Intrinsically Safe Equipment Market Size, Share, & Industry Analysis Report

: By Zone, By Class (Class 1, Class 2, and Class 3), By Product, By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5699

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

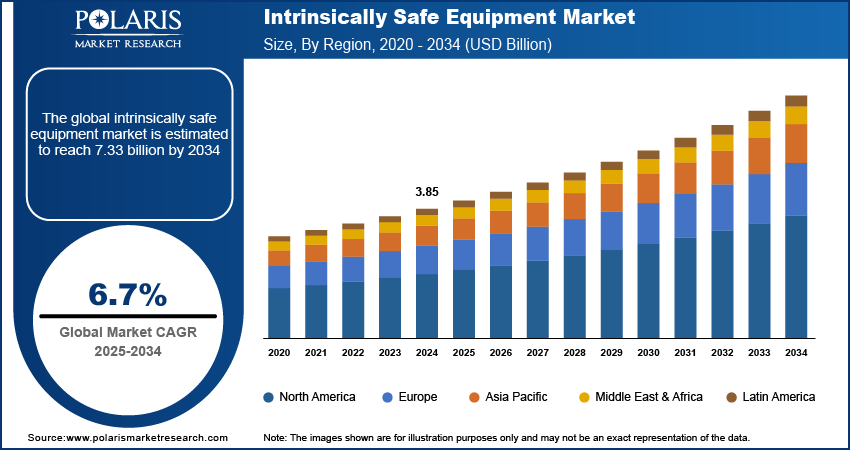

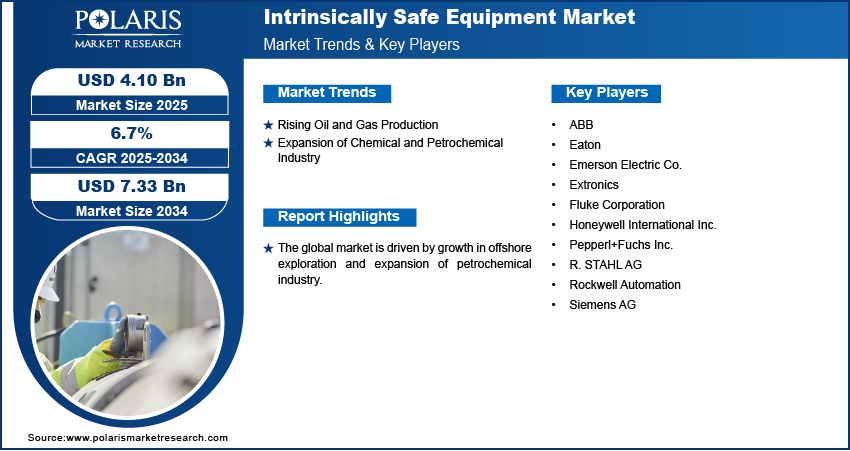

The global intrinsically safe equipment market size was valued at USD 3.85 billion in 2024, growing at a CAGR of 6.7% during 2025–2034. The market is driven by growth in offshore exploration and expansion of petrochemical industry.

Intrinsically safe equipment is designed to operate safely in hazardous environments by preventing the release of sufficient energy to cause ignition of flammable gases, vapors, or dust. It is commonly used in industries such as oil and gas, mining, and chemical processing to ensure operational safety in explosive atmospheres.

Governments worldwide have introduced strict safety regulations to protect workers and facilities in hazardous environments. Standards such as ATEX in Europe, IECEx globally, and NEC in North America require industries to use intrinsically safe devices to prevent explosions. These rules ensure that devices do not produce sparks or heat that could ignite flammable industrial gases or dust. The demand for certified intrinsically safe products is rising as companies are complying with these laws. This regulatory pressure drives manufacturers to develop advanced safety solutions, further driving the demand for these equipment.

