IoT Node and Gateway Market Share, Size, Trends, Industry Analysis Report

By Component (Hardware, Software, Services); By Connectivity Type; By End-User; By Region; Segment Forecast, 2024- 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM4128

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

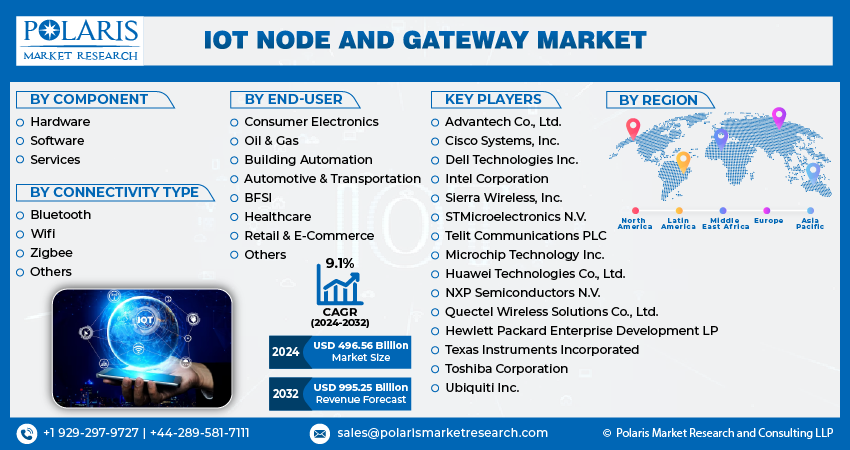

The global IoT node and gateway market was valued at USD 456.36 billion in 2023 and is expected to grow at a CAGR of 9.1% during the forecast period.

IoT nodes and gateways are the foundation of the IoT revolution, enabling seamless communication between devices and central servers. While the market for these components continues to expand, it is essential to address security concerns and interoperability challenges. The opportunities presented by IoT technology in healthcare, smart cities, and agriculture are immense, promising a future where interconnected devices drive innovation and efficiency across various industries.

To Understand More About this Research: Request a Free Sample Report

Moreover, the onset of the COVID-19 pandemic acted as a catalyst, expediting the adoption of IoT solutions. Industries were driven to enhance their capabilities in remote monitoring and fine-tune resource allocation, further amplifying the demand for IoT nodes and gateways. This surge reinforced their pivotal role in facilitating the seamless transmission of data between devices and central servers, emphasizing their critical significance in the ever-evolving technological landscape.

- For instance, in December 2022, Worldsensing, a frontrunner in remote monitoring for the Internet of Things (IoT), is bolstering its commitment to the mining sector. They introduced a solution that ensures smooth data acquisition and transmission in subterranean environments, aimed at enhancing risk management practices.

However, security concerns and interoperability challenges are the factors hampering the growth of the IoT node and gateway market. As the number of connected devices continues to rise, so do concerns about data security and privacy. Vulnerabilities in IoT nodes and gateways could potentially lead to breaches, making robust security measures imperative. Addressing these concerns is crucial to sustaining the growth of the IoT market.

Moreover, the heterogeneity of devices and protocols within the IoT ecosystem poses a significant challenge. Ensuring seamless communication between various nodes and gateways from different manufacturers requires standardized protocols and effective middleware solutions.

Growth Drivers

- Increasing demand for Industry 4.0 is projected to spur the product demand.

The integration of digital technologies into manufacturing processes, known as Industry 4.0, has led to the rapid growth of IoT nodes and gateways. These components are crucial for smart factories, as they enable real-time data exchange between machines, increasing productivity and reducing downtime.

The development of wireless communication technologies, such as 5G, has greatly impacted the IoT node and gateway market. This high-speed and low-latency connectivity allows for seamless communication between IoT nodes, gateways, and central servers, creating new opportunities for applications such as autonomous vehicles, intelligent infrastructure, and precision agriculture.

In addition, the demand for real-time data processing and analysis has led to the adoption of edge computing. In this paradigm, IoT gateways play a crucial role by processing data at or near the source, reducing latency and bandwidth consumption. This trend is particularly important in sectors such as healthcare, where quick response times are essential.

Report Segmentation

The market is primarily segmented based on component, connectivity type, end-user, and region.

|

By Component |

By Connectivity Type |

By End-User |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Component Analysis

- Services segment is expected to witness highest growth during forecast period

The services segment is experiencing robust growth and is likely to maintain growth throughout the forecast period. This surge can be attributed to the increasing complexity of IoT implementations, requiring specialized expertise for deployment, integration, and maintenance. Companies are seeking comprehensive services that encompass consulting, customization, and ongoing support to ensure seamless operation of their IoT ecosystems.

