Industrial Refrigeration Systems Market Share, Size, Trends, Industry Analysis Report

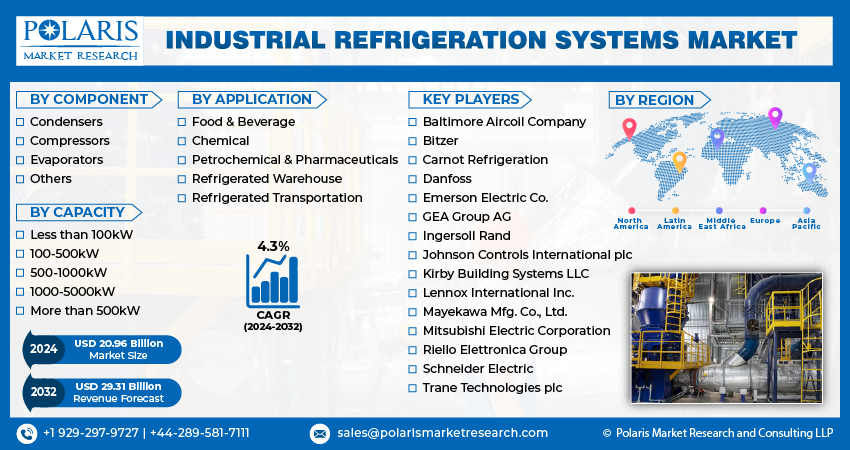

By Component (Condensers, Compressors, Evaporators, Others); By Capacity; By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Feb-2024

- Pages: 117

- Format: PDF

- Report ID: PM4518

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

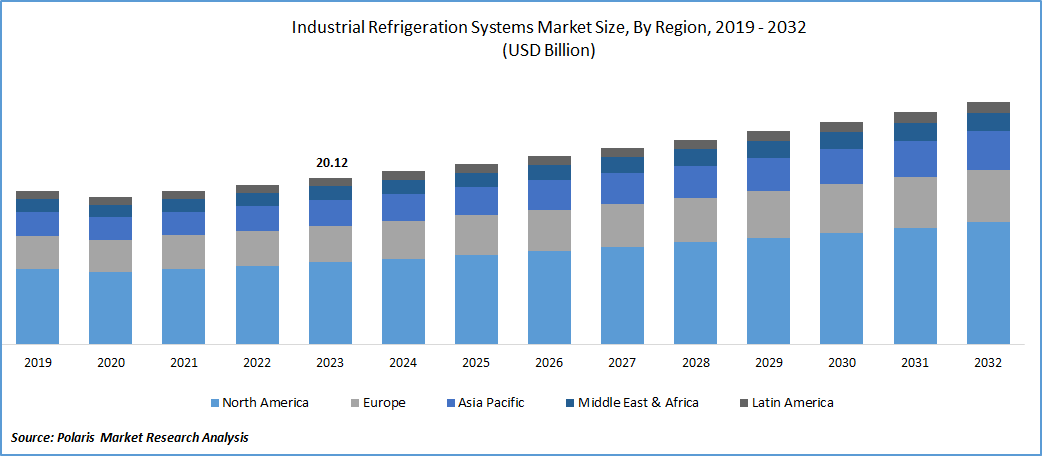

- Industrial Refrigeration Systems Market size was valued at USD 20.12 billion in 2023.

- The market is anticipated to grow from USD 20.96 billion in 2024 to USD 29.31 billion by 2032, exhibiting the CAGR of 4.3% during the forecast period.

Market Introduction

Industrial refrigeration systems find application in diverse industries, including pharmaceuticals, food and beverage, processing, and chemicals. These systems are commonly employed in areas such as cold food storage, beverage production, dairy processing, ice rinks, and heavy industries, effectively extracting heat from materials and large-scale processes to achieve the desired temperature.

