Industrial Cleaning Chemicals Market Size, Share, Trends, Industry Analysis Report

By Application (Healthcare, Retail & Food Service, Automotive & Aerospace, Hospitality, Others), By Ingredient Type, By Product Type, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 130

- Format: PDF

- Report ID: PM2398

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

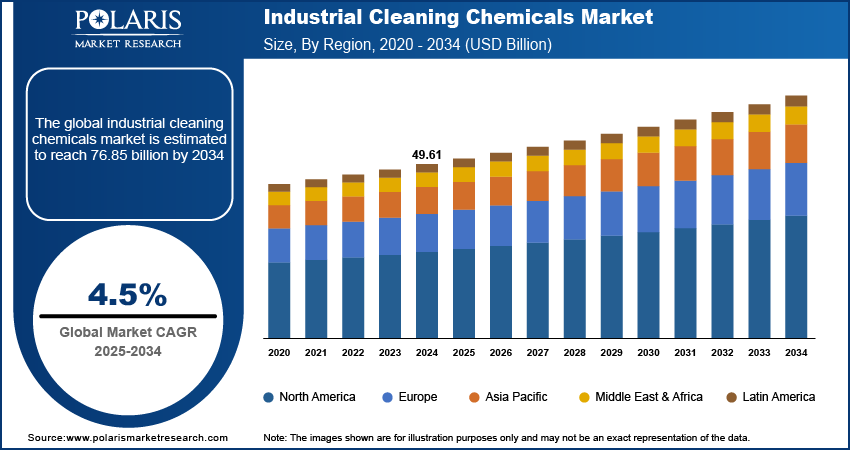

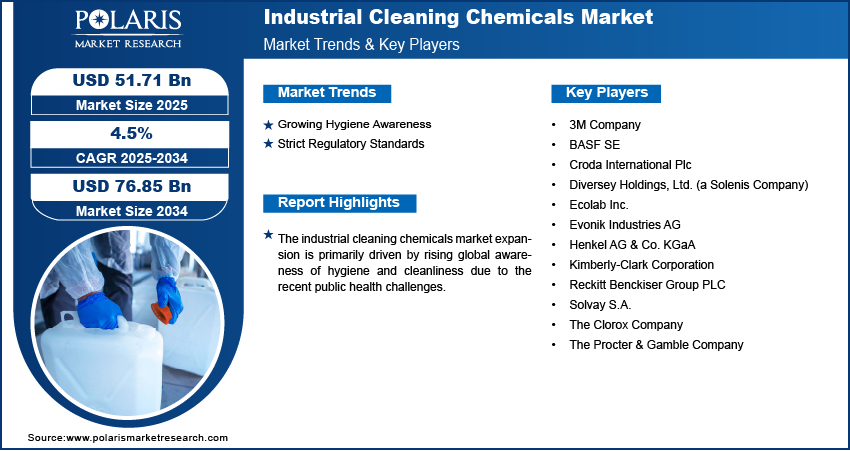

The global industrial cleaning chemicals market size was valued at USD 49.61 billion in 2024 and is anticipated to register a CAGR of 4.5% from 2025 to 2034. Rising industrialization and strict environmental regulations are boosting demand for effective cleaning chemicals. Additionally, increasing automation in manufacturing and the need for maintaining hygiene standards in food, pharmaceuticals, and electronics sectors are driving growth in the industrial cleaning chemicals market globally.

Key Insights

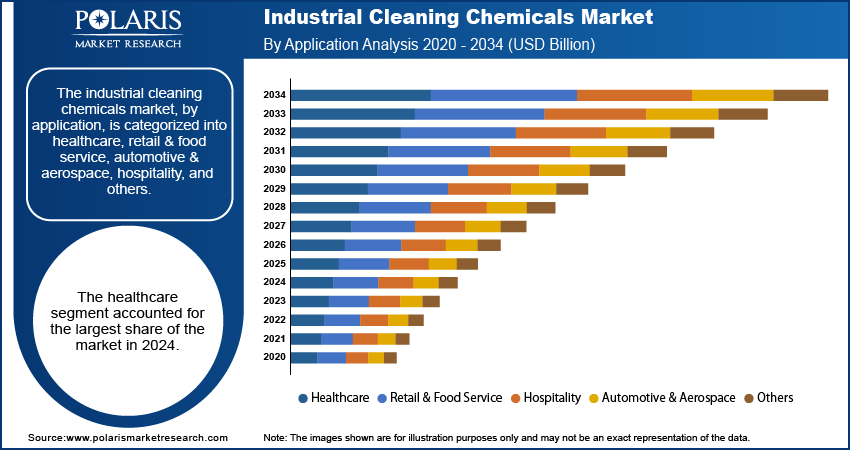

- By application, the healthcare segment held the largest share in 2024, driven by the critically high standards of hygiene and sanitation required in hospitals, clinics, and other medical facilities to prevent healthcare-associated infections (HAIs) and ensure patient and staff safety.

