IoT Medical Devices Market Share, Size, Trends, Industry Analysis Report

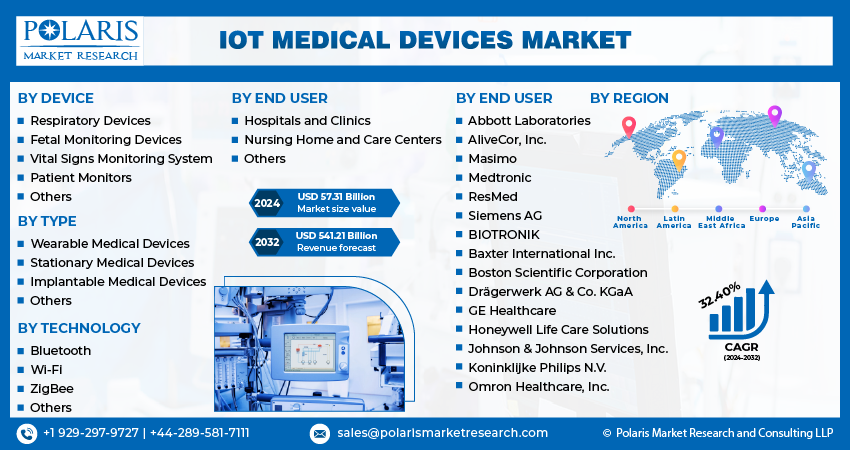

By Device (Respiratory Devices, Fetal Monitoring Devices, Vital Signs Monitoring System, Patient Monitors, Others); By Type; By Technology; By End User; By Region; Segment Forecast, 2024- 2032

