High-torque Synchronous Motor Market Size, Share, & Industry Analysis Report

: By Application (Propulsion, Auxiliary Systems, Deck Machinery), By Mounting Type, By Technology, By Industry, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5852

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

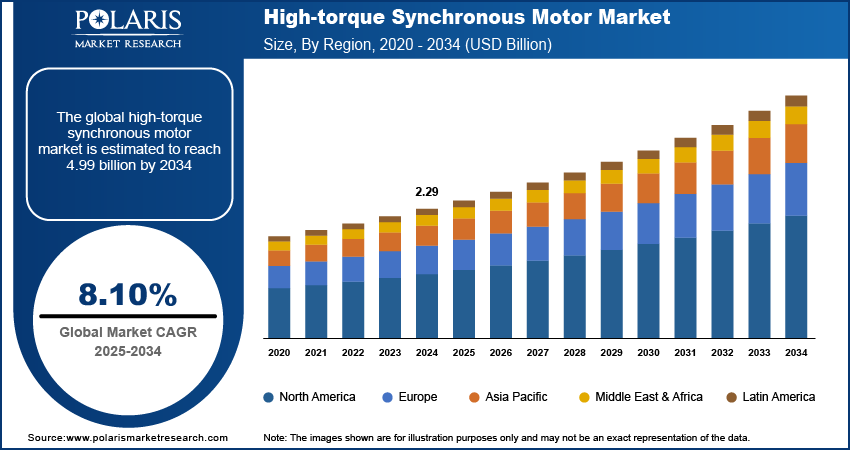

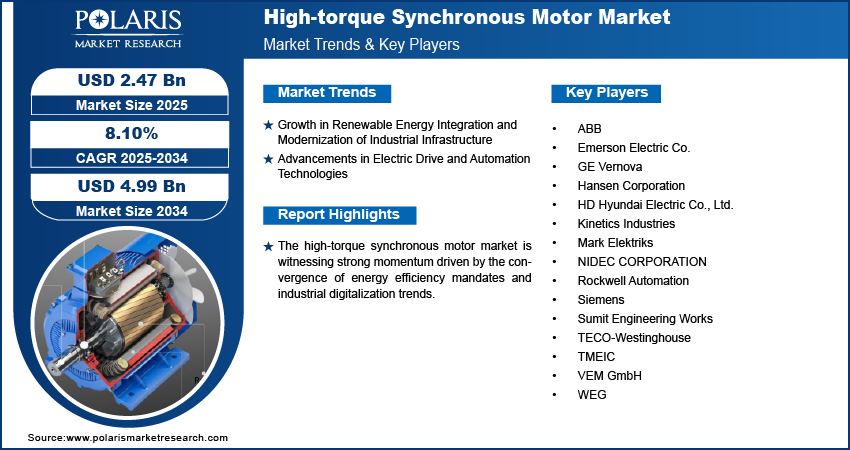

The global high-torque synchronous motor market size was valued at USD 2.29 billion in 2024, growing at a CAGR of 8.10% during 2025–2034. The growth is driven by the rising demand for energy-efficient propulsion and machinery systems, regulatory pressure for de-carbonization, regulatory pressure for de-carbonization.

A high-torque synchronous motor is an electric motor that operates at a constant speed under unstable loads, delivering high torque with exceptional efficiency and stability. These motors are gaining increasing importance across industrial and mobility sectors due to their capability to support demanding applications while aligning with emerging sustainability goals. The constant regulatory pressure for de-carbonization and policies for low-emission standards are propelling the sector's growth. Governments and regulatory bodies worldwide are enforcing strict policies aimed at carbon footprint management in industrial operations, which in turn is encouraging manufacturers and end users to shift toward energy-efficient and eco-friendly motor technologies like this synchronous motors. According to a June 2021 report, India's Ministry of Power expanded its Perform Achieve and Trade (PAT) scheme to 13 energy-intensive sectors (cement, steel, etc.), achieving annual savings of 17 MTOE and reducing 87 million tonnes of CO₂ through industrial energy efficiency measures, contributing to the management of carbon footprint.

Additionally, their ability to minimize energy loss and optimize process efficiency makes them an ideal solution for companies aiming to meet emission targets without compromising on operational performance.

To Understand More About this Research: Request a Free Sample Report

The accelerated expansion of electrification initiatives across both transportation and industrial sectors further drives growth opportunities. The global push toward electric and hybrid vehicles, along with the electrification of processes in heavy industries, is creating substantial demand for high-performance motors capable of delivering consistent torque across varied loads. According to a July 2022 IEA report, global electric car stock reached 26 million, with 60% growth compared to previous years. Heat pump sales grew 11%, driven by the electrification of heating/cooling in buildings and industry, reflecting growing demand for high-performance motors. These motors are particularly well-suited for such applications due to their robust design, superior control capabilities, and low maintenance requirements. Their integration into electric drivetrains and industrial machinery enhances system reliability and performance, contributing to the broader transition toward cleaner, more efficient power systems. Therefore, as electrification continues to reshape industrial and mobility landscapes, the adoption of high-torque motors is expected to rise in alignment with these transformative trends.

