Iron And Steel Market Size, Share, Trends, Industry Analysis Report

By Product (Iron Ore, Steel), By End Use (Building & Construction, Automotive & Transportation), By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6075

- Base Year: 2024

- Historical Data: 2020-2023

Overview

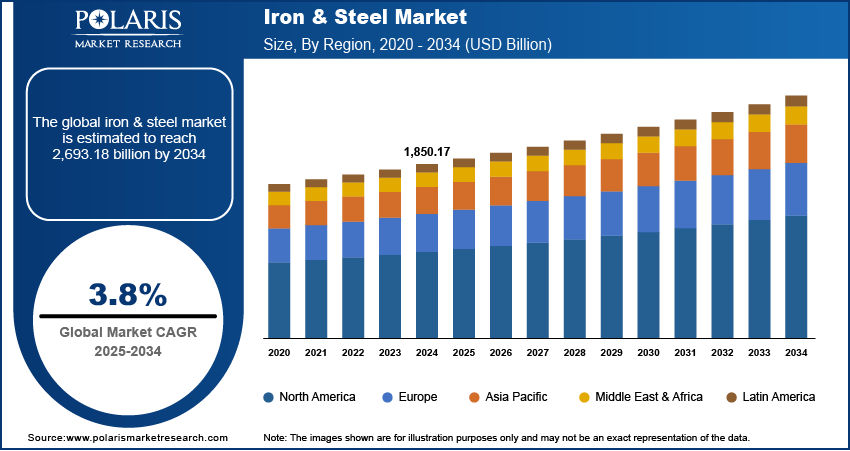

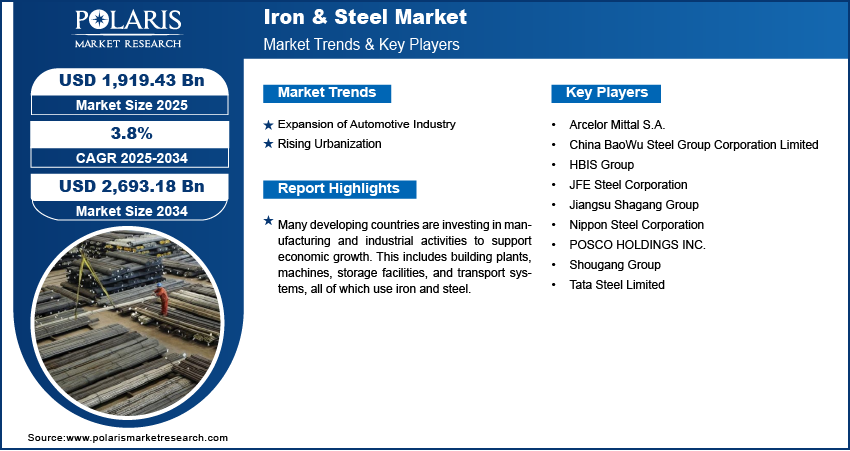

The global iron And steel market size was valued at USD 1,850.17 billion in 2024, growing at a CAGR of 3.8% from 2025 to 2034. The expansion of automotive industry and rising urbanization across the world drive the demand for iron and steel.

Key Insights

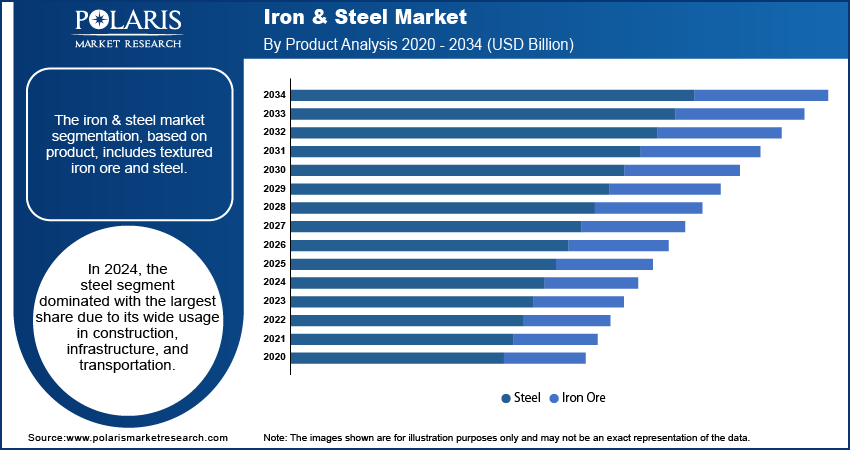

- In 2024, the steel segment dominated with a larger share due to its wide usage in construction, infrastructure, and transportation.

