In-vehicle Infotainment Market Size, Share, Trends, Industry Analysis Report

By Component (Hardware, Software, and Services), By Installation, By Location, By Vehicle, and By Region -Market Forecast, 2025 - 2034

- Published Date:Sep-2025

- Pages: 114

- Format: PDF

- Report ID: PM2452

- Base Year: 2024

- Historical Data: 2020 - 2023

Overview

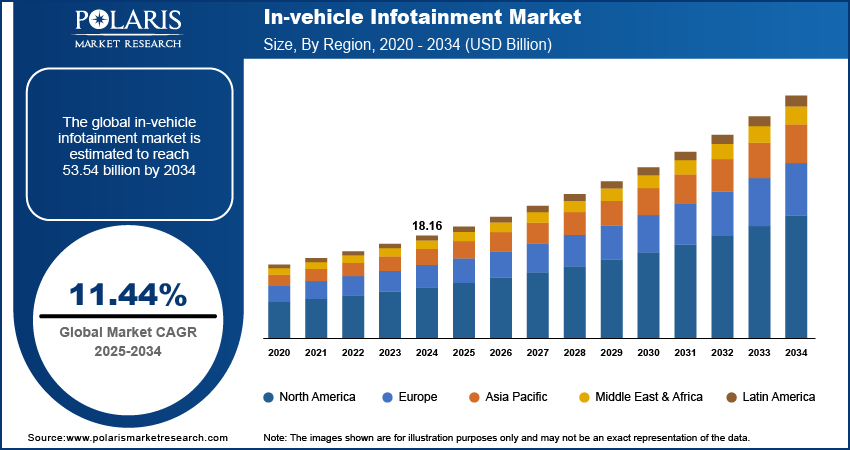

The global in-vehicle infotainment market size was valued at USD 18.16 billion in 2024. The market is projected to grow at a CAGR of 11.44% during 2025 to 2034. Key factors driving demand for in-vehicle infotainment include integration of advanced driver-assistance systems (ADAS) in vehicles for safety, increasing urbanization, and growing production of automobiles.

Key Insights

- The passenger car segment accounted for a major revenue share, owing to rising disposable income and growing focus on advanced safety systems.

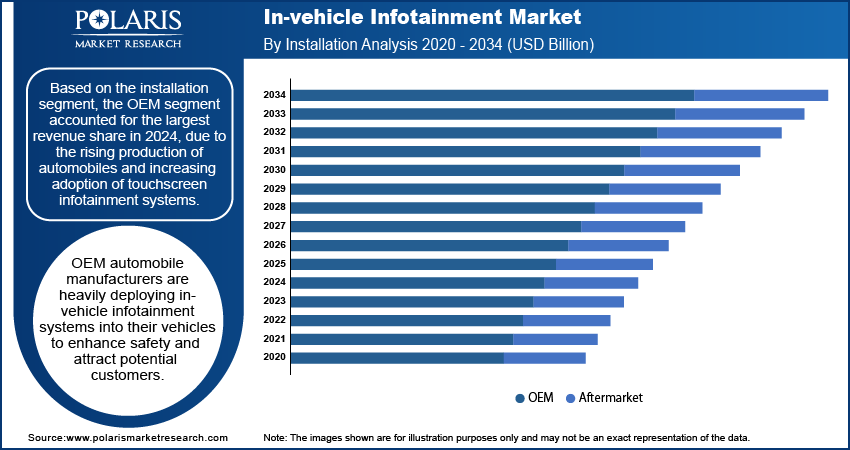

- The OEM segment accounted for the largest revenue share in 2024, due to the rising production of automobiles and increasing adoption of touchscreen infotainment systems.

