Hydrogenated Vegetable Oil Market Size, Share, Trends, & Industry Analysis Report

By Grade (Unfractionated, Fractionated, and Others), By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 128

- Format: PDF

- Report ID: PM5787

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

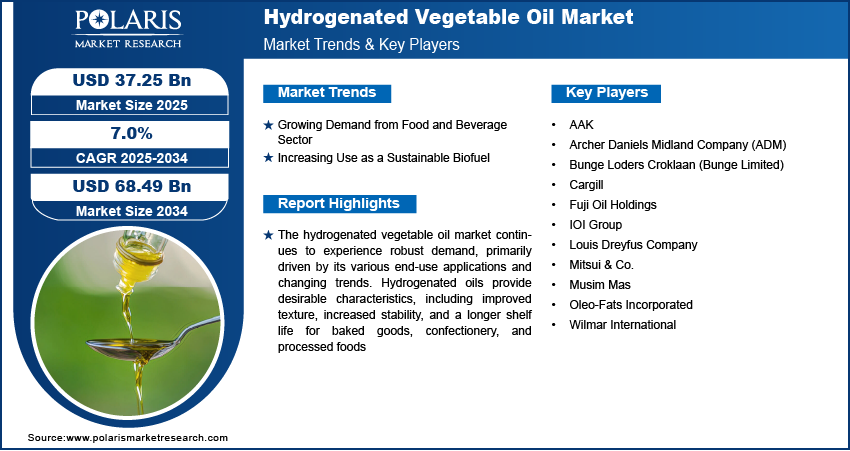

The global hydrogenated vegetable oil market size was valued at USD 34.90 billion in 2024 and is anticipated to register a CAGR of 7.0% from 2025 to 2034. The market is witnessing increased demand driven by its widespread use in processed foods, such as baked goods and snacks. The global push for renewable energy sources is increasing the use of hydrogenated vegetable oil as a sustainable biofuel.

The hydrogenated vegetable oil involves producing and using vegetable oils that have undergone a process called hydrogenation. This process adds hydrogen atoms to unsaturated fatty acids in the oil, making it more solid at room temperature and enhancing its stability. These oils are widely used across various sectors, impacting numerous products' texture, shelf life, and functional properties.

The extensive application in the food and beverage industry is a major growth factor. Hydrogenated oils offer desirable characteristics such as improved texture, increased stability, and extended shelf life for baked goods, sugar confectionery, and processed foods. Food manufacturers utilize these oils because hydrogenation transforms liquid oils into semi-solid or solid fats, essential for achieving specific textures and consistencies in a wide range of products. For instance, hydrogenated vegetable oil helps provide structure, richness, and a desirable mouthfeel in creating baked goods such as cookies, pastries, and bread. Their stability also means products stay fresh longer, reducing spoilage. The US Food and Drug Administration (FDA) has historically recognized the functional properties of these oils in processed foods. However, regulatory focus has shifted toward reducing trans fats, leading to increased use of fully hydrogenated oils with different fat profiles.

The hydrogenated vegetable oil sector also benefits from the demand for these oils in industrial applications beyond food. Another significant driver is the increasing adoption of hydrogenated vegetable oil as a renewable and sustainable fuel. The oil serves as an alternative to traditional diesel, aligning with global efforts to reduce carbon emissions and transition to cleaner energy sources. The demand from the automotive, marine, and aviation sectors contributes to its overall growth potential.

Industry Dynamics

Expanding Demand from Food and Beverage Sector

The food and beverage sector represents a significant driver for the hydrogenated vegetable oil market due to the unique functional properties these oils impart to food products. The oil is widely used in baked goods, confectionery, and various processed foods as it offers desirable textures, improved stability, and extended shelf life. Hydrogenation allows manufacturers to create solid or semi-solid fats from liquid oils, which are crucial for achieving specific product consistencies and preventing spoilage, thereby meeting consumer demands for convenient and longer-lasting food items.

