Ignition Coil Market Size, Share, & Trends Analysis Report

: By Product Type, By End Use (Automotive, Marine, Agriculture, and Others), and By Region– Forecast, 2025–2034

- Published Date:May-2025

- Pages: 125

- Format: PDF

- Report ID: PM5680

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

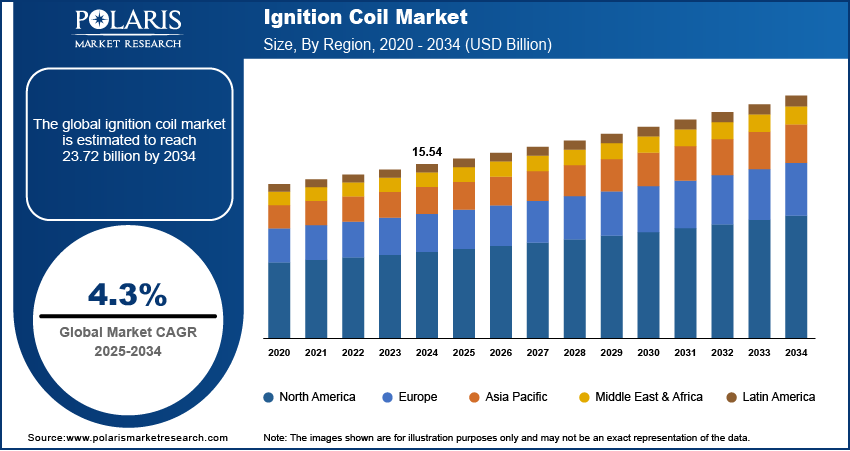

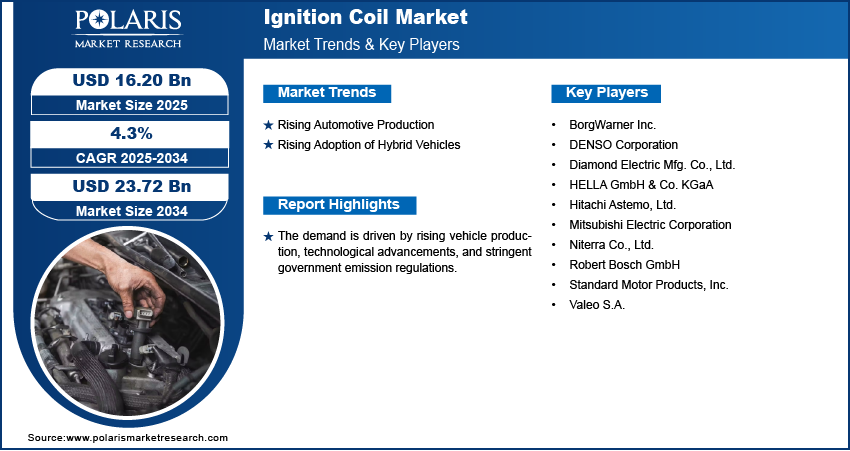

The ignition coil market size was valued at USD 15.54 billion in 2024 and is projected to exhibit a CAGR of 4.3% during the forecast period. The demand is driven by rising vehicle production, technological advancements, and stringent government emission regulations.

An ignition coil is an induction coil in a vehicle's ignition system that transforms the battery's low voltage into the high voltage needed to create an electric spark in the spark plugs. This spark ignites the air-fuel mixture in the engine's cylinders to power the vehicle.

The global increase in vehicles on the road directly raises the demand for maintenance and replacement parts. Many vehicle owners choose to repair and maintain their existing cars instead of purchasing new ones, particularly in regions where consumers are more cost-conscious. This behavior strengthens the aftermarket segment of the ignition coil industry. Ignition coils, being components that wear out over time, frequently require replacement. The consistent need for these parts among auto repair shops and independent mechanics ensures steady growth in the aftermarket.

To Understand More About this Research: Request a Free Sample Report

Technological advancements have resulted in the creation of smarter and more efficient ignition coils. These advanced components are made using high-performance materials that improve durability and maintain functionality under tough operating conditions. Smart ignition coils also support engine monitoring and contribute to improved fuel efficiency. Vehicle manufacturers continue to focus on enhancing engine performance and minimizing energy waste, making such innovations essential. Improved technology supports compliance with environmental regulations and attracts consumers seeking dependable, fuel-efficient vehicles. This growing preference fuels the demand for advanced ignition coils in both existing and new vehicle models.

Market Dynamics

Rising Automotive Production

Vehicle manufacturing is rising rapidly across the world, particularly in countries such as China, India, and Brazil. The growing preference for personal vehicles over public transportation in many developing nations is accelerating the sales of vehicles. According to the Society of Indian Automobile Manufacturers, in 2024, 0.342 million vehicles were manufactured in India alone. Increased car production is boosting the demand for essential engine components such as ignition coils. Every internal combustion engine relies on ignition coils.

