Industrial Fans Market Size, Share, Trends, Industry Analysis Report

By Product (Centrifugal Fans, Axial Fans), By Flow Capacity, By Application, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6307

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

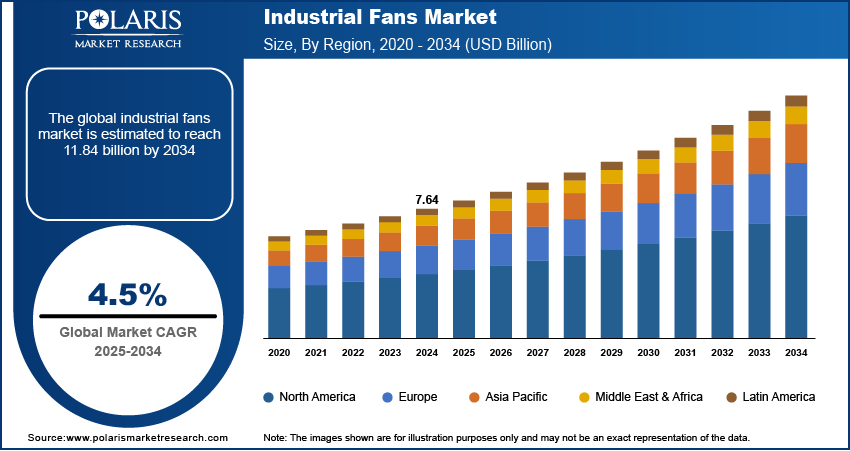

The global industrial fans market size was valued at USD 7.64 billion in 2024 and is anticipated to register a CAGR of 4.5% from 2025 to 2034. The demand for industrial fans is mainly driven by the ongoing need for better workplace safety and air quality, which is influenced by government rules. A growing emphasis on energy-efficient solutions is another key driver, as companies look to lower their operating costs and follow sustainability goals. In addition, the expansion of industries in developing nations is increasing the demand for industrial fans.

Key Insights

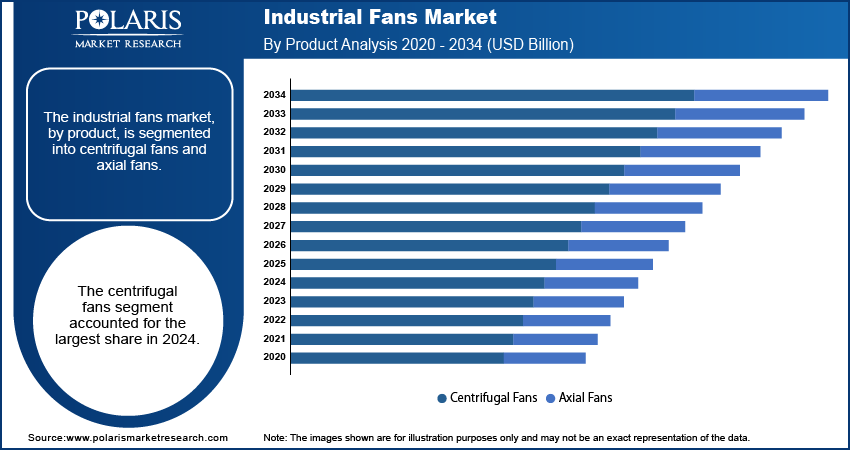

- By product, the centrifugal fans segment held the largest share in 2024, due to its ability to move air at high pressure.

- By flow capacity, the medium flow capacity segment held the largest share in 2024, with a flow rate between 5,000 and 50,000 CFM.

- By application, the ventilation application segment dominated in 2024, driven by strict rules for workplace safety and air quality.

- By end use, the manufacturing segment held the largest share in 2024, because of its widespread and constant need for industrial fans.

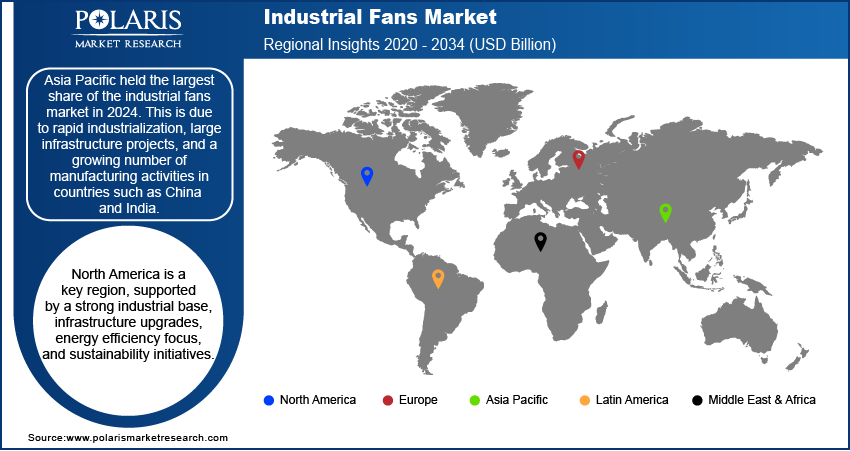

In 2024, Asia Pacific held the largest share of the industrial fan market, driven by rapid industrialization, urban infrastructure growth, and rising demand for energy-efficient ventilation solutions.

Industry Dynamics

- Strict government rules on worker safety and air quality propel the demand for industrial fans. These rules require companies to use proper ventilation to keep workplaces safe from dust, fumes, and other pollutants.

- The push for energy efficiency is a key growth factor. Industries are seeking ways to lower their energy use and operating costs. This is increasing the demand for new fans with advanced technology that uses less power.

- The rapid growth of industries in developing economies is driving demand. As more factories and manufacturing plants are built in these areas, the need for air management and cooling solutions for these large spaces grows.

Market Statistics

- 2024 Market Size: USD 7.64 billion

- 2034 Projected Market Size: USD 11.84 billion

- CAGR (2025–2034): 4.5%

- Asia Pacific: Largest market in 2024

AI Impact on Industrial Fans Market

- Artificial intelligence (AI) is turning industrial fans into smart, adaptive systems. These smart systems can optimize environments, protect assets, and support sustainability goals.

- Machine learning (ML) models can adjust fan direction and speed based on real-time data such as humidity, temperature, and equipment heat output.

- AI-enabled smart industrial fans are integrated into HVAC automation systems, especially in the automotive and food processing sectors

The industrial fans landscape is focused on creating, producing, and selling large fans used for air circulation, ventilation, and cooling in various industrial places. These fans are crucial for keeping the air clean, controlling temperature, and making industrial spaces safe and comfortable for workers.

The rising demand for better air quality in different industries boosts the industry growth. This is not just about keeping workers safe, but also about protecting sensitive equipment and products. For example, in cleanrooms for electronics or pharmaceuticals, a controlled environment is needed to prevent contamination.

The demand is also influenced by the growing adoption of smart and automated solutions. Modern industrial facilities are moving toward automated systems that require fans with advanced controls and monitoring features. This allows for better airflow management, energy use, and predictive maintenance. For instance, sensors can adjust fan speed based on real-time air quality data, which helps improve performance.

Drivers and Trends

Increased Industrialization in Developing Countries: Rapid industrial growth in developing countries is a significant driver for the industrial fan market. As these nations expand their manufacturing and infrastructure, there is a greater need for equipment to handle air quality, cooling, and ventilation. This growth is linked to a rise in manufacturing facilities, warehouses, and other industrial spaces that all need proper air circulation. The move toward modern manufacturing techniques also requires better climate control for sensitive equipment and production processes. This increase in industrial activities creates a direct demand for these products, supporting the overall market expansion.

According to the "Global Energy Review 2025" from the International Energy Agency (IEA), global energy demand rose at a faster pace in 2024. This growth was driven by the power sector, with electricity demand in the industrial and manufacturing sectors increasing. The report notes that this was mainly fueled by the expansion of industries in developing economies. This shows that industrialization in these regions is directly tied to a growing need for energy, which leads to a higher demand for equipment such as industrial fans to support these operations. The expansion of these industries in emerging markets is a strong driver.

Strict Regulatory Standards for Workplace Safety and Air Quality: Government regulations aimed at improving workplace safety and indoor air quality are a key driver. These rules often set specific standards for air ventilation and the removal of airborne contaminants such as dust, fumes, and chemical vapors. Companies across various sectors, including manufacturing, construction, and mining, must follow these standards to ensure the health and safety of their employees. This makes the use of effective fan systems a legal and operational requirement, not just an option.

As an example, the International Labour Organization (ILO) released a "Workplace Safety and Health Report" in 2024. It mentioned that 2.41 billion workers worldwide are exposed to excessive heat each year. The report emphasizes the need for improved safety and health measures to prevent heat-related injuries. This highlights the growing focus by global organizations on creating safer work environments. This focus on improving conditions and the need to meet safety standards is a strong force driving the need for better air circulation and ventilation systems.

Segmental Insights

Product Analysis

Based on product, the segmentation includes centrifugal fans and axial fans. The centrifugal fans segment held the largest share in 2024. This makes them essential for heavy-duty applications that need a strong and steady airflow. They are often used in places where air is moved through ducts, filters, or other systems with resistance. Their design allows them to handle dirty air, dust, and other contaminants without getting damaged. This makes them ideal for use in industries such as mining, cement, and chemical processing, where the air quality is often poor. The strong demand for these fans from a wide range of end-use industries is a key reason for their large presence.

