Industry 5.0 Market Share, Size, Trends, Industry Analysis Report

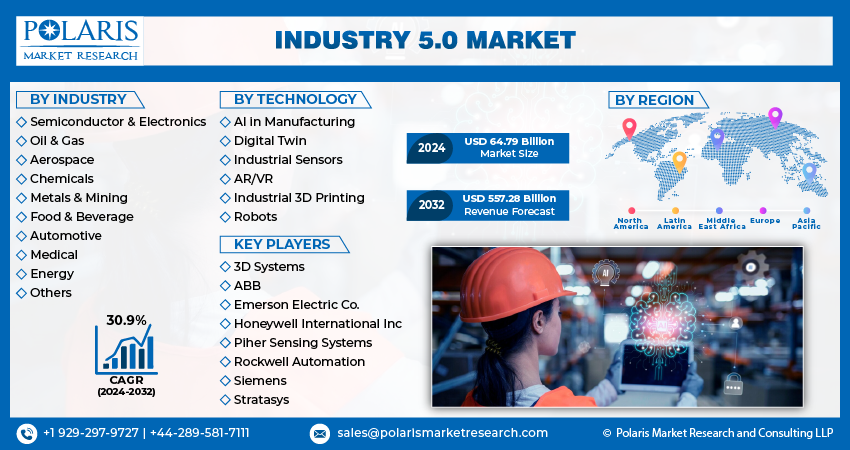

By Technology (AI in Manufacturing, Digital Twin, Industrial Sensors, AR/VR, Industrial 3D Printing, Robots); By Industry; By Region; Segment Forecast, 2024 - 2032

- Published Date:Feb-2024

- Pages: 119

- Format: PDF

- Report ID: PM4685

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

Industry 5.0 Market size was valued at USD 49.70 billion in 2023. The market is anticipated to grow from USD 64.79 billion in 2024 to USD 557.28 billion by 2032, exhibiting a CAGR of 30.9% during the forecast period

Industry 5.0 Market Overview

The emergence of the Industry 5.0 market has been rapid with no signs of abating as the evolving and tighter integration of advanced technologies like AI, IoT, robotics, and 3D printing is driving the Industry 5.0 market size. These developments give manufacturers the ability to perform a range of tasks with automation, customize products, and improve the general effectiveness of their operations. Utilization of AI and robotics, for example, for a highly productive production line and a higher level of practicality, brings us a better quality of products and a better utilization of resources.

Consumer demands are indeed a major facilitator in the emergence of Industry 5.0. Customers now want more than just predictable products; the move towards customization, sustainability, and the ability to catch up with changing trends in the market quickly is now on the rise. Industry 5.0 answers these challenges by introducing flexible and responsive manufacturing models, which makes it possible for companies to take into account the individual peculiarities of their clients while producing their goods. Personalization, as more and more companies switch to a customer-centric approach, is gaining ground in manufacturing, and consumer experience is becoming an important determining factor in shaping Industry 5.0 market trends.

To Understand More About this Research: Request a Free Sample Report

On the other hand, Industry 5.0 relies on resilience in the face of disruptions, while sustainable development issues have become increasingly topical. While the world supply chains are under strain from multiple factors, such as geopolitical uncertainties and unexpected occurrences like the recent global pandemic, there is an urgent need to build resilient and robust manufacturing systems to make them feasible and more sustainable. Resource optimization, adaptation to the changing operational circumstances, and the social well-being of workers, namely, compose industry 5.0, which is the more socially responsible and sustainable counterpart of the market. This strategy mirrors a holistic approach that goes beyond just technology, involving the whole society and the ecological components as well in industrialization.

In general, the growing demand for Industry 5.0 is motivated by technological advances, changing customer inclinations, as well as the necessity of flexibility and sustainability. Such a transitional period in manufacturing is marked by the incorporation of the most modern technologies, a shift towards customization, as well as the deployment of resources for both efficiency and the preservation of workers' health. The synergy of these forces in creating an active and eventful Industry 5.0 market landscape reinforces the fact that it holds some very far-reaching consequences for the future of industrial manufacturing.

Industry 5.0 Market Dynamics

Market Drivers

Increased emphasis on incorporating environmentally friendly technologies for sustainable manufacturing bolstering the growth of the Industry 5.0 market share.

Green technologies include various materials, techniques, and approaches essential for recycling waste and clean energy aside from the other aspects that target the reduction of the impacts resulting from climate change. Adoption of such technologies like the use of renewables and storage and waste-to-energy solutions and AI integrated for carbon emissions monitoring and green structure development enables the manufacturing sector to lean production and lower its emissions while actively responding to climate change. This production strategy thus saves the amount of waste created while at the same time contributing to a considerable drop in the overall environmental impact that is related to the production process. Sustenance manufacturers who have very high continuous energy demands can commit to renewable energy sources such as wind, biomass, and solar.

For instance, Greenam Energy from Greenam Energy India Private Limited, which is a part of AM International and SPIC a company known for making fertilizers. The floating solar power plant placed already on the premises of Greenham Energy within the riverside SPIC powered by the sun serves internal and external needs, resulting in the leveraging of the company itself and also providing the opportunity to supply energy to the state’s grid, thus, promoting the use of renewable energy by others.

Market Restraints

An insufficiently skilled workforce familiar with sophisticated manufacturing equipment is likely to hamper the industry's 5.0 market growth.