Industry Dynamics

Growth in Renewable Energy Integration and Modernization of Industrial Infrastructure

The growing integration of renewable energy sources and the ongoing modernization of industrial infrastructure are supporting the adoption of high-torque motors. According to a 2022 PNNL report, integrating renewables is essential for achieving net-zero emissions, reducing fossil fuel dependence, and lowering carbon output. Generating 35% of US electricity from wind and solar cut emissions by up to 45%. There is a high need for motors that operate efficiently within variable and decentralized power environments, such as wind or solar installations, as industries shift toward more sustainable energy systems. High-torque synchronous provide excellent performance in such settings due to their ability to maintain constant speed and deliver high torque, even under fluctuating power conditions. Furthermore, modern industrial upgrades prioritize energy efficiency, automation compatibility, and operational reliability all areas where these motors excel. Their durability, precision control, and adaptability to advanced energy systems make them a preferred choice in supporting infrastructure modernization efforts driven by clean energy goals.

Advancements in Electric Drive and Automation Technologies

Advancements in electric drive systems and automation technologies such as Trapezoidal Stator Radial Flux (TSRF) technology, wide bandgap technologies (such as SiC and GaN), and others are fueling demand for high-torque motors across various applications. The need for precise, high-efficiency motors that can seamlessly integrate with intelligent drive systems becomes essential as industries move toward digitalized and automated processes. High-torque synchronous motors offer superior torque density, accurate speed control, and compatibility with advanced power electronics and control algorithms. These characteristics enable optimized performance in industrial robotics, automotive robotics, conveyor systems, electric vehicles, and other automated equipment. Their integration with modern drive technologies assures improved productivity, lower operational costs, and greater system responsiveness, making them a crucial component in the evolution of smart industrial and mobility solutions.

Segmental Insights

Application Analysis

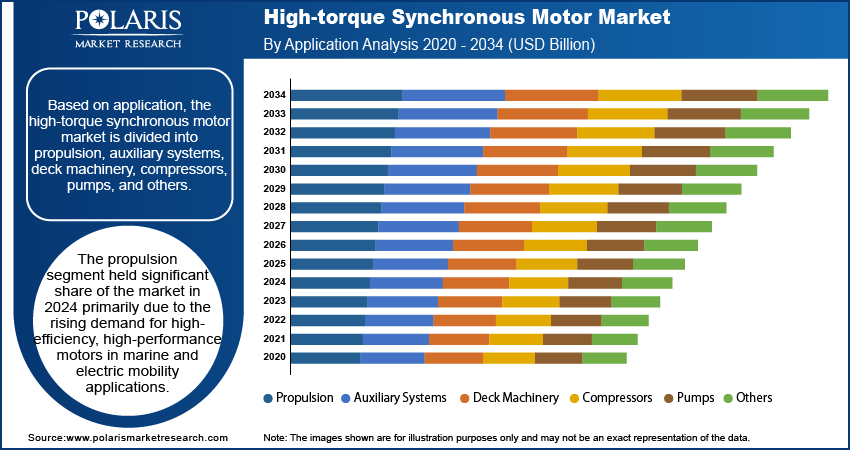

The global segmentation, based on application, includes propulsion, auxiliary systems, deck machinery, compressors, pumps, and others. The propulsion segment held significant share of the market in 2024 primarily due to the rising demand for high-efficiency, high-performance motors in marine and electric mobility applications. These motors are well-suited for propulsion systems as they provide consistent torque, precise speed control, and improved energy efficiency under changing load conditions. The growing focus on reducing fuel consumption and emissions in transportation and marine operations has accelerated the shift toward electric propulsion, where these synchronous motors are increasingly integrated. Their superior torque density and ability to operate effectively in dynamic environments make them ideal for propulsion-driven systems in both commercial and industrial use.

Mounting Type Analysis

The global segmentation, based on mounting type, includes horizontal and vertical. The horizontal segment growth is driven its widespread use in industrial applications that require stable and compact motor alignment. Horizontal motors are generally easier to install and maintain, and they allow for efficient transmission of torque in conveyor systems, compressors, and pumps. Their design facilitates better heat excess and integration with existing mechanical layouts, making them particularly attractive for large-scale manufacturing and processing plants. Horizontal synchronous motors offer a reliable and space-efficient solution as industries continue to modernize and automate, further supporting their increased adoption across various sectors.

