Polyolefin Compound Market Size, Share, Industry Analysis Report

By Polymer Type (PP Compounds, PE Compounds, Recycled Polyolefin Compounds, Other Types), By Application, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6043

- Base Year: 2024

- Historical Data: 2020-2023

Overview

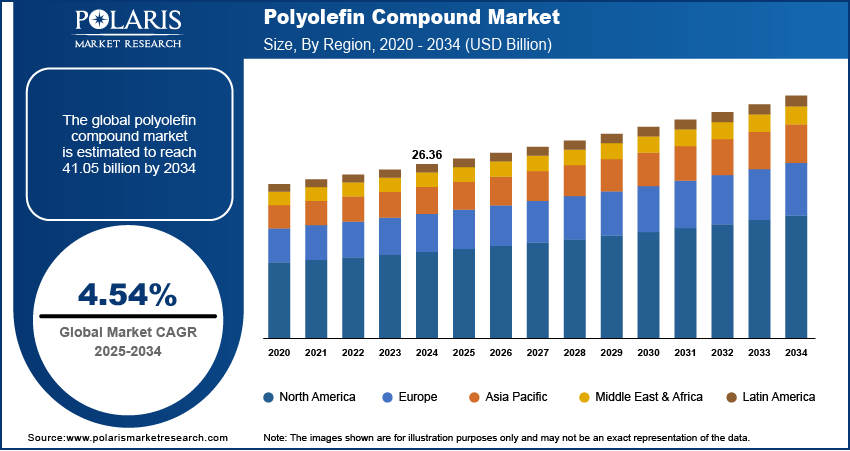

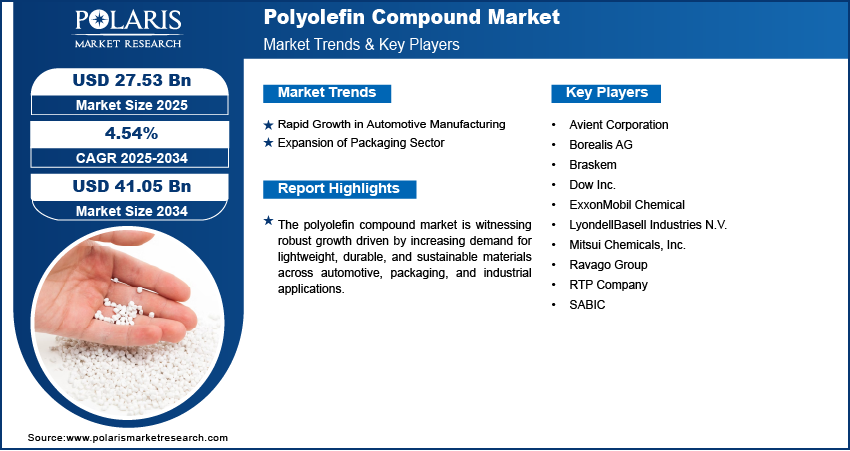

The global polyolefin compound market size was valued at USD 26.36 billion in 2024, growing at a CAGR of 4.54% from 2025 to 2034. Key factors driving demand for polyolefin compounds include the technological innovations and the rise of customized compounds, rapid growth in automotive manufacturing, and the expansion of the packaging sector.

Key Insights

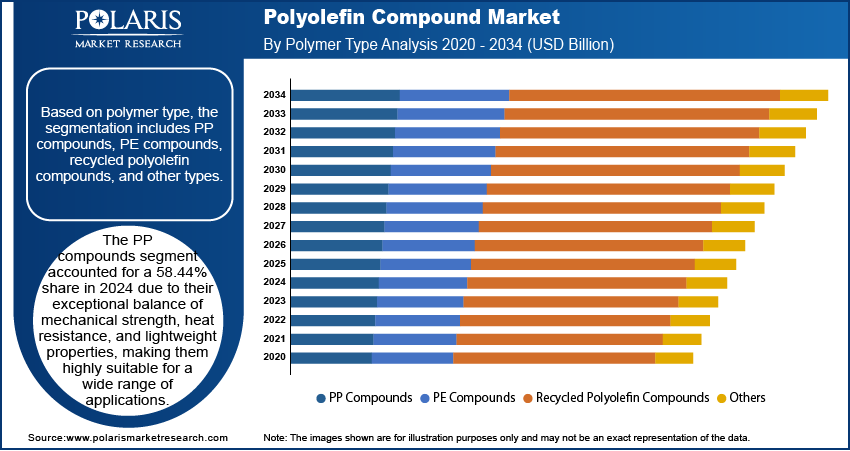

- The PP compounds segment accounted for 58.44% share in 2024.

