Hydraulic Cylinder Market Size, Share, Trends, Industry Analysis Report

By Product (Welded, Tie Rod, Telescopic, And Mill Function Cylinders), By Function, By Application, By Industry Vertical, and By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 124

- Format: PDF

- Report ID: PM2449

- Base Year: 2024

- Historical Data: 2020-2023

Overview

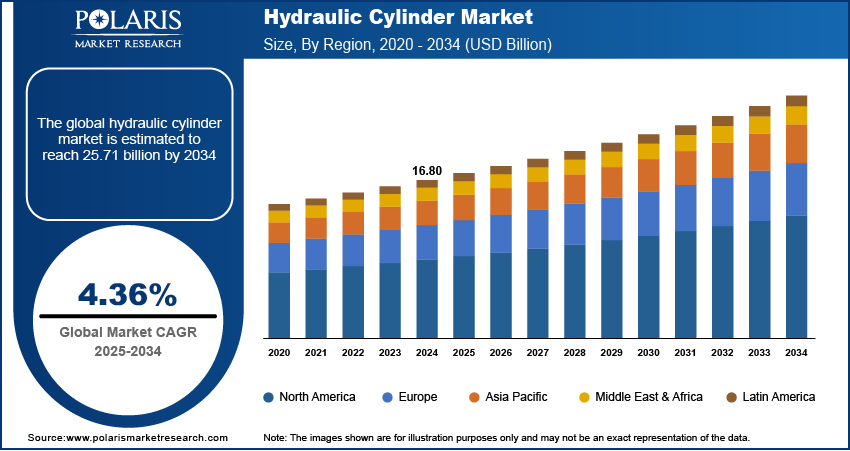

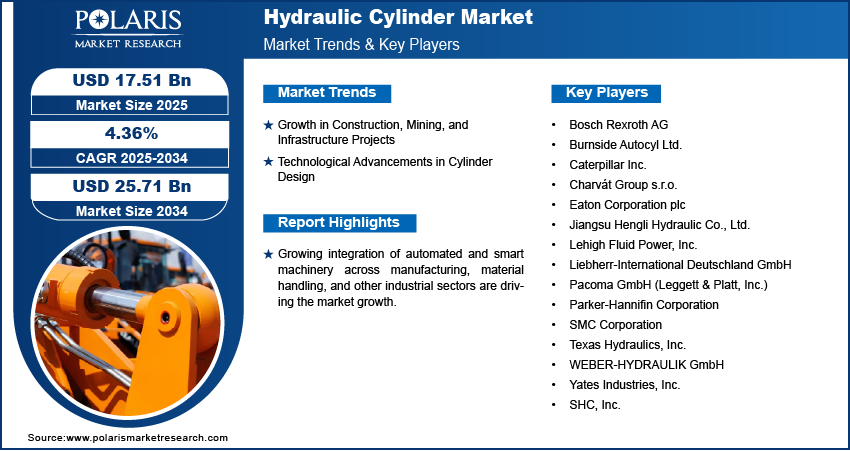

The global hydraulic cylinder market size was valued at USD 16.80 billion in 2024, growing at a CAGR of 4.36% from 2025 to 2034. Growing construction, mining, and infrastructure projects coupled with technological advancements in cylinder design is propelling the market growth.

Key Insights

- Welded cylinders segment led market in 2024, driven by durable design, compact build, and applicability in heavy-duty industrial machinery.

- Tie rod cylinders segment anticipated to grow at a rapid pace, led by reliability, low maintenance, and widespread application in construction and material handling equipment.