The increasing global consumption of processed and ready-to-eat foods fuels the demand for hydrogenated vegetable oil. For example, a study titled "Trends in Consumption of Ultraprocessed Foods Among US Youths Aged 2–19 Years, 1999–2018" indicates that the estimated percentage of total energy from ultra-processed foods consumed by US youths increased from 61.4% to 67.0% from 1999 to 2018. While this study highlights a different aspect of processed foods, it demonstrates the substantial and growing role of processed foods in diets, many of which traditionally rely on functional fats such as hydrogenated oils for their structure and stability. This consistent demand from the food processing sector, driven by consumer preference for convenience and product quality, continues to drive the growth.

Growing Adoption as a Sustainable Biofuel

The rising global emphasis on renewable energy sources and reducing carbon emissions is a powerful driver. Hydrogenated vegetable oil is chemically similar to petroleum diesel, allowing it to be used as a "drop-in" fuel in existing diesel engines without modifications. This makes it a highly attractive alternative to traditional fossil fuels across various transportation sectors, including road, marine, and aviation, contributing to decarbonization efforts.

Government policies and incentives worldwide are actively promoting the production and consumption of biofuels such as hydrogenated vegetable oil. For instance, the US Energy Information Administration (EIA) reported in an article titled "EIA: US capacity to produce biofuels increased 7% in 2023", that capacity to produce biofuels in the US increased by 7% in 2023, reaching 24 billion gallons per year, with a significant 44% increase in renewable diesel and other biofuels. The EIA also highlighted in an article titled "Consumption of renewable diesel continues general growth trend on the U.S. West Coast" that renewable diesel consumption on the US West Coast has approximately doubled since the first quarter of 2023, largely due to state-level clean fuel programs. These robust policy frameworks and the environmental benefits of hydrogenated vegetable oil are significantly accelerating their adoption, thus driving the market growth for hydrogenated vegetable oil.

Segmental Insights

By Grade

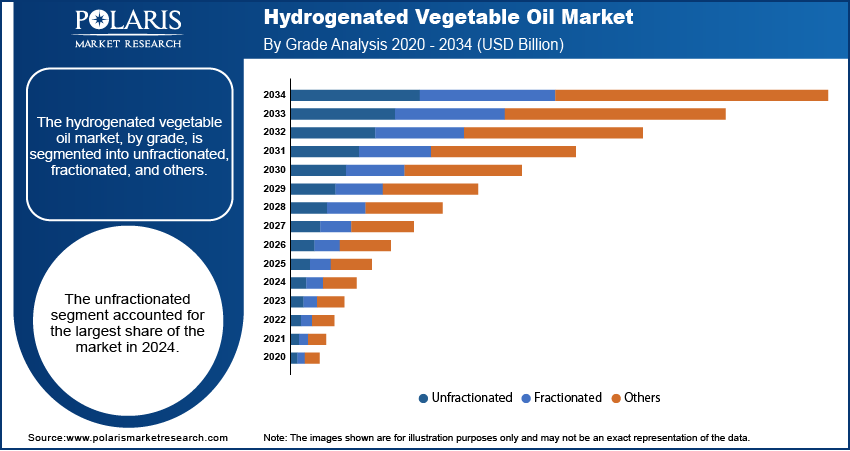

The unfractionated segment held the largest share at approximately 45% in 2024. This dominance is driven by its versatility and cost-effectiveness, making it a vital element in various industrial applications, particularly in the food & beverage sector. Unfractionated oils, which retain the complete triglyceride profile, offer natural oxidative stability and are widely used in products requiring general consistency and extended shelf life, such as bakery shortenings and frying fats. Their widespread use across diverse food formulations underscores their substantial presence.

The fractionated segment is expected to register the highest growth rate during 2025–2034. Fractionation involves a specialized process of controlled crystallization to separate and isolate specific fatty acid fractions from the oil. This allows for the creation of fats with highly tailored functional properties, such as sharper melting profiles and specific textural characteristics, which are desirable for specialized applications. A study indicates that the widespread consumption of processed foods indirectly highlights the need for diverse fat solutions, including those with specialized properties. The capability of fractionated oils to meet specific technical requirements for confectionery coatings, premium fat systems, and certain cosmetic formulations accelerates their adoption and market expansion.