- The automotive And transportation segment is expected to experience significant growth during the forecast period due to rising vehicle production in emerging regions and the increasing shift toward electric vehicles (EVs) in developed economies.

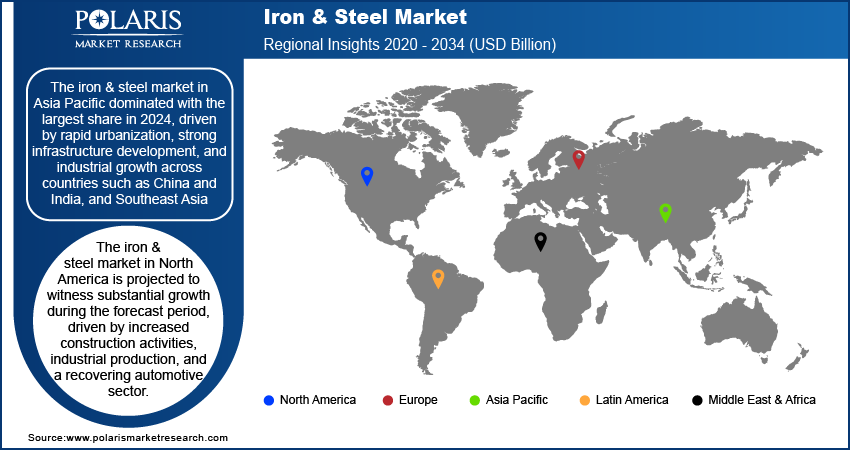

- Asia Pacific dominated with the largest share in 2024, driven by rapid urbanization, strong infrastructure development, and industrial growth across countries such as China and India, as well as Southeast Asia.

- The market in North America is projected to witness substantial growth during the forecast period, driven by increased construction activities, industrial production, and a recovering automotive sector.

- The U.S. iron And steel market is expected to experience significant growth in the coming years, driven by federal infrastructure spending and a resurgence in domestic manufacturing.

Industry Dynamics

- The expansion of the automotive industry is driving the demand for high performance steel and iron ore.

- Rising urbanization is fueling the industry growth as the demand for commercial and residential buildings grows.

- Many developing countries are investing in manufacturing and industrial activities to support economic growth, thereby driving the demand for steel and iron.

- High energy costs and environmental regulations are restraining the iron and steel industry.

Market Statistics

- 2024 Market Size: USD 1,850.17 billion

- 2034 Projected Market Size: USD 2,693.18 billion

- CAGR (2025–2034): 3.8%

- Asia Pacific: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

Iron and steel are strong, durable metals widely used in construction, transportation, and various manufacturing applications. Iron is a natural element extracted from ore, while alloy steel is made by combining iron with a small amount of carbon to improve strength and flexibility. Together, they form the backbone of modern infrastructure, from buildings and bridges to tools and machines.

The construction industry is expanding rapidly worldwide due to multiple factors. According to the HBI, in the U.S. alone, the employment in construction increased by 239,000 in 2024 compared to 2023. The construction industry uses iron and steel in almost every type of building such as residential, commercial, and industrial. From skyscrapers and factories to airports and shopping malls, steel provides the structural backbone. The need for high-quality steel increases as countries invest in modern infrastructure and repair old buildings. Additionally, government spending on housing, smart cities, and transportation hubs is growing, thereby driving the growth.

Many developing countries are investing in manufacturing and industrial activities to support economic growth. This includes building plants, machines, storage facilities, and transport systems, all of which use iron and steel. The demand for steel-based equipment and structures grows as countries expand their industrial base. This is especially evident in regions such as Southeast Asia, Africa, and parts of South America. Industrial development further leads to more demand for basic infrastructure, creating a cycle that supports continuous steel consumption in these regions.

Drivers and Opportunities

Expansion of Automotive Industry: The automotive sector utilizes substantial quantities of steel for manufacturing vehicle bodies, engines, and safety components. The demand for steel is increasing as more people in both developed and developing countries are purchasing vehicles. According to the Organization of Motor Vehicle Manufacturers, in North America Alone, 7,079,750 new passenger vehicles were registered. Even as electric vehicles become more common, steel remains a core material due to its strength and cost efficiency. Lightweight and high-strength steels are further being used to meet fuel efficiency and safety regulations. As a result, vehicle manufacturing remains a significant contributor to global steel consumption.