Additionally, as the IoT landscape continues to evolve, there is a growing demand for services related to data analytics, security, and scalability. Service providers are capitalizing on this trend by offering tailored solutions that address specific industry needs, further propelling the expansion of the services segment in the IoT node and gateway market. This growth signifies a shift towards a more holistic approach to IoT implementation, emphasizing the importance of reliable and expert support for successful IoT initiatives.

By Connectivity Type Analysis

- WiFi segment accounted for the largest market share in 2022

WiFi accounted for the largest market share in 2022 and is likely to retain its market position throughout the forecast period. This surge is attributed to the widespread accessibility and reliability of WiFi technology, making it a preferred choice for IoT device connectivity. Its high-speed data transmission capabilities and existing infrastructure in homes and businesses are pivotal in seamlessly integrating IoT devices. The advent of advanced WiFi standards like WiFi 6 further amplifies its appeal, offering improved efficiency and capacity. Consequently, WiFi-enabled IoT nodes and gateways are becoming increasingly prevalent, driving the expansion of this segment and cementing WiFi's pivotal role in the IoT ecosystem.

By End-User Analysis

- Consumer electronics segment held the significant market revenue share in 2022

The consumer electronics segment in the IoT node and gateway market is witnessing substantial growth. This surge is propelled by the rising demand for smart, interconnected devices in households. Consumers are increasingly adopting IoT-enabled gadgets like smart thermostats, security systems, and voice-activated assistants, driving the need for nodes and gateways for seamless communication. Convenience, energy efficiency, and enhanced control over home environments are key factors fueling this trend. With the IoT node and gateway market expanding, the consumer electronics segment is poised to continue its upward trajectory, underscoring the growing integration of IoT technology in our daily lives.