Advances in technology have improved the design and capabilities of this equipment. Modern devices incorporate smart sensors, wireless communication, and Internet of Things (IoT) technology, allowing real-time monitoring and better control in hazardous areas. These innovations improve safety, efficiency, and data management, making intrinsically safe devices more attractive to industries. Additionally, manufacturers are continuously developing products that are lighter, more durable, and easier to install. Technology further helps reduce maintenance costs and improve performance. These improvements are major drivers encouraging companies to adopt the latest intrinsically safe technologies, thereby driving intrinsically safe equipment market growth.

Industry Dynamics

Rising Oil and Gas Production

Oil and gas exploration and production are rising globally, especially in challenging and hazardous environments, which is significantly boosting the demand for these equipment. According to Statistics Canada, in 2024, the synthetic crude oil production in Canada alone rose by 4.3% compared to 2023. Exploration in offshore, deep-water, and remote areas exposes operations to flammable gases and volatile conditions, making safety critical. This is driving the demand for intrinsically safe devices to help prevent accidents by controlling ignition sources. Additionally, the need for reliable and certified safety equipment is growing as companies are expanding their drilling and refining activities to meet energy demands, further driving the demand for intrinsically safe equipment.

Expansion of Chemical and Petrochemical Industry

The chemical and petrochemical industry is growing rapidly globally. According to the Cybersecurity and Infrastructure Security Agency, the US chemical industry alone contributes more than 25% to the US GDP. Chemical and petrochemical plants handle volatile substances that easily ignite, making safety equipment essential. The use of intrinsically safe devices is increasing as these industries are expanding due to rising demand for chemicals, plastics, and fertilizers. These products help monitor and control processes safely in explosive environments. Strict safety regulations and the need to prevent serious accidents are pushing companies to adopt advanced intrinsically safe sensors, switches, and communication devices. This growth in chemical processing activities worldwide directly fuels the adoption of intrinsically safe equipment.

Segmental Insights

By Zone Analysis

The zone 21 segment is expected to experience significant growth in the coming years. Zone 21 refers to areas where combustible dust is likely to be present occasionally during normal operations, such as grain processing or chemical plants. Increasing safety regulations and awareness about dust explosion hazards are driving industries to adopt intrinsically safe equipment in these zones. Companies are investing in reliable, certified devices to prevent ignition sources and ensure worker safety. This growing focus on dust-prone environments is boosting the demand for zone 21 intrinsically safe equipment.

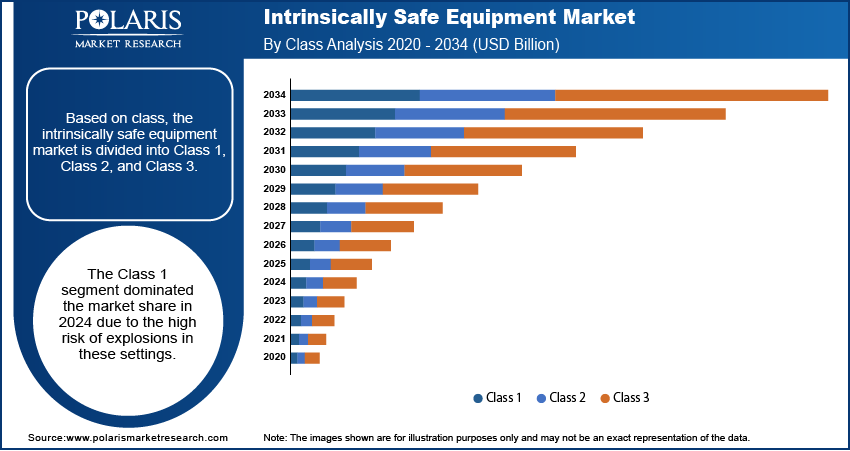

By Class Analysis

The Class 1 segment dominated the market in 2024. Class 1 intrinsically safe equipment are used in environments where flammable gases or vapors are present continuously or frequently, such as oil refineries, chemical plants, and gas processing facilities. Due to the high risk of explosions in these settings, industries prioritize using intrinsically safe equipment to prevent sparks or heat that could ignite these substances. Strict safety regulations and the need to protect workers and assets drive the demand for Class 1 certified devices. This focus on hazardous gas environments is driving the Class 1 segment growth.

