Infantile Spasm Therapeutics Market Share, Size, Trends, Industry Analysis Report

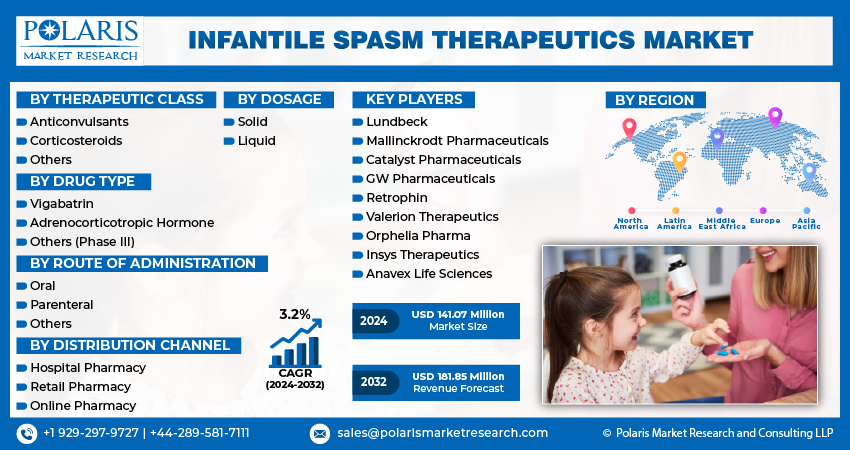

By Therapeutic Class (Anticonvulsants, Corticosteroids, Others); By Drug Type; By Dosage, By Route of Administration; By Distribution Channel; and Region 2024 - 2032

- Published Date:Jan-2024

- Pages: 117

- Format: PDF

- Report ID: PM3416

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

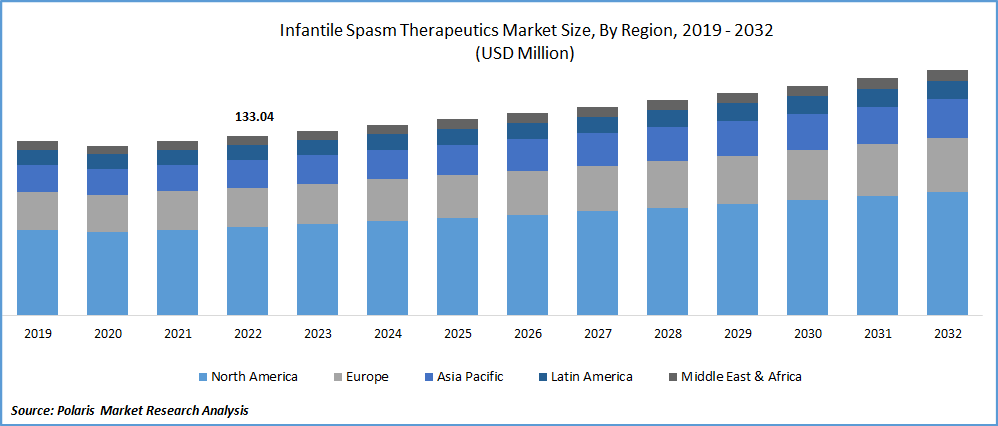

The global infantile spasm therapeutics market size was valued US$ 136.96 Million in 2023 and is expected to grow at a CAGR of 3.2% during the forecast period. The rising prevalence of infantile seizures, according to data, infantile spasms are rare disorder with an incidence rate of 1.6 to 4.5 per 10,000 live births, with occurrence in children of all ethnic groups. Alongside, increased health consciousness among the populace leading to early diagnosis, the growing number of product approvals, for example, in March 2022, FDA approved “Ztalmy” for the treatment of seizures associated with kinase 5 deficiency disorder in patients of age 2 or more, government initiatives especially in developing nations, and developing nations as well.

The research report offers a quantitative and qualitative analysis of the infantile spasm therapeutics market to enable effective decision-making. It covers the key trends and growth opportunities anticipated to have a favorable impact on the market. Besides, the study covers segment and regional revenue forecasts for market assessment.

To Understand More About this Research: Request a Free Sample Report

Therapeutics for infantile spasms are the methods used to treat seizures or an epileptic syndrome in young children, often between the ages of four months and a year. The body stiffens abruptly during a spasm episode, the arms, legs, and head bend forward, the back arches, and there are brief, mild convulsions. Brain tumors, birth traumas, brain infections, and genetic abnormalities can all result in infantile spasm. Infantile spams can be treated in several ways, including with steroids, hormone treatment with corticotropin injectable gel and glucocorticoids, and anti-seizure drugs.

If therapies for infantile spasms are started within three weeks of the onset of the spasms, either monotherapy or combination therapy can be used to treat the condition. Physical examination, neurological testing, brain MRIs, blood tests, and urine tests are all used to identify infantile spasms. The COVID-19 epidemic put a burden on conventional medical treatment.

Pediatric epilepsy specialists in the US had developed recommendations for the diagnosis and management of infantile spasms in the COVID-19 period, acknowledging the need to strike a balance between the public health needs of a pandemic and the fast evaluation of infantile spasms. Government-imposed limitations made it difficult for Americans to access child neurology clinical expertise in person. Telemedicine made it possible for doctors to assess kids from a distance. Growing evidence revealed telemedicine was a practical and efficient means to provide access to pediatric neurology care prior to the COVID-19 epidemic. Clinical judgement for infantile spasms is based on the infant's medical and neurologic history as well as the features of the occurrences, which may be assessed remotely.

Industry Dynamics

Growth Drivers

The rising incidence of infantile spasms in newborns which show that roughly infantile spasm is found in 1.6 to 4.5 infants per 10,000 live births. This can be due to an exponential increase in birth rates worldwide, in 2020, that was roughly 2.3 births per woman. Along these lines, the market is benefiting from an increase in product approvals as well as the availability of medications with promising pipelines.

The infantile spasm therapeutics market is being stimulated by ongoing technical developments in the management of infantile spasms, such as the development of seizure warning wearable device that can detect seizures and notify care takers, example FDA approved device manufactured by Neurospace by the name RNS System.

Additionally, the high incidence of infantile spasm medicine penetration is boosting the market expansion due to the general knowledge of early diagnosis and treatment. The leading market participants have been engaged in considerable research and development (R&D) operations, with an emphasis on the creation of novel medications with greater success rates, with global spending reaching a record high almost USD 1.7 trillion.

Report Segmentation

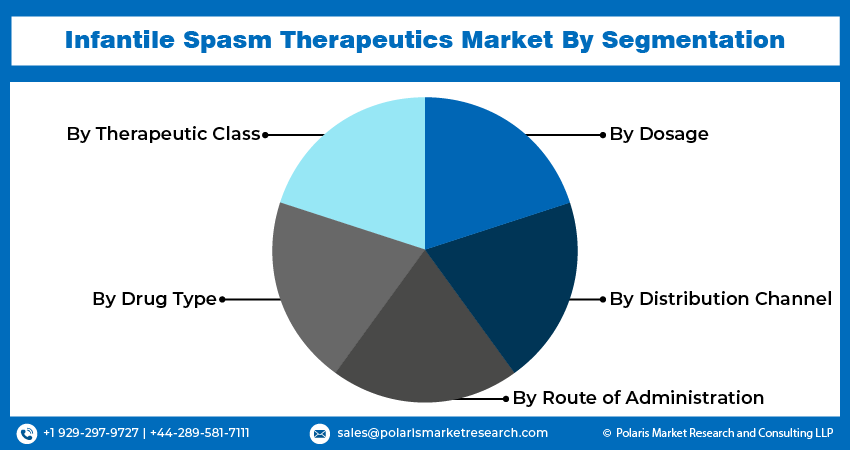

The market is primarily segmented based on therapeutic class, drug type, dosage, route of administration, distribution channel, end user and region.

|

By Therapeutic Class |

By Drug Type |

By Dosage |

By Route of Administration |

By Distribution Channel |

By Region |

|

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Anticonvulsants segment accounted for the largest revenue share

The anticonvulsants segment held the largest revenue share during the forecast period, owing to its pose ease of tolerance in patients thus increase in patient compliance. Medical practitioner also prefers anticonvulsants when it comes to treating infantile spasm due to the higher clinical efficacy in terms degree of seizure reduction and the lack of drug interactions with other medications going on.

Anticonvulsants depict the fastest growing segment as they show little to no side effects in comparison to other drug classes, thus the practitioner also prescribes anticonvulsants more frequently than others. Their pharmacological effects also augment the further growth of the segment.

Adrenocorticotropic hormone segment anticipated to hold the largest revenue share

Adrenocorticotropic hormone segment anticipated to hold the largest revenue share throughout the forecast period. Adrenocorticotropic hormone is one the drugs of choice in the treatment of infantile spasm because of which it has been able to capture largest market share amongst other drug options. Hormonal Therapy especially that of Adrenocorticotropic hormone is popular amongst clinicians as well to treat infantile spasms which makes it the holder of largest market share.

Liquid segment accounted for the largest market share in 2022

Liquid segment accounted for the largest market share in 2022. Liquid dosage form has numerous benefits over other dosage form for example; for individuals who have trouble swallowing pills or capsules, such as pediatrics, liquid dose forms are the best option. Also, liquid dosage forms are quickly available for absorption than tablets and capsules, thus the time for showing effects decreases and shows rapid actions.

They are popular because of numerous forms of liquid dosage form, i.e., suspensions, solutions or emulsions, offering numerous options and alternative to practitioner and patient to administer according to the patient’s needs. They also prove to be convenient since they can be administered easily especially in pediatric patients which make liquid dosage form the fastest growing segment.

Parenteral segment anticipated to hold the largest share during forecast period

This is due to the fact that parenteral route is the route of choice for drugs that have poor absorption in the GIT, especially when hormonal therapy is the choice of treatment here. And since adrenocorticotropic hormone used which needs to surpass liver metabolism so as to make it available, it is administered using parenteral route. Moreover, parenteral can be used in situations of emergency owing to its rapid action and least downtime. It also gives 100% bioavailability thus preference is given to the parenteral dosage form, as it gives more predictable bioavailability, which help it grow at highest CAGR in the market.

Hospital pharmacy segment account for largest market share in 2022

Hospital pharmacy segment dominated the market in largest shares. Hospital pharmacies witnessed the largest market share since infantile spasm require medical attention given during a set-up like that in a hospital under the surveillance of skilled medical practitioner like doctors and nurses. These factors account for a significant market share of hospital pharmacies as a distribution channel. Also, hospital pharmacies provide more convenience when compared to retail and online pharmacies.

North America dominated the market with largest revenue shares in 2022

North America accounted for the largest revenue share, in 2022. Region’s growth is primarily due to rise in prevalence of infantile spasms, which is found with an incidence rate of 1.6 to 4.5 per 10,000 live births, US alone contributes roughly 2000 to 2500 new case every year. Moreover, high diagnosis rate due to awareness among general population, huge unmet medical needs, and well-developed reimbursement scenario in both the U.S and Canada contribute to growth of this market in the region. This also comes from high adoption rate for treatment options, novel products and procedures and large-scale R&D activities which result in technologically advancement in the region.

Competitive Insight

Key players include Lundbeck, Mallinckrodt Pharmaceuticals, Catalyst Pharmaceuticals, GW Pharmaceuticals, Retrophin, Valerion Therapeutics, Orphelia Pharma, Insys Therapeutics, and Anavex Life Sciences.

Recent developments

- In December 2022, Cerecin received USFDA approval for study CER-001 under Investigational New Drug Application for Infantile Spasm. The drug already has orphan drug designation approved in 2020. This gives the drug developers up to 7 years of market exclusivity, along with waivers on FDA user fees and tax credits for costs for qualified clinical trials.

- In January 2022, FDA gave its final approval for Sabril (vigabatrin) to treat infantile spasm in children aged 1 month to 2 years. Sabril is a natural calming substance and works by inhibiting the breakdown of GABA in the brain. The drug is manufactured by Zydus formulation facility, India.

Infantile Spasm Therapeutics Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 141.07 million |

|

Revenue forecast in 2032 |

USD 181.85 million |

|

CAGR |

3.2% from 2024 - 2032 |

|

Base year |

2023 |

|

Historical data |

2019 - 2022 |

|

Forecast period |

2024 - 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Therapeutic Class, By Drug Type, By Dosage, By Route of Administration, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

H. Lundbeck A/S, Mallinckrodt Pharmaceuticals, Catalyst Pharmaceuticals, GW Pharmaceuticals plc, Retrophin, Inc., Valerion Therapeutics, Orphelia Pharma SA, Insys Therapeutics, Inc., and Anavex Life Sciences Corp. |

Seeking a more personalized report that meets your specific business needs? At Polaris Market Research, we’ll customize the research report for you. Our custom research will comprehensively cover business data and information you need to make strategic decisions and stay ahead of the curve.

FAQ's

The infantile spasm therapeutics market size is expected to reach USD 181.85 million by 2032

Key players in the infantile spasm therapeutics market are Lundbeck, Mallinckrodt Pharmaceuticals, Catalyst Pharmaceuticals, GW Pharmaceuticals, Retrophin, Valerion Therapeutics.

North America contribute notably towards the global infantile spasm therapeutics market.

The global infantile spasm therapeutics market is expected to grow at a CAGR of 3.2% during the forecast period.

The infantile spasm therapeutics market report covering key segments are therapeutic class, drug type, dosage, route of administration, distribution channel, end user and region.