Hypodermic Syringes and Needles Market for Animal Health Size, Share, Industry Analysis Report

By Animal Type (Livestock Animals, Companion Animals), By Syringe Type, By Needle Length, By Application, By Distribution Channel, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5928

- Base Year: 2024

- Historical Data: 2020-2023

Overview

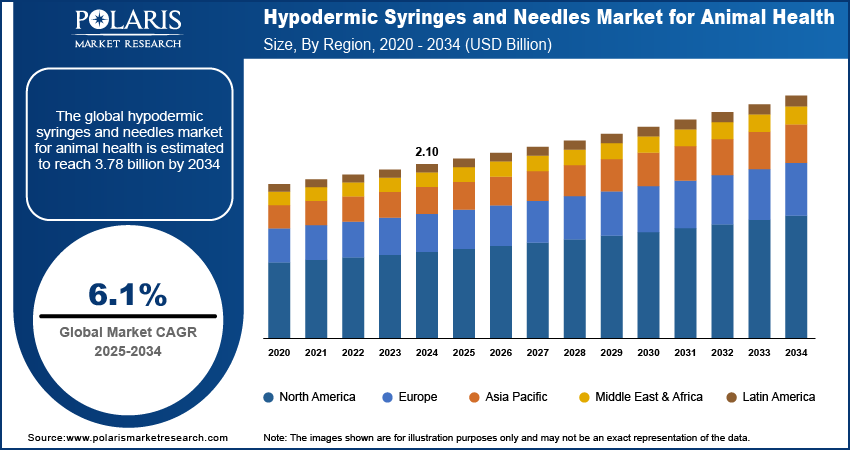

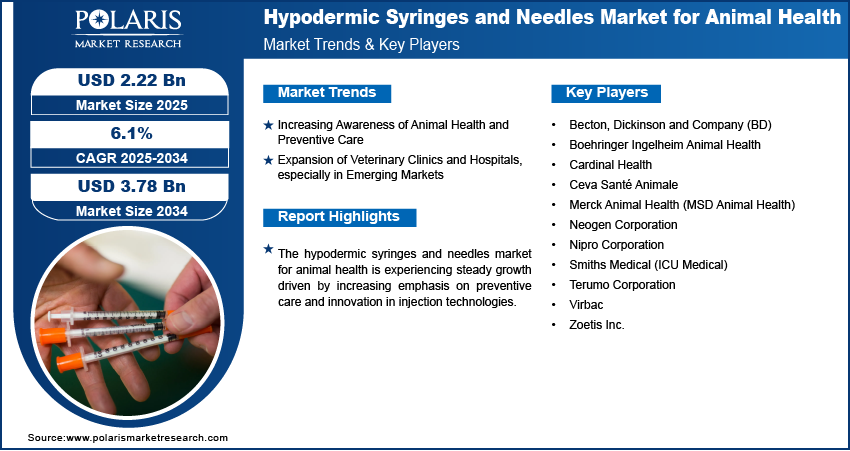

The global hypodermic syringes and needles market for animal health size was valued at USD 2.10 billion in 2024, growing at a CAGR of 6.1% from 2025 to 2034. Key factors driving demand for hypodermic syringes and needles for animal health include increasing support from government bodies through initiatives and funding, rising awareness of animal health, and expansion of veterinary clinics and hospitals.

Key Insights

- The livestock animals segment accounted for a substantial revenue share in 2024.

