Solid State Drive Market Size, Share, Trends, Industry Analysis Report

: By Interface (SATA, SAS, and PCIe), By Type, By Storage, By Application, and By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 119

- Format: PDF

- Report ID: PM3907

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

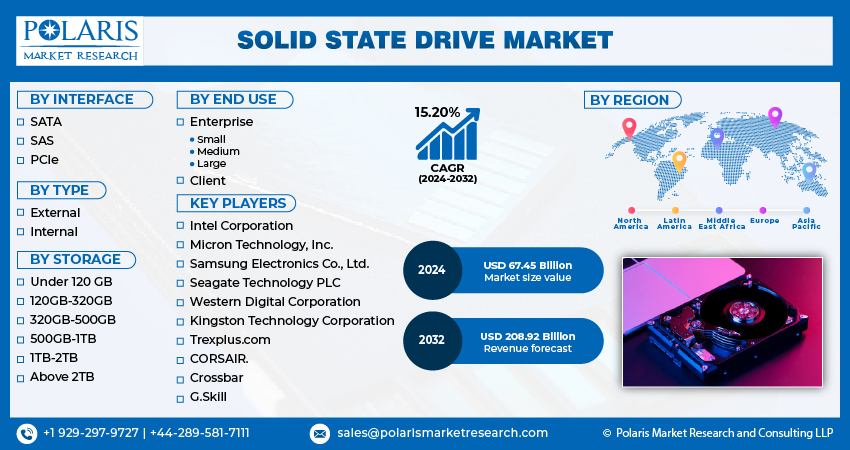

The solid state drive market was valued at USD 22.24 billion in 2024, growing at a CAGR of 16.4% during 2025–2034. The market growth is primarily fueled by increased demand for high-performance computing and technological advancements in solid state drives.

Key Insights

- The SATA segment dominates the market, owing to the high prevalence of SATA interfaces in current computer systems.

- The external segment is registering a higher growth rate. The segment’s growth is primarily attributed to the rising demand for high-speed and portable storage solutions for data backup and on-the-go access.

- The 500 GB–1 TB segment leads the market due to its ability to balance cost-effectiveness and storage capacity for various users.

- The enterprise segment is registering the highest growth rate. Growing demand for reliable and high-performance storage solutions across enterprise servers and data centers is fueling the segment’s growth.

- Asia Pacific accounts for the largest market share. The region’s dominant market position is attributed to its robust consumer electronics manufacturing hub and increased demand from the client and enterprise sectors.

- Asia Pacific is also witnessing the highest growth rate, primarily due to the growing investments in IT infrastructure in the region.

Industry Dynamics

- The increased demand for high-performance computing across several sectors is a key factor driving market growth.

- Rising adoption of SSDs in data centers and cloud computing to handle large data volumes and provide seamless services is contributing to the market expansion.

- Growing usage of solid state drives in industrial and automotive applications is expected to create several market opportunities in the coming years.

- Higher cost per gigabyte compared to traditional hard disk drives may hinder market growth.

Market Statistics

2024 Market Size: USD 22.24 billion

2034 Projected Market Size: USD 101.75 billion

CAGR (2025-2034): 16.4%

Asia Pacific: Largest Market in 2024

AI Impact on Solid State Drive Market

- AI enhances SSD performance by optimizing data caching, wear leveling, and error correction in real time.

- Machine learning models predict drive failures by analyzing usage patterns. The use of these models enables proactive replacement and reduces data loss risks.

- AI-driven storage management enhances workload distribution, improving efficiency in cloud computing and data center environments.

- Intelligent analytics help manufacturers design next-generation SSDs with higher reliability, longer lifespan, and better adaptability to diverse applications.