Rising Adoption of Hybrid Vehicles

Hybrid vehicles, which use both a gasoline engine and an electric motor, are becoming more popular as people seek fuel-efficient and eco-friendly transport options. According to the International Energy Agency, in 2024, sales of hybrid vehicles rose by 30% compared to 2024. These vehicles require advanced ignition systems that can work with their complex engines. Automakers are increasing the production of vehicles that need specialized ignition coils as more consumers shift toward hybrid technology. This rising interest in hybrid cars is creating new opportunities for ignition coil manufacturers to design and supply products suited to this growing sector.

Segment Analysis

Ignition Coil Market Assessment by Product Type

The block ignition coils segment is expected to witness significant growth during the forecast period. Block ignition coils are widely used in modern engines as they offer better energy output and improved performance compared to older designs. Their compact size and ability to support multiple cylinders at once make them ideal for newer vehicle models. Demand for block ignition coils is rising as automakers continue to upgrade engine systems for efficiency and reliability.

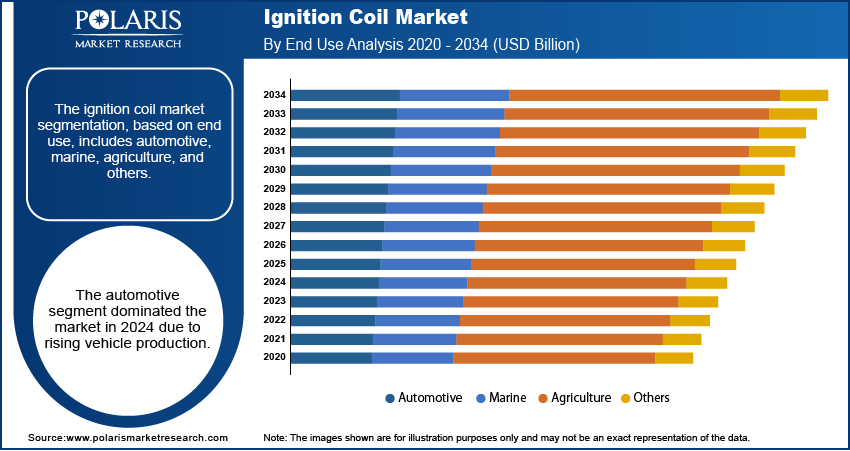

Ignition Coil Market Evaluation by End Use

The automotive segment dominated the market in 2024 due to the high number of passenger and commercial vehicles being produced worldwide. Modern cars rely heavily on advanced ignition systems for better fuel efficiency and lower emissions, which increases the need for reliable ignition coils. The automotive sector continues to drive significant demand for ignition coils as more consumers prefer personal vehicles and governments impose stricter emission standards.

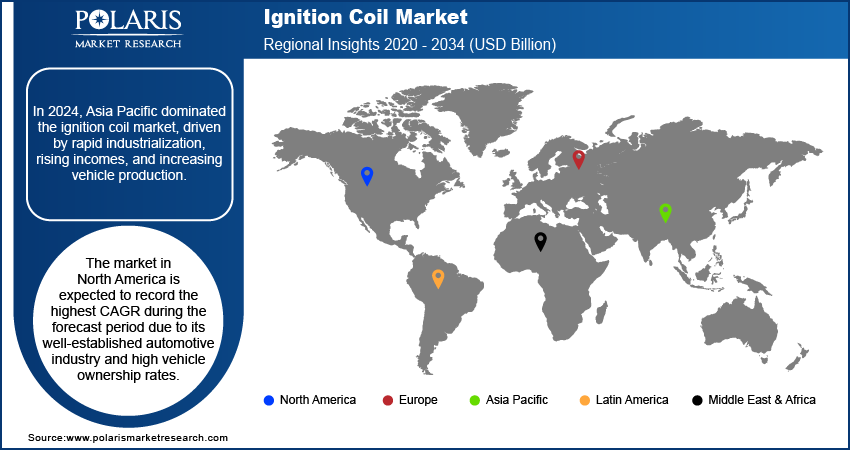

Regional Analysis

By region, the study provides the insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, Asia Pacific dominated the market, driven by rapid industrialization, rising incomes, and increasing vehicle production. Countries such as China, India, and Japan are major contributors due to their large automotive manufacturing bases and expanding domestic markets. Growing urbanization and government initiatives to reduce emissions are pushing automakers to adopt advanced engine technologies, including high-performance ignition coils. The region further benefits from strong aftermarket demand as more people own and maintain their vehicles, thereby driving the Asia Pacific ignition coil market.

The India ignition coil market is growing rapidly due to increasing vehicle production, rising middle-class income, and strong demand for affordable personal transportation. Government policies promoting emission control and fuel efficiency are encouraging the use of advanced ignition systems, further boosting the ignition coil demand across both OEM and aftermarket segments.

North America is expected to record the highest CAGR during the forecast period due to its well-established automotive industry and high vehicle ownership rates. The US, in particular, sees strong demand for both new vehicles and aftermarket parts, including ignition coils. Consumers in this region are focused on vehicle performance and maintenance, which supports steady growth in replacement parts. Additionally, the presence of leading automotive manufacturers and advanced technology providers drives innovation in ignition systems. The growing adoption of hybrid and electric vehicles is further driving the North America ignition coil market expansion.