By End Use

The food and beverage segment held the largest share of over 50% in 2024. This dominance is attributed to the critical functional properties that hydrogenated vegetable oils impart to various food products. These oils are essential for achieving desired textures, providing stability, and extending the shelf life of baked goods, confectionery, snacks, and processed foods. Their ability to solidify and resist oxidation makes them indispensable for manufacturers looking to ensure product quality and consumer appeal. This segment is followed by the personal care and cosmetics segment, which holds a market share of over 20% in 2024, due to its use in skincare products such as balms, skin cream, and other items.

The industrial segment is expected to register the highest growth rate during the forecast period, primarily driven by the increasing adoption of hydrogenated vegetable oil as a sustainable biofuel. The global shift toward cleaner energy sources and stringent environmental regulations is accelerating the demand for hydrogenated vegetable oil as a viable alternative to traditional fossil fuels across transportation sectors such as road, marine, and aviation. For example, the US Energy Information Administration (EIA) noted in a May 2025 update that renewable diesel production in the country was expected to rise, with forecasts indicating continued growth in 2025 and 2026.

Regional Analysis

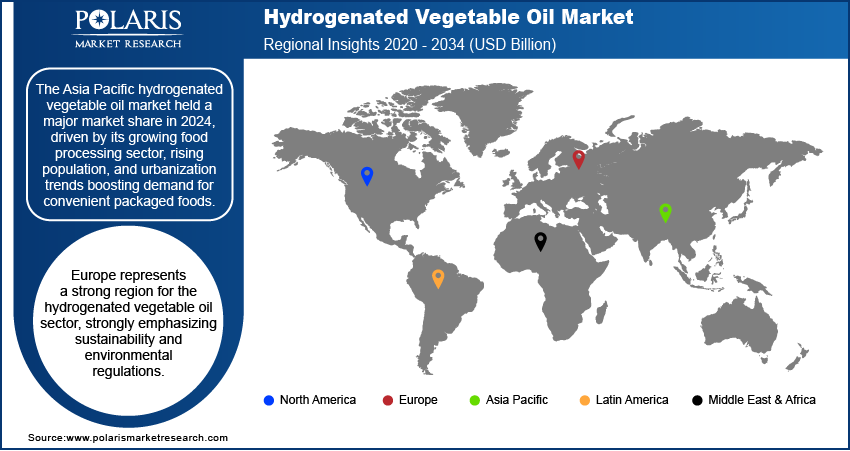

The Asia Pacific hydrogenated vegetable oil market accounted for approximately 35% of the global market in 2024. This growth is primarily driven by the growing processed food industry, which is influenced by rapid urbanization, changing lifestyles, and increasing disposable incomes across many countries in this region. As consumers increasingly seek convenience, the demand for packaged snacks, ready-to-eat meals, and confectionery, all of which utilize hydrogenated oils, is rising. Alongside this, there is a growing recognition of the need for sustainable energy solutions, which has led to an increasing interest in biofuels.

The China hydrogenated vegetable oil market growth is driven by its large and growing food processing sector, which serves a vast population with changing dietary habits. Furthermore, China's sustainable development and energy security efforts foster interest in biofuels. A 2023 report from the USDA Foreign Agricultural Service, titled "Biofuels Annual," indicated China's policy to promote non-grain-based biofuels and develop advanced biofuels, including those that could utilize hydrogenated vegetable oil as a feedstock. On the other hand, it has been noted that Chinese exports of used cooking oil have been on the rise, which is also a primary feedstock for hydrogenated vegetable oil. Although challenging, the long-term strategic focus on reducing reliance on fossil fuels and managing agricultural resources indicates a growing potential for industrial applications for these oils.

North America Hydrogenated Vegetable Oil Market Insight

The North America hydrogenated vegetable oil market experiences steady demand, primarily driven by the extensive food and beverage sector. This region is anticipated to register a CAGR of more than 7% during the forecast period. Consumers in this region consistently prefer processed foods, convenience meals, and baked goods, which often incorporate hydrogenated oils for their functional benefits, such as improved texture and extended shelf life. In addition to food, the personal care and cosmetics sector also drives demand, using these oils for their emollient properties and stability. The region's mature industrial base and established supply chains support the consistent flow of these products.

