Hydrogen Tanks Market Size, Share, Trends, Industry Analysis Report

: By Pressure, Material Type (Metal, Composite), Tank Type, Application, and Region – Market Forecast, 2025-2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM5642

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

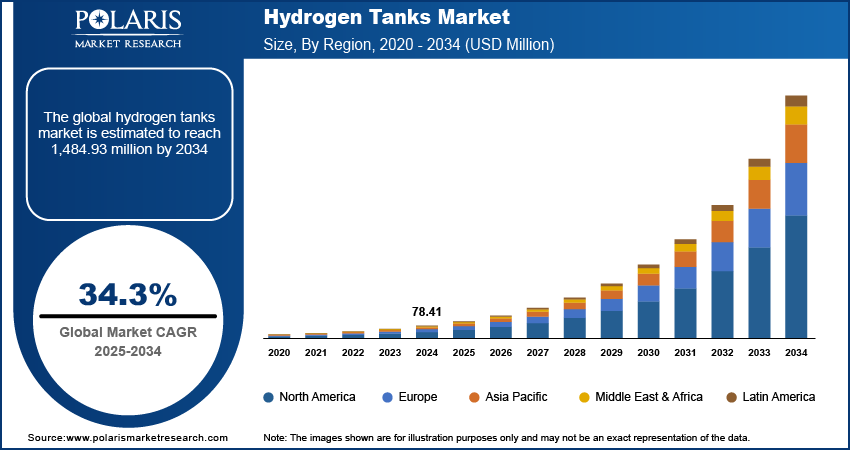

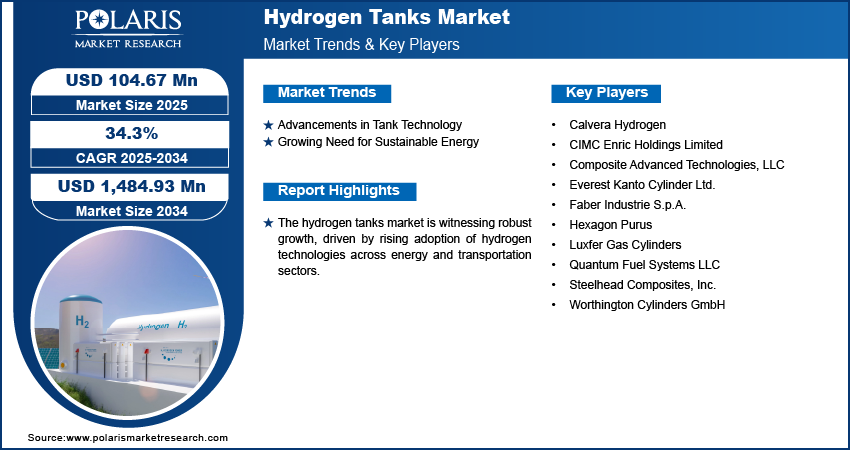

The global hydrogen tanks market was valued at USD 78.41 million in 2024, at a CAGR of 34.3% during the forecast period. The market is driven by rising hydrogen demand in clean mobility and energy systems, fueled by government investments, sustainability goals, and technological advancements enabling safer, lighter, and higher-capacity storage solutions.