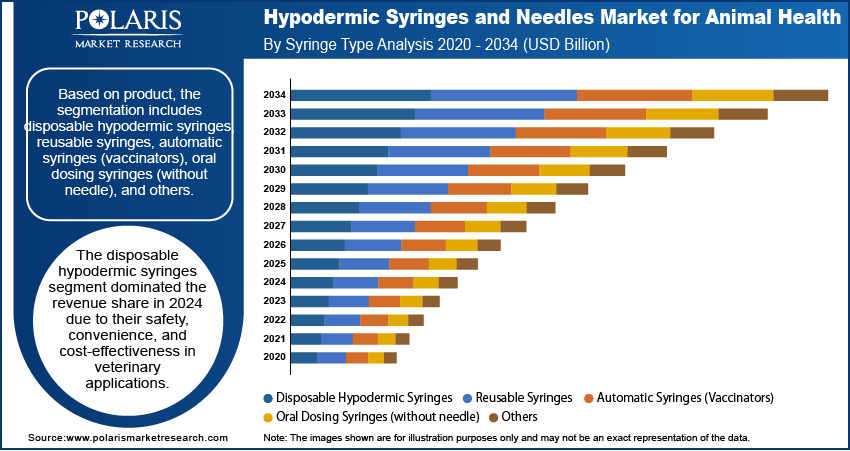

- The disposable hypodermic syringes segment dominated the revenue share in 2024 due to their safety, convenience, and cost-effectiveness in veterinary applications.

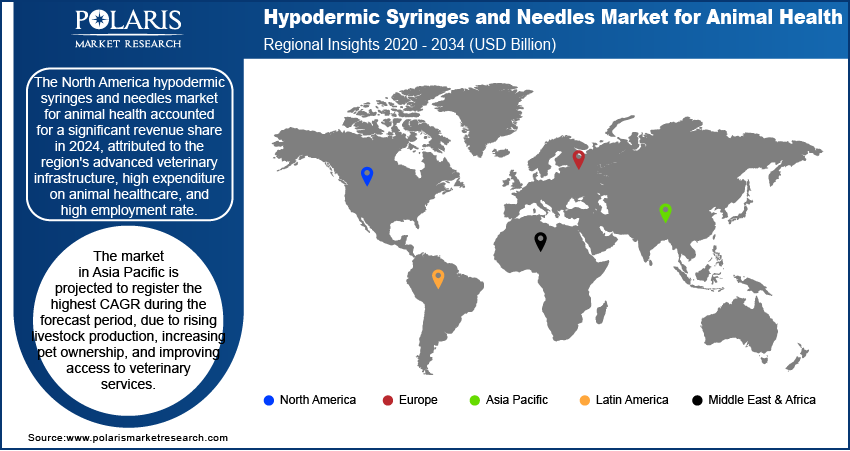

- North America accounted for a significant revenue share in 2024.

- The U.S. held a significant revenue share in the North America hypodermic syringes and needles market for animal health in 2024 due to its highly developed veterinary healthcare infrastructure and widespread pet ownership.

- The market in Asia Pacific is projected to register the highest CAGR during the forecast period due to rising livestock production, increasing pet ownership, and improving access to veterinary services.

- The market in India is expanding due to growing investments in animal husbandry, rising awareness of animal health.

Hypodermic syringes and needles for animal health are medical devices used to administer medications, vaccines, and other therapeutic agents directly into an animal's body with precision and minimal tissue damage. These instruments are vital tools in veterinary medicine, especially within large-scale immunization and disease prevention initiatives. The growth of this market is boosted due to the increasing support from government bodies through initiatives and funding aimed at controlling animal-borne diseases. In October 2024, India's Ministry of Fisheries, Animal Husbandry and Dairying launched a USD 25 million Pandemic Fund Project to strengthen animal health security for pandemic preparedness. Funded by the G20, it aims to enhance disease surveillance and response systems. Additionally, national and regional veterinary health programs often include mass vaccination campaigns, disease eradication efforts, and livestock health monitoring, all of which heavily rely on reliable and standardized hypodermic delivery systems. This focus on preventive healthcare is encouraging wider adoption of high-quality syringes and needles in both farm and wild animal healthcare sectors.

The rising rate of pet adoption, along with the subsequent demand for enhanced companion animal healthcare, further drives the demand. According to the 2024 Shelter Animals Count report, 4,192,443 dogs and cats were adopted (2 million each), marking a 0.4% rise (17,153 more) from 2023, reflecting steady adoption trends for shelter pets across the nation. There has been a notable shift in the expectations of pet healthcare standards, as more households adopt pets into their family. This includes routine vaccinations, chronic disease management, and preventive treatments, many of which require frequent injections. Consequently, veterinary professionals and pet owners alike are increasingly relying on safe, easy-to-use hypodermic syringes and needles designed for a wide range of animal sizes and treatment requirements. Moreover, the growing emotional and financial investments in pet well-being are driving demand for advanced veterinary tools, thereby expanding the market for hypodermic syringes and needles for animal health.