The global surge in e-commerce grocery sales outpaces the growth of physical grocery sales. Concurrently, cold chains play a pivotal role in preventing harvest spoilage, employing technologies like evaporator/passive coolers and absorption refrigerators. Market expansion is influenced by factors such as elevated temperatures, excessive heat, and agro-climatic conditions. Notably, in developing nations, the adoption of cold chain systems is hindered by limited budgets allocated for advanced equipment.

To Understand More About this Research: Request a Free Sample Report

- For instance, in September 2023, Denso, player in the Japanese automotive industry with a focus on tackling challenges in the logistics sector, including enhancing working conditions for truck drivers and optimizing energy utilization, has engineered an innovative cooling system. This system was designed to deliver both comfort and energy efficiency, particularly when the engine of a commercial vehicle is not in operation.

Industrial refrigeration systems are becoming more and more necessary as the demand for packaged and processed foods and beverages rises and spoiling must be prevented. Natural refrigerants are being given preference by producers over potentially hazardous coolants due to worries about global warming. Because natural refrigerants are less expensive and have no negative impact on the climate, the market for equipment made with real refrigerants has expanded significantly in recent years. In the future, new and improved cold chain systems that are implemented globally are expected to have an impact on the industrial refrigeration systems market.

The research study provides a comprehensive analysis of the industry, assessing the market on the basis of various segments and sub-segments. It sheds light on the competitive landscape and introduces Multi-access Edge Computing Market key players from the perspective of market share, concentration ratio, etc. The study is a vital resource for understanding the growth drivers, opportunities, and challenges in the industry.

Market Trends

Industry Growth Drivers

Stringent regulatory standards is projected to spur the product demand.

The industrial refrigeration systems market growth is greatly aided by stringent regulatory standards. Stringent regulations dictating the utilization of particular refrigerants and the energy efficiency of industrial systems are compelling businesses to pursue sophisticated and compliant refrigeration solutions. This strict regulatory environment acts as a pivotal driver for innovation in the market.

Increasing consumer demand for quality and safety is expected to drive industrial refrigeration systems market growth.

A growing emphasis from consumers on the quality and safety of perishable products is propelling industries to invest in reliable and advanced refrigeration systems. This heightened demand is spurring investments to ensure the preservation and integrity of goods throughout the entire supply chain.

Industry Challenges

High initial cost is likely to impede the market industrial refrigeration systems growth opportunities.

High initial cost stand as a prominent factor hindering the growth of the industrial refrigeration systems market. The initial expenses linked to the adoption of advanced industrial refrigeration systems, particularly those integrating eco-friendly refrigerants and smart technologies, may present a hurdle for certain businesses. Nonetheless, the enduring energy savings and compliance advantages frequently surpass the initial investment.

Moreover, the incorporation of sophisticated IoT technologies and intelligent features into current refrigeration systems can be challenging. Legacy systems might necessitate upgrades or replacements to fully capitalize on the benefits offered by connected and intelligent refrigeration solutions.

Report Segmentation

The market is primarily segmented based on component, capacity, application, and region.

|

By Component |

By Capacity |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report : Speak to Analyst

By Component Analysis

Compressors segment is expected to witness highest growth during forecast period

The compressors segment is projected to grow at a high CAGR during the projected period in the industrial refrigeration systems market. The expansion in this sector is propelled by swift industrialization, the adoption of automation, and an increased need for oil-free compressors within the HVAC industry, driven by environmental considerations. Compressors hold a crucial function in refrigeration systems, ensuring the effective cooling of materials and large-scale processes. Anticipated growth opportunities in this segment stem from the escalating demand for energy-efficient compressors with a reduced carbon footprint.

By Capacity Analysis

500kW-1000kW segment is expected to dominate the industrial refrigeration systems market during forecast period

In 2023, the industrial refrigeration systems market share was predominantly influenced by 500kW-1000kW, commanding a significant market share. Within this segment, the cooling capacity range is predominantly employed for the storage and processing of food and beverages, particularly for perishable and processed products. Additionally, daily plants utilize these cooling capacity ranges to extend the shelf life of stored items without the risk of contamination.