Rising Urbanization: The need for basic infrastructure, such as roads, bridges, housing, and public transportation, grows as more people move into cities. According to the World Bank Group, in 2024, 58% of the total population lived in urban areas. Iron and steel are essential materials in these projects because they provide structural support. Many developing countries are investing in new infrastructure to support growing populations, while developed countries are repairing or replacing old structures. This steady demand for construction materials keeps the iron and steel industry active. Moreover, large-scale public projects such as railways, airports, and water systems further depend on a consistent supply of steel products, thereby driving the growth.

Segmental Insights

Product Analysis

The segmentation, based on product, includes textured iron ore and steel. In 2024, the steel segment dominated with a larger share due to its wide usage in construction, infrastructure, and transportation. Steel is preferred over other materials because it offers high strength, flexibility, and cost-effectiveness. Countries with ongoing urban development projects, such as China, India, and several Middle Eastern nations, experience demand for structural and reinforcement steel. Developed regions such as North America and Europe also maintained strong consumption, especially in repairing old infrastructure. The availability of advanced steel types further fuels its demand across multiple sectors, thereby driving the segment growth.

The iron ore segment is expected to experience significant growth during the forecast period due to high production levels in key countries such as Australia, Brazil, and India. These countries supplied large amounts of iron ore to steel producers worldwide, especially in Asia. The demand from countries such as China, where steel production remains high, supported the iron ore industry. Despite price fluctuations, the consistent need for iron ore as the base material for steel-making helped it retain a central position in the global supply chain, especially in regions focused on manufacturing and heavy industry, thereby driving the segment growth.

End Use Analysis

The segmentation, based on end use, includes building And construction, automotive And transportation, heavy industry, consumer goods, and other. In 2024, the building And construction segment dominated with the largest share as urban development, population growth, and government-funded infrastructure projects fuels the demand. Countries in Asia Pacific, especially India and China, experience a rise in residential and commercial building activities. In developed regions, renovation of old infrastructure boosted steel consumption. Steel’s properties such as durability, cost efficiency, and ease of fabrication made it ideal for construction. From bridges and railways to high-rise buildings and warehouses, the material was in steady demand, thereby driving the segment growth.

The automotive And transportation segment is expected to experience significant growth during the forecast period due to rising vehicle production in emerging regions and the shift towards electric vehicles in developed economies. Automakers are increasingly using advanced high-strength steel to make vehicles lighter and more fuel-efficient while maintaining safety standards. Rail, air, and shipping transport systems also require strong, durable materials, which fuels steel usage, thereby driving the segment growth.

Regional Analysis

Asia Pacific Iron And Steel Market Trends

Asia Pacific dominated with the largest share in 2024, driven by rapid urbanization, strong infrastructure development, and industrial growth across countries such as China and India, as well as Southeast Asia. The region is home to several major steel-producing countries and further supports strong export. Government investments in transportation, housing, and energy infrastructure boost steel consumption. Additionally, local manufacturing and construction sectors are expanding, further increasing the use of iron and steel. Asia Pacific’s strong economic activity and large population further fuels both production and consumption, thereby driving the growth.

China Iron And Steel Market Insights

The industry in China is expected to witness significant growth during the forecast period, due to massive infrastructure projects, ongoing urbanization, and a strong manufacturing sector. China’s Belt and Road Initiative further fuels steel exports for international infrastructure projects. Production levels remain high due to internal needs and global demand. The growing construction, automotive, and industrial machinery sectors further fuels the market growth in China.

North America Iron And Steel Market Analysis

The market in North America is projected witness substantial growth in the coming years, driven by increased construction activities, industrial production, and a recovering automotive sector. The U.S., Canada, and Mexico benefit from integrated supply chains under trade agreements such as USMCA. Regional investments in infrastructure upgrades and energy projects further supported demand. The region imports a portion of its steel. Rising focus to modernize facilities and increase efficiency has fuel the local production. North America is further focusing on sustainable steelmaking practices, which could shape future demand and investments in low-emission technologies.

U.S. Iron And Steel Market Analysis

The U.S. iron And steel market is expected to experience significant growth during the forecast period, driven by federal infrastructure spending and a resurgence in domestic manufacturing. Key sectors such as construction, automotive, and energy contributed to rising steel demand. The government's push to improve roads, bridges, and public buildings boosted domestic steel consumption. The U.S. further experience an increase in steel recycling and electric arc furnace usage to meet sustainability goals. Moreover, trade policies and tariffs influenced the import-export balance, encouraging more domestic production, thereby driving the growth.