- The packaging segment is expected to witness a CAGR of 5.1% during the forecast period.

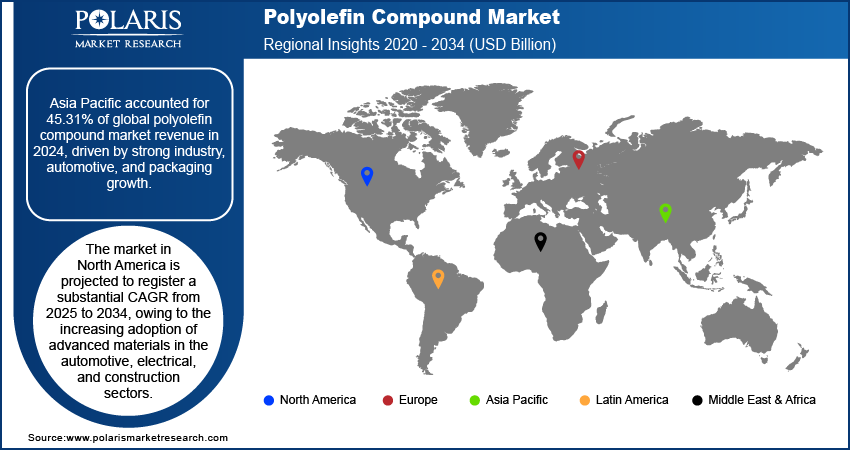

- Asia Pacific accounted for a 45.31% share of the global polyolefin compound market in 2024.

- The market in China is expected to witness significant growth during the forecast period, due to its large-scale manufacturing ecosystem, strong domestic demand, and increasing investments such as advanced steam crackers, high-end polyolefin plants, and integrated petrochemical.

- The market in North America is projected to register a substantial CAGR from 2025 to 2034.

- The U.S. polyolefin compound market is expanding due to the rising demand for lightweight, durable, and sustainable materials.

Industry Dynamics

- Growing automotive production boosts demand for lightweight, durable compounds to enhance fuel efficiency and reduce costs.

- Rising packaging needs drive polyolefin adoption, valued for their lightweight, flexible, and eco-friendly properties.

- Volatile raw material prices and supply chain disruptions present challenges for polyolefin compound manufacturers, affecting production costs and profit margins.

- Circular economies boost bio-based and recycled polyolefin, aligning with sustainability goals and enabling new applications in electric vehicles and packaging.

Market Statistics

- 2024 Market Size: USD 26.36 billion

- 2034 Projected Market Size: USD 41.05 billion

- CAGR (2025–2034): 4.54%

- Asia Pacific: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

Polyolefin compounds are engineered blends of polyethylene, polypropylene, and additives designed for specific mechanical, thermal, or aesthetic performance. They increasingly support modern applications in plastics. Technological innovations and the rise of customized compounds are driving growth opportunities. Advances in catalyst chemistry, reactive extrusion, and precise additive dosing enable formulators to tailor properties such as clarity, impact strength, and chemical resistance for specific end uses, ranging from automotive interiors to medical packaging. This shift to “fit-for-purpose” formulae enhances value by enabling converters to utilize single polyolefin solutions, streamline processing, and reduce design cycles, thereby driving demand across the value chain.