The axial fans segment is anticipated to register the highest growth rate during the forecast period. This growth is driven by the rising need for energy-efficient and cost effective cooling solutions. Axial fans are known for their ability to move a large amount of air at a lower pressure, which makes them perfect for ventilation in large, open spaces such as warehouses, tunnels, and data centers. Their design is simpler and more compact than other types of fans, which often results in lower production costs and easier installation. As industries focus more on sustainability and reducing energy use, the appeal of axial fans with their high airflow and lower power consumption has increased. This trend, combined with a rise in infrastructure and construction projects, is fueling the fast growth of this product type.

Flow Capacity Analysis

Based on flow capacity, the segmentation includes low flow capacity (upto 5,000 CFM), medium flow capacity (5,000–50,000 CFM), and high flow capacity (above 50,000 CFM). The medium flow capacity segment held the largest share in 2024. This is because these fans provide a good balance of performance and energy use, making them a common choice for a wide variety of industrial settings. They are well suited for medium to large-sized facilities, such as manufacturing plants, warehouses, and automotive shops. Their versatility allows them to be used in different applications, including general ventilation, cooling, and air handling within HVAC systems. As a result, the widespread need for these products in a diverse range of industries is a major reason for the segment's dominant position. The demand from these sectors ensures that medium flow capacity fans continue to be a go-to solution for many businesses.

The high flow capacity segment is anticipated to register the highest growth rate during the forecast period. This growth is driven by the increasing size and scale of industrial operations, particularly in sectors that require massive air movement. Examples include power generation facilities, mining operations, and large-scale manufacturing plants where processes create significant heat or fumes that must be quickly removed. The need for these high-power fans is also increasing with the construction of large infrastructure projects, such as tunnels and stadiums, which require robust ventilation systems. In addition, the focus on stricter air quality monitoring systems and safety standards in these heavy industries is pushing the adoption of these powerful fans. This trend toward larger industrial spaces and more demanding applications is fueling the rapid expansion of the high flow capacity segment.

Application Analysis

Based on application, the segmentation includes ventilation, cooling, drying, and material handling. The ventilation segment held the largest share in 2024. Industrial ventilation systems are crucial for removing harmful airborne particles, fumes, and gases that are common in manufacturing, chemical, and mining facilities. These systems ensure that air quality meets legal standards and protects the well-being of workers. The continued need for proper air circulation to control temperature and prevent the buildup of heat in large industrial spaces also contributes to this segment's large share. The universal need for ventilation across almost all industrial sectors makes it a dominant application.

The cooling application segment is anticipated to register the highest growth rate during the forecast period. This is due to rising global temperatures and the need to protect both people and machinery from heat-related problems. As industries expand and operate in hotter climates, there is an increasing demand for effective cooling solutions to keep working conditions safe and prevent equipment from overheating. This is especially important for sensitive electronics and machinery that can be damaged by high temperatures. The need for efficient cooling systems is growing in sectors such as data centers, power generation, and manufacturing. This trend, combined with a greater emphasis on energy efficiency in cooling, is a key reason for the fast growth of this application segment.

End Use Analysis

Based on end use, the segmentation includes manufacturing, food & beverage, oil & gas, cement, chemical & petrochemical, power generation, mining, and others. The manufacturing segment held the largest share in 2024. Manufacturing facilities, ranging from heavy machinery production to electronics assembly, rely on these fans for a variety of critical functions. They are essential for general ventilation, which helps maintain a safe and comfortable working environment by circulating air and managing temperatures. In addition, fans are used for specific processes such as cooling machinery to prevent overheating and for exhausting fumes, dust, and other contaminants from the production area. The ongoing growth and modernization of the manufacturing sector, especially in developing regions, ensures a steady demand for these products, making it the dominant end-use segment.

The mining segment is anticipated to register the highest growth rate during the forecast period. The demand from this sector is driven by the need for powerful ventilation systems in both surface and underground mining operations. In deep underground mines, a constant supply of fresh air is needed to ensure worker safety by removing toxic gases and dust. As mining companies go deeper to find resources, the need for more powerful and efficient fans becomes even greater. Furthermore, there is a strong global focus on improving worker safety and health in the mining industry, which leads to new rules and a push for better ventilation technology. This, combined with a rising demand for minerals worldwide, is a key reason for the fast growth in this end-use segment.

Regional Analysis

The Asia Pacific industrial fans market accounted for the largest share in 2024. This is driven by rapid industrialization, large-scale infrastructure projects, and a growing number of manufacturing and construction activities. As economies such as China and India expand, there is a huge need for industrial fans for new factories, warehouses, and power plants. The region's focus on becoming a global manufacturing hub has directly increased the demand for equipment that can ensure safety and efficiency in these large industrial settings.

China Industrial Fans Market Insights

China is a major market in Asia Pacific. The country's extensive manufacturing base and large-scale infrastructure investments create a huge demand for industrial fans. China's government plans, such as the Five-Year Plan, support new projects in energy, transportation, and construction, which all need advanced ventilation and air handling systems. This focus on industrial and commercial expansion, along with a move toward higher quality and more efficient products, makes China a central force in the regional market.