Industry Dynamics

- Increasing awareness of animal health and preventive care is directly impacting the frequency and quality of veterinary interventions, which is driving demand for hypodermic syringes and needles for animal health.

- Expansion of veterinary clinics and hospitals, especially in emerging markets, due to an increase in the availability and accessibility of professional veterinary services for animal healthcare, propels the market growth.

- The expansion of veterinary healthcare infrastructure and government-funded animal immunization programs presents a significant opportunity by driving higher demand for reliable vaccination and treatment tools.

- Strict regulatory requirements and high costs associated with advanced veterinary equipment create challenges by increasing compliance burdens and R&D expenses, limiting market entry for smaller players, and slowing the adoption of innovative technologies due to affordability constraints.

Increasing Awareness of Animal Health and Preventive Care: Increasing awareness of animal health and preventive care is driving growth opportunities in the animal health sector, as it directly influences the frequency and quality of veterinary interventions. In February 2025, the Department of Animal Husbandry and Dairying (DAHD) launched a nationwide animal welfare initiative aimed at improving livestock management, disease prevention, and breed improvement. The program educates farmers on scientific practices, government schemes, and modern techniques to boost productivity and sustainability. There is an increasing demand for tools that support regular veterinary procedures, driven by a growing understanding among livestock owners and pet parents about the benefits of early diagnosis, timely vaccination, and disease prevention. Hypodermic syringes and needles play a crucial role in administering vaccines, antibiotics, and other injectable medications essential for maintaining animal health. This shift toward proactive healthcare practices is driving the widespread adoption of these devices across both commercial livestock operations and companion animal care settings.

Expansion of Veterinary Clinics and Hospitals, especially in Emerging Markets: The expansion of veterinary clinics and hospitals, particularly in emerging markets, is driving growth opportunities in the animal health sector. There is an increase in the availability and accessibility of professional veterinary services as infrastructure for animal healthcare improves. A November 2024 report by the South African Veterinary Association indicated that there were approximately 4,000 registered veterinarians in the country, with the profession experiencing steady growth. This expansion facilitates higher volumes of outpatient visits, surgical interventions, and routine check-ups, all of which require sterile and efficient injection solutions. Moreover, the establishment of modern veterinary facilities in underserved regions is accelerating the standardization of care practices, including the consistent use of hypodermic syringes and needles, thus contributing to overall market growth.

Segmental Insights

Animal Type Analysis

Based on animal type, the segmentation includes livestock animals, companion animals, exotic & zoo animals, and aquaculture. The livestock animals segment accounted for a substantial revenue share in 2024 due to the extensive use of hypodermic syringes and needles in disease management, vaccination, and therapeutic administration for large-scale animal feed. Livestock monitoring is critical for ensuring food safety, productivity, and biosecurity, making regular medical interventions necessary. The high frequency of disease outbreaks, coupled with the need for herd immunity, has led to the widespread adoption of injectable treatments. Additionally, large commercial farms rely heavily on injectable drug delivery systems for efficiency and accuracy, contributing to the strong revenue performance of this segment.

Syringe Type Analysis

In terms of syringe type, the segmentation includes disposable hypodermic syringes, reusable syringes, automatic syringes (vaccinators), oral dosing syringes (without needle), and others. The disposable hypodermic syringes dominated the revenue share in 2024 due to their safety, convenience, and cost-effectiveness in veterinary applications. These single-use devices reduce the risk of cross-contamination and ensure compliance with hygiene standards in animal health practices. Veterinary professionals and animal handlers prefer disposable syringes due to their ease of handling, reduced sterilization requirements, and suitability for both small and large animal procedures. Furthermore, the growing awareness regarding infection control and biosafety in veterinary settings continues to support the demand for disposable syringes over reusable alternatives.