Technology Analysis

The global segmentation, based on technology, includes smart sensors and digital integration, VFD compatibility, and condition monitoring. The smart sensors and digital integration segment is expected to grow at a significant CAGR during the forecast period supported by the global trend toward Industry 4.0 and intelligent automation. These motors, integrated with smart sensor technology, enable real-time performance monitoring, predictive maintenance, and seamless system diagnostics. These features help reduce unplanned downtime and improve operational efficiency. The growing focus on digital transformation in industries is accelerating the need for motors equipped with advanced connectivity and analytics capabilities, making smart-integrated solutions increasingly indispensable for next-generation motor systems.

Industry Analysis

The global segmentation, based on industry, includes marine, oil & gas, metal & mining, paper & pulp, chemicals & petrochemicals, automotive, and others. The marine segment is expected to witness highest share of the market driven by the increasing adoption of electric and hybrid propulsion systems in maritime vessels. These synchronous motors offer a viable alternative with lower emissions and greater fuel efficiency as environmental regulations get strict, and the industry shifts toward sustainable solutions. Their ability to handle heavy-duty propulsion tasks with high reliability under marine operating conditions supports their integration into ships, ferries, and offshore platforms. Additionally, the demand for precise motor control and improved energy efficiency at sea is driving consistent growth in the marine sector's reliance on these motors.

Regional Analysis

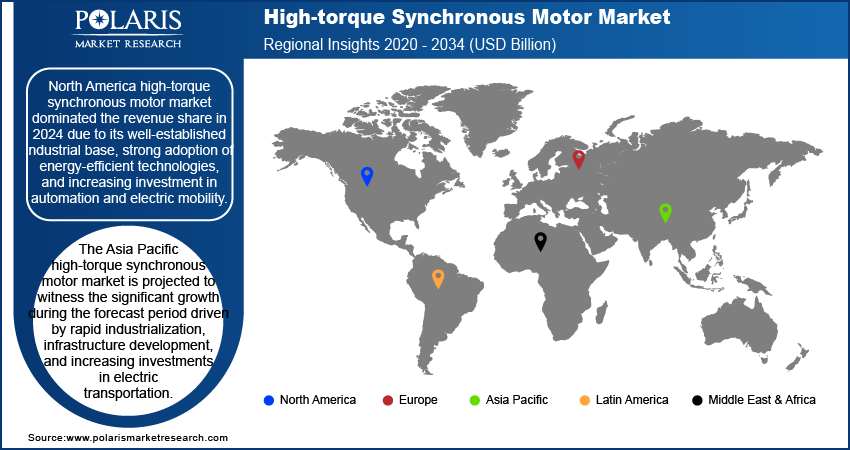

The report provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America high-torque synchronous motor market dominated the revenue share in 2024 due to its well-established industrial base, strong adoption of energy-efficient technologies, and increasing investment in automation and electric mobility. For instance, in March 2025, Schneider Electric announced a USD 700M investment to expand automation capabilities, manufacturing, and energy infrastructure. The region’s mature infrastructure and regulatory focus on reducing industrial emissions have encouraged the integration of advanced motor systems in a wide range of applications. Additionally, ongoing innovation in smart motor technologies and the presence of major manufacturers and OEMs further support the widespread deployment of high-torque synchronous motors across various industries.

The US high-torque synchronous motor market held the largest share, primarily due to its advanced industrial ecosystem, strong focus on energy efficiency, and rapid adoption of automation. The presence of major manufacturers and well-established infrastructure for electric mobility and renewable energy integration further support widespread deployment. Additionally, regulatory mandates around carbon reduction have encouraged industries to transition to high-efficiency motor systems, boosting growth opportunities.

The Asia Pacific high-torque synchronous motor market is projected to witness the significant growth during the forecast period driven by rapid industrialization, infrastructure development, and increasing investments in electric transportation. According to a February 2025 report from the Ministry of Health and Family Welfare India's PM E-DRIVE scheme allocated USD 1.3 billion in September 2024 for a 2-year program supporting EVs (e-2W, e-3W, e-trucks, e-buses), charging infrastructure, and testing facility upgrades. Countries across the region are accelerating efforts to modernize manufacturing and reduce energy consumption, which has boosted the demand for efficient, high-performance motors. Additionally, the expanding automotive and marine industries are creating opportunities for large-scale deployment of high-torque synchronous motors. The region's robust manufacturing capacity and growing focus on automation and electrification position it as a major growth hub for the market.

China's high-torque synchronous motor sector is experiencing growth, driven by its aggressive industrial expansion and government-backed electrification initiatives. The country’s focus on upgrading manufacturing capabilities through smart factory investments is creating a strong demand for precision motor solutions. Furthermore, the rapid development of its electric vehicle and renewable energy markets is driving the need for high-performance motors capable of delivering consistent torque in energy-requiring environments.