- Published Date:Jan-2024

- Pages: 116

- Format: PDF

- Report ID: PM3877

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

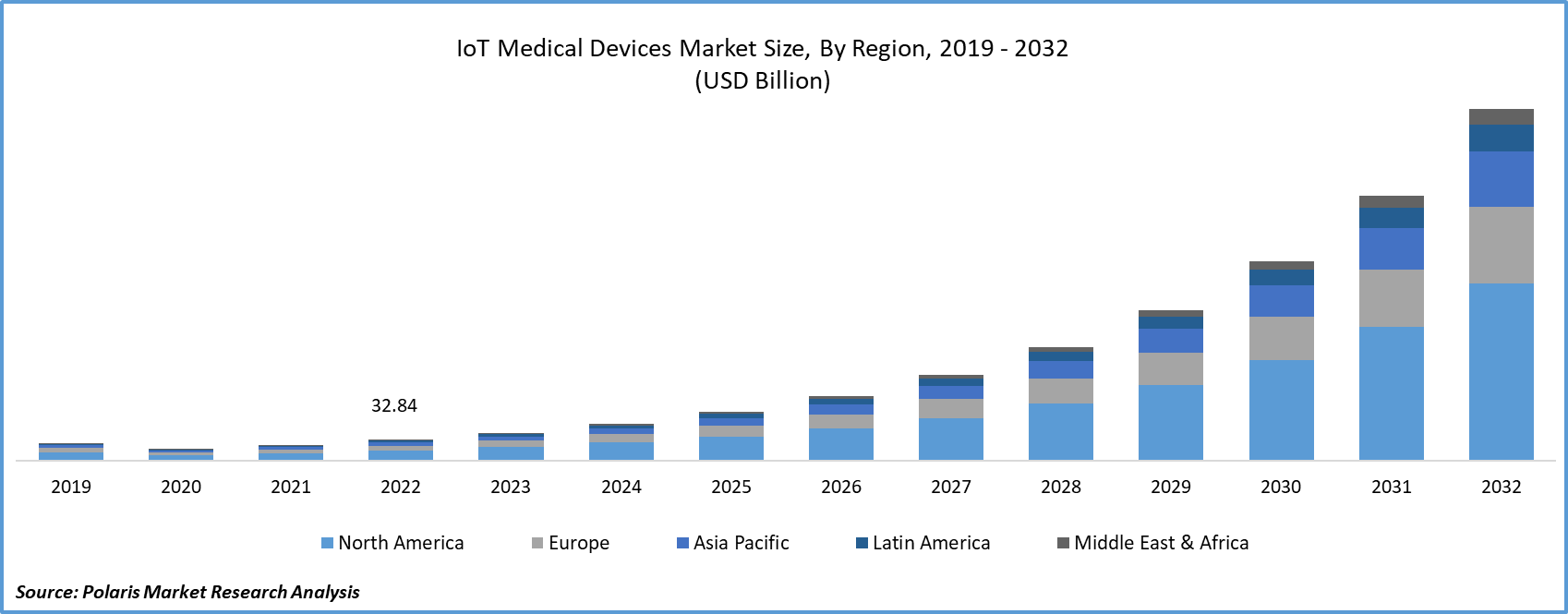

The global IoT medical devices market was valued at USD 43.38 billion in 2023 and is expected to grow at a CAGR of 32.40% during the forecast period.

The healthcare sector is progressively embracing data-driven approaches. IoT devices generate substantial health data, which can be subject to sophisticated analysis to uncover trends, predict health outcomes, and enhance treatment strategies. IoT medical devices provide continuous, real-time data collection, enabling healthcare providers to conduct thorough monitoring of patient's health status. This leads to enhanced patient care, early identification of health concerns, and the ability to create personalized treatment plans tailored to individual needs.

To Understand More About this Research: Request a Free Sample Report

In addition, companies operating in the IoT medical devices market are introducing new products to cater to the growing demand.

For instance, in April 2023, Honeywell introduced its new real-time health monitoring system, which is developed to monitor patients’ vital signs both in the hospital and remotely. It is integrated with advanced sensing technology that captures vital signs through a skin patch. The data and insights are then transferred to healthcare providers via mobile devices and online dashboard in real time.

Ongoing advancements in sensor technology, wireless connectivity, and data analytics have made it increasingly feasible to develop and deploy IoT medical devices. These technological breakthroughs have elevated device precision, dependability, and affordability. IoT medical devices have undergone a remarkable downsizing, becoming more inconspicuous and increasingly wearable. This miniaturization enables patients to comfortably wear these devices, ensuring continuous data collection without inconvenience.

Global health crises, including COVID-19 and other outbreaks, have elevated the importance of early detection and continuous monitoring of infectious diseases. IoT devices play a pivotal role in surveillance and rapid response efforts. IoT devices have been enlisted to oversee and optimize the supply chain of critical medical equipment and supplies. This ensures that healthcare establishments maintain uninterrupted access to indispensable resources, mitigating shortages during periods of heightened demand.

Growth Drivers

Increased Demand for Remote Patient Monitoring is Projected to Spur the Market Demand

The increasing need for remote patient monitoring and telehealth services, which has been further amplified during the COVID-19 pandemic, has expedited the development and widespread adoption of IoT medical devices. These devices empower healthcare professionals to remotely track patients' vital signs and conditions, allowing for timely interventions while minimizing the necessity for in-person visits.

The prevalence of chronic diseases such as diabetes, cardiovascular issues, and respiratory ailments has accelerated the demand for continuous monitoring. IoT medical devices empower patients to more effectively manage their conditions by providing real-time data on vital signs and relevant biomarkers.

The global aging population has intensified the requirement for healthcare services. IoT devices assist in delivering efficient and cost-effective care for senior citizens, enabling them to age in place while being closely monitored from remote locations.

Report Segmentation

The market is primarily segmented based on device, type, technology, end user, and region.

|

By Device |

By Type |

By Technology |

By End User |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Device Analysis

Vital Signs Monitoring System Segment to Experience Fastest Growth During the Forecast Period

The vital signs monitoring system segment is expected to experience the fastest growth during the forecast period. Serving as the central hub, this system receives, processes, and analyzes data sourced from IoT medical devices. It typically integrates data analytics software, data storage capabilities, and user interfaces for healthcare professionals. A vital signs monitoring system represents an innovative fusion of healthcare and technology designed for the continuous and remote monitoring of essential physiological parameters. It can be programmed to generate alerts when vital signs fall outside preset thresholds, ensuring that healthcare professionals are alerted to potential issues immediately.