Key Insights

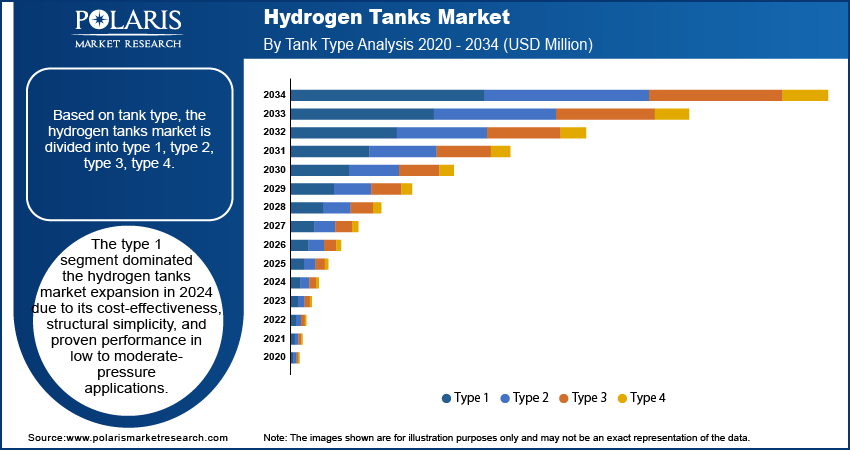

- Type 1 tanks led the market in 2024 due to affordability, structural reliability, and suitability for low to mid-pressure applications.

- Metal tanks are growing fast, offering high-pressure tolerance and cost-effective manufacturing with robust safety features in harsh environments.

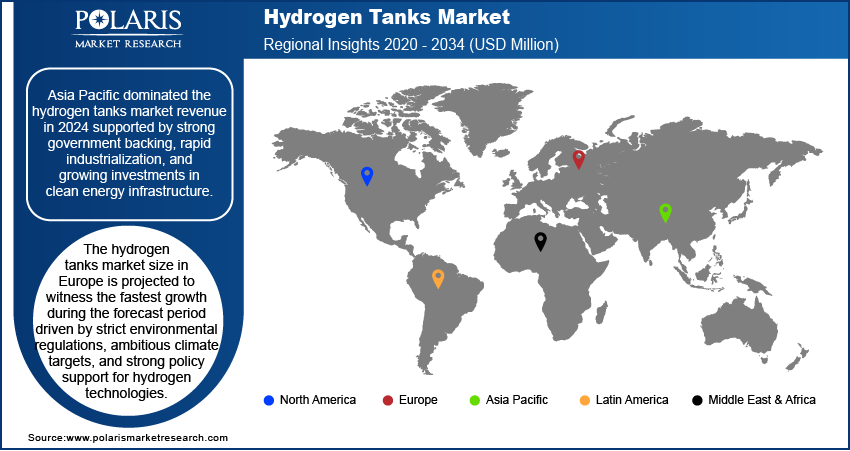

- Asia Pacific dominated due to strong policy support, industrial expansion, and rising clean energy investment, particularly in hydrogen mobility and power.

- Europe shows fastest growth, driven by aggressive hydrogen targets, environmental policies, and push for lightweight, high-performance hydrogen tank technologies.

Industry Dynamics

- Rising demand for hydrogen-powered vehicles is increasing the need for lightweight, high-pressure storage tanks with extended range and fast refueling.

- Government investments in clean energy infrastructure and hydrogen strategies are accelerating the development of advanced hydrogen storage systems.

- Technological innovations in composite materials and tank design are improving safety, reducing weight, and enhancing storage capacity.

- Expansion of hydrogen production and distribution networks is supporting widespread adoption of hydrogen tanks across mobility and industrial sectors.

- High manufacturing costs and regulatory challenges remain key barriers to large-scale commercialization and adoption of hydrogen tank technologies.

Market Statistics

2024 Market Size: USD 78.41 million

2034 Projected Market Size: USD 1,484.93 million

CAGR (2025–2034): 34.3%

Asia Pacific: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

Hydrogen tanks are high-pressure storage vessels designed to safely contain hydrogen gas for various applications, most notably in fuel cell-powered vehicles and clean energy systems. The hydrogen tanks market is experiencing substantial traction as the global focus on sustainability and decarbonization intensifies, and the increasing demand for hydrogen-fueled vehicles is driving the market growth. According to a report from the International Energy Agency (IEA) published in 2024, global hydrogen demand exceeded 97 million tons (Mt) in 2023 and is anticipated to reach nearly 100 Mt in 2024. Automakers and energy companies are actively exploring hydrogen as a clean alternative to conventional fossil fuels, especially for heavy-duty transport and long-haul applications where battery-electric vehicles face limitations. This shift is fueling the need for robust, lightweight, and high-capacity hydrogen tanks that can support extended driving ranges and quick refueling capabilities.

