Hydrazine Hydrate Market Share, Size, Trends, Industry Analysis Report

By Concentration Level (24%-35%, 40%-55%, 60%-85% and 100%); By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 114

- Format: PDF

- Report ID: PM3604

- Base Year: 2023

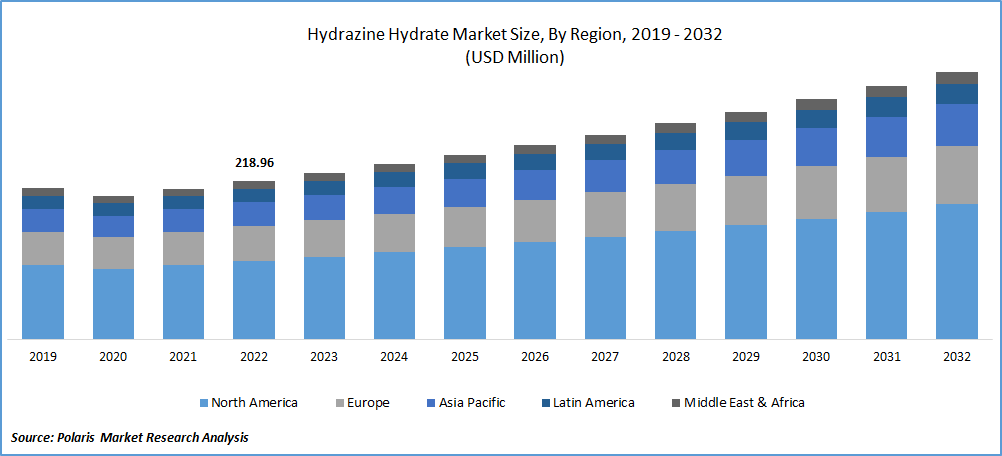

- Historical Data: 2019-2022

Report Outlook

The global hydrazine hydrate market was valued at USD 230.34 million in 2023 and is expected to grow at a CAGR of 5.40% during the forecast period. Increased R&D activities lead to technological advancements in hydrazine hydrate production, application, and utilization. The study published in the Analyst Journal focused on developing a novel fluorescent probe based on a di benzothiazole derivative for detecting hydrazine (N2H4) in various environments. This research and technological advancement in hydrazine detection methods can affect the hydrazine hydrate market.

To Understand More About this Research: Request a Free Sample Report

The ability to detect hydrazine accurately and selectively, such as using probes, can contribute to hydrazine hydrate's overall demand and application in industries that utilize it, including chemical synthesis, water treatment, and polymer foam production. These technological advancements enhance detection capabilities and open possibilities for new product development and innovation. This fosters market growth by attracting investment and driving technological advances in the hydrazine hydrate industry.

Industry Dynamics

Growth Drivers

Growing innovations in the industry are driving the growth of the market. For instance, a recent study published in Wiley Online Library, The hydrazine hydrate-induced surface modification of the CdS layer, enabling 10.3 percent efficient Sb2 (S, Se)3 solar cells, is driving the market's growth. This study highlights the use of hydrazine hydrate in enhancing the efficiency of solar cells by modifying the CdS layer. The promising results and improved performance achieved through this hydrazine hydrate-induced surface modification technique contribute to the increased demand for hydrazine hydrate in the renewable energy sector. As the adoption of efficient solar cell technologies continues to grow, the need for hydrazine hydrate for surface modifications and related applications is expected to drive the overall growth of the hydrazine hydrate market.

Report Segmentation

The market is primarily segmented based on concentration level, application and region.

|

By Concentration Level |

By Application |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

60%-85% segment is expected to witness fastest growth during forecast period

60%-85% segment is expected to have faster growth for the market. Hydrazine hydrate with a concentration level of 60%-85% is widely used in various industries, including pharmaceuticals, agriculture, water treatment, and chemical synthesis. Its versatility and ability to be used in multiple applications contribute to its growing demand. This concentration level provides a balance between effectiveness and cost. It is often more cost-effective than higher concentration levels, making it a preferred choice for applications where maximum purity is not required. Hydrazine hydrate at 100% concentration is highly volatile and toxic. The 60%-85% concentration level balances usability and safety, making it more manageable to handle and transport than higher concentrations.