- By ingredient type, the surfactants segment held the largest share in 2024 because of the fundamental and versatile role of natural surfactants in almost all cleaning formulations. They are essential for breaking down and lifting dirt and grease, making them indispensable components in a wide range of industrial cleaning products.

- By product type, the general & medical device cleaning segment held the largest share in 2024, due to their widespread utility in daily maintenance tasks across nearly all commercial and industrial environments.

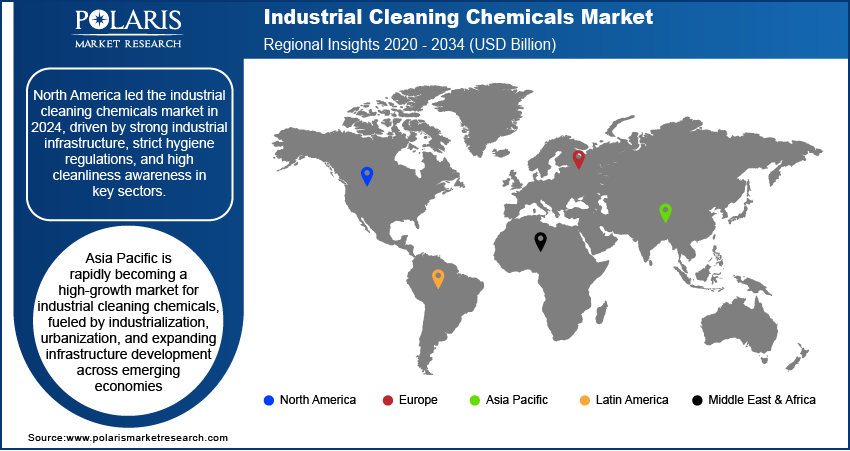

- By region, North America holds the largest share of the industrial cleaning chemicals market. This is primarily driven by its mature industrial infrastructure, stringent regulatory standards for hygiene, and high public awareness regarding cleanliness across sectors such as healthcare and manufacturing.

Industry Dynamics

- Rising public and institutional awareness of cleanliness, especially after recent global health crises, is significantly boosting demand. Businesses and public spaces are prioritizing thorough cleaning to ensure public health and safety. This increased focus leads to greater use of products that ensure effective sanitation.

- Various industries are subject to increasingly stringent health and safety regulations. These rules often mandate specific cleaning protocols and the use of approved chemicals to prevent contamination and maintain sterile environments. Compliance with these regulations necessitates a consistent demand for effective cleaning solutions.

- The continuous growth of sectors such as healthcare, food processing, and hospitality is a major driver. These industries inherently require high levels of hygiene to operate safely and meet consumer expectations, leading to a rising need for specialized cleaning products.

Market Statistics

- 2024 Market Size: USD 49.61 billion

- 2034 Projected Market Size: USD 76.85 billion

- CAGR (2025–2034): 4.5%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

The industrial cleaning chemicals involves the production and distribution of chemical solutions used for maintaining cleanliness and hygiene across various industrial and institutional settings. These chemicals are essential for removing dirt, grime, and contaminants from surfaces, equipment, and facilities, ensuring operational efficiency and safety.

The increasing adoption of automated cleaning systems and the growing preference for sustainable and eco-friendly cleaning solutions propel the demand for industrial cleaning chemicals. The integration of automated cleaning technologies, such as robotic scrubbers and autonomous floor cleaners, necessitates specialized chemical formulations that are compatible with these systems, driving innovation in product development. This trend pushes manufacturers to create highly concentrated or specifically designed chemicals that work efficiently with automated equipment, ensuring optimal performance and reduced labor costs.

The rising awareness of environmental impact and health concerns is leading to a significant shift toward sustainable industrial cleaning solutions. Consumers and businesses are increasingly seeking products with biodegradable ingredients, reduced volatile organic compound (VOC) content, and certifications from environmental agencies. Government websites such as the National Institutes of Health (NIH) and the World Health Organization (WHO) often provide guidelines and information regarding safer chemical use and environmental health, influencing the demand for greener cleaning alternatives. This trend encourages manufacturers to invest in research and development (R&D) to offer products that are effective and minimize harm to both human health and the environment.