Key Players and Competitive Analysis

The opportunity is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers and acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new regions.

New companies are impacting the industry by introducing innovative products to meet the demand of specific sectors. This competitive trend is amplified by continuous progress in product offerings. A few major players include BorgWarner Inc.; DENSO Corporation; Diamond Electric Mfg. Co., Ltd.; HELLA GmbH & Co. KGaA; Hitachi Astemo, Ltd.; Mitsubishi Electric Corporation; Niterra Co., Ltd.; Robert Bosch GmbH; Standard Motor Products, Inc.; and Valeo S.A.

DENSO Corporation, founded in 1949 and based in Kariya, Japan, is a major global supplier of automotive components. It operates through 187 consolidated subsidiaries and employs over 158,000 people across 35 countries and regions, including Japan, North America, Europe, and Asia. The company’s business is organized into five main segments: thermal systems, automotive powertrain systems, mobility electronics, electrification systems, and advanced devices. Its products include climate control units, engine management systems, safety and automated driving components, electric vehicle parts, and electronic devices. Beyond automotive components, DENSO applies its technology in areas such as factory automation, food value chains, and household systems. The company allocates around 8.6% of its global sales to research and development and holds over 38,000 patents. Its operations are spread globally, with manufacturing and research facilities in Japan, China, India, the US, Mexico, Brazil, Germany, Spain, and other countries. DENSO’s ignition coil features a compact, lightweight design with integrated circuitry, advanced materials for reliability, efficient energy use, and easy installation due to an integrated igniter, making it suitable for high-temperature automotive applications.

HELLA GmbH & Co. KGaA is a German automotive supplier headquartered in Lippstadt, Germany, with origins dating back to 1899. The company focuses on the development and manufacture of lighting and electronic components for vehicles. In 2022, HELLA merged with Faurecia, forming the FORVIA Group, but continues to operate under the HELLA brand. As of 2024, the company employed over 36,000 people across more than 125 locations worldwide. Its operations are divided into three primary segments: Lighting, Electronics, and Lifecycle Solutions. The Lighting segment produces vehicle lighting systems such as headlamps, rear combination lamps, and interior lighting, including components such as illuminated logos and radomes. These products utilize LED and adaptive lighting technologies and serve various vehicle categories. The Electronics segment covers vehicle electronics, including sensors, actuators, and driver assistance systems. It includes radar and lidar sensors for automated driving, body electronics such as access and lighting control systems, and energy management components. This segment supports developments in digital cockpits and automated driving features. The Lifecycle Solutions segment caters to the independent aftermarket and special vehicle sectors by providing spare parts, diagnostic tools, and calibration services. It also supplies lighting and electronic components for vehicles used in agriculture, construction, marine, and emergency services. HELLA operates globally, with a presence in Europe, the Americas, and Asia Pacific.

Key Companies

- BorgWarner Inc.

- DENSO Corporation

- Diamond Electric Mfg. Co., Ltd.

- HELLA GmbH & Co. KGaA

- Hitachi Astemo, Ltd.

- Mitsubishi Electric Corporation

- Niterra Co., Ltd.

- Robert Bosch GmbH

- Standard Motor Products, Inc.

- Valeo S.A.

Ignition Coil Industry Developments

In January 2024, Niterra launched its MOD Performance Ignition Coils, introducing 10 part numbers covering over 40 million VIO, specifically designed for performance vehicles and automotive enthusiasts across North America’s aftermarket segment.

In May 2023, Niterra launched 29 new ignition coils for global automakers, including Hyundai, Kia, and Mercedes-Benz, expanding its aftermarket coverage in South Korea, Japan, and EMEA, targeting nearly 22 million vehicles and boosting its global product offering.

Ignition Coil Market Segmentation

By Product Type Outlook (Revenue USD Billion, 2020–2034)

- Distributor Ignition Coils

- Pencil Ignition Coil

- Block Ignition Coils

- Others

By End Use Outlook (Revenue USD Billion, 2020–2034)

- Automotive

- Marine

- Agriculture

- Others

By Regional Outlook (Revenue USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Ignition Coil Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 15.54 billion |

|

Market Size Value in 2025 |

USD 16.20 billion |

|

Revenue Forecast by 2034 |

USD 23.72 billion |

|

CAGR |

4.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape

|

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The size was valued at USD 15.54 billion in 2024 and is projected to grow to USD 23.72 billion by 2034.

The market is projected to register a CAGR of 4.3% during the forecast period.

Asia Pacific held the largest share in 2024.

A few key players are BorgWarner Inc.; DENSO Corporation; Diamond Electric Mfg. Co., Ltd.; HELLA GmbH & Co. KGaA; Hitachi Astemo, Ltd.; Mitsubishi Electric Corporation; Niterra Co., Ltd.; Robert Bosch GmbH; Standard Motor Products, Inc.; and Valeo S.A.

The automotive segment dominated the market in 2024 due to the rising vehicle production.

The block ignition coil segment is expected to witness significant growth during the forecast period. They are widely used in modern engines as they offer better energy output and improved performance compared to older designs.