Regional Insights

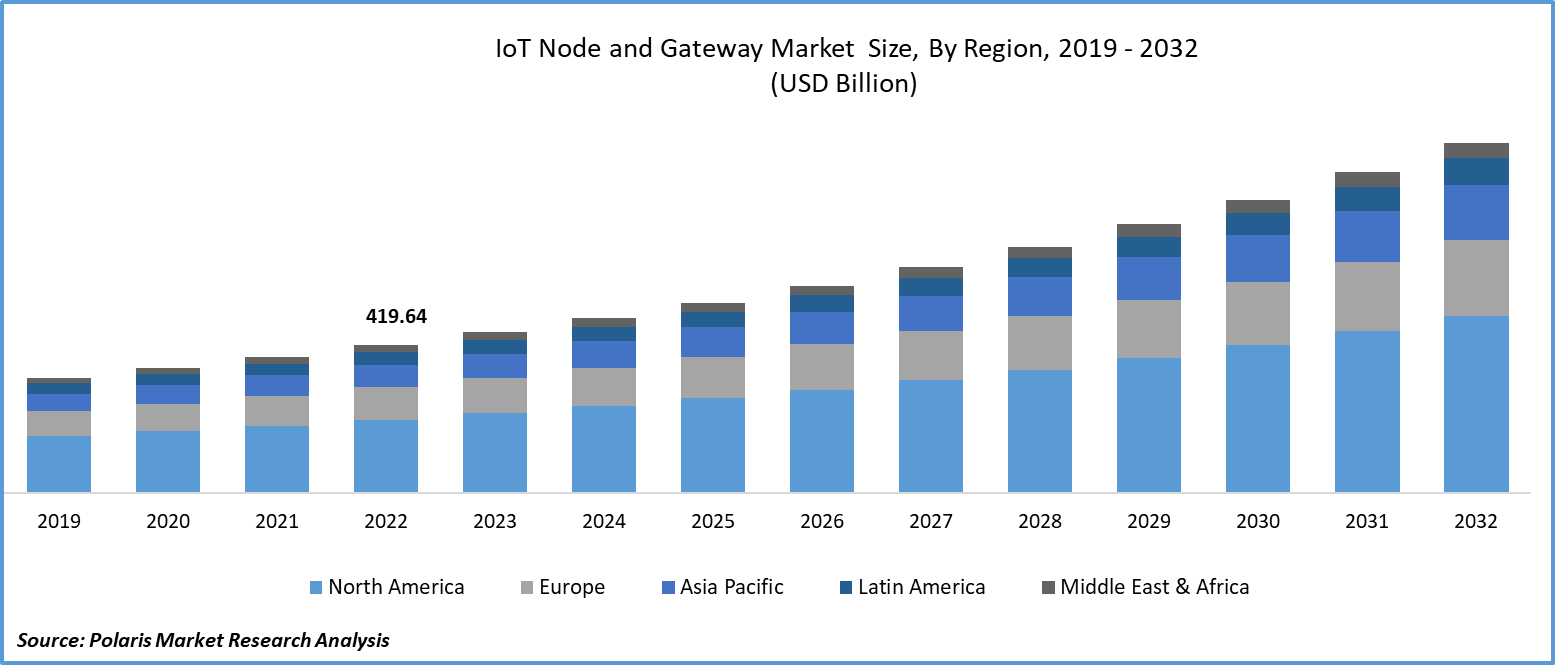

- North America region dominated the global market in 2022

The North America region dominated the global market with the largest market share in 2022 and is expected to maintain its dominance over the anticipated period. The growth of the segment market is largely attributed to robust infrastructure, extensive adoption of advanced technologies, and a mature industrial landscape. Major industries such as manufacturing, healthcare, agriculture, and transportation have embraced IoT solutions, leading to an increasing demand for nodes and gateways to connect and manage a myriad of devices and sensors.

Key drivers of this growth include the burgeoning Industry 4.0 initiatives, emphasizing the integration of digital technologies into manufacturing processes. This has propelled the deployment of IoT nodes and gateways in smart factories, facilitating real-time data exchange between machines resulting in heightened productivity and reduced downtime.

Furthermore, the region benefits from the relentless progress in wireless communication technologies. The rollout of high-speed, low-latency networks like 5G is revolutionizing the IoT landscape by enabling seamless communication between IoT nodes, gateways, and central servers. This facilitates applications such as autonomous vehicles, smart infrastructure, and precision agriculture, driving the demand for IoT devices.

Moreover, North America's strong focus on edge computing, which processes data at or near the data source, is another significant factor promoting the adoption of IoT gateways. In sectors like healthcare, immediate response times are critical, making IoT gateways essential for processing data in real time. However, challenges like data security and interoperability issues persist in the region, underscoring the need for robust security measures and standardized protocols.

Thus, the North American IoT node and gateway market is characterized by its substantial growth, driven by the adoption of IoT across various sectors and the region's technological advancements. With its strong industrial base and commitment to cutting-edge technologies, North America is poised to continue shaping the global IoT landscape.

The IoT node and gateway markets in China and India represent two major players in the global IoT landscape. China, with its robust manufacturing sector, leads in IoT deployment across industries such as smart manufacturing, agriculture, and smart cities. Chinese companies are driving innovation and manufacturing cost-effective IoT devices, nodes, and gateways, contributing to market growth. In India, IoT adoption is steadily increasing, particularly in sectors like agriculture, healthcare, and logistics. However, infrastructure challenges and regulatory hurdles can be barriers. Despite these challenges, both countries show significant potential, with increasing investments and government initiatives boosting the IoT node and gateway markets in their respective regions.

Key Market Players & Competitive Insights

The IoT node and gateway market is fragmented and is anticipated to witness competition due to the presence of several players. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Advantech Co., Ltd.

- Cisco Systems, Inc.

- Dell Technologies Inc.

- Hewlett Packard Enterprise Development LP

- Huawei Technologies Co., Ltd.

- Intel Corporation

- Microchip Technology Inc.

- NXP Semiconductors N.V.

- Quectel Wireless Solutions Co., Ltd.

- Sierra Wireless, Inc.

- STMicroelectronics N.V.

- Telit Communications PLC

- Texas Instruments Incorporated

- Toshiba Corporation

- Ubiquiti Inc.

Recent Developments

- In October 2021, Dell unveiled satellite nodes as part of its VxRail lineup of hyperconverged hardware, initially introduced in 2016. Dell emphasized that this single-node deployment streamlines everyday operations, conducts health monitoring, and manages the lifecycle centrally, eliminating the requirement for on-site technical expertise and specialized resources.

IoT Node and Gateway Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 496.56 billion |

|

Revenue forecast in 2032 |

USD 995.25 billion |

|

CAGR |

9.1% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Component, By Connectivity Type, By End-User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The global IoT node and gateway market size is expected to reach USD 995.25 billion by 2032.

Key players in the market are Dell Technologies Inc., Hewlett Packard Enterprise Development LP, Huawei Technologies Co., Ltd

North America contribute notably towards the global IoT node and gateway market.

The global IoT node and gateway market is expected to grow at a CAGR of 9.0% during the forecast period.

The IoT node and gateway market report covering key segments are component, connectivity type, end-user, and region.