To Understand More About this Research: Request a Free Sample Report

The solid state drive (SSD) market encompasses the buying and selling of semiconductor-based data storage devices that utilize integrated circuits, primarily NAND flash memory, to store persistent data. Unlike traditional Hard Disk Drives (HDDs), which rely on mechanical platters and read/write heads, SSDs have no moving parts, resulting in significantly faster data access speeds, lower latency, increased durability, and reduced power consumption. This fundamental difference drives their increasing adoption across various applications. The growing demand for high-performance computing in personal computers and enterprise servers is a significant market growth factor. The enhanced responsiveness and quicker boot times offered by SSDs improve user experience and system efficiency. Furthermore, the increasing adoption of cloud computing and the subsequent need for faster and more reliable data storage solutions in data centers are propelling demand for SSDs. The decreasing cost of SSDs over time, driven by advancements in NAND flash technology and production efficiencies, is also enhancing market penetration across different price points.

The SSD market dynamics are shaped by evolving technology and shifting consumer preferences. Industry trends indicate a continuous increase in storage capacity and performance, alongside a decline in price per gigabyte, making SSDs more accessible to a wider range of consumers and businesses. The development of new interface technologies such as NVMe (Non-Volatile Memory Express) over PCIe (Peripheral Component Interconnect Express) further enhances data transfer rates, catering to demanding applications such as gaming, video editing, and artificial intelligence. Owing to these factors, the market outlook suggests a strong upward trajectory.

Market Dynamics

Increasing Demand for High-Performance Computing

The escalating demand for high-performance computing across various sectors is a significant market growth factor for the solid state drive market. SSDs offer significantly faster read and write speeds compared to traditional Hard Disk Drives (HDDs). Systems with SSDs can boot up in as little as 10-30 seconds, compared to 30-60 seconds or more with HDDs. Application loading times are also drastically reduced, often by 50% or more.

The low latency and high read/write speeds of SSDs enable quicker boot times, faster application loading, and seamless multitasking, making them a preferred choice for high-performance computing environments. For instance, a study published on the National Center for Biotechnology Information (NCBI) website in 2023, titled "High-Performance Computing for Biomedical Data Analysis," highlights the critical role of fast storage solutions such as SSDs in accelerating complex genomic sequencing and analysis, significantly reducing processing times. This need for speed and efficiency in data-intensive tasks across diverse applications directly translates to a strong demand for SSDs.

Growing Adoption in Data Centers and Cloud Computing

Data centers require storage solutions that offer high capacity and exceptional speed, reliability, and energy efficiency to handle massive volumes of data and ensure seamless service delivery. SSDs, with their superior performance and lower power consumption compared to HDDs, are increasingly being deployed in data centers to optimize data access times and reduce operational costs. A research article published on PubMed in 2022, "Energy Efficiency in Cloud Data Centers Through Optimized Storage Solutions," discusses the benefits of using SSDs in reducing the energy footprint and improving the overall efficiency of cloud infrastructure. The ability of SSDs to handle high input/output operations per second (IOPS) is crucial for the virtualized environments prevalent in cloud computing. As the volume of digital data continues to grow exponentially and more businesses transition to cloud-based solutions, the demand for high-performance SSDs in data center applications will continue to surge. Hence, the rapid expansion of data centers and the widespread adoption of cloud computing services are substantial drivers for the solid state drive solid state drive market growth.

Declining Prices and Increasing Affordability

The continuous advancements in NAND flash memory technology and improved manufacturing processes have led to a significant decrease in the cost of solid state drives, making them increasingly affordable for a wider range of consumers and enterprises. As the price gap between SSDs and traditional HDDs narrows, more users are opting for the performance benefits offered by SSDs in their personal computers, laptops, and gaming consoles. Furthermore, the increased affordability enables businesses, including Small and Medium-sized Enterprises (SMEs), to adopt SSDs for their storage needs, enhancing their IT infrastructure without significant capital expenditure. A report published by the National Institute of Standards and Technology (NIST) in 2021, "Trends in Solid-State Storage Technologies and Cost Analysis," outlines the historical price reduction trends in NAND flash memory and their impact on the adoption rates of SSDs in various applications. This increased affordability and accessibility are driving the widespread adoption of SSDs across various end users.