Drivers and Trends

Growing Hygiene Awareness: Rising global awareness regarding public health and the importance of sanitation has significantly driven the demand for industrial cleaning chemicals. Following major health events, there has been a notable shift in how businesses and public institutions approach cleanliness, leading to more frequent and thorough cleaning practices. This increased focus is evident across a wide range of settings, from offices and educational institutions to retail spaces and transportation hubs, where visible cleanliness and disinfection are paramount.

The emphasis on creating clean and safer environments has led to a greater adoption of advanced cleaning protocols and stronger disinfectants. A 2020 IEOM Society article reported that the COVID-19 pandemic dramatically increased demand for household cleaning products. From January to June 2020, production of disinfecting wipes and cleaning sprays rose by an average of 23% compared to the same period in 2019, reflecting heightened hygiene concerns worldwide. While this specific instance focuses on household supplies, the underlying trend of increased demand for deep cleaning and disinfection directly translates to the industrial and institutional sectors, as businesses sought to reassure employees and customers of safe premises. This broad and sustained focus on maintaining high hygiene standards continues to drive the demand for industrial cleaning chemicals.

Strict Regulatory Standards: The implementation and enforcement of rigorous health and safety regulations by government bodies are another major driver for the industrial cleaning chemicals. Industries such as healthcare, food and beverage processing, and pharmaceuticals are subject to strict mandates regarding sanitation and contamination control. These regulations often control the used of cleaning chemicals, their application methods, and the frequency of cleaning to ensure product safety and prevent the spread of pathogens.

Compliance with these regulatory frameworks requires industrial facilities to invest in high-quality, approved cleaning chemicals and maintain detailed cleaning schedules. The Occupational Safety and Health Administration (OSHA) provides guidelines for workplace safety, including those related to maintaining clean floors to prevent slips, trips, and falls and controlling dust and debris to improve air quality. A March 2025 article by ServiceMaster Clean, titled "The Role of Cleaning in Meeting OSHA Standards for Industrial Facilities," emphasizes that "proper cleaning and maintenance are critical components of OSHA compliance" and directly help reduce workplace hazards. Such continuous regulatory oversight ensures a sustained demand for industrial cleaning chemicals as companies strive to avoid penalties, ensure worker safety, and maintain operational licenses.

Segmental Insights

Application Analysis

Based on application, the segmentation includes healthcare, retail & food service, automotive & aerospace, hospitality, and others. The healthcare segment held the largest share in 2024. This dominance is primarily driven by the critically high standards of hygiene and sanitation required in hospitals, clinics, and other medical facilities to prevent healthcare-associated infections (HAIs) and ensure patient and staff safety. The continuous need for sterilizing medical equipment, disinfecting surfaces, and maintaining overall cleanliness in environments where vulnerable individuals are present leads to a significant and ongoing consumption of specialized cleaning solutions. This essential demand for effective infection control measures makes healthcare a leading contributor to the overall industrial cleaning chemicals landscape.

The retail & food service segment is anticipated to register the highest growth rate during the forecast period. This accelerated growth is attributed to the increasing emphasis on food safety, public health, and creating hygienic environments in restaurants, supermarkets, hotels, and various other consumer-facing businesses. Stringent regulations pertaining to food hygiene and preparation, coupled with rising consumer expectations for clean premises, drive a consistent demand for effective degreasers, sanitizers, and general cleaning agents. Furthermore, the expansion of the global hospitality and retail sectors, alongside the post-pandemic focus on enhanced disinfection protocols, propels the demand for industrial cleaning chemicals in this rapidly expanding application area.

Ingredient Type Analysis

Based on ingredient type, the segmentation includes surfactants, solvents, chelating agents, pH regulators, solubilizers/hydrotropes, and others. The surfactants segment held the largest share in 2024, due to their fundamental role and versatility across nearly all cleaning applications. Surfactants are compounds that reduce the surface tension of liquids, allowing cleaning solutions to penetrate dirt, grease, and oils more effectively. They are essential components in detergents, degreasers, hand sanitizers, and general-purpose cleaners, which are widely used in commercial, institutional, and manufacturing settings. Their ability to emulsify, disperse, and suspend various contaminants makes them indispensable for achieving thorough cleanliness. The continuous and widespread demand for effective cleaning in diverse environments, from manufacturing floors to food service kitchens, underpins the substantial and enduring share of natural surfactants.

The enzymes segment is anticipated to register the highest growth rate during the forecast period. This growth is largely fueled by the increasing demand for eco-friendly and sustainable cleaning solutions. Enzymes offer a powerful yet biodegradable alternative to traditional harsh chemicals by specifically breaking down organic matter such as proteins, fats, and starches at a molecular level. Their high efficiency, even at lower concentrations and temperatures, along with their nontoxic and environmentally benign properties, make them highly attractive for industries seeking to reduce their environmental footprint and improve worker safety. As regulatory pressures for greener products increase and industries prioritize sustainability, the adoption of enzyme-based cleaning solutions is expected to accelerate significantly, driving this ingredient type toward a higher growth trajectory.

Product Type Analysis

Based on product type, the segmentation includes general & medical device cleaning, metal cleaners, disinfectants, commercial laundry, dish washing, and others. The general & medical device segment held the largest share in 2024, owing to the universal and continuous need for maintaining basic hygiene across a vast spectrum of industrial and institutional settings. These cleaners are widely used for routine maintenance of floors, surfaces, and common areas in commercial offices, educational institutions, and healthcare facilities. Their broad utility for daily dirt and grime removal, alongside their essential role in ensuring basic hygiene for medical equipment and premises, makes them an indispensable product category with consistent demand across nearly all end-use sectors.

The disinfectants segment is anticipated to register the highest growth rate during the forecast period. This rapid growth is directly linked to the heightened global emphasis on public health, infection prevention, and control, particularly in critical environments such as healthcare, food processing, and hospitality. The imperative to mitigate the spread of pathogens and maintain sterile conditions has led to increased demand for high-efficacy disinfectants and sanitizers. As industries continue to prioritize robust hygiene protocols and respond to evolving health concerns using cleaning & hygiene products, the adoption and consumption of disinfectants are projected to accelerate significantly, driving this segment's expansion.

Regional Analysis

The North America industrial cleaning chemicals market accounted for the largest share in 2024, driven by its robust industrial base and high standards of hygiene across commercial and institutional sectors. The presence of a large number of manufacturing facilities, extensive healthcare infrastructure, and a well-developed food service industry contributes substantially to the consistent demand for cleaning solutions including contract cleaning services. Furthermore, stringent regulatory bodies and a strong emphasis on workplace safety and environmental compliance compel businesses to adopt advanced cleaning protocols and utilize high-performance chemical products. This proactive approach toward maintaining cleanliness and adhering to established standards ensures a steady consumption of industrial cleaning chemicals throughout the region.

U.S. Industrial Cleaning Chemicals Market Insights

In North America, the U.S. stands out as a major contributor to the industrial cleaning chemicals. The country is characterized by a high level of awareness regarding health and sanitation, particularly after recent global health crisis, which has led to increased demand for disinfectants and sanitizers across all sectors. The country's expansive healthcare system, large food and beverage processing industry, and numerous commercial and institutional buildings create a continuous need for specialized cleaning agents. Moreover, the strong enforcement of regulations by bodies such as the Environmental Protection Agency (EPA) and Occupational Safety and Health Administration (OSHA) drives innovation toward safer and more effective chemical formulations. The trend toward sustainable and eco-friendly products is also gaining traction, influencing product development and dynamics in the U.S.

Europe Industrial Cleaning Chemicals Market Assessment

Europe holds a substantial position in the global industrial cleaning chemicals market, characterized by stringent environmental regulations and a strong commitment to sustainability. The region's mature industrial landscape, including robust manufacturing, healthcare, and hospitality sectors, ensures a consistent demand for a wide range of cleaning solutions. European countries often lead in adopting advanced cleaning technologies and practices, driven by both regulatory compliance and a consumer preference for greener products. The focus on reducing environmental impact and promoting occupational safety influences the development and widespread use of eco-friendly and biodegradable industrial cleaning chemicals across the region.

Germany is a major country contributing significantly to the European industry. The Germany industrial cleaning chemicals market holds a strong industrial base, particularly in manufacturing and chemicals, along with a highly developed healthcare system, fuels substantial demand for industrial cleaning chemicals. The country's strict adherence to environmental protection laws and high standards for workplace hygiene necessitate the use of premium, compliant cleaning solutions. German manufacturers are also at the forefront of innovation, developing advanced and sustainable chemical formulations to meet evolving needs and regulatory requirements, thereby reinforcing its prominent role in the European industrial cleaning chemicals landscape.