Europe Iron And Steel Market Insights

The industry in Europe is expected to experience rapid growth in the future driven by infrastructure renewal, automotive production, and green energy projects. The region focuses heavily on sustainable steel production, investing in low-carbon technologies and recycling methods. Countries such as Germany, Italy, and France lead in both production and consumption. The European Union’s climate goals are influencing how steel is made, with a shift toward electric arc furnaces and hydrogen-based production. Additionally, strong demand from the construction and automotive sectors, combined with policy support for clean industry, boost the growth in Europe.

Germany Iron And Steel Market Assessment

The market growth in Germany is attributed to its strong industrial base and advanced manufacturing sector. The demand for steel in automotive production, machinery, and construction is growing. The country is further a leader in developing green steel technologies, with several pilot projects using hydrogen to reduce emissions in steelmaking. Germany imports a portion of its iron ore and has well-established steel production facilities, particularly in Ruhr. Government support for climate-friendly industry and ongoing infrastructure investments continue to drive demand for steel across the country.

Key Players and Competitive Analysis

The iron And steel market is highly competitive and dominated by a mix of global giants and regionally strong players. Leading companies such as Arcelor Mittal S.A., China BaoWu Steel Group Corporation Limited, and Nippon Steel Corporation maintain their positions through large-scale production capacities, technological advancements, and global distribution networks. Chinese firms such as HBIS Group, Jiangsu Shagang Group, and Shougang Group benefit from strong domestic demand and government support, contributing significantly to global steel output. JFE Steel Corporation and POSCO HOLDINGS INC. play key roles in Asia Pacific, focusing on innovation and high-grade steel products. Meanwhile, Tata Steel Limited represents one of the major players from India, expanding globally through strategic acquisitions and sustainable practices. The market is shaped by price volatility, raw material costs, trade regulations, and growing emphasis on green steel production, pushing competitors to invest in cleaner technologies and diversified product portfolios.

Key Players

- Arcelor Mittal S.A.

- China BaoWu Steel Group Corporation Limited

- HBIS Group

- JFE Steel Corporation

- Jiangsu Shagang Group

- Nippon Steel Corporation

- POSCO HOLDINGS INC.

- Shougang Group

- Tata Steel Limited

Industry Developments

In July 2025, Tata Steel signed an MoU with Australia’s InQuik Group to launch modular bridge construction technology in India, expanding its infrastructure portfolio with sustainable, rapid-build solutions that strengthen rural connectivity and mark a major step in construction innovation.

In July 2025, ArcelorMittal Nippon Steel India commissioned a new galvanising line at its Hazira plant, enabling domestic production of advanced high-strength steel up to 1180 MPa for the automotive sector, as part of its USD 6.96 billion expansion project.

In May 2025, Tata Steel inaugurated the Phase II expansion of its Kalinganagar plant, increasing crude steel capacity from 3 to 8 MTPA with an investment of USD 3.13 Billion, strengthening its infrastructure footprint and reinforcing Odisha as a key industrial hub.

In April 2024, HBIS ZhangXuan High Tech launched the world’s first hydrogen shaft furnace and zero-carbon emission arc furnace project, marking a major step in its 1.2 million-ton hydrogen steelmaking initiative to advance China’s green steel transformation.

Iron And Steel Market Segmentation

By Product Type Outlook (Volume, Million Tons, Revenue, USD Billion, 2020–2034)

- Iron Ore

- Steel

By End Use Outlook (Volume, Million Tons, Revenue, USD Billion, 2020–2034)

- Building And Construction

- Automotive And Transportation

- Heavy Industry

- Consumer Goods

- Other

By Regional Outlook (Volume, Million Tons, Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East And Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East And Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Iron And Steel Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1,850.17 Billion |

|

Market Size in 2025 |

USD 1,919.43 Billion |

|

Revenue Forecast by 2034 |

USD 2,693.18 Billion |

|

CAGR |

3.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume in Million Tons, Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Volume Forecast, Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1,850.17 billion in 2024 and is projected to grow to USD 2,693.18 billion by 2034.

The global market is projected to register a CAGR of 3.8% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few of the key players in the market are Arcelor Mittal S.A., China BaoWu Steel Group Corporation Limited, HBIS Group, JFE Steel Corporation, Jiangsu Shagang Group, Nippon Steel Corporation, POSCO HOLDINGS INC., Shougang Group, and Tata Steel Limited.

The steel segment dominated the market share in 2024.

The automotive & transportation segment is expected to witness the significant growth during the forecast period.