By Product Analysis

The detectors segment is expected to record significant growth during the forecast period. These devices play a critical role in identifying the presence of hazardous gases, vapors, or dust before they reach dangerous levels. The need for early warning systems is growing rapidly as industries such as oil & gas, mining, and chemicals are operating in high-risk environments. Intrinsically safe detectors are designed to function safely without igniting explosive atmospheres, making them essential for worker protection and process safety. More companies are investing in advanced, reliable detectors with increasing safety regulations and growing awareness of workplace hazards, driving strong demand for this segment.

By End Use Analysis

The oil and gas segment dominated with the largest share in 2024, due to its high exposure to flammable gases, vapors, and volatile chemicals. Exploration, drilling, refining, and distribution processes involve hazardous environments where safety is critical. Intrinsically safe equipment ensures that electrical devices do not trigger explosions, making them essential across upstream, midstream, and downstream operations. Additionally, oil and gas companies are adopting these solutions to protect workers and assets due to strict regulatory standards and increasing investments in safety infrastructure. This consistent demand for safe and compliant operations is driving the oil and gas industry segment growth.

Regional Analysis

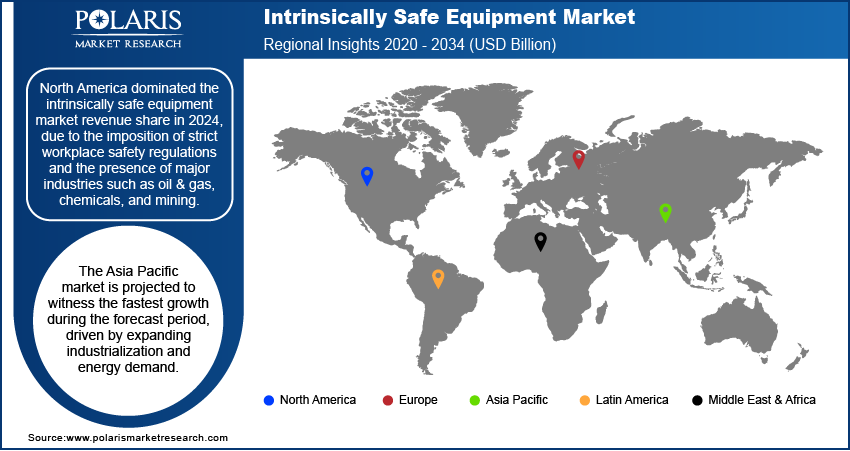

North America intrinsically safe equipment market recorded largest share in 2024 due to strict workplace safety regulations and the presence of major industries such as oil & gas, chemicals, and mining. The US and Canada have strong regulatory bodies such as OSHA and NEC that enforce compliance with explosion-proof equipment standards. Many companies in the region invest heavily in advanced safety technologies to protect workers and assets. Additionally, the presence of key market players and early adoption of industrial automation are further boosting the demand in the region.

The Asia Pacific intrinsically safe equipment market is experiencing the fastest growth, driven by expanding industrialization and energy demand. Countries such as China, India, Japan, and South Korea are increasing investments in oil refining, chemical production, and mining, all of which require explosion-proof equipment. Growing awareness of safety standards and stricter regulations are pushing industries to adopt certified equipment. Additionally, the rise in factory automation and smart manufacturing across Asia is further boosting demand. Asia Pacific is expected to become one of the fastest-growing regions as industrial sectors grow and governments strengthen safety laws.