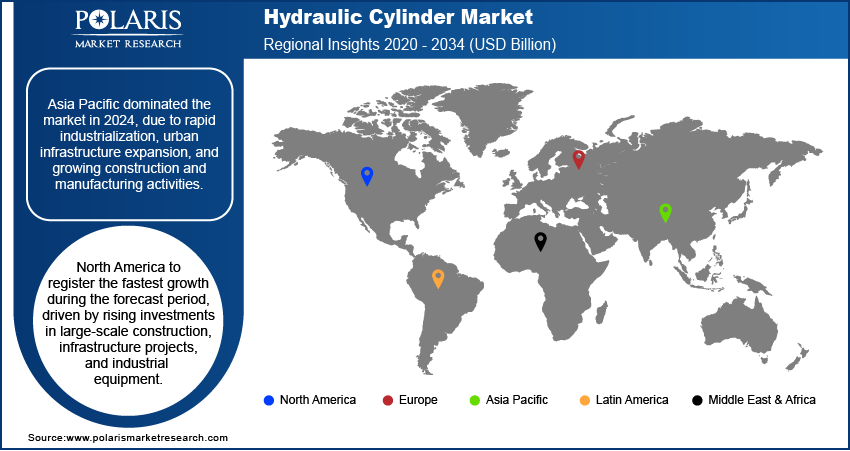

- Asia Pacific dominated the hydraulic cylinder market in 2024, driven by industrialization, infrastructure development in cities, and increasing construction and manufacturing activities.

- China dominated the region, driven by growth in the manufacturing of automobiles and heavy machinery in China, India, and Southeast Asia.

- North America is projected to grow at a fast rate over the forecast period, fueled by increased investment in large-scale building, infrastructure, and industrial equipment.

- The U.S. dominated the regional market due to the growing demand for automation, robotics, and advanced hydraulic systems across mining, construction, and material handling operations.

Industry Dynamics

- Rising investment in construction, mining, and infrastructure projects is driving hydraulic cylinder adoption.

- Technological advancements in cylinder design, including improved durability, efficiency, and compact form factors, are further boosting demand across industrial and mobile applications.

- High initial investment and maintenance costs continue to constrain market growth.

- Advancements in cylinder design, including IoT-enabled smart cylinders, offer opportunities for real-time monitoring, predictive maintenance, and improved efficiency.

Market Statistics

- 2024 Market Size: USD 16.80 Billion

- 2034 Projected Market Size: USD 25.71 Billion

- CAGR (2025–2034): 4.36%

- Asia Pacific: Largest Market Share

The hydraulic cylinder industry is comprised of precision-crafted mechanical actuators employed to produce linear force and motion in construction machinery, industrial equipment, agricultural machinery, and material handling systems. Hydraulic cylinders are widely utilized in excavators, loaders, presses, and automation systems facilitating heavy-duty lifting, pushing, and positioning tasks with high reliability and efficiency.

The market is growing rapidly due to the increasing adoption of automated and intelligent machinery in manufacturing, material handling, and other industrial applications. Advanced hydraulic systems are increasingly used by newer production units for optimizing operational efficiency, high accuracy, and overall productivity, apart from facilitating complex automation operations.

Growing economies are witnessing significant increase in industrial equipment and machinery production. This growth is creating a consistent demand for dependable, high-performance hydraulic cylinders that fulfill a variety of manufacturing and material handling tasks with consistent performance across a variety of operating conditions.

Drivers & Opportunities

Growth in Construction, Mining, and Infrastructure Projects: The global rise in infrastructure development, mining, and energy projects is also driving the demand for hydraulic machinery. Oxford Economics predicts that global construction will rise from USD 9.7 trillion in 2022 to USD 13.9 trillion by 2037, with China, the United States, and India driving growth. Economic growth is accelerating due to rapid urbanization and aggressive green infrastructure development plans.

Technological Advancements in Cylinder Design: Design innovations in hydraulic cylinders are improving efficiency, reliability, and load capacity which in turn is fueling the market growth. In September 2024, Idroteck, an Italian hydraulic component maker launched an extensive BIM (Building Information Modeling) database for its hydraulic compact cylinders. Powered by CADENAS, the move gives engineers and designers quick access to accurate 3D models and simplifies design and integration work.