North America Industrial Fans Market Trends

North America is a key market, driven by a strong industrial base and a focus on upgrading existing infrastructure. There is a growing emphasis on energy efficiency and modern solutions to lower operating costs and meet environmental standards. The region also has strict rules for workplace safety and air quality, which require companies to invest in high-quality ventilation and air handling systems. As a result, sectors such as food and beverage, manufacturing, and power generation are major sources of demand for industrial fans.

U.S. Industrial Fans Market Overview

The U.S. is a significant contributor to North America, with a large and diverse industrial landscape. The country's strong focus on advanced manufacturing and the use of new technology in factories is a key driver. Companies are increasingly looking for smart fans with features like automated controls and sensors to improve efficiency and reduce energy use. The U.S. also has a well-developed power generation sector and a strong need for industrial fans to support cooling and ventilation in these large facilities.

Europe Industrial Fans Market Assessment

Europe is a notable market due to its focus on sustainability and energy efficient products. The region has some of the world's most demanding environmental and energy standards, which push companies to adopt fans with new technologies such as variable speed drives and smart controls. There is a strong trend toward replacing older, less efficient systems with modern ones to comply with these rules and cut down on energy costs. The industry is also supported by a large manufacturing sector and a growing need for air management solutions in food processing and chemical plants.

In Europe, the Germany industrial fans market dominated in 2024. Its robust manufacturing base, especially in the automotive and engineering industries, creates a high and constant demand for industrial fans. The country is also a major innovator in the field of energy efficient technology. German companies are at the forefront of developing advanced fans that meet strict local and EU standards, making them a hub for both production and consumption of these products.

Key Players and Competitive Insights

The landscape for industrial fans includes a number of key players such as Greenheck Fan Corporation, Twin City Fan Companies, Ltd., Howden Group, ebm-papst Group, FläktGroup, Systemair AB, and Ziehl-Abegg. The competitive landscape is defined by a mix of large, global companies and smaller, regional firms. Major players often compete on a global scale, using their strong brand recognition, wide distribution networks, and a focus on research and development to create new, energy efficient products. These companies often offer a full range of products and services, from custom engineering to after-sales support.

A few prominent companies in the industry include Greenheck Fan Corporation; Twin City Fan Companies, Ltd.; Howden Group Holdings; ebm-papst Group; FläktGroup; Systemair AB; Ziehl-Abegg; Volution Group plc; Loren Cook Company; The New York Blower Company; and Acme Engineering and Manufacturing Corporation.

Key Players

- Greenheck Fan Corporation

- Howden Group Holdings

- Loren Cook Company

- Systemair AB

- The New York Blower Company

- Twin City Fan Companies, Ltd.

- Volution Group plc

- Ziehl-Abegg

Industrial Fans Industry Developments

July 2025: Siemens acquired the industrial drive technology (IDT) business of ebm-papst. The sale of this division, which included intelligent mechatronic systems, was a strategic move by ebm-papst.

December 2024: Greenheck Fan Corporation introduced the RSQ Hooded Rooftop Fan. This new fan uses mixed flow wheel technology to improve airflow and efficiency while also reducing sound. The design is also more compact.

Industrial Fans Market Segmentation

By Product Outlook (Revenue – USD Billion, 2020–2034)

- Centrifugal Fans

- Axial Fans

By Flow Capacity Outlook (Revenue – USD Billion, 2020–2034)

- Low Flow Capacity (Upto 5,000 CFM)

- Medium Flow Capacity (5,000 - 50,000 CFM)

- High Flow Capacity (Above 50,000 CFM)

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Ventilation

- Cooling

- Drying

- Material Handling

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- Manufacturing

- Food & Beverage

- Oil & Gas

- Cement

- Chemical & Petrochemical

- Power Generation

- Mining

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Industrial Fans Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 7.64 billion |

|

Market Size in 2025 |

USD 7.97 billion |

|

Revenue Forecast by 2034 |

USD 11.84 billion |

|

CAGR |

4.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 7.64 billion in 2024 and is projected to grow to USD 11.84 billion by 2034.

The global market is projected to register a CAGR of 4.5% during the forecast period.

Asia Pacific dominated the share in 2024.

A few key players include Greenheck Fan Corporation; Twin City Fan Companies, Ltd.; Howden Group Holdings; ebm-papst Group; FläktGroup; Systemair AB; Ziehl-Abegg; Volution Group plc; Loren Cook Company; The New York Blower Company; and Acme Engineering and Manufacturing Corporation.

The centrifugal fans segment accounted for the largest share of the market in 2024.

The high flow capacity (above 50,000 CFM) segment is expected to witness the fastest growth during the forecast period.