The Europe intrinsically safe equipment market is expected to record significant growth due to robust safety regulations and mature industrial infrastructure. The ATEX directive, a major regulation in the European Union, mandates strict compliance for equipment used in explosive environments. Countries such as Germany, the UK, and France are adopting the intrinsically safe technology across oil & gas, chemicals, pharmaceuticals, and manufacturing sectors. European companies are further at the forefront of developing eco-friendly and smart safety solutions, thereby driving the market demand in Europe.

The Middle East & Africa intrinsically safe equipment market is largely driven by its extensive oil and gas reserves. Countries such as Saudi Arabia, UAE, and South Africa rely heavily on industries that operate in hazardous environments. The demand to prevent industrial accidents and comply with international safety standards has led to increased adoption of certified equipment. Additionally, government initiatives to modernize infrastructure and boost energy production further support the industry's growth.

Key Players & Competitive Analysis Report

The intrinsically safe equipment market is highly competitive, with key players such as Pepperl+Fuchs Inc., Fluke Corporation, Honeywell International Inc., and R. STAHL AG leading through innovation and comprehensive product portfolios. Companies such as Eaton, Emerson Electric Co., and Siemens AG leverage global distribution networks and industry expertise to maintain market presence. Rockwell Automation and ABB focus on automation-integrated safety solutions, while Extronics specializes in rugged, hazardous-area communication and tracking technologies. Strategic initiatives, including product launches, certifications, and partnerships, are central to maintaining technological leadership and meeting strict regulatory requirements across oil & gas, chemicals, and manufacturing sectors.

Honeywell International, Inc. offers industry specific solutions to aerospace and automotive products and services. It specializes in turbochargers control, sensing and security technologies for buildings and homes; specialty chemicals; electronic and advanced materials; process technology for refining and petrochemicals; and energy efficient products and solutions for homes, business, and transportation. It operates through the following segments: Aerospace, Home and Building Technologies, Performance Materials and Technologies, and Safety and Productivity Solutions. The Aerospace segment provides aircraft engines, integrated avionics, systems and service solutions, and related products and services for aircraft manufacturers, turbochargers to improve the performance and efficiency of passenger cars and commercial vehicles as well as spare parts, repair, overhaul and maintenance services such as auxiliary power units, propulsion engines, environmental control systems, wireless connectivity services, electric power systems, engine controls, flight safety, communications, navigation hardware and software, radar and surveillance systems, aircraft lighting, management and technical services, advanced systems and instruments, satellite and space components, aircraft wheels and brakes, repair and overhaul services, turbochargers and thermal systems. The Home and Building Technologies segment provides products, software, solutions and technologies that help home owners stay connected and in control of their comfort, security and energy use such as controls and displays for heating, cooling, indoor air quality, ventilation, humidification combustion, lighting and home automation; advanced software applications for building control and optimization; sensors, switches, control systems and instruments for measuring pressure, air flow, temperature and electrical current; products, services and solutions for measurement, regulation, control and metering of gases and electricity; metering and communications systems for water utilities and industries; access control; video surveillance; fire products; remote patient monitoring systems; and installation, maintenance, and upgrades of systems. The Performance Materials and Technologies segment develops and manufactures materials, process technologies, and automation solutions. It provides process solutions in automation control, instrumentation, advanced software, and related services for the oil and gas, refining, pulp and paper, industrial power generation, chemicals and petrochemicals, biofuels, life sciences, and metals, minerals, and mining industries. The Safety and Productivity Solutions segment provides products, software and connected solutions, which include personal protection equipment and footwear designed for work, play and outdoor activities. It also offers gas detection technology, mobile devices and software for computing, data collection and thermal printing; supply chain and warehouse automation equipment, software, and solutions; custom-engineered sensors, switches and controls for sensing and productivity solutions; and software-based data and asset management productivity solutions. The company was founded by Albert M. Butz in 1885 and is headquartered in Morris Plains, NJ. Honeywell offers intrinsically safe rate-of-rise thermal detectors and compatible power supplies for hazardous environments. The detectors feature dual 360° LED indicators, fast and accurate thermal sensing, and ATEX certification, ensuring reliable fire detection and status indication in explosive atmospheres. Power supplies are designed for safe operation in these zones