Needle Length Analysis

The segmentation, based on needle length, includes short needles, medium-length needles, and long needles. The medium-length segment is expected to witness robust growth during the forecast period, as it offers an ideal balance between penetration depth and ease of handling across various animal sizes. Medium-length needles are particularly well-suited for administering vaccines and medications to both livestock and companion animals, providing versatility in both field and clinical settings. Their compatibility with a wide range of injection sites and reduced risk of tissue damage make them a preferred choice for routine veterinary procedures. As a result, their practicality and adaptability are driving consistent uptake among veterinary practitioners.

Application Analysis

The segmentation, based on application, includes vaccination, drug delivery (antibiotics and hormones), anesthesia/sedation, euthanasia, and others. The drug delivery (antibiotics and hormones) segment growth is driven by the increasing prevalence of infectious diseases and the need for productivity-enhancing treatments in both livestock and companion animals. Hypodermic syringes and needles are essential tools for the precise administration of antibiotics, hormones, and other therapeutic agents that help manage animal health and optimize reproductive cycles. Additionally, the increasing use of hormone therapies to enhance breeding efficiency, combined with strict treatment protocols for bacterial infections, drives the demand for accurate and efficient injectable delivery systems.

Regional Analysis

The North America hypodermic syringes and needles market for animal health accounted for a significant revenue share in 2024, attributed to the region's advanced veterinary infrastructure, high expenditure on animal healthcare, and high employment rate. According to a December 2024 AVMA report, the U.S. veterinary workforce totaled 130,415 professionals in 2024. The figure reflects the current employment landscape for veterinarians nationwide. The presence of a well-established livestock industry, along with widespread pet ownership, ensures consistent demand for injectable veterinary tools. Additionally, proactive government policies and strong adoption of preventive healthcare measures among animal owners contribute significantly to market leadership in this region.

U.S. Hypodermic Syringes and Needles Market for Animal Health

The U.S. held a significant revenue share in North America in 2024 due to its highly developed veterinary healthcare infrastructure, widespread pet ownership, and intensive livestock production systems. Strong regulatory frameworks, combined with a high adoption rate of advanced veterinary practices, support consistent use of injectable solutions. Additionally, the presence of leading market players and increased spending on animal disease prevention contribute to the country’s leadership.

Asia Pacific Hypodermic Syringes and Needles Market for Animal Health

The market in Asia Pacific is projected to register the highest CAGR during the forecast period, due to rising livestock production, increasing pet ownership, and improving access to veterinary services. Economic growth in the region is driving investments in animal healthcare infrastructure, including the adoption of modern treatment methods, such as hypodermic injections. Greater awareness of animal disease management also boosts the demand for syringes and needles. In March 2025, FAO's ECTAD launched a three-year, Australian-funded initiative to strengthen animal health systems in Southeast Asia and the Pacific. The project aims to improve disease prevention, detection, and response through resilient veterinary infrastructure. This emerging focus on animal welfare and productivity improvement is expected to sustain strong market growth across Asia Pacific.

India Hypodermic Syringes and Needles Market for Animal Health

The market in India is expanding due to growing investments in animal husbandry, rising awareness of animal health, and increasing vaccination coverage for livestock. The government’s focus on improving veterinary services and enhancing productivity in the dairy and poultry sectors is driving demand for hypodermic syringes and needles. Furthermore, the expanding companion animal population in urban areas is supporting greater uptake of veterinary injectable across clinics and households.

Europe Hypodermic Syringes and Needles Market for Animal Health

The hypodermic syringes and needles market for animal health in Europe is projected to hold a substantial share in 2034, driven by the region's strict animal welfare regulations and well-integrated veterinary service networks. Europe’s focus on sustainable farming and animal health monitoring programs ensures the continuous use of injectable therapies for disease prevention and treatment. The growing focus on biosafety, traceability, and the use of certified medical tools further supports demand in the region. Additionally, ongoing research and innovation in veterinary healthcare technologies are expected to maintain Europe's significant presence in the global market in the coming years.