The lack of relevant skills becomes a classical bottleneck to implementing the concept of the market. Despite the barrier stemming from limitations in being competent in complicated technologies and cultural challenges towards it, the integration, implementation, and recruitment of talent introduces additional complexities. Even though the online trend is growing, the majority of companies don’t realize what can be done via diverse technologies and how they work because of their complexity and lack of understanding of the technology. The case of the creation of a digital twin for an asset or processor (the basis for deploying IoT in the Industrial Industry) would notably require access to cross-functional technologies, personnel with very specific skill sets, and people proficient in dealing with the latest equipment and software systems.

The digital disruption leads to a change in the skill requirement of workers, replacing the analog transition across the different stages of the value chain, from manufacturing to sales and marketing. The current workforce has to change their skills to operate the new technology systems. Otherwise, their progress will slow down, their competitors will gain an advantage, and they might even become unemployed. This reflects the meaningful collaborative solution that requires companies to invest in trainer accessibility, the re-skilling ecosystem for lifelong learning, and smooth handover to harness the power of the next wave of the industrial revolution.

Report Segmentation

The market is primarily segmented based on industry, technology, and region.

|

By Industry |

By Technology |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Industry 5.0 Market Segmental Analysis

By Industry Analysis

- The automotive segment is forecast to make a significant contribution to the Industry 5.0 market share in 2023. This segment is the one that is identified to grow fast in the treading years and this is been influenced by the concepts of Industry 5.0. Industry 5.0 signals a dramatic transition in manufacturing processes, where machines work hand in hand with knowledge workers. One of the crucial sectors of the automobile industry is the innovations like automated manufacturing facilities, connected vehicles, and elevated customer experiences that accelerate growth. Industry 5.0 is an evolution in manufacturing technology to that of intelligent systems that use this technology for data analysis, predictive maintenance, and adaptive production processes. Thus, it increases efficiency, reduces downtime, and improves the quality of products. In that case, Industry 5.0 turns to tailor-made products and individual services to meet specific customer demands. It aims to increase customer satisfaction and a loyal customer base, creating value and market share.

By Technology Analysis

- The digital twin segment is poised to dominate the market share in the upcoming forecast period. Digital twin technology, which involves creating virtual replicas of physical objects or systems, has gained significant traction due to its transformative impact on various industries. This approach enables real-time monitoring, analysis, and optimization of physical assets, processes, or systems. Its widespread adoption is driven by the ability to enhance efficiency, productivity, and decision-making across sectors such as manufacturing, healthcare, and transportation.

The anticipated leadership of the digital twin segment is indicative of the growing recognition and integration of this technology, especially as it aligns with the principles of Industry 5.0. The dynamic nature of digital twins, offering accurate and interactive simulations, contributes to improved operational insights and fosters innovation. As industries increasingly seek solutions for optimization and intelligent decision-making, the digital twin segment is well-positioned to play a central role, solidifying its prominence in the Industry 5.0 market forecast period.

Industry 5.0 Market Regional Insights

The North America region dominated the largest industry 5.0 market share in 2023

Industry 5.0 signifies a transformative evolution in manufacturing and industry, accentuating the integration of advanced digital technologies with traditional processes to enhance efficiency, productivity, and competitiveness. In North America, this paradigm shift is underpinned by various factors, including a robust ecosystem of innovative startups, technology firms, and research institutions, alongside well-established infrastructure and a skilled workforce. Additionally, North America exhibits a vibrant entrepreneurial culture and a supportive regulatory environment, fostering innovation and encouraging investments in emerging technologies.

Competitive Landscape

The Industry 5.0 market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- 3D Systems

- ABB

- Emerson Electric Co.

- Honeywell International Inc

- Piher Sensing Systems

- Rockwell Automation

- Siemens

- Stratasys

Recent Developments

- In October 2023, Piher Sensing Systems, a subsidiary of Amphenol Corporation, unveiled the hcso-1w open-loop current sensor. This high-precision sensor is well-suited for the measurement of both AC and DC currents in applications such as battery management systems, industrial battery chargers, and motor control.

- In June 2023, Honeywell introduced its new solution, the Honeywell Digital Prime, a cloud-based digital twin aimed at simplifying the monitoring, management, and testing of process control changes and system modifications. This cost-efficient tool enables users to perform regular testing, resulting in increased precision of results and a significant decrease in the necessity for reactive maintenance.

- In April 2023, Stratasys launched the GrabCAD Print Pro software, featuring integrated quality assurance capabilities from Riven. This sophisticated software oversees the print preparation process for Stratasys 3D printers, specifically catering to manufacturers aiming for efficient large-scale production of end-use parts. Its primary focus lies in improving the accuracy of printed parts, minimizing waste, and reducing the time required for production.

Report Coverage

The Industry 5.0 market report emphasizes key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive industry, technology, and futuristic growth opportunities.

Industry 5.0 Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 64.79 billion |

|

Revenue Forecast in 2032 |

USD 557.28 billion |

|

CAGR |

30.9% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Industry, By Technology, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global Industry 5.0 market size is expected to reach USD 557.28 billion by 2032

Key players in the market are 3D Systems, ABB, Emerson Electric Co., Honeywell International Inc

North America contribute notably towards the global Industry 5.0 Market

Industry 5.0 Market exhibiting a CAGR of 30.9% during the forecast period

The Industry 5.0 Market report covering key segments are industry, technology, and region.