Polymerization & Blowing Agents segment accounted for the largest market share in 2022

Polymerization & Blowing Agents segment holds the largest market share in the study period. Hydrazine hydrate is utilized as a chain transfer agent in polymerization reactions. It helps control polymers' molecular weight and structure, resulting in desired properties such as improved strength, flexibility, and thermal stability. The increasing demand for polymers in various industries, including packaging, automotive, and construction, is driving the growth of hydrazine hydrate in this application segment. It is also used as a chemical blowing agent in producing foams and cellular materials. It releases nitrogen gas upon decomposition, creating bubbles and expanding the material. This process is widely employed in manufacturing expanded polystyrene (EPS), polyurethane foams, and other foam-based products.

The growing demand for foams in insulation, packaging, and construction applications contributes to the increased use of hydrazine hydrate as a blowing agent. This is compatible with various polymerization processes and can be used in different polymers, including polyethylene, polypropylene, polystyrene, and polyurethane. Its versatility in polymer production and blowing agent applications makes it an attractive choice for manufacturers. It offers certain technical advantages in polymerization and blowing agent applications. It can help improve processing efficiency, reduce cycle time, and enhance the physical properties of the resulting materials, such as foam density and cell structure.

APAC registered with the highest growth rate in the study period in 2022

APAC is projected to witness a higher growth rate for the market. Developing countries heavily invest in novel technologies like India to become Self - reliant. There is a strong demand for the process technology for hydrazine hydrate in India, as India imports 100 percent of the hydrogen hydrate. In close collaboration with a leading industrial partner, Gujarat Alkalies, the CSIR-Indian Institute of Chemical Technology (CSIR-IICT) made a breakthrough in the domestic development of HH technology. The initiatives Make-in-India, Sashakt Bharat, & Atmanirbhar Bharat are responsible for the technology. The indigenous development of HH technology increases domestic hydrazine hydrate production in India. This reduces the country's reliance on imports and strengthens its self-sufficiency in meeting the demand for hydrazine hydrate.

North America is expected to witness a larger revenue share in the market. This region's pharmaceutical and agrochemical industries are substantial consumers of hydrazine hydrate. It is used in pharmaceutical synthesis to produce medicines and pharmaceutical intermediates. In the agrochemical sector, hydrazine hydrate is utilized to formulate pesticides and herbicides. The growth of these industries in North America contributes to the demand for hydrazine hydrate. The presence of the largest hydrazine hydrate exporter is driving the market's growth.

Competitive Insight

Some of the major players operating in the global market include LANXESS, Otsuka-MGC Chemical Company, Yibin Tianyuan, Arkema, Lonza, Japan Finechem, HOS-Technik, Weifang Yaxing Chemical, Charkit Chemical Company, Arrow Fine Chemicals, Acros Organics, Tennants Fine Chemicals, Hunan Zhuzhou Chemical Industry, Spectrum Chemical Manufacturing, Hubei Xiangyun Chemical, Chemtex Speciality.

Recent Developments

- In September 2022, Gujarat Alkalies and Chemicals updated its 10,000 TPA (80%) Hydrazine Hydrate Project, which includes forward integration to Hydrogen Peroxide to produce an imported equivalent at the Dahej Complex.

- In May 2022, ALSA Ventures, a London-based European biotech investment company, and Lonza, a multinational partner with expertise in developing and producing pharmaceuticals, biotech goods, and nutrition solutions, signed a framework partnership agreement.

Hydrazine Hydrate Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 242.41 million |

|

Revenue forecast in 2032 |

USD 369.77 million |

|

CAGR |

5.40% from 2024 - 2032 |

|

Base year |

2023 |

|

Historical data |

2019 - 2022 |

|

Forecast period |

2024 - 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Concentration Level, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

LANXESS, Otsuka-MGC Chemical Company, Yibin Tianyuan, Arkema, Lonza, Japan Finechem, HOS-Technik, Weifang Yaxing Chemical, Charkit Chemical Company, Arrow Fine Chemicals, Acros Organics, Tennants Fine Chemicals, Hunan Zhuzhou Chemical Industry, Spectrum Chemical Manufacturing, Hubei Xiangyun Chemical, Chemtex Speciality. |

FAQ's

key companies in Hydrazine Hydrate Market are LANXESS, Otsuka-MGC Chemical Company, Yibin Tianyuan, Arkema, Lonza, Japan Finechem, HOS-Technik, Weifang Yaxing Chemical, Charkit Chemical Company, Arrow Fine Chemicals.

The global hydrazine hydrate market expected to grow at a CAGR of 5.4% during the forecast period.

The Hydrazine Hydrate Market report covering key are concentration level, application and region.

key driving factors in Hydrazine Hydrate Market are Increasing innovation in the industry.

The global hydrazine hydrate market size is expected to reach USD 369.77 million by 2032.