By Type Analysis

Stationary Medical Devices Segment Emerged as the Largest Segment in 2022

The stationary medical devices segment emerged as the largest segment in 2022. Stationary IoT medical devices are fixed or immobile devices strategically placed within healthcare settings to fulfill various roles in advancing patient care and healthcare operations. These devices are instrumental in modern healthcare, continuously monitoring, collecting data, and maintaining connectivity. Within hospital rooms, IoT sensors and devices integrated into patient beds assume pivotal roles. They incessantly monitor vital signs such as heart rate, respiratory rate, and body temperature, delivering real-time data to healthcare practitioners. In critical situations, these devices can trigger alarms, ensuring swift responses to any changes in a patient's condition.

By Technology Analysis

Wi-Fi Emerged as the Largest Segment in 2022

The Wi-Fi segment accounted for a significant share in 2022. IoT medical devices, such as wearable health trackers and vital sign monitors, can seamlessly connect to Wi-Fi networks to relay real-time patient data to healthcare providers. This facilitates remote monitoring of patient's well-being, proving especially valuable for individuals managing chronic ailments like diabetes, cardiovascular conditions, or hypertension. IoT devices equipped with Wi-Fi capabilities, such as smart medication dispensers and adherence aids, deliver timely reminders to patients regarding medication schedules. These devices can issue alerts and notifications to patients' mobile devices, caregivers, or healthcare providers, ensuring consistent adherence to prescribed medications.

By End User Analysis

Hospitals and Clinics Segment Held the Significant Market Revenue Share in 2022

The hospitals and clinics segment accounted for a significant share in 2022. IoT devices enable the uninterrupted tracking of patients' vital signs, such as heart rate, blood pressure, and oxygen levels. This real-time data is swiftly transmitted to healthcare professionals, allowing for immediate interventions and reducing the need for constant bedside monitoring. Hospitals use IoT technology to track the location and status of medical equipment, such as infusion pumps, wheelchairs, and diagnostic devices. This optimizes equipment utilization, minimizes losses, and ensures equipment availability when required. IoT devices track the movement of patients and staff throughout the hospital. This information aids in optimizing workflows, reducing congestion in waiting areas, and enhancing the overall patient experience.

Regional Insights

North America Region Emerged as the Largest Region in 2022

The IoT medical devices industry in North America is a rapidly evolving sector encompassing a wide array of connected medical devices and technologies. This growth is driven by various factors, including rising healthcare costs, an aging population, the increasing demand for remote patient monitoring, and a strong emphasis on enhancing healthcare outcomes. The industry operates within a well-defined regulatory framework, with institutions such as the FDA (Food and Drug Administration) playing a critical role in ensuring the safety and efficacy of IoT medical devices. The region has witnessed significant adoption of telemedicine and virtual care platforms, often integrated with IoT medical devices to provide real-time data to healthcare providers.

The COVID-19 pandemic accelerated the adoption of telemedicine and remote monitoring in Asia-Pacific. IoT devices are pivotal in enabling remote consultations, continuous patient monitoring, and timely interventions. Both healthcare providers and consumers in Asia are becoming increasingly aware of the benefits offered by IoT medical devices. These devices empower individuals to take proactive control of their health, detect diseases early, and receive personalized treatment plans.

Key Market Players & Competitive Insights

The market for IoT Medical Devices is characterized by its fragmentation and is expected to experience competition due to the presence of numerous players. Key market participants are continually launching innovative products to solidify their market positions. These players emphasize partnerships, product enhancements, and collaborative efforts to gain a competitive advantage over their counterparts and secure a notable market share.

Some of the major players operating in the global market include:

- Abbott Laboratories

- AliveCor, Inc.

- Baxter International Inc.

- BIOTRONIK

- Boston Scientific Corporation

- Drägerwerk AG & Co. KGaA

- GE Healthcare

- Honeywell Life Care Solutions

- Johnson & Johnson Services, Inc.

- Koninklijke Philips N.V.

- Masimo

- Medtronic

- Omron Healthcare, Inc.

- ResMed

- Siemens AG

Recent Developments

- In May 2023, Medtronic plc announced the acquisition of EOFlow Co. Ltd. The acquisition is aimed at enhancing the company’s portfolio for diabetes through combination of Medtronic's Meal Detection Technology algorithm and next-generation continuous glucose monitor with EOPatch device, which is a tubeless, wearable and fully disposable insulin delivery device.

IoT Medical Devices Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 57.31 billion |

|

Revenue forecast in 2032 |

USD 541.21 billion |

|

CAGR |

32.40% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019-2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Device, By Type, By Technology, By End User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |