Influenza Medications Market Share, Size, Trends, Industry Analysis Report

By Influenza Type (Influenza A and Influenza B); By Treatment; By Distribution Channel; By Region; Segment Forecast, 2024- 2032

- Published Date:Mar-2024

- Pages: 118

- Format: PDF

- Report ID: PM4800

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

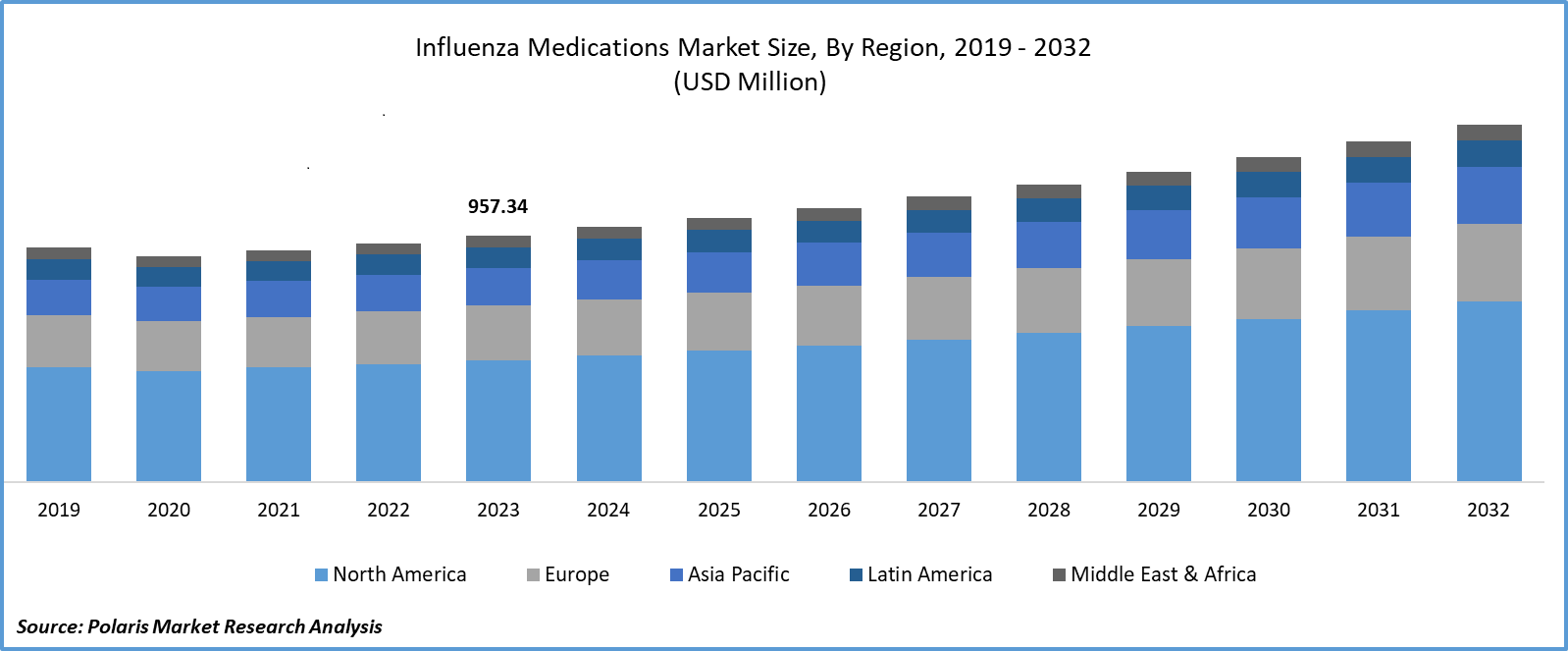

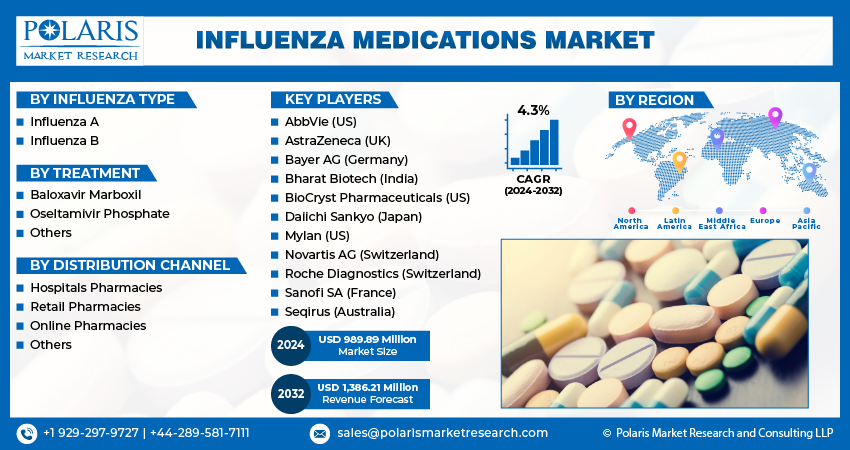

Global influenza medications market size was valued at USD 957.34 million in 2023. The market is anticipated to grow from USD 989.89 million in 2024 to USD 1,386.21 million by 2032, exhibiting the CAGR of 4.3% during the forecast period.

Market Overview

The growing cases of seasonal flue, increased prevalence of contagious respiratory illness, and increase in patient population who are at the risk of developing flu-related complications, are key factors driving the market growth. For instance, according to the Centers for Disease Control and Prevention, about 3 to 11 percent of total U.S. population gets infected from flu symptoms every year, and the population under the age of 18 years are most likely to develop symptoms of flu virus infection.

To Understand More About this Research:Request a Free Sample Report

Furthermore, there has been greater focus of companies towards the development and incorporation of new technologies like recombinant flu vaccines in manufacturing of influenza medications. Recombinant flu vaccines emerging as a new technology which does not rely on eggs for the production of medications, as they are developed with the help of genetic engineering techniques and offer numerous advantages over conventional techniques.

Growth Factors

Rising incidences of influenza and increasing awareness about public health to drive market growth

As influenza is a very common and widespread respiratory illness which affects millions of people across the globe every year, thereby the increasing incidences of influenza is driving the need for effective medications. Additionally, several leading healthcare organizations worldwide are recognizing the importance of proper treatment and medications for influenza outbreaks, which is positively impacting the market growth.

- For instance, according to a report by the World Health Organization, there are over one billion cases of seasonal influenza every year, including around 3 to 5 million incidences of severe illness. It results in approx. 290,000 to 650,000 respiratory deaths each year worldwide.

Increased R&D efforts and growing regulatory approvals to foster market growth

With the growing investments in research & development activities by both pharmaceutical companies and research institutions to develop advanced and improved medications for influenza, the adoption of such medications is increasing rapidly. Also, companies are focusing to get approvals for their products and treatments from government healthcare authorities such as US Food and Drug Administration (FDA) and European Medicines Association that ensures the safety and efficacy of their products, and leading to increased demand globally.

- For instance, in December 2022, Pfizer Inc. and BioNTech SE, announced that they have received the Fast Track Designation from US FDA for their new mRNA-based combination vaccine for influenza. It mainly aims to prevent two different respiratory illness with the help of a single injection.

Restraining Factors

Seasonal demand and availability of alternative treatments to hinder growth

The demand for influenza medications is highly seasonal with highest demand during the flu season that lead to revenue and sales fluctuations for companies. Also, there are several alternative treatment or home remedies easily available to tackle influenza that negatively impact the demand of conventional medications.

Report Segmentation

The market is primarily segmented based on influenza type, treatment, distribution channel, and region.

|

By Influenza Type |

By Treatment |

By Distribution Channel |

By Region |

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Influenza Type Insights

Influenza A segment accounted for the largest market share in 2023

The influenza A segment accounted for largest share in 2023. Segment’s dominance is attributed to rising number of cases of this influenza type and growing awareness among people about the available treatment options for these conditions. In addition, favorable environmental factors for influenza A virus to spread such as low temperature and humidity and increasing number of individuals with weekend immune systems like elderly and young children who are at higher risk of developing illnesses from influenza A, are factors further escalating the segment’s growth.

By Treatment Insights

Oseltamivir phosphate segment held the majority share in 2023

The oseltamivir phosphate segment held the maximum revenue share. This dominance is due to their widespread adoption as prescribed drugs because of their strong efficacy, decreased complications, higher effectiveness against multiple strains, and widespread available compared to other treatment types. In addition, the continuous advances in research & development activities focused on developing new formulations of oseltamivir phosphate, could also drive the segment’s growth.

By Distribution Channel Insights

Online pharmacies segment is expected to witness highest growth over the forecast period

The online pharmacies segment is expected to grow at highest growth rate. This growth is attributable to emergence of several online platforms offering influenza medications with several benefits including convenience, accessibility, remote doctor consultations, and availability of detailed information about usage instructions, side effects, and drugs interactions.

The retail pharmacies segment led the market with noteworthy share. This dominance is attributed to its widespread availability that makes them accessible to larger patient population and offer higher convenient as compared to other healthcare settings. As companies are introducing over the counter (OTC) influenza medication products which allow consumers to purchase them without any prescription, the segment is increasing rapidly because retail pharmacies play a major role in providing OTC medications to patients.

Regional Insights

North America region dominated the global market in 2023

The North America region dominated the global market with major share. This dominance is accelerated by high prevalence of influence, focus of healthcare organizations towards the improvement of people health, and robust presence of well-established healthcare infrastructure in the region. In addition, there are several players in the region focusing on the development of novel therapeutics to cater to growing prevalence of the condition. For instance, in August 2022, Genentech, announced that the US FDA has approved their supplemental new drug application for Xofluza, mainly for the treatment of acute uncomplicated influenza. It is approved for the prevention of influenza in children between the age of 5 to 12 years.

The Asia Pacific region is anticipated to emerge as fastest growing region with a healthy CAGR, owing to region’s increasing elderly population who are more susceptible to respiratory illnesses and presence of large pharmaceutical companies focusing on the development of novel treatment options for influenza. In addition, continuous improvements in economic conditions of several APAC countries like India, South Korea, China, and Malaysia, leading to increased consumer spending capacity on healthcare including influenza medication.

- For instance, in March 2023, TaiGen Biotechnology, announced that they have entered into an exclusive licensing agreement with the Joincare Pharmaceutical. The aim of this agreement is to develop and commercialize TG-1000 in China, which is a type of novel pan-influenza antiviral.

Key Market Players & Competitive Insights

Investments in research & development activities to drive market competition

The influenza medications market is highly fragmented. The key players are competing on numerous factors including implementation on several business expansion strategies like partnerships and collaborations and growing their investments in research & development activities to introduce more improved medications.

Some of the major players operating in the global market include:

- AbbVie (US)

- AstraZeneca (UK)

- Bayer AG (Germany)

- Bharat Biotech (India)

- BioCryst Pharmaceuticals (US)

- Daiichi Sankyo (Japan)

- Mylan (US)

- Novartis AG (Switzerland)

- Roche Diagnostics (Switzerland)

- Sanofi SA (France)

- Seqirus (Australia)

Recent Developments in the Industry

- In September 2023, Moderna, announced that their new flu vaccine named ‘mRNA-1010’ met its primary endpoint successfully in Phase 3 trial. With the help of new vaccine, improved immunogenicity was observed across different age groups and more importantly in the older population.

- In September 2022, Pfizer, successfully recruited for pivotal Phase 3 clinical trial for evaluating the safety, efficiency, and tolerability of company’s quadrivalent modified influenza vaccine.

Report Coverage

The influenza medications market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, influenza type, treatment, distribution channel, and their futuristic growth opportunities.

Influenza Medications Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 989.89 million |

|

Revenue forecast in 2032 |

USD 1,386.21 million |

|

CAGR |

4.3% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The global influenza medications market size is expected to reach USD 1,386.21 million by 2032

Key players in the market are Bayer, Roche Diagnostics, Novartis, Sanofi, AstraZeneca

North America contribute notably towards the global Influenza Medications Market

Influenza medications market exhibiting the CAGR of 4.3% during the forecast period.

The Influenza Medications Market report covering key segments are influenza type, treatment, distribution channel, and region.