Segment Insights

Market Assessment – By Interface

The solid state drive market, by interface, is segmented into SATA, SAS, and PCIe. The SATA segment holds the largest share. This dominance can be attributed to the widespread prevalence of SATA interfaces in existing computer systems, particularly in the consumer and enterprise sectors. SATA SSDs have been the primary upgrade path for users looking to transition from traditional hard disk drives due to their compatibility and relatively lower cost compared to other interface technologies. The established infrastructure and broad availability of SATA-enabled devices contribute significantly to its current market leadership. This extensive adoption across a wide range of applications solidifies SATA as the interface with the highest existing market share.

The PCIe segment is experiencing the highest growth rate during the forecast period. This rapid expansion is driven by the increasing demand for higher bandwidth and lower latency, which PCIe interfaces inherently offer compared to SATA and SAS. The adoption of NVMe (Non-Volatile Memory Express) protocol over PCIe further amplifies its performance advantages, making it the preferred choice for high-performance computing, gaming, and enterprise applications requiring ultra-fast data transfer speeds. The continuous advancements in PCIe technology and the decreasing cost of PCIe-enabled SSDs are accelerating their adoption. This growing preference for superior performance positions the PCIe interface as the segment with the highest growth rate, indicating a future shift in interface preferences as technology evolves and costs become more competitive.

Market Evaluation– By Type

The solid state drive market, by type, is segmented into external and internal. The internal segment holds a larger share. This dominance is primarily attributed to the widespread use of internal SSDs as the primary storage solution in personal computers, laptops, and enterprise servers. The integration of internal SSDs directly into the system architecture provides optimal performance and seamless operation, making them the preferred choice for the majority of computing needs. The increasing adoption of SSDs as standard in new devices and as a primary upgrade for existing systems solidifies the internal segment's leading position.

The external segment is experiencing a higher growth rate, fueled by the increasing need for portable and high-speed storage solutions for data backup, transfer, and on-the-go access. The compact form factors, increasing storage capacities, and enhanced transfer speeds of external SSDs are making them an attractive alternative to traditional external hard disk drives. The growing demand from content creators, business professionals, and general consumers for reliable and fast external storage options is driving this expansion. The convenience and performance benefits offered by external SSDs are key factors contributing to the highest growth rate in this segment.

Market Evaluation – By Storage

The solid state drive market, by storage, is segmented into under 120 GB, 120 GB–320 GB, 320 GB–500 GB, 500 GB–1 TB, 1 TB–2 TB, and above 2 TB. The 500 GB–1 TB segment holds the largest share. This significant share can be attributed to the segment's sweet spot in balancing storage capacity and cost-effectiveness for a wide range of users. This capacity range adequately meets the storage needs for operating systems, frequently used applications, and a substantial amount of personal or professional data, making it a popular choice for both mainstream consumers and business professionals. The widespread demand for this storage capacity in laptops, desktops, and workstations solidifies its position as the leading segment.

The above 2TB segment is experiencing the highest growth rate. This rapid expansion is driven by the increasing demand for large storage capacities to accommodate growing digital content, including high-resolution videos, extensive media libraries, and large datasets in professional applications such as video editing, data analytics, and scientific research. As the creation and consumption of data-intensive content continue to rise, the need for high-capacity storage solutions is escalating. The decreasing cost per terabyte for larger capacity SSDs is also making them more accessible, further fueling their adoption and resulting in the highest growth rate for the above 2TB segment.

Market Evaluation – By Application

The solid state drive market, by application, is segmented into enterprise and client. The client segment holds the largest share. This dominance is primarily driven by the widespread adoption of SSDs in personal computers, laptops, gaming consoles, and other consumer electronic devices, including Consumer Network Attached Storage. The sheer volume of individual consumers and the increasing integration of SSDs as a standard component in these devices contribute significantly to the client segment's leading position. The demand for faster boot times, improved application responsiveness, and enhanced overall user experience in personal computing drives the substantial share of the client segment.