The industry-wide focus on lightweight, high-performance materials enhances the appeal of polyolefin across the transportation, consumer goods, and infrastructure sectors. Automakers, for example, substitute glass-filled metals with long-fiber-reinforced polypropylene to reduce vehicle weight without sacrificing structural integrity, while appliance makers adopt mineral-filled polyethylene blends that deliver stiffness at a lower density, thereby reducing shipping costs and embodied carbon. In June 2025, BASF enhanced Ultramid Advanced N3U42G6, a halogen-free flame-retardant polyamide 9T for E&E components. It resists electro-corrosion, excels in high-temperature stability, and strengthens thin-walled HV connectors in EVs, meeting demand for durable, safe materials in warm, humid environments. Coupled with ongoing regulatory pressure for circularity and fuel efficiency, this lightweighting imperative drives R&D into high-modulus, low-VOC, and recycled-content formulations, strengthening them as a versatile and sustainable alternative in advanced material portfolios.

Drivers and Opportunities

Rapid Growth in Automotive Manufacturing: The rapid growth in automotive manufacturing is driving the market, as the industry increasingly relies on lightweight, durable, and cost-effective materials. Polyolefin compounds, particularly polypropylene-based formulations, are widely used in automotive interiors, exteriors, and under-the-hood components due to their excellent moldability, chemical resistance, and weight reduction capabilities. This shift toward sustainable materials is further reinforced by regulatory measures. For instance, in June 2025, the European Parliament proposed requiring new vehicles to contain at least 20% recycled plastic within six years, with the target rising to 25% within a decade. The demand for materials that substitute metal without compromising performance continues to rise as manufacturers aim to meet fuel efficiency standards and reduce emissions. This has positioned them as a preferred choice for achieving design flexibility and enhancing vehicle efficiency in high-volume automotive production.

Expansion of Packaging Sector: The expansion of the packaging sector drives demand for polyolefin compounds, fueled by the need for lightweight, flexible, and sustainable packaging solutions. These compounds offer excellent moisture resistance, durability, and transparency, making them ideal for a wide range of applications in consumer goods, food, and industrial packaging. According to a February 2025 IBEF report, India's flexible packaging market is expected to grow to USD 15.6 billion at a CAGR of 12.7% from 2024 to 2028, driven by strong demand for FMCG products. The adaptability of polyolefins in producing films, containers, and molded parts allows converters to optimize both functionality and aesthetics while maintaining cost efficiency. Therefore, as packaging trends evolve toward recyclability and material reduction, play a vital role in meeting industry requirements for performance, sustainability, and regulatory compliance.

Segmental Insights

Polymer Type Analysis

Based on polymer type, the segmentation includes PP compounds, PE compounds, recycled polyolefin compounds, and other types. The PP compounds segment accounted for 58.44% share in 2024 due to their exceptional balance of mechanical strength, heat resistance, and lightweight properties, making them highly suitable for a wide range of applications. Their widespread adoption in automotive parts, consumer goods, packaging, and appliances is driven by their versatility, cost-effectiveness, and ease of processing. Furthermore, advancements in impact copolymer and filled polypropylene grades continue to expand their performance envelope, enabling manufacturers to replace traditional engineering plastics in many applications. These factors collectively reinforce the dominance of PP compounds.

Application Analysis

In terms of application, the segmentation includes automotive, packaging, building & construction, electrical & electronics, consumer goods, industrial, and other applications. The packaging segment is expected to witness growth at a CAGR of 5.1% during the forecast period as industries increasingly aim for high-performance materials that meet both sustainability and functional demands. Polyolefin compounds are integral to the production of flexible films, rigid containers, caps, closures, and protective packaging, offering a favorable combination of strength, lightweight, and moisture resistance. Additionally, the ongoing shift toward recyclable and mono-material packaging formats aligns with the intrinsic properties of polyolefin, further enhancing their appeal. Additionally, growth in e-commerce, food safety requirements, and the need for retail-ready packaging are expected to sustain the growth of this segment.

Regional Analysis

The Asia Pacific polyolefin compound market accounted for a 45.31% global market share in 2024. This dominance is attributed to the region’s robust industrial base, large-scale automotive production, and rapidly expanding packaging and construction sectors. Countries such as China, India, Japan, and South Korea continue to invest in manufacturing infrastructure. According to an April 2025 IBEF report, India's manufacturing FDI reached USD 165.1 billion, representing a 69% growth over 10 years, driven by PLI schemes. Total FDI inflows over the five years reached USD 383.5 billion. The availability of cost-effective labor and raw materials further drives high-volume production. Moreover, rising urbanization and consumer demand across emerging markets in the region fuel demand for polyolefin-based applications in both consumer and industrial sectors, solidifying Asia Pacific’s leadership position in the global landscape.