Substantial government investments in clean energy infrastructure are accelerating the adoption of hydrogen technologies, including storage solutions. A 2024 IEA report projects global energy investment will surpass USD 3 trillion for the first time in 2024, with clean energy technologies and infrastructure accounting for approximately two-thirds, i.e., USD 2 trillion, of this total expenditure. Governments across various regions are integrating hydrogen into their national energy strategies, offering incentives, funding research, and establishing regulatory frameworks to build a viable hydrogen economy. These initiatives directly bolster the development and deployment of advanced hydrogen storage systems, as safe and efficient storage remains a critical enabler of hydrogen’s widespread utilization. Together, these drivers are shaping the market development, supported by advancements in materials, engineering, and policy.

Driver Dynamics

Advancements in Tank Technology

Advancements in tank technology address critical challenges related to safety, weight, and storage capacity. Innovations in composite materials and tank design have enabled the development of lighter, stronger, and more efficient hydrogen storage solutions that can withstand higher pressures while maintaining structural integrity. These technological improvements are essential for expanding the feasibility of hydrogen-powered systems across transportation and industrial sectors. For instance, Cevotec's February 2024 collaboration with industry partners to demonstrate Fiber Patch Placement (FPP) technology, which reduces carbon fiber usage by ~15% through localized dome reinforcement. This innovation exemplifies how material-efficient manufacturing directly translates to lighter tanks, lower costs, and increased storage capacity without compromising performance. Such advancements improve vehicle range and refueling efficiency and also improve overall system reliability and cost-effectiveness, making hydrogen a more viable energy carrier in the transition to clean energy.

Growing Need for Sustainable Energy

The growing need for sustainable energy solutions is also driving increased demand for hydrogen tanks. Hydrogen is gaining recognition as a clean and versatile energy source capable of supporting de-carbonization efforts across multiple sectors as global energy systems shift toward low-emission alternatives. Efficient storage plays a pivotal role in the hydrogen value chain, enabling its production, transportation, and end-use in power generation, mobility, and industrial processes. Hydrogen tanks are, therefore, essential infrastructure components that support the scaling of renewable energy and low-carbon hydrogen initiatives. According to a January 2023 report from India's Ministry of New and Renewable Energy, the government has initiated the National Green Hydrogen Mission with an allocated budget of approximately USD 2.4 million, aiming to establish an annual production capacity of 5 million metric tonnes of green hydrogen. Global environmental commitments and the push for long-term energy security further strengthen this demand.

Segment Assessment

Hydrogen Tanks Market Assessment by Tank Type Outlook

The segmentation based on tank type, includes type 1, type 2, type 3, type 4. The type 1 segment dominated the market expansion in 2024 due to its cost-effectiveness, structural simplicity, and proven performance in low to moderate-pressure applications. Type 1 tanks, made entirely of metal, provide durability and are easy to manufacture. They are an appealing choice for applications where weight is less of a concern, such as in stationary hydrogen storage or industrial uses. Their well-established production processes and lower initial investment requirements have led to widespread adoption across early-stage hydrogen infrastructure projects. This dominance reflects the market’s initial focus on affordability and reliability as the hydrogen ecosystem continues to develop globally.

Hydrogen Tanks Market Evaluation by Material Type Outlook

The segmentation based on material type, includes metal, composite. The metal segment is expected to witness the fastest growth during the forecast period as the metal-based tanks, particularly those made from high-strength steel or aluminum alloys, offer robust containment for hydrogen gas under high pressure. These tanks are relatively easier to manufacture and are favored in applications prioritizing durability over weight reduction. Additionally, metal tanks serve as a critical bridge in emerging hydrogen applications, where performance and safety are prioritized while composite technologies continue to evolve and scale. Their increasing adoption across energy storage and transportation sectors is contributing to the segment’s projected accelerated growth.