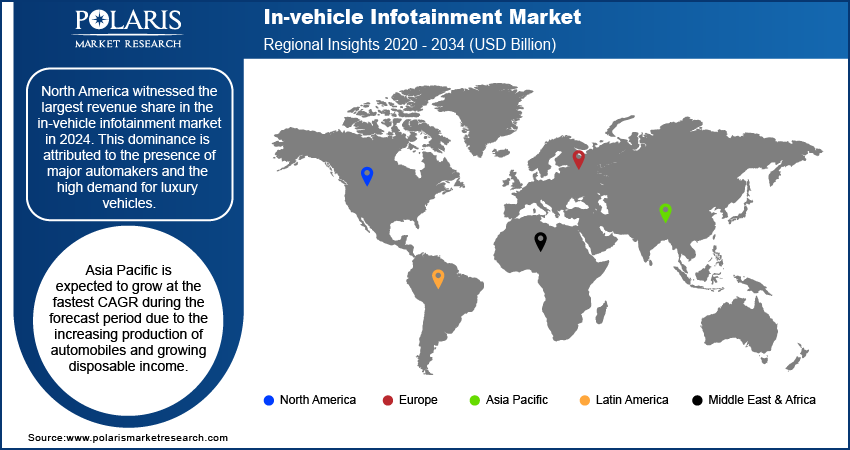

- North America witnessed the largest revenue share in the in-vehicle infotainment market in 2024. This dominance is attributed to the presence of major automakers and the high demand for luxury vehicles.

- Asia Pacific is expected to grow at the fastest CAGR during the forecast period due to the increasing production of automobiles and growing disposable income.

Industry Dynamics

- The global in-vehicle infotainment market is fueled by increasing sales of passenger vehicles across the globe, particularly in countries such as India.

- The growth in production of automated vehicles is anticipated to increase demand for in-vehicle infotainment.

- The rising demand for electric and hybrid vehicles, especially in emerging countries, is creating a lucrative market opportunity.

- Cybersecurity vulnerabilities may hamper the market growth.

Market Statistics

- 2024 Market Size: USD 18.16 Billion

- 2034 Projected Market Size: USD 53.54 Billion

- CAGR (2025-2034): 11.44%

- North America: Largest Market Share

To Understand More About this Research:Request a Free Sample Report

AI Impact on In-vehicle Infotainment Market

- Voice recognition powered by AI enhances hands-free control, improving safety and convenience.

- Alerts, navigate, and optimize driving efficiency.

- Supports real-time data processing for entertainment, connectivity, and smart vehicle function.

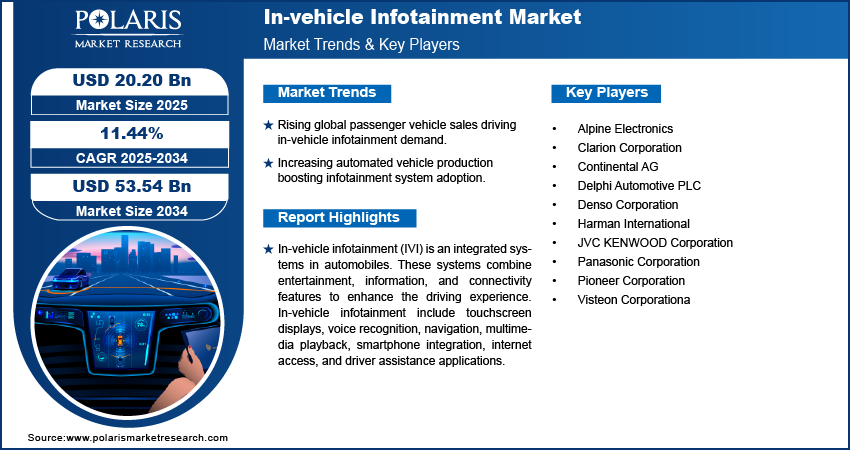

In-vehicle infotainment (IVI) is an integrated systems in automobiles. These systems combine entertainment, information, and connectivity features to enhance the driving experience. In-vehicle infotainment include touchscreen displays, voice recognition, navigation, multimedia playback, smartphone integration, internet access, and driver assistance applications. It is used to provide drivers and passengers with real-time navigation, music and video streaming, hands-free calling, and vehicle diagnostics. In-vehicle infotainment (IVI) also helps in reducing driver distraction and supporting connected car technologies.

The in-vehicle infotainment market is driven by the increasing popularity of electric vehicles (EV) and autonomous vehicles (AV). In-vehicle infotainment is crucial system in electric and automous vehicles to display battery status, range, charging stations, and energy management. The growing traffic congestion and road accidents acoss the globe are also leading the market growth.

Industry Dynamics

Growth Drivers

The increasing sales of passenger vehicles across the globe, particularly in countries such as India is contributing to the market growth. Total Passenger Vehicle sales rose to 43.02 lakh units in FY 2024-25 from 42.19 lakh units in FY 2023- 24 in India. Passenger and commercial vehicles need in-vehicle infotainment (IVI) systems to provide integrated entertainment and real time information. The growing focus of governments across the globe is also projected to increase the demand for in-vehicle infotainment (IVI) systems. Governments across the globe are setting strict vehicle safety norms, which propelling automakers to deploy in-vehicle infotainment systems into their vehicles to reduce fatal road accidents by integrating ADAS. Moreover, the growing disposable income in emerging and developed countries is leading to an increase in market revenue.

Know more about this report: Request for sample pages

Report Segmentation

The market is primarily segmented based on component, installation, vehicle, location, and region.

|

By Component |

By Installation |

By Vehicle |

By Location |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Insight by Vehicle

Based on the vehicle segment, the passenger car segment accounted for a major revenue share in 2024, owing to rising disposable income and growing focus on advanced safety systems. Growing disposable income in emerging countries like is India and Brazil encouraged people to purchase passenger cars built with high safety standards, which contributed to the high demand for in-vehicle infotainment systems. The growing focus of governments wordwide on vehicle safety system, driven by road accidents encouraged automakers to use in-vehicle infotainment systems into their vehicles to enhance the safety feature. The growing employment rate and rising demand for sustainable mobility, globally further led the segment's dominance.

Insight by Installation

Based on the installation segment, the OEM segment accounted for the largest revenue share in 2024, due to the rising production of automobiles and increasing adoption of touchscreen infotainment systems. OEM automobile manufacturers are heavily deploying in-vehicle infotainment systems into their vehicles to enhance safety and attract potential customers. Moreover, the growing demand for luxury or premium features in affordable vehicle segment also propelled OEM automakers to deploy in-vehicle infotainment systems into their vehicles.

Geographic Overview

North America had the largest revenue share in the industry in 2024. This is attributed to the the presence of major automakers and the high demand for luxury vehicles. Luxury vehicles are equipped with in-vehicle infotainment systems to meet evolving consumer demands for a connected, entertaining, and safe driving experience. The presence of major automakers in the region, particulary in the U.S. is leading to high production of automobiles, which contributed to the regional dominance. Moreover, the growing popularity of autonomous vehicles in the region propelled the market growth in North America.

Asia Pacific is expected to grow at the fastest CAGR during the forecast period due to the increasing production of automobiles and growing disposable income. The growing road accidents coupled with rising nroms on vehicle safety is promoting the deployment of in-vehicle infotainment systems in the new vehciles. The growing demand for electric and hybrid vehciles is further leading to market growth as EVs need in-vehicle infotainment systems to display battery status, range, charging stations, and energy management.

Competitive Insight

Major players operating in the industry include Alpine Electronics, Clarion Corporation, Continental AG, Delphi Automotive PLC, Denso Corporation, Harman International, JVC KENWOOD Corporation, Panasonic Corporation, Pioneer Corporation, and Visteon Corporation, among others.

In-vehicle Infotainment Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 18.16 Billion |

| Market size value in 2025 | USD 20.20 Billion |

|

Revenue forecast in 2034 |

USD 53.54 Billion |

|

CAGR |

11.44% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Segments covered |

|

|

Regional scope |

|

|

Key companies |

Alpine Electronics, Clarion Corporation, Continental AG, Delphi Automotive PLC, Denso Corporation, Harman International, JVC KENWOOD Corporation, Panasonic Corporation, Pioneer Corporation, and Visteon Corporation |

FAQ's

• The global market size was valued at USD 18.16 billion in 2024 and is projected to grow to USD 53.54 billion by 2034.

• The global market is projected to register a CAGR of 11.44% during the forecast period.

• North America dominated the market in 2024.

• A few of the key players in the market include Alpine Electronics, Clarion Corporation, Continental AG, Delphi Automotive PLC, Denso Corporation, Harman International, JVC KENWOOD Corporation, Panasonic Corporation, Pioneer Corporation, and Visteon Corporation.

• The passenger car segment dominated the market revenue share in 2024.