The enterprise segment is experiencing the highest growth rate. This rapid expansion is fueled by the increasing demand for high-performance, reliable, and energy-efficient storage solutions in data centers, cloud computing infrastructure, and enterprise servers. The need to process and manage large volumes of data with low latency and high input/output operations per second (IOPS) is driving the adoption of SSDs in enterprise environments. The benefits of SSDs in terms of speed, durability, and reduced power consumption are becoming increasingly critical for business operations, leading to the highest growth rate in the enterprise segment.

Regional Analysis

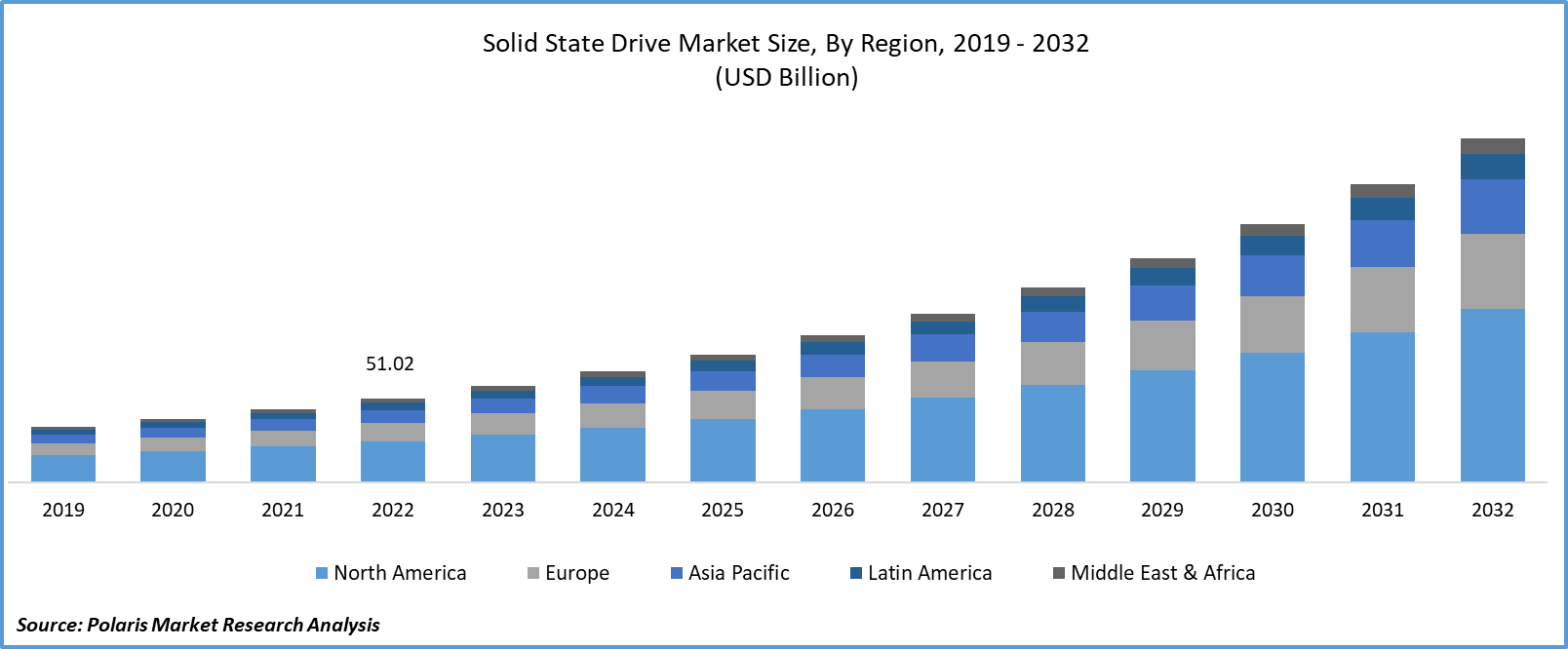

The solid state drive market demonstrates varied adoption and growth patterns across different geographical regions, including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Each region's market dynamics are influenced by factors such as technological infrastructure, economic development, the presence of key industry players, and the demand from both enterprise and consumer sectors. While mature markets such as North America and Europe exhibit significant adoption rates, Asia Pacific is emerging as a powerhouse due to its large consumer base and rapid industrialization. Latin America and the Middle East & Africa are also witnessing increasing adoption, albeit from a smaller base, driven by growing digitalization and infrastructure investments.

Asia Pacific holds the largest solid state drive market share. This dominance is primarily attributed to the region's vast consumer electronics manufacturing hub, the presence of major NAND flash memory producers, and the burgeoning demand from both the client and enterprise sectors in countries such as China, Japan, and South Korea. The high volume of PC and smartphone production, coupled with the increasing adoption of SSDs in data centers and cloud infrastructure across the region, contributes significantly to its leading market position. The strong manufacturing capabilities and the large addressable market solidify Asia Pacific's status as the region with the largest revenue share.

The Asia Pacific market is also exhibiting the highest growth rate. This rapid expansion is fueled by the continuous growth in its electronics manufacturing sector, increasing investments in IT infrastructure, and the rising adoption of advanced technologies across various industries. The burgeoning middle-class population and increasing disposable incomes in many Asia Pacific countries are driving consumer demand for SSD-equipped devices. Furthermore, the aggressive expansion of cloud services and the development of robust digital infrastructure across the region are propelling the demand for high-performance SSDs in enterprise applications, making Asia Pacific the region with the most promising growth prospects.