ABB is a global manufacturer and seller of electrification, automation, robotics, and motion products. The company operates in various segments to serve a diverse range of industries. In the electrification segment, ABB provides a wide array of products, including renewable power solutions, electric vehicle charging infrastructure, distribution automation products, modular substation packages, and intelligent home and building solutions. The robotics & discrete automation focuses on industrial robots, autonomous mobile robotics, software, and digital services, offering solutions based on programmable logic controllers, industrial PCs, transport systems, servo motion, and machine vision. The Motion segment specializes in designing, manufacturing, and selling drives, generators, motors, and traction converters to drive the low-carbon future for industries, infrastructure, cities, and transportation. Process automation develops and sells control technologies, manufacturing execution systems, advanced process control software, marine propulsion systems, instrumentation, and turbochargers and provides services such as preventive maintenance, remote monitoring, emission monitoring, asset performance management, and cybersecurity. ABB serves a broad range of industries globally, including aluminum, chemical, automotive, data centers, mining, oil and gas, power generation, railway, food and beverage, water, and wind power. The company provides S800 I/O modules and termination units with intrinsic safety interface provide reliable, flexible I/O solutions for hazardous environments. They support analog and digital signals, feature built-in diagnostics, and comply with ATEX directives, ensuring safe operation and easy integration in process automation systems.

IS Equipment Market Key Players

- ABB

- Eaton

- Emerson Electric Co.

- Extronics

- Fluke Corporation

- Honeywell International Inc.

- Pepperl+Fuchs Inc.

- R. STAHL AG

- Rockwell Automation

- Siemens AG

Intrinsically Safe Equipment Industry Developments

In October 2023, NOHKEN launched the updated Intrinsic Safety Ex-approved MS651/671 Magnetostrictive Continuous Level Monitors, enhancing noise immunity and compatibility with CVV-S cables for safer, more efficient industrial liquid level monitoring.

In September 2023, BlackBerry launched its Intrinsically Safe-certified Radar H2M IS device for hazardous materials carriers, offering real-time asset tracking with C1/D1 certification. The solution enhanced safety compliance and targeted fuel haulers, tank carriers, railroads, and shipping lines globally.

March 2022, Monnit launched its IECEx-certified ALTA-ISX® Wireless Sensors to enhance safety in hazardous industrial environments. The intrinsically safe sensors, including temperature, dry contact, and pressure variants, enable long-range monitoring in explosive atmospheres for petrochemical, manufacturing, and energy sectors.

Intrinsically Safe Equipment Market Segmentation

By Zone Outlook (Revenue, USD Billion, 2020–2034)

- Zone 0

- Zone 20

- Zone 1

- Zone 21

- Zone 2

- Zone 22

By Class Outlook (Revenue, USD Billion, 2020–2034)

- Class 1

- Class 2

- Class 3

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Sensors

- Detectors

- Switches

- Transmitters

- Isolators

- LED Indicators

- Others

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Oil and Gas

- Mining

- Power

- Chemical and Petrochemical

- Processing

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Intrinsically Safe Equipment Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 3.85 Billion |

|

Market Size Value in 2025 |

USD 4.10 Billion |

|

Revenue Forecast by 2034 |

USD 7.33 Billion |

|

CAGR |

6.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global IS equipment market size was valued at USD 3.85 billion in 2024 and is projected to grow to USD 7.33 Billion by 2034.

The global market is projected to register a CAGR of 6.7% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Pepperl+Fuchs Inc., Fluke Corporation, Honeywell International Inc., R. STAHL AG, Eaton, Emerson Electric Co., Siemens AG, Rockwell Automation, ABB, and Extronics.

The class 1 segment dominated the market share in 2024.

The zone 21 segment is expected to witness the fastest growth during the forecast period.