inc.

Industry Developments

- February 2025: Foundation Medicine, Inc. announced plans to introduce two new germline tests, FoundationOne Germline, and FoundationOne Germline More, in the United States. These tests aim to identify genetic variants linked to hereditary cancers, assisting healthcare providers in assessing underlying risks for patients and their families.

- October 2024: Myriad Genetics, Inc. announced a collaboration with Flatiron Health, a health technology company focused on enhancing point-of-care solutions in oncology. Through this partnership, physicians can order Myriad’s MyRisk Hereditary Cancer Test and access the results directly within Flatiron’s cloud-based Electronic Medical Record (EMR) platform, OncoEMR.

Market Segmentation

By Technology Outlook (Revenue-USD Billion, 2020–2034)

- Cytogenetic

- Biochemical

- Molecular Testing

By Sample Type Outlook (Revenue-USD Billion, 2020–2034)

- Tumor Tissue

- Bone Marrow

- Saliva

- Blood

- Others

By Disease Type Outlook (Revenue-USD Billion, 2020–2034)

- Hereditary Cancer

- Lung Cancer

- Colorectal Cancer

- Ovarian Cancer

- Prostate Cancer

- Breast Cancer

- Melanoma

- Sarcoma

- Others

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 7.73 billion |

|

Market Value in 2025 |

USD 8.36 billion |

|

Market Revenue Forecast by 2034 |

USD 17.13 billion |

|

CAGR |

8.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is Report Valuable for Organization?

Workflow/Innovation Strategy

The hereditary testing market has been segmented into detailed segments of technology, sample type, and disease type. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy

Companies in the hereditary testing market focus on expanding their service offerings through research collaborations, strategic partnerships, and acquisitions. Increased investment in next-generation sequencing and AI-driven genetic analysis enhances test accuracy and efficiency. Many companies are also expanding direct-to-consumer genetic testing services to improve accessibility. Regulatory approvals and reimbursement policies play a crucial role in market penetration. Additionally, geographic expansion, particularly in emerging markets, is a key strategy to reach a broader customer base.

FAQ's

The hereditary testing market size was valued at USD 7.73 billion in 2024 and is projected to grow to USD 17.13 billion by 2034.

The market is projected to register a CAGR of 8.3% during the forecast period, 2025-2034.

North America had the largest share of the market.

The hereditary testing market key players include Agilent Technologies, Inc.; CENTOGENE N.V.; CooperSurgical, Inc.; F. Hoffmann-La Roche Ltd.; Fulgent Genetics, Inc.; Illumina, Inc.; Laboratory Corporation of America Holdings, and MedGenome Inc.

The molecular testing segment accounted for the larger share of the market in 2024.

Hereditary testing, also known as genetic testing, is a diagnostic procedure used to identify mutations in genes, chromosomes, or proteins that may be associated with inherited disorders. This testing helps determine an individual's risk of developing genetic conditions, passing them on to offspring, or diagnosing hereditary diseases such as certain cancers, cardiovascular disorders, and metabolic conditions. It is commonly used in preventive healthcare, personalized medicine, and reproductive planning to guide medical decisions and treatment strategies.

A few key trends in the market are described below: Advancements in Next-Generation Sequencing (NGS): Increased adoption of NGS technology enables faster, cost-effective, and high-throughput genetic analysis. Rising Demand for Direct-to-Consumer (DTC) Genetic Testing: Growing consumer awareness and accessibility of at-home genetic tests are driving market expansion. Integration of Artificial Intelligence (AI) and Bioinformatics: AI-driven genetic analysis improves test accuracy, data interpretation, and personalized medicine applications. Increasing Focus on Rare and Complex Genetic Disorders: Companies are expanding test portfolios to include rare hereditary conditions and polygenic risk assessments.

A new company entering the hereditary testing market can focus on advanced technologies such as AI-driven genetic analysis and next-generation sequencing to enhance test accuracy and efficiency. Expanding direct-to-consumer genetic testing with user-friendly digital platforms can improve accessibility and market reach. Specializing in rare genetic disorders or integrating multi-omics approaches may create differentiation. Developing cost-effective and rapid testing solutions can help gain a competitive edge. Additionally, forming strategic partnerships with healthcare providers and investing in regulatory compliance can facilitate market entry and long-term growth