Key Players and Competitive Insights

A few major players actively operating in the solid state drive market include Samsung Electronics Co., Ltd.; Western Digital Corporation; SK hynix Inc.; Micron Technology, Inc.; Kingston Technology Corporation; Seagate Technology Holdings plc; Toshiba Corporation (Kioxia Holdings Corporation); Transcend Information Inc.; ADATA Technology Co., Ltd.; and Lexar Media, Inc. (Longsys Electronics (HK) Co., Limited). These companies are significant contributors to the market, offering a diverse range of internal and external SSDs across various interfaces and storage capacities to cater to both client and enterprise applications.

The competitive landscape is characterized by intense rivalry among a mix of established memory manufacturers and storage solution providers. Competition is driven by factors such as product innovation, performance specifications, pricing strategies, storage capacity offerings, and brand reputation. Key industry insights reveal a continuous focus on technological advancements to enhance read/write speeds, increase storage density, and improve endurance. Furthermore, strategic collaborations, mergers, and expansions in production capacities are common approaches adopted by players to strengthen their market position and cater to the growing demand for SSDs. The competitive intensity fosters ongoing developments and cost efficiencies within the market.

Samsung Electronics Co., Ltd., headquartered in Suwon, South Korea, offers a comprehensive portfolio of solid state drives spanning client and enterprise applications. Their offerings include high-performance NVMe SSDs, SATA SSDs, and portable SSDs, utilizing their in-house NAND flash memory and controller technologies. Samsung's diverse product line caters to a wide range of needs, from consumer PCs and gaming consoles to data centers and high-end workstations.

Western Digital Corporation, with its primary operations in San Jose, California, USA, provides a broad spectrum of solid state drives under the Western Digital and SanDisk brands. Their product offerings encompass internal SATA and NVMe SSDs for client computing, as well as enterprise-grade SSDs optimized for server and storage systems. Western Digital's established presence in the storage industry and their diverse range of SSD solutions position them as a significant and relevant participant in the market.

List of Key Companies in Solid State Drive Market

- ADATA Technology Co., Ltd.

- Kingston Technology Corporation

- Kioxia Holdings Corporation

- Lexar Media, Inc.