Asia Pacific Industrial Cleaning Chemicals Market Overview

Asia Pacific is rapidly emerging as a dynamic and high-growth region for industrial cleaning chemicals, primarily propelled by rapid industrialization, urbanization, and increasing infrastructure development. The expanding manufacturing sector, coupled with a growing awareness of hygiene and public health across various commercial and institutional spaces, is driving significant demand. Countries within this region are experiencing rapid economic growth, leading to increased construction activities, development of new commercial facilities, and a growing food processing sector, all of which contribute to the escalating need for industrial cleaning solutions.

China Industrial Cleaning Chemicals Market Insights

China is a dominant country in Asia Pacific industrial cleaning chemicals. Its vast manufacturing output, large population, and expanding infrastructure create an immense demand for cleaning and hygiene products across industrial and commercial sectors. The increasing focus on public health and safety, particularly following health crises, has led to more stringent sanitation practices and a greater consumption of disinfectants and general cleaning agents. Furthermore, the availability of raw materials and a robust chemical manufacturing sector support the production and supply of a wide array of industrial cleaning chemicals within China, cementing its position as a major player in the region.

Key Players and Competitive Insights

The industrial cleaning chemicals industry features a competitive landscape with several major players vying for share, including companies such as Ecolab, Diversey, BASF, Henkel, and 3M. These companies compete based on product innovation, sustainability initiatives, global reach, and the ability to offer specialized solutions tailored to various industrial applications such as healthcare, food service, and manufacturing. The sector is dynamic, with ongoing research and development aimed at creating more effective, eco-friendly, and cost-efficient cleaning agents to meet evolving industry demands and stringent regulatory requirements.

A few prominent companies in the industry include Ecolab Inc.; Diversey Holdings, Ltd. (Solenis Company); BASF SE; Henkel AG & Co. KGaA; 3M Company; Kimberly-Clark Corporation; Reckitt Benckiser Group PLC; The Clorox Company; The Procter & Gamble Company; Solvay S.A.; Evonik Industries AG; and Croda International Plc.

Key Players

- 3M Company

- BASF SE

- Croda International Plc

- Diversey Holdings, Ltd. (a Solenis Company)

- Ecolab Inc.

- Evonik Industries AG

- Henkel AG & Co. KGaA

- Kimberly-Clark Corporation

- Reckitt Benckiser Group PLC

- Solvay S.A.

- The Clorox Company

- The Procter & Gamble Company

Industrial Cleaning Chemicals Industry Developments

August 2024: Ecolab Inc. deployed its Ultrasil membrane technology at client sites. This initiative supports food and beverage companies in upholding hygiene standards while reducing environmental impact.

June 2024: Solenis acquired Aqua ChemPacs LLC to enhance its portfolio of specialty chemicals for institutional cleaning and disinfection. The acquisition enables the integration of pre-measured, dissolvable cleaning pods that allow users to prepare cleaning and disinfecting solutions directly on-site.

Industrial Cleaning Chemicals Market Segmentation

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Healthcare

- Retail & Food Service

- Automotive & Aerospace

- Hospitality

- Others

By Ingredient Type Outlook (Revenue – USD Billion, 2020–2034)

- Surfactants

- Solvents

- Chelating Agents

- pH Regulators

- Solubilizers/Hydrotropes

- Enzymes

- Others

By Product Type Outlook (Revenue – USD Billion, 2020–2034)

- General & Medical Device Cleaning

- Metal Cleaners

- Disinfectants

- Commercial Laundry

- Dish Washing

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Industrial Cleaning Chemicals Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 49.61 billion |

|

Market Size in 2025 |

USD 51.71 billion |

|

Revenue Forecast by 2034 |

USD 76.85 billion |

|

CAGR |

4.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 49.61 billion in 2024 and is projected to grow to USD 76.85 billion by 2034.

The global market is projected to register a CAGR of 4.5% during the forecast period.

North America dominated the share in 2024.

A few key players include Ecolab Inc.; Diversey Holdings, Ltd. (Solenis Company); BASF SE; Henkel AG & Co. KGaA; 3M Company; Kimberly-Clark Corporation; Reckitt Benckiser Group PLC; The Clorox Company; The Procter & Gamble Company; Solvay S.A.; Evonik Industries AG; and Croda International Plc.

The healthcare segment accounted for the largest share in 2024.

The enzymes segment is expected to witness the fastest growth during the forecast period.