Segmental Insights

By Product

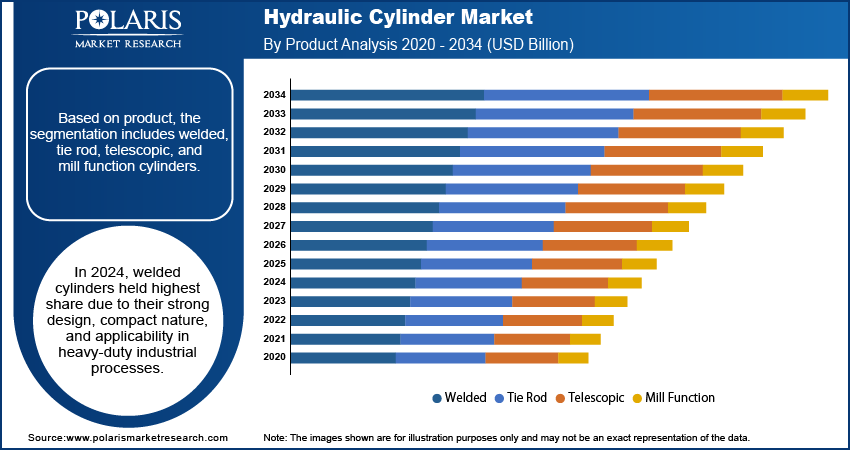

On the basis of product type, the hydraulic cylinder market is categorized into welded, tie rod, telescopic, and mill function cylinders. In 2024, welded cylinders held highest share due to their strong design, compact nature, and applicability in heavy-duty industrial processes.

Tie rod cylinders are anticipated to see steady growth over the forecast period due to its reliability, simple maintenance, and widespread application in construction and material handling machines.

By Function

By function, the market is divided into double-acting and single-acting cylinders. Double-acting cylinders led the market in 2024 driven by its versatility and capacity to execute work in directions, thus suitable for a variety of industrial and mobile applications.

Single-acting cylinders are expected to increase rapidly in operations that involve simpler mechanisms and less operational expenses.

By Application

In terms of application, the market is segmented as mobile, industrial, energy & power, and others. Mobile applications represented the highest market share in 2024, with extensive utilization in building machines, farm equipment, and material handling trucks.

Industrial applications are anticipated to grow at a robust rate, propelled by growing automation, requirements for production efficiency, and demands for efficient hydraulic systems in manufacturing facilities and power generation sites.

By Industry Vertical

On the basis of industry vertical, the market is divided into aerospace, material handling, construction, agriculture, mining, automotive, marine, oil & gas, and others. Construction led in 2024, fueled by increasing infrastructure development, mechanization of heavy equipment, and growing industrial projects globally.

Automotive segments are anticipated experience strong growth over the forecast period due to technological innovation, rising demand for precision hydraulic systems, and demand for high-performance machinery in niche applications.

Regional Analysis

Asia Pacific led the hydraulic cylinder market driven by rapid industrialization, urban infrastructure growth, and intensifying construction and manufacturing activities. Rising mining, agriculture, and heavy equipment operations also drive market growth, as industries look for high-performance and durable hydraulic solutions.

China Hydraulic Cylinder Market Overview

China dominated the Asia pacific market, driven by growing automobile and heavy machinery manufacturing in China, India, and Southeast Asia. According to China Automotive Technology and Research Center report published on November 2024, from January to October 2024, China's automotive sales reached 24.62 million units, up 2.7% year on year, reflecting the increasing demand for hydraulic systems in assembly lines and manufacturing.

North America Hydraulic Cylinder Market Insights

North America is witnessing rapid growth in the hydraulic cylinder market, fueled by increasing investments in heavy construction, infrastructure development, and machinery used in industry. The established industrial machinery, automotive, and material handling industries in the region also contribute to market growth.

The U.S. Hydraulic Cylinder Market Analysis

The U.S. is leading the market in North America, due to the increasing adoption of automation, robotics, and advanced hydraulic systems in mining, construction, and material handling equipment. As per report from the International Federation of Robotics (IFR) shows that in 2023, industrial robot installations in the U.S. rose by 12%, reaching 44,303 units, reflecting a growing emphasis on efficiency, productivity, and mechanization in industrial operations.

Europe Hydraulic Cylinder Market Assessment

Europe held significant market share in hydraulic cylinder due to continued modernization of infrastructure, urbanization schemes, and construction work in major economies of Europe. Industry 4.0 initiatives and automated production systems are further increasing the demand for sophisticated hydraulic cylinders that provide precision and reliability. As per the International Federation of Robotics (IFR) November 2024 report, the European Union boasts a robot density of 219 robots per 10,000 employees, up by 5.2%, with Germany, Sweden, Denmark, and Slovenia among the world's top ten, demonstrating the continent's emphasis on automation and smart manufacturing technology.