US Hydrogenated Vegetable Oil Market Insight

The US is a significant market for hydrogenated vegetable oil in North America. The country's robust food processing sector, notable for its large consumer base of packaged and ready-to-eat items, drives substantial demand for these oils. Moreover, the US is adopting, specifically, hydrogenated vegetable oil as a renewable diesel alternative. According to the U.S. Energy Information Administration (EIA) update from June 2024, renewable diesel and biodiesel production in the country declined in Q1 2025, highlighting an overall decrease in renewable diesel output despite an increase in production capacity. This indicates a strong policy push and growing industry focus on sustainable fuels, contributing significantly to the demand in the industrial segment across the nation.

Europe Hydrogenated Vegetable Oil Market Insights

Europe represents a robust region focused on sustainability and environmental regulations. While the food industry continues to experience strong demand for the traditional applications of hydrogenated vegetable oil, the most significant market growth driver is the widespread adoption of the oil as a biofuel. European Union directives, such as the Renewable Energy Directive (RED II and RED III), mandate increasing shares of renewable energy in the transport sector, directly boosting the demand for advanced biofuels such as hydrogenated vegetable oil. These regulations encourage industries to shift away from fossil fuels, making the oil crucial in achieving decarbonization targets across various sectors.

The Germany hydrogenated vegetable oil market is significantly influenced by the country's proactive renewable energy policies and strong industrial sector. The country has played a key role in promoting biofuels, with government support for incorporating sustainable fuels into its energy mix. For instance, the approval of hydrogenated vegetable oil as a heating fuel by the German Bundesrat signifies the nation's commitment to reducing its carbon footprint and moving toward eco-friendly energy sources. This consistent regulatory push and industrial application in sectors beyond food contribute to the country's strong and growing demand for hydrogenated vegetable oil.

Key Players and Competitive Insights

A mix of large global players and specialized regional manufacturers shapes the competitive landscape of the hydrogenated vegetable oil industry. Companies often compete on factors such as product innovation, supply chain efficiency, sustainability practices, and the ability to offer tailored solutions for diverse end-use applications. There is a continuous focus on adapting to evolving consumer preferences and regulatory changes, particularly concerning fat profiles and sustainable sourcing, leading to ongoing strategic adjustments.

A few prominent companies in the industry include Archer Daniels Midland Company (ADM), Cargill, Bunge Loders Croklaan (Bunge Limited), Wilmar International, Louis Dreyfus Company, IOI Group, AAK, Musim Mas, Oleo-Fats Incorporated, Fuji Oil Holdings, and Mitsui & Co.

Key Players

- AAK

- Archer Daniels Midland Company (ADM)

- Bunge Loders Croklaan (Bunge Limited)

- Cargill

- Fuji Oil Holdings

- IOI Group

- Louis Dreyfus Company

- Mitsui & Co.

- Musim Mas

- Oleo-Fats Incorporated

- Wilmar International

Industry Developments

April 2025, Bunge entered into a partnership with Repsol to advance the production of renewable fuels derived from hydrogenated vegetable oils. The collaboration aims to convert crops like camelina and safflower into low-carbon intensity oils, which will be used as feedstock for hydrotreated vegetable oil (HVO), supporting the development of sustainable energy alternatives.

Hydrogenated Vegetable Oil Market Segmentation

By Grade Outlook (Revenue – USD Billion, 2020–2034)

- Unfractionated

- Fractionated

- Others

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- Food & Beverage

- Personal Care and Cosmetics

- Industrial

- Others

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Hydrogenated Vegetable Oil Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 34.90 billion |

|

Market Size in 2025 |

USD 37.25 billion |

|

Revenue Forecast by 2034 |

USD 68.49 billion |

|

CAGR |

7.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Customize your report according to your requirements concerning countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 34.90 billion in 2024 and is projected to grow to USD 68.49 billion by 2034.

The global market is projected to register a CAGR of 7.0% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few key players in the market include Archer Daniels Midland Company (ADM), Cargill, Bunge Loders Croklaan (Bunge Limited), Wilmar International, Louis Dreyfus Company, IOI Group, AAK, Musim Mas, Oleo-Fats Incorporated, Fuji Oil Holdings, and Mitsui & Co.

The unfractionated segment accounted for the largest share of the market in 2024.

The fractionated segment will witness the fastest growth during the forecast period.