The Europe high-torque synchronous motor market is projected to grow with substantial CAGR during the forecast period driven by strong regulatory frameworks focused on energy efficiency, sustainability, and carbon neutrality. The region’s push toward green technologies and the modernization of its industrial infrastructure is encouraging the adoption of advanced motor systems. The synchronous motors, with their precision, reliability, and compatibility with smart systems, align well with Europe’s industrial automation goals. The increasing focus on electrification in sectors such as transportation, manufacturing, and maritime is expected to further boost the demand for these motors across the region.

A growing focus on sustainable industrial practices and the modernization of infrastructure through digital integration supports the UK high-torque synchronous motor market. Industries are increasingly adopting smart motor technologies to meet energy efficiency targets and align with de-carbonization strategies. The UK continues to invest in high-efficiency synchronous motors to ensure operational reliability and reduced environmental impact with advancements in sectors such as marine engineering, process automation, and renewable energy.

Key Players & Competitive Analysis Report

The high-torque synchronous motor sector is witnessing significant transformation, driven by technological advancements in energy-efficient designs and smart manufacturing integration. Developed markets like North America and Europe lead in innovation, with players such as Siemens, ABB, and TMEIC focusing on strategic investments in IoT-enabled motor systems for industrial automation. Meanwhile, emerging markets in Asia-Pacific show high growth potential, fueled by expanding manufacturing sectors and infrastructure modernization.

Competitive intelligence reveals a shift toward sustainable value chains, with manufacturers prioritizing rare-earth-free magnets and modular designs to address supply chain exposures. Disruptions and trends include the rise of direct-drive systems in wind turbines and electric vehicles, creating latent demand for customized high-torque solutions. Vendor strategies emphasize partnerships with renewable energy and EV OEMs, while regional footprints expand to capitalize on localized production incentives.

A few key players are ABB; Emerson Electric Co.; GE Vernova; Hansen Corporation; HD Hyundai Electric Co., Ltd.; Kinetics Industries; Mark Elektriks; NIDEC CORPORATION; Rockwell Automation; Siemens; Sumit Engineering Works; TECO-Westinghouse; TMEIC; VEM GmbH; and WEG.

Key Players

- ABB

- Emerson Electric Co.

- GE Vernova

- Hansen Corporation

- HD Hyundai Electric Co., Ltd.

- Kinetics Industries

- Mark Elektriks

- NIDEC CORPORATION

- Rockwell Automation

- Siemens

- Sumit Engineering Works

- TECO-Westinghouse

- TMEIC

- VEM GmbH

- WEG

Industry Developments

September 2024: WEG committed USD 125M to expand transformer and motor production in Mexico (new wire plant) and Brazil (facility expansions in Itajaí [+9,500m²] and Guaramirim [+6,000m²]). Investments target North/South American demand over 3–5 years.

September 2024: WEG acquired Türkiye-based Volt Electric Motors for USD 88 million, gaining its 27,000 m² factory producing industrial/commercial motors (up to 450 kW). The deal expands WEG's manufacturing footprint in key growth markets.

June 2023: TMEIC developed a synchronous reluctance motor with a world-class 8.5kNm continuous torque, 10x higher than its previous models. The IE5-efficient, permanent magnet-free design reduces resource use and supports industrial energy savings, aligning with UN SDGs.

High-torque Synchronous Motor Market Segmentation

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Propulsion

- Auxiliary Systems

- Deck Machinery

- Compressors

- Pumps

- Others

By Mounting Type Outlook (Revenue, USD Billion, 2020–2034)

- Horizontal

- Vertical

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- Smart Sensors and Digital Integration

- VFD Compatibility

- Condition Monitoring

By Industry Outlook (Revenue, USD Billion, 2020–2034)

- Marine

- Oil & Gas

- Metal & Mining

- Paper & Pulp

- Chemicals & Petrochemicals

- Automotive

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

High-torque Synchronous Motor Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.29 billion |

|

Market Size in 2025 |

USD 2.47 billion |

|

Revenue Forecast by 2034 |

USD 4.99 billion |

|

CAGR |

8.10% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 2.29 billion in 2024 and is projected to grow to USD 4.99 billion by 2034.

The global market is projected to register a CAGR of 8.10% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are ABB; Emerson Electric Co.; GE Vernova; Hansen Corporation; HD Hyundai Electric Co., Ltd.; Kinetics Industries; Mark Elektriks; NIDEC CORPORATION; Rockwell Automation; Siemens; Sumit Engineering Works; TECO-Westinghouse; TMEIC; VEM GmbH; and WEG

The propulsion segment held significant share of the market in 2024.

The smart sensors and digital integration segment is expected to grow at a significant CAGR during the forecast period.