Key Players & Competitive Analysis

The hydraulic cylinder market globally is moderately competitive, with business units concentrating on enhancing performance, longevity, and customization of hydraulic systems. Developments focus on advanced materials, advanced sealing technologies, and miniaturization for efficiency and reliability improvements in applications. Strategic relationships with OEMs, distributors, and service providers are facilitating players to increase their market base, while ongoing product development is intended to cater to changing industrial specifications and operating needs.

Key players operating in the global hydraulic cylinder market include Bosch Rexroth AG, Burnside Autocyl Ltd., Caterpillar Inc., Charvát Group s.r.o., Eaton Corporation plc, Jiangsu Hengli Hydraulic Co., Ltd., Lehigh Fluid Power, Inc., Liebherr-International Deutschland GmbH, Pacoma GmbH (Leggett & Platt, Inc.), Parker-Hannifin Corporation, SMC Corporation, Texas Hydraulics, Inc., WEBER-HYDRAULIK GmbH, Yates Industries, Inc., and SHC, Inc.

Key Players

- Bosch Rexroth AG

- Burnside Autocyl Ltd.

- Caterpillar Inc.

- Charvát Group s.r.o.

- Eaton Corporation plc

- Jiangsu Hengli Hydraulic Co., Ltd.

- Lehigh Fluid Power, Inc.

- Liebherr-International Deutschland GmbH

- Pacoma GmbH (Leggett & Platt, Inc.)

- Parker-Hannifin Corporation

- SMC Corporation

- Texas Hydraulics, Inc.

- WEBER-HYDRAULIK GmbH

- Yates Industries, Inc.

- SHC, Inc.

Hydraulic Cylinder Industry Developments

In November 2024, Fortress Investment Group acquired TH Holdings, which encompasses Texas Hydraulics, Hydromotion, and Oilgear. These companies specialize in manufacturing custom hydraulic components and providing related services across multiple heavy-duty industries.

In June 2024, HPS International launched the SBC series of hydraulic cylinders, offering a simplified and more cost-effective alternative to their GVCN line. These M20 mounting cylinders feature fixed strokes, easy selection options, and can be delivered within five working days.

Hydraulic Cylinder Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Welded

- Tie Rod

- Telescopic

- Mill Function

By Function Outlook (Revenue, USD Billion, 2020–2034)

- Double-acting

- Single-acting

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Mobile

- Off-highway Machinery

- Material Handling

- Marine & Offshore

- Industrial

- Steel Plant Equipment

- Pulp & Paper Machinery

- Others

- Energy & Power

- Others

By Industry Vertical Outlook (Revenue, USD Billion, 2020–2034)

- Construction

- Aerospace

- Material Handling

- Agriculture

- Mining

- Automotive

- Marine

- Oil & Gas

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Hydraulic Cylinder Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 16.80 Billion |

|

Market Size in 2025 |

USD 17.51 Billion |

|

Revenue Forecast by 2034 |

USD 25.71 Billion |

|

CAGR |

4.36% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion, Volume in Kilotons and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 16.80 billion in 2024 and is projected to grow to USD 25.71 billion by 2034.

The global market is projected to register a CAGR of 4.36% during the forecast period.

Asia Pacific dominated the market in 2024.

A few of the key players in the market are Bosch Rexroth AG, Burnside Autocyl Ltd., Caterpillar Inc., Charvát Group s.r.o., Eaton Corporation plc, Jiangsu Hengli Hydraulic Co., Ltd., Lehigh Fluid Power, Inc., Liebherr-International Deutschland GmbH, Pacoma GmbH (Leggett & Platt, Inc.), Parker-Hannifin Corporation, SMC Corporation, Texas Hydraulics, Inc., WEBER-HYDRAULIK GmbH, Yates Industries, Inc., and SHC, Inc.

The welded cylinders segment dominated the market revenue share in 2024.

The single-acting cylinders segment is projected to witness the fastest growth during the forecast period.