UK Hypodermic Syringes and Needles Market for Animal Health

The UK hypodermic syringes and needles market for animal health is driven by a well-regulated veterinary healthcare system, emphasis on preventive care, and strong adherence to animal welfare standards. Increasing adoption of modern veterinary tools by professionals and the shift toward sustainable livestock management practices are promoting the use of precision injection devices. Additionally, the rising number of pet owners seeking routine vaccinations and treatments is fueling market expansion in the UK.

Key Players and Competitive Analysis

The hypodermic syringes and needles sector for animal health presents significant revenue opportunities, driven by rising demand in both emerging and developed markets. Major trends, such as technological advancements in needle design and the use of sustainable materials, are reshaping competitive intelligence and strategy. Small and medium-sized businesses are leveraging growth projections to expand their presence, while larger players focus on strategic investments to enhance production capabilities. Southeast Asia and Africa show high latent demand and opportunities due to increasing livestock health initiatives, whereas North America and Europe benefit from advanced veterinary infrastructure. Economic and geopolitical shifts, including supply chain disruptions, influence pricing and availability. Expert insights emphasize the importance of sustainable value chains in meeting future needs. Additionally, leading vendors are capitalizing on expansion opportunities through mergers and acquisitions, and partnerships to strengthen their regional presence. Revenue growth analysis indicates strong potential in oral dosing syringes and automatic vaccinators.

A few major companies operating in the hypodermic syringes and needles market for animal health include Becton, Dickinson and Company (BD); Boehringer Ingelheim Animal Health; Cardinal Health; Ceva Santé Animale; Merck Animal Health (MSD Animal Health); Neogen Corporation; Nipro Corporation; Smiths Medical (ICU Medical); Terumo Corporation; Virbac; and Zoetis Inc.

Key Players

- Becton, Dickinson and Company (BD)

- Boehringer Ingelheim Animal Health

- Cardinal Health

- Ceva Santé Animale

- Merck Animal Health (MSD Animal Health)

- Neogen Corporation

- Nipro Corporation

- Smiths Medical (ICU Medical)

- Terumo Corporation

- Virbac

- Zoetis Inc.

Industry Development

- September 2024: ThaMa-Vet launched two all-metal automatic syringes (ThaMa 405 single-barrel and 422 double-barrel) for precise, high-volume fish vaccination. Designed for wet environments, they enable fatigue-free operation and dual-vaccine delivery, already adopted by vaccine producers.

Hypodermic Syringes and Needles Market for Animal Health Segmentation

By Animal Type Outlook (Revenue, USD Billion, 2020–2034)

- Livestock Animals

- Companion Animals

- Exotic & Zoo Animals

- Aquaculture

By Syringe Type Outlook (Revenue, USD Billion, 2020–2034)

- Disposable Hypodermic Syringes

- Reusable Syringes

- Automatic Syringes (Vaccinators)

- Oral Dosing Syringes (Without Needle)

- Others

By Needle Length Outlook (Revenue, USD Billion, 2020–2034)

- Short Needles

- Medium-Length Needles

- Long Needles

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Vaccination

- Drug Delivery (Antibiotics, Hormones)

- Anesthesia/Sedation

- Euthanasia

- Others

By Distribution Channel Outlook (Revenue, USD Billion, 2020–2034)

- Veterinary Supply Distributors

- Online Retail

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Hypodermic Syringes and Needles Market for Animal Health Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.10 Billion |

|

Market Size in 2025 |

USD 2.22 Billion |

|

Revenue Forecast by 2034 |

USD 3.78 Billion |

|

CAGR |

6.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 2.10 billion in 2024 and is projected to grow to USD 3.78 billion by 2034.

The global market is projected to register a CAGR of 6.1% during the forecast period.

The market in Asia Pacific is projected to register the highest CAGR during the forecast period.

A few of the key players in the market are Becton, Dickinson and Company (BD); Boehringer Ingelheim Animal Health; Cardinal Health; Ceva Santé Animale; Merck Animal Health (MSD Animal Health); Neogen Corporation; Nipro Corporation; Smiths Medical (ICU Medical); Terumo Corporation; Virbac; and Zoetis Inc.

The disposable hypodermic syringes segment dominated the revenue share in 2024.

The medium-length segment is expected to witness robust growth during the forecast period.