China Polyolefin Compound Market Insight

The market in China is expected to witness significant growth during the forecast period, due to its large-scale manufacturing ecosystem, strong domestic demand, and increasing investments in the automotive, packaging, and construction industries. The country's push toward infrastructure modernization and industrial automation is driving the demand for high-performance materials. Additionally, favorable government policies supporting the production of electric vehicles and the use of recyclable materials are accelerating the adoption of advanced compounds across various end-use sectors.

North America Polyolefin Compound Market Trend

The market in North America is projected to grow at a substantial CAGR from 2025 to 2034, owing to the increasing adoption of advanced materials in the automotive, electrical, and construction sectors. The region’s focus on energy-efficient, lightweight, and durable solutions aligns well with the evolving capabilities of polyolefin. Regulatory emphasis on sustainability and recyclability is also pushing demand for high-performance, recycled-content polyolefin grades. Additionally, investments in technological innovation, combined with a mature processing industry, create a conducive environment for expansion across the U.S. and Canada.

U.S. Polyolefin Compound Market Overview

The U.S. market is expanding due to the rising demand for lightweight, durable, and sustainable materials in the automotive, consumer goods, and electrical industries. Technological advancements in compounding processes, combined with growing investments in R&D, are enabling the development of customized, high-performance formulations tailored to specific regulatory and application requirements. Furthermore, the country’s strong focus on circular economy principles and product innovation is supporting broader usage of both virgin and recycled compounds.

Europe Polyolefin Compound Market Trends

Europe is projected to hold a substantial share of the global market by 2034, driven by strict environmental regulations, strong demand for sustainable packaging, and innovation-driven automotive manufacturing. The European Union's circular economy initiatives are encouraging compounders and end users to adopt recyclable and resource-efficient materials, where these compounds offer a viable solution. Furthermore, advancements in polymer modification technologies and the growing use of lightweight materials in electric vehicles and building insulation are continuing to boost regional adoption. The presence of leading material science firms and a well-established recycling ecosystem further supports long-term market growth.

UK Polyolefin Compound Market Outlook

The polyolefin compound market growth in the UK is driven by an increasing focus on sustainable packaging solutions and lightweight materials across various industries. The demand for mono-material and easily recyclable packaging formats is increasing, driven by a strong push for environmental compliance and recycling. Moreover, the country’s expanding healthcare and consumer goods sectors are contributing to the increased usage of polyolefin in applications that require cost-effective, high-barrier, and safe plastic materials.

Key Players and Competitive Analysis

The polyolefin compound industry is witnessing revenue growth, driven by emerging markets and technological advancements in polymer science. Competitive intelligence and strategy reveal that major players are focusing on sustainable value chains, with strategic investments in bio-based polyolefins to address environmental concerns. Industry trends highlight rising demand from the automotive and packaging sectors, where lightweight, durable materials are critical. Economic and geopolitical shifts, such as regional trade policies, are reshaping regional footprints, favoring localized production in developed markets. Small and medium-sized businesses are leveraging expansion opportunities through niche applications, such as medical-grade polymers. Meanwhile, supply chain disruptions have accelerated the adoption of recycled polyolefin, aligning with future development strategies for circular economies.

A few major companies operating in the polyolefin compound industry include Avient Corporation; Borealis AG; Braskem; Dow Inc.; ExxonMobil Chemical; LyondellBasell Industries N.V.; Mitsui Chemicals, Inc.; Ravago Group; RTP Company; and SABIC.

Key Players

- Avient Corporation

- Borealis AG

- Braskem

- Dow Inc.

- ExxonMobil Chemical

- LyondellBasell Industries N.V.

- Mitsui Chemicals, Inc.

- Ravago Group

- RTP Company

- SABIC

Polyolