Interposer and Fan-out Wafer Level Packaging Market Share, Size, Trends, Industry Analysis Report

By Packaging Component & Design (Interposer, FOWLP); By Packaging Type; By Device Type; By End-Use Industry; By Region; Segment Forecast, 2024 - 2032

- Published Date:Feb-2024

- Pages: 118

- Format: PDF

- Report ID: PM4541

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

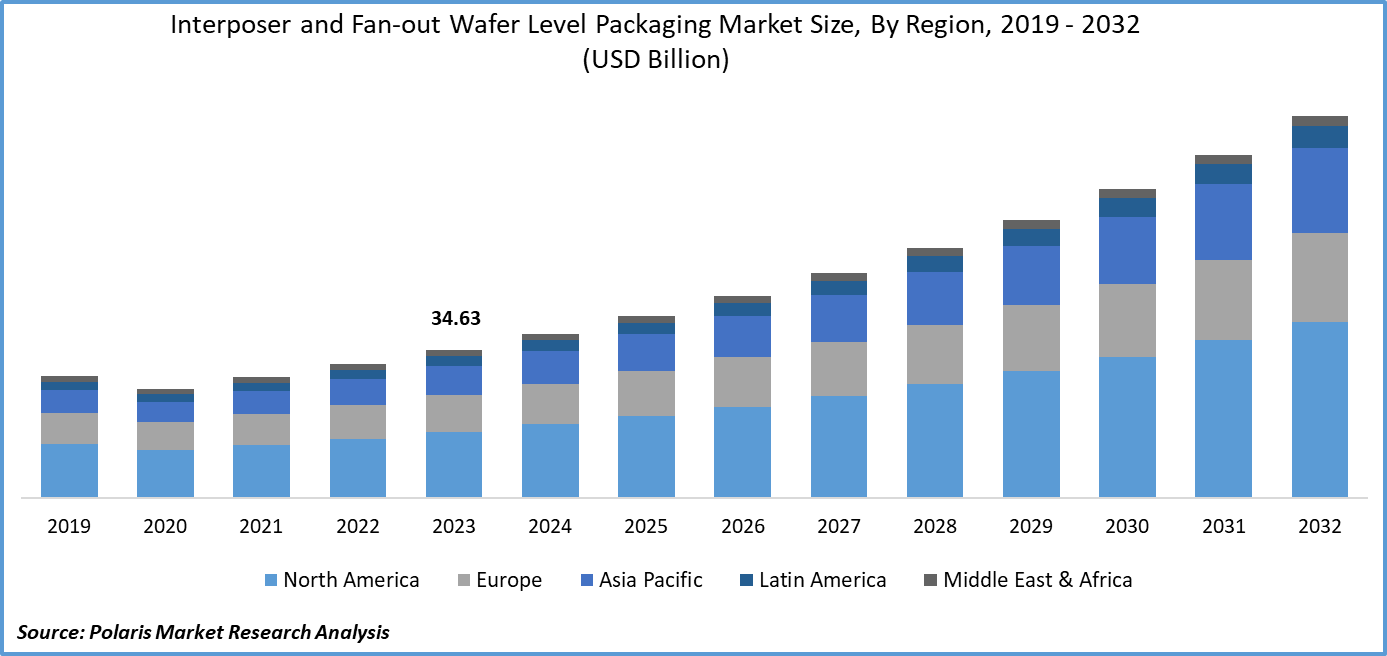

Global interposer and fan-out wafer level packaging market size and share was valued at USD 34.63 billion in 2023. The market is anticipated to grow from USD 38.41 billion in 2024 to USD 89.51 billion by 2032, exhibiting a CAGR of 11.2% during the forecast period

Industry Trends

An interposer is a small, silicon or organic substrate that serves as an intermediate connection between a flip-chip device and the printed circuit board (PCB). It provides high-density I/O connections between the device and PCB, allowing for more complex system integration and improved performance. Fan-out wafer level packaging (FOWLP) is a technique used to package integrated circuits (ICs) where the input/output (I/O) connections are distributed across the entire surface of the die instead of being concentrated on a single edge.

The interposer and fan-out wafer level packaging market size is expected to experience significant growth in the coming years, driven by increasing demand for advanced packaging technologies in various industries such as electronics, automotive, and healthcare. The growing need for high-performance, low-power, and cost-effective electronic devices has led to the development of new packaging technologies that can provide improved performance, reduced form factor, and increased functionality. Interposers and fan-out wafer level packages offer several advantages over other packaging methods, including improved thermal and electrical performance, higher integration density, and reduced package size.

- For instance, in March 2019, A*STAR's Institute of Microelectronics and Soitec, a semiconductor materials manufacturer, partnered to develop and implement a new layer transfer process in advanced wafer-level multi-chip packaging techniques. This joint program aimed to enhance packaging solutions by integrating innovative technologies that will enable the production of high-performance, energy-efficient microchips.

To Understand More About this Research: Request a Free Sample Report

Another key driver of this market is the increasing use of these technologies in the automotive industry. With the rise of electric vehicles and autonomous driving, there is a growing need for high-reliability and high-performance electronics that can withstand harsh environments and operate efficiently under extreme conditions. Interposers and fan-out wafer level packages are well suited to meet these requirements, making them an attractive option for automotive applications.

However, the main restraints that affect the market growth are the high cost associated with the production of these packages, which is expensive for some manufacturers. Also, the complexity of the manufacturing process and the lack of standardization in the industry makes it difficult for companies to transition from regular packaging methods to advanced packaging technologies.

The market research report offers an in-depth analysis of the industry to support informed decision-making. It offers a meticulous breakdown of various market niches and keeps readers updated on the latest industry developments. Along with tracking the interposer and fan-out wafer level packaging market on the basis of SWOT and Porter’s Five Forces models, the research report includes graphs, tables, charts, and other pictorial representations to help readers understand the key insights and important data easily.

Key Takeaways

- North America dominated the market and contributed over 32% market share of the total market value in 2023

- By packaging type category, the 3D segment is expected to grow with a significant CAGR over the interposer and fan-out wafer level packaging market forecast period

- By device type category, the MEMS/Sensors segment dominated the global interposer and fan-out wafer level packaging market in terms of market size

- By end-use industry, the automotive segment is anticipated to exhibit a significant CAGR over the forecast period

What are the market drivers driving the demand for Interposer and Fan-out Wafer Level Packaging market?

The increasing demand for advanced packaging technologies by several industries fuels market growth.

The growing need for packaging solutions across various industries is a significant factor driving the expansion of the interposer and fan-out wafer-level packaging market size. As technology advances, there is an increasing requirement for more complex and compact electronic components that can deliver higher performance, power efficiency, and reliability. Interposers and fan-out wafer-level packaging address these needs by enabling the integration of multiple dies, improved thermal management, and reduced package size, making them attractive options for applications in sectors such as mobile devices, high-performance computing, Internet of Things (IoT), and automotive electronics.

Along with this, the escalating market trends toward miniaturization and the necessity for increased functionality in smaller form factors further boost the adoption of these advanced packaging technologies. The surging demand from these industries creates opportunities for market players to develop innovative solutions, invest in research and development, and expand their customer base, ultimately contributing to the growth of the interposer and fan-out wafer-level packaging market size.

Which factor is restraining the demand for Interposer and Fan-out Wafer Level Packaging?

The complexity of the process hampers the interposer and fan-out wafer-level packaging market growth.

The complexity of the process acts as a significant restraint on the growth of the market. The manufacturing process for these advanced packaging technologies involves multiple layers of processing, including chip fabrication, substrate preparation, bumping, wire bonding, and encapsulation. This complex process requires specialized equipment and expertise, leading to high production costs and longer cycle times. In parallel, the yield loss during the manufacturing process can be significant, resulting in lower production volumes and increased costs. The complexity of the process also makes it challenging to ensure consistent quality and reliability, which can impact customer confidence and adoption rates.

Also, the need for advanced manufacturing facilities and specialized equipment creates barriers to entry for new players, limiting competition and innovation in the market. Thus, the complexity of the process poses significant challenges to the widespread adoption of interposer and fan-out wafer-level packaging technologies, thereby hampering the market's growth potential.

Report Segmentation

The market is primarily segmented based on packaging component & design, packaging type, device type, end-use industry, and region.

|

By Packaging Component & Design |

By Packaging Type |

By Device Type |

By End-Use Industry |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Category Wise Insights

By Packaging Type Insights

Based on packaging type analysis, the market has been segmented on the basis of 2.5D and 3D. The 3D segment is expected to experience significant growth in the global interposer and fan-out wafer level packaging market during the forecast period due to its ability to provide higher integration density, improved performance, and reduced form factor. 3D interposers and fan-out WLP allow for the stacking of multiple dies on top of each other, increasing the overall functionality of the package while minimizing its footprint. This makes them particularly useful for applications such as mobile devices, IoT, and AI, where high performance and low power consumption are critical.

In addition, 3D interposers are used to integrate different types of dies, such as CPUs, GPUs, and memory, into a single package, enabling better performance and reducing the need for wire bonds and substrates. All these factors contribute to the growing adoption of 3D interposers and fan-out WLP in various industries, driving the growth of this segment in the market.

By Device Type Insights

Based on device type category analysis, the market has been segmented on the basis of logic ICs, imaging & optoelectronics, LEDs, MEMS/Sensors, memory devices, and others. The MEMS/Sensors segment dominated the global interposer and fan-out wafer-level packaging market due to the increasing demand for compact, high-performance, and low-power devices in various applications such as smartphones, wearables, and IoT devices. MEMS (Micro-Electro-Mechanical Systems) and sensors are critical components in these devices, and they require advanced packaging technologies like interposers and fan-out WLP to achieve high integration and improved performance.

Interposers provide a platform for integrating multiple dies, passives, and active components in a single package, while fan-out WLP enables the redistribution of I/O signals from the die to the package substrate, reducing the overall size and improving thermal performance. These advantages make interposers and fan-out WLP ideal for MEMS and sensor applications, leading to their increased adoption and contributing to the dominance of this segment in the market.

By End-Use Industry Insights

Based on end-use industry analysis, the market has been segmented on the basis of consumer electronics, communications, manufacturing, automotive, medical devices, and aerospace. The automotive segment is anticipated to drive the growth of the market over the forecast period, owing to the increasing demand for advanced driver assistance systems (ADAS) and autonomous vehicles. Interposers and fan-out WLPs are essential components in the development of ADAS sensors, such as LIDAR, RADAR, and cameras, which require high-performance, low-power, and small form factor electronics.

Also, the market trends toward electric vehicles (EVs) and hybrid electric vehicles (HEVs) also propels the demand for these technologies, as they rely on sophisticated power management systems that can be efficiently achieved using interposers and fan-out WLPs. In addition, the growing need for safety features, such as collision avoidance systems and infotainment systems, further accelerates the adoption of these advanced packaging technologies in the automotive industry.

Regional Insights

North America

The North American region held the largest market share in the global interposer and fan-out wafer level packaging market in 2023 due to the the availability of advanced manufacturing infrastructure and skilled workforce in the region enables the efficient production of interposers and fan-out WLPs, supporting the growth of the market. Also, the North American region is home to several key industries that require advanced packaging technologies, such as aerospace, defense, automotive, and healthcare. The demand for high-performance, compact, and power-efficient electronics in these sectors drives the adoption of interposers and fan-out WLPs, which can meet the required specifications and performance standards.

Asia Pacific

The Asia Pacific region is expected to experience the most rapid growth in the market since the region is home to a large number of leading semiconductor manufacturers, such as Taiwan Semiconductor Manufacturing Company (TSMC), Jiangsu Changjiang Electronics Tech Co, and Siliconware Precision Industries Co., Ltd., who are adopting advanced packaging technologies to stay competitive in the industry. Also, the growing demand for consumer electronics, such as smartphones, tablets, and laptops, in countries like China, India, and South Korea, is driving the need for more advanced and efficient chip packaging solutions. Also, governments in the region are investing heavily in research and development initiatives to support the growth of the semiconductor industry, which is also contributing to the increased adoption of interposer and fan-out wafer-level packaging technologies.

Competitive Landscape

The market for global interposer and fan-out wafer-level packaging is a highly competitive one, with several key players vying for a larger share of the market. These companies continuously engage in innovation and invest heavily in research and development to gain a competitive edge and meet the increasing demand for advanced packaging solutions. The market is primarily dominated by established and financially stable manufacturers that have extensive experience in the industry. These companies have diversified product portfolios, state-of-the-art technologies, and robust global sales and marketing networks.

Some of the major players operating in the global market include:

- Taiwan Semiconductor Manufacturing Company

- Jiangsu Changjiang Electronics Tech Co

- Siliconware Precision Industries Co., Ltd.

- Tongfu Microelectronics Co., Ltd.

- Amkor Technology

- ASE TECHNOLOGY HOLDING

- TOSHIBA CORPORATION

- SPTS Technologies Ltd.

- Brewer Science, Inc.

- Fraunhofer IZM

- Cadence Design Systems, Inc.

Recent Developments

- In June 2023, Siemens Digital Industries Software and Siliconware Precision Industries Co. Ltd (SPIL) collaborated to create an advanced workflow for fan-out wafer-level packaging (FOWLP) technologies. The new workflow includes an integrated circuit (IC) package assembly planning and a 3D layout vs. schematic (LVS) assembly verification process.

- In October 2023, Advanced Semiconductor Engineering, Inc. announced the launch of its Integrated Design Ecosystem™ (IDE), a collaborative design toolset optimized to systematically boost advanced package architecture across its VIPack™ platform. This innovative approach allows a seamless transition from single-die SoC to multi-die disaggregated IP blocks including chipsets and memory for integration using 2.5D or advanced fanout structures.

Report Coverage

The Interposer and Fan-out Wafer Level Packaging market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the interposer and fan-out wafer level packaging market size while focusing on various key aspects such as competitive analysis, packaging component & design, packaging type, device type, end-use industry, and their futuristic growth opportunities.

Interposer and Fan-out Wafer Level Packaging Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 34.63 billion |

|

Revenue forecast in 2032 |

USD 89.51 billion |

|

CAGR |

11.2% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Packaging Component & Design, By Packaging Type, By Device Type, By End-Use Industry, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

Gain profound insights into the 2024 interposer and fan-out wafer level packaging market with meticulously compiled statistics on market share, size, and revenue growth rate by Polaris Market Research Industry Reports. This thorough analysis not only provides a glimpse into historical trends but also unfolds a roadmap with a market forecast extending to 2032. Immerse yourself in the comprehensive nature of this industry analysis through a complimentary PDF download of the sample report.

Browse Our Top Selling Reports

Refsum Disease Treatment Market Size, Share 2024 Research Report

Blood Meal Market Size, Share 2024 Research Report

Bisabolene Market Size, Share 2024 Research Report

FAQ's

The Interposer and Fan-out Wafer Level Packaging Market report covering key segments are packaging component & design, packaging type, device type, end-use industry, and region.

Interposer and Fan-out Wafer Level Packaging Market Size Worth USD 89.51 Billion By 2032

Interposer and Fan-out Wafer Level Packaging Market exhibiting the CAGR of 11.2% during the forecast period

North American is leading the global market

key driving factors in Interposer and Fan-out Wafer Level Packaging Market 1. The increasing demand for advanced packaging technologies by several industries fuels market growth