Regional Analysis

By region, the report provides insights into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. Asia Pacific dominated in 2024 supported by strong government backing, rapid industrialization, and growing investments in clean energy infrastructure. A report by the Indian Brand Equity Foundation (IBEF) reveals that Indian industry alliances are planning USD 800 million in investments across green hydrogen etc. Countries in the region are actively advancing hydrogen strategies as part of broader de-carbonization goals, with a particular focus on transportation, power generation, and industrial fuel substitution. The presence of essential automotive and energy manufacturing hubs, combined with growing demand for alternative energy solutions, has driven significant uptake of hydrogen tanks. The region’s proactive view on sustainable energy development and its robust manufacturing capabilities make it a key contributor to global market leadership.

Europe is projected to witness the fastest growth during the forecast period driven by strict environmental regulations, ambitious climate targets, and strong policy support for hydrogen technologies. For instance, as of September 2024, 58 governments, the EU, and ECOWAS have adopted hydrogen strategies. Their collective targets for low-emission hydrogen production will reach 35-43 million tonnes annually by 2030, covering 55-65% of the Net Zero Emissions (NZE) Scenario's projected needs. The region is aggressively pushing forward hydrogen adoption across sectors such as mobility, energy storage, and heavy industry, creating a rising demand for advanced storage systems. Additionally, Europe’s emphasis on lightweight and high-performance solutions has encouraged innovation in hydrogen tank design and materials. This forward-looking regulatory and innovation landscape positions Europe as a high-growth region in the evolving hydrogen economy.

Hydrogen Tanks Key Market Players & Competitive Analysis Report

The competitive landscape features global leaders and regional players competing for market share through innovation, strategic alliances, and regional expansion. Global players utilize strong R&D capabilities, technological advancements, and extensive distribution networks to deliver advanced solutions, meeting the growing demand for disruptive technologies and sustainable value chains. Market trends highlight rising demand for emerging technologies, digitalization, and business transformation driven by economic growth, geopolitical shifts, and macroeconomic trends. Global players focus on strategic investments, mergers and acquisitions, and joint ventures to strengthen their market position. Post-merger integration and strategic alliances are key strategies to improve competitive positioning and expand regional footprints. Regional companies, meanwhile, address localized needs by offering cost-effective solutions and leveraging economic landscapes. Competitive benchmarking includes market entry assessments, expansion opportunities, and partnership ecosystems to meet the demand for innovative products and future-ready solutions. The market is experiencing technological advancements, such as disruptive technologies and digital transformation, reshaping industry ecosystems. Companies are investing in supply chain management, procurement strategies, and sustainability transformations to align with demand, trends, and future development strategies. Pricing insights, revenue growth analysis, and competitive intelligence are critical for identifying opportunities and driving long-term profitability. A few key major players are Calvera Hydrogen, CIMC Enric Holdings Limited, Composite Advanced Technologies, LLC (CATiC Gases), Everest Kanto Cylinder Ltd., Faber Industrie S.p.A., Hexagon Purus, Luxfer Gas Cylinders, Quantum Fuel Systems LLC, Steelhead Composites, Inc., Worthington Cylinders GmbH.

Quantum Fuel Systems LLC, established in 1999 and headquartered in Ventura, California, specializes in advanced fuel system solutions for the automotive and power sports industries. The company is a leading supplier of high-performance fuel pumps, fuel system components, and replacement parts, trusted by over 2,100 dealers globally. Quantum has also expanded its expertise to alternative fuel technologies, including compressed natural gas (CNG) and hydrogen storage systems. Its proprietary Q-Lite Type IV technology is a key innovation, offering lightweight, durable hydrogen tanks designed for medium- and heavy-duty trucks. These tanks maximize fuel capacity while minimizing weight, enabling higher payloads and improved efficiency. Quantum's hydrogen storage solutions meet OEM standards with modular designs that simplify installation and maintenance. The company supports sustainable energy initiatives and zero-emission mobility solutions by focusing on low-emission technologies.

Worthington Cylinders GmbH, an Austrian-based subsidiary of Worthington Industries, is a manufacturer of high-pressure cylinders. Established in 1817, the company has evolved into a modern industrial powerhouse, producing over 750,000 seamless steel cylinders annually. It specializes in high-pressure solutions for industrial gases, such as compressed natural gas (CNG) and acetylene applications. Worthington Cylinders GmbH is renowned for its innovative composite cylinders, such as Type II and Type III designs, which cater to diverse industries such as automotive and breathing air systems. The company adheres to strict quality standards, holds certifications such as ISO 9001 and ISO 14000, and employs advanced practices such as Six Sigma and Kaizen. A substantial development from Worthington Industries is the introduction of ThermaGuard hydrogen cylinders. These advanced composite cylinders are designed for storing and transporting high-pressure hydrogen gas efficiently. They operate at temperatures up to 250°F (121°C), eliminating the need for expensive pre-chilling processes and ensuring durability under extreme conditions. These cylinders support zero-emission mobility solutions and sustainable hydrogen infrastructure with service pressures ranging from 248–700 bar (3,600–10,150 psi). Worthington’s expertise in aerospace-grade standards ensures longer cylinder life, faster filling times, and reduced costs for hydrogen fuel applications.

Key Companies in Hydrogen Tanks Market

- Calvera Hydrogen

- CIMC Enric Holdings Limited

- Composite Advanced Technologies, LLC (CATiC Gases)

- Everest Kanto Cylinder Ltd.

- Faber Industrie S.p.A.

- Hexagon Purus

- Luxfer Gas Cylinders

- Quantum Fuel Systems LLC

- Steelhead Composites, Inc.

- Worthington Cylinders GmbH

Hydrogen Tanks Market Development

March 2025, GenH2 launched its LS20 mobile liquid hydrogen system, a compact liquefaction and storage unit producing 2-20 kg/day of liquid hydrogen. Designed for research and pilot projects, it supports transportation, energy storage, and material testing applications.

March 2023, Toyoda Gosei launched high-pressure hydrogen tanks for fuel-cell trucks, storing 8x more hydrogen than passenger vehicle tanks (e.g., Toyota Mirai). Developed with Toyota’s refined storage tech, they support CJPT’s light-duty hydrogen trucks, addressing growing demand for heavy transport solutions.

August 2022, INOXCVA (India) deployed India's largest liquid hydrogen storage tank (238m³ capacity), designed to European and Korean safety standards. The tank was shipped from Kandla to South Korea for a clean energy demonstration project.

Hydrogen Tanks Market Segmentation

By Pressure Outlook (Revenue, USD Million, 2020 - 2034)

- Below 250 BAR

- 250 to 500 BAR

- Above 500 BAR

By Material Type Outlook (Revenue, USD Million, 2020 - 2034)

- Metal

- Composite

By Tank Type Outlook (Revenue, USD Million, 2020 - 2034)

- Type 1

- Type 2

- Type 3

- Type 4

By Application Outlook (Revenue, USD Million, 2020 - 2034)

- Stationary Storage

- Fuel Tank

- Transportation

By Regional Outlook (Revenue, USD Million, 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Hydrogen Tanks Market Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 78.41 million |

|

Market Size Value in 2025 |

USD 104.67 million |

|

Revenue Forecast in 2034 |

USD 1,484.93 million |

|

CAGR |

34.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global hydrogen tanks market size was valued at USD 78.41 million in 2024 and is projected to grow to USD 1,484.93 million by 2034.

The global market is projected to grow at a CAGR of 34.3% during the forecast period.

Asia Pacific dominated the market in 2024.

Some of the key players in the market are Calvera Hydrogen, CIMC Enric Holdings Limited, Composite Advanced Technologies, LLC (CATiC Gases), Everest Kanto Cylinder Ltd., Faber Industrie S.p.A., Hexagon Purus, Luxfer Gas Cylinders, Quantum Fuel Systems LLC, Steelhead Composites, Inc., Worthington Cylinders GmbH.

The type 1 segment dominated in 2024.

The metal segment is expected to witness the fastest growth during the forecast period.