- Micron Technology, Inc.

- Samsung Electronics Co., Ltd.

- Seagate Technology Holdings plc

- SK hynix Inc.

- Transcend Information Inc.

- Western Digital Corporation

Solid State Drive Industry Developments

- March 2025: KIOXIA America, Inc. announced the launch of its LC9 Series NVMe SSD, offering a massive 122.88 terabytes of storage in a 2.5-inch form factor. This marks the first SSD to utilize KIOXIA’s eighth-generation BiCS FLASH 3D flash memory, featuring QLC 2-terabit die.

- March 2025: Chinese SSD manufacturer UNIS Flash Memory introduced the world’s fastest PCIe Gen5 SSDs, delivering blazing read speeds of up to 14,900 MB/s.

SSD Market Segmentation

By Interface Outlook (Revenue – USD Billion, 2020–2034)

- SATA

- SAS

- PCIe

By Type Outlook (Revenue – USD Billion, 2020–2034)

- External

- Internal

By Storage Outlook (Revenue – USD Billion, 2020–2034)

- Under 120 GB

- 120GB–320GB

- 320GB–500GB

- 500GB–1TB

- 1TB–2TB

- 2TB

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Enterprise

- Client

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Solid State Drive Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 22.24 billion |

|

Market Size Value in 2025 |

USD 25.84 billion |

|

Revenue Forecast by 2034 |

USD 101.75 billion |

|

CAGR |

16.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The solid state drive market has been segmented into detailed segments of interface, type, storage, and application. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Market Entry Strategies: Growth strategies within the solid state drive market are heavily focused on technological innovation, particularly in increasing storage density, enhancing performance metrics such as read/write speeds, and improving power efficiency. Industry penetration is being driven by decreasing prices, making SSDs more accessible to a broader consumer base and encouraging upgrades from traditional HDDs. Marketing efforts emphasize the superior performance, durability, and energy savings of SSDs compared to their mechanical counterparts. Furthermore, strategic partnerships with Original Equipment Manufacturers (OEMs) to integrate SSDs into new devices and targeted campaigns highlighting the benefits for specific applications, such as gaming and professional content creation, are key marketing strategies to further market development.

FAQ's

The market size was valued at USD 22.24 billion in 2024 and is projected to grow to USD 101.75 billion by 2034.

The market is projected to register a CAGR of 16.4% during the forecast period.

Asia Pacific held the largest share of the market in 2024.

A few key players in the market are Samsung Electronics Co., Ltd.; Western Digital Corporation; SK hynix Inc.; Micron Technology, Inc.; Kingston Technology Corporation; Seagate Technology Holdings plc; Toshiba Corporation (Kioxia Holdings Corporation); Transcend Information Inc.; ADATA Technology Co., Ltd.; and Lexar Media, Inc. (Longsys Electronics (HK) Co., Limited).

The SATA segment accounted for the largest share of the market in 2024

Following are a few of the market trends: ? Increasing adoption of NVMe (Non-Volatile Memory Express) interface: NVMe over PCIe is becoming the preferred interface due to its significantly higher data transfer speeds and lower latency compared to SATA and SAS, especially in high-performance computing and enterprise applications. ? Growing demand for higher storage capacities: The increasing creation and consumption of digital content, along with data-intensive applications, are driving the demand for SSDs with larger storage capacities, including 1TB, 2TB, and above.

A solid state drive (SSD) is a type of non-volatile storage device used in computers that stores persistent data on solid-state flash memory. Unlike traditional Hard Disk Drives (HDDs), which use spinning magnetic platters and read/write heads, SSDs have no moving mechanical parts. This fundamental difference results in several advantages, including significantly faster data access speeds, lower latency, increased durability, reduced power consumption, and silent operation. SSDs are increasingly replacing HDDs in many applications, especially where performance and responsiveness are critical, such as in laptops, desktops, and enterprise servers.