By Application Analysis

Food & Beverage segment is expected to dominate the industrial refrigeration systems market during forecast period

Food & Beverage segment emerged as the dominant players in the distribution channels segment. Fueled by increasing demand for processed and frozen foods, companies are developing advanced systems to handle large volumes efficiently. Rising global food consumption and industry-specific needs are driving innovations, contributing to the segment's expansion.

Regional Insights

North America region dominated the global industrial refrigeration systems market in 2023

North America dominated the global industrial refrigeration systems market in 2023 and is expected to continue to do so. Factors such as increasing investments in food processing, pharmaceuticals, and cold storage facilities, along with stringent environmental regulations, drive the market expansion. Growing awareness about energy-efficient solutions further boosts adoption. The advent of technologies like IoT and eco-friendly refrigerants contributes to the region's market growth. As North American businesses prioritize sustainability, the market anticipates continued expansion, offering advanced refrigeration solutions to meet the evolving needs of industries and comply with environmental standards.

In the meanwhile, the Asia Pacific region is poised for rapid expansion, driven by substantial growth in cold chain storage facilities in countries like India, Japan, China. China, the world's leading producer of fruits and vegetables, is closely followed by India. These nations play pivotal roles in global crop exports. To enhance cold storage and refrigeration capabilities, the governments of China and India are implementing numerous projects. These initiatives aim to extend cold storage management and enhance refrigeration and refrigerated warehouse facilities, reinforcing their commitment to modernize and optimize storage practices for agricultural products.

Key Market Players & Competitive Insights

The industrial refrigeration systems market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Baltimore Aircoil Company

- Bitzer

- Carnot Refrigeration

- Danfoss

- Emerson Electric Co.

- GEA Group AG

- Ingersoll Rand

- Johnson Controls International plc

- Kirby Building Systems LLC

- Lennox International Inc.

- Mayekawa Mfg. Co., Ltd.

- Mitsubishi Electric Corporation

- Riello Elettronica Group

- Schneider Electric

- Trane Technologies plc

Recent Developments

- In June 2023, Johnson Controls acquired M&M Carnot. M&M Carnot is a top supplier of natural refrigeration solutions with extremely low global warming potential (GWP). It is anticipated that this calculated action would strengthen Johnson Controls' dedication to helping clients meet their sustainability objectives.

- In March 2023, Tecumseh Products Company broadened its TC Series compressor platform to incorporate models featuring Propane R-290 refrigerant, specifically designed for the Indian market expansion.

Market Analysis & Report Coverage

The industrial refrigeration systems market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, component, capacity, application, and their futuristic growth opportunities.

Industrial Refrigeration Systems Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 20.96 billion |

|

Revenue forecast in 2032 |

USD 29.31 billion |

|

CAGR |

4.3% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

Navigate through the intricacies of the 2024 Industrial Refrigeration Systems Market with precision, thanks to the comprehensive statistics on market share, size, and revenue growth rate assembled by Polaris Market Research Industry Reports. This thorough analysis not only provides a glimpse into the historical context but also extends its reach with a market forecast outlook until 2032. Immerse yourself in the richness of this industry analysis by securing a complimentary PDF download of the sample report.

Browse Our Top Selling Reports

Razor Market Size, Share 2024 Research Report

Solid State Drive Market Size, Share 2024 Research Report

Red Yeast Rice Market Size, Share 2024 Research Report

Telehandler Market Size, Share 2024 Research Report

Pharmaceutical Excipients Market Size, Share 2024 Research Report

FAQ's

Carnot Refrigeration, Danfoss, Emerson Electric Co., GEA Group AG, Ingersoll Rand, Johnson Controls International plc are the key companies in Industrial Refrigeration Systems Market.

Industrial Refrigeration Systems Market is estimated CAGR of 4.3% during the forecast period.

The Industrial Refrigeration Systems Market report covering key segments are component, capacity, application, and region.

Stringent regulatory standards is projected to spur the product demand.

The global industrial refrigeration systems market size is expected to reach USD 29.31 billion by 2032