Inoculants Market Share, Size, Trends, Industry Analysis Report

By Type (Silage inoculants, Agricultural inoculants); By Microbe; By Crop Type; By Form; By Region; Segment Forecast, 2023 - 2032

- Published Date:Nov-2023

- Pages: 118

- Format: PDF

- Report ID: PM3902

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

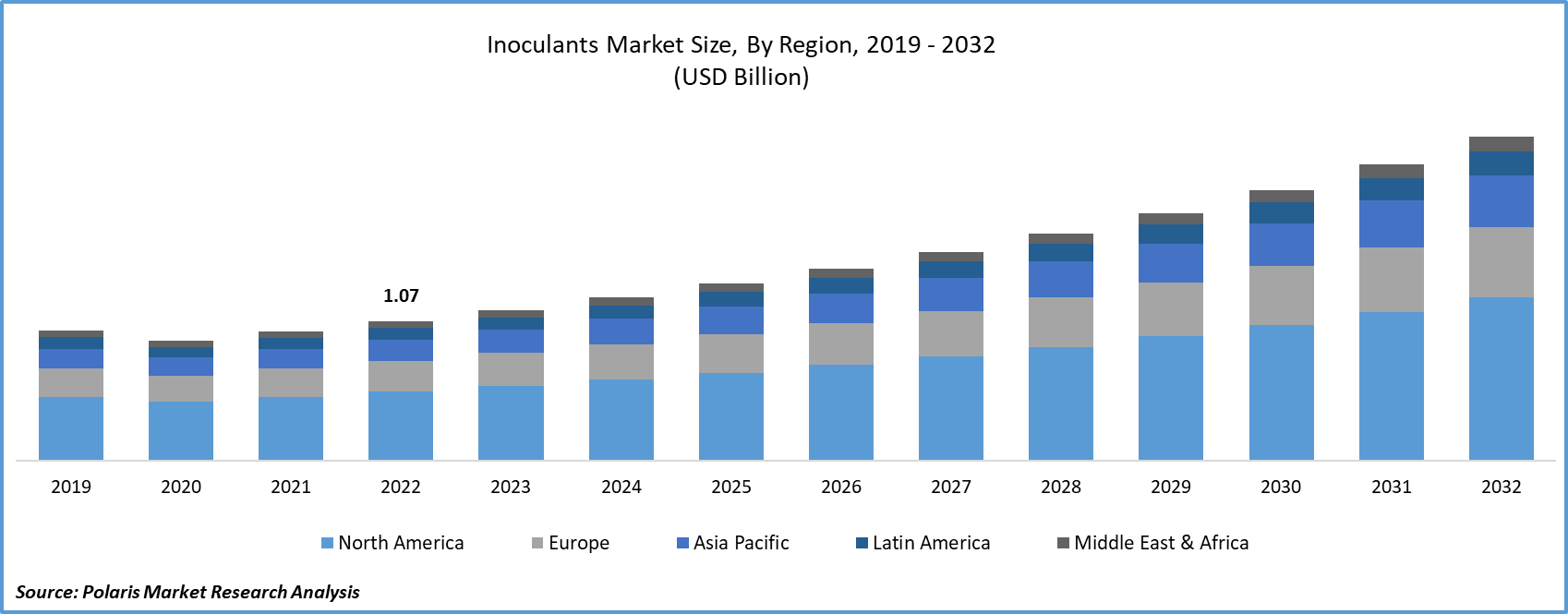

The global Inoculants market was valued at USD 1.07 billion in 2022 and is expected to grow at a CAGR of 8.9% during the forecast period.

The Global Inoculants Market is experiencing growth driven by rising environmental apprehensions about pesticide and fertilizer usage, along with the increased embrace of organic and sustainable farming practices. Inoculants, sometimes referred to as microbial inoculants, are a mixture of microorganisms that enhance soil fertility and health by improving the nutritional status of host plants, reducing the reliance on fertilizers, and containing beneficial microbes such as bacteria, fungi, protozoa, and algae, which support plant growth, pest/disease suppression, and foster an ecosystem that benefits overall plant development; they not only enhance plant nutrition but also stimulate plant hormone production to promote growth.

To Understand More About this Research: Request a Free Sample Report

Rising environmental apprehensions surrounding pesticide and fertilizer usage, coupled with the widespread embrace of organic and sustainable farming methods, drive the robust expansion of the Global Inoculants Market as the global demand for organically grown products intensifies, emphasizing the safer and more environmentally friendly approach offered by microbial inoculants to enhance plant and soil well-being; further bolstered by the increasing awareness of crop health, growing productivity demands, and the adoption of advanced agricultural techniques.

The upsurge in organic farming practices has driven a heightened consumption of agricultural inoculants, as these beneficial microorganisms enhance soil nutrient availability, reduce reliance on chemical fertilizers, and foster sustainable agriculture, resulting in a significant recent increase in their utilization. Additionally, the expansion of the poultry industry, the growing use of silage for biofuel feedstock, and the upswing in the livestock sector are propelling the demand for silage inoculants, thus bolstering the Inoculants Market's growth, in tandem with the rising consumer preference for protein-rich poultry products in various regions.

Industry Dynamics

Growth Drivers

The trend is shifting towards embracing organic and eco-friendly farming methods fuels growth.

A substantial shift in global dietary preferences has emerged, with consumers prioritizing their health, food quality, and nutritional value. This led to a gradual transition to organic foods despite their premium pricing, thereby boosting the organic market as health-conscious consumers willingly invest in these products. This heightened awareness is driving an expansion of organic farming worldwide, with a parallel rise in demand for organic inputs to enhance crop productivity, thus fueling the growth of the inoculants market, especially for crops resistant to abiotic stress. Furthermore, governments in various developing economies, such as India, are actively supporting farmers in their transition to organic and sustainable agricultural practices.

Report Segmentation

The market is primarily segmented based on type, microbe, crop type, form, and region.

|

By Type |

By Microbe |

By Crop Type |

By Form |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

The Disposable segment held the largest revenue share in 2022

In 2022, cereals and grains claimed the most significant market share, which includes corn, wheat, barley, and rice. The widespread adoption of inoculants for cereal crops like corn, wheat, and rice in countries like the United States, China, Spain, and Brazil is a key driver of market growth. The United States, the largest wheat producer globally, considers wheat its third most crucial crop, following corn and soybeans. Additionally, Brazil stands as the world's top corn producer on a global scale. According to the FAO, in 2020, the total harvested area for cereal crops exceeded 498 million hectares, constituting over half of the total crop area, underscoring cereals and grains' dominance compared to other crops.

Moreover, within the agricultural inoculants industry, the oilseeds and pulses sector is poised for the most rapid growth in the foreseeable future, fueled by the introduction of innovative products from companies like Bayer, Novozymes, and Lallemand Plant Care, particularly tailored for oilseeds and pulses. Furthermore, the increasing utilization of agricultural inoculants on crops such as soybeans, canola, beans, and peas in countries like the United States, Canada, Brazil, and Argentina is propelling the expansion of the oilseeds and pulses segment. Globally, there is a heightened demand for soybeans due to their value as a protein source for vegetarians and as a high-value cash crop, there is a rising need for disease-resistant and high-yielding soybean seeds.

By Microbe Analysis

The Bacterial segment accounted for the highest market share during the forecast period

The bacterial segment is poised to be the primary choice among microorganisms, with species or strains such as Azotobacter, Azospirillum, Bacillus spp., Pseudomonas, and Rhizobium widely employed in various applications, including biofertilizers and biopesticides. Furthermore, numerous companies are proactively creating combinations of bacterial species in conjunction with other microorganisms to enhance plant growth.

On the other hand, the fungal inoculant sector is expected to demonstrate the most rapid growth, driven by the escalating utilization of Penicillium sp. for phosphate solubilization and the growing recognition of Trichoderma species as effective biocontrol agents.

Regional Insights

Asia Pacific dominated the largest market in 2022

Throughout the forecast period, the Asia Pacific region is projected to dominate the global inoculants market in terms of revenue share. The increasing adoption of sustainable agricultural practices and growing awareness of the benefits of inoculants in farming are propelling the market's expansion in this region. Countries like India and China, marked by extensive agricultural landscapes and burgeoning populations, are witnessing a surge in inoculant demand. The need to adopt modern farming techniques and boost crop yields further bolsters the demand for inoculants in this area.

Moreover, the presence of numerous inoculant manufacturers in China is expected to intensify competition in the Asia-Pacific market. Chinese manufacturers are well-regarded for offering cost-effective inoculant solutions, making them accessible and efficient for farmers. Additionally, the market's growth in this region is driven by favorable government initiatives and policies that promote the use of inoculants in agriculture.

Throughout the projected period, the North American market is poised to experience a substantial CAGR. The demand for inoculants in this region is being propelled by the increasing focus on sustainable agricultural practices and the imperative to improve soil health. A growing awareness of the benefits of inoculants in enhancing crop yields and reducing reliance on chemical fertilizers, in conjunction with the adoption of modern farming technologies and precision agricultural methods, fuels the market's expansion in North America. Furthermore, the presence of significant economies with strong agricultural foundations, such as the United States and Canada, known for their extensive research and development efforts in the agricultural sector, encourages innovation and the advancement of improved inoculant products within the region.

Key Market Players & Competitive Insights

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include:

- Advanced Biological Marketing, Inc.

- BASF SE

- Bayer AG

- BioWorks Inc.

- BrettYoung Seeds Limited

- E. I. du Pont de Nemours and Company (DuPont)

- Lallemand Inc.

- Novozymes A/S

- QualiTech Inc.

- XiteBio Technologies Inc.

Recent Developments

- In November 2022, Corteva Agriscience recently revealed its acquisition of The Stoller Group, Inc., a prominent independent biologicals company in the industry, aiming to swiftly enhance its scale and profitability, while also boosting EBITDA margins.

- In September 2022, Rizobacter and Marrone Bio-Innovations (MBI) joined forces to pioneer sustainable crop solutions on a global scale.

- In September 2021, Novozymes A/S introduced Optimize FXC, designed to enhance nitrogen fixation, soil nutrient availability, and water absorption in soybean plants, consequently reducing fertilizer requirements.

Inoculants Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 1.16 billion |

|

Revenue forecast in 2032 |

USD 2.49 billion |

|

CAGR |

8.9% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments Covered |

By Type, By Microbe, By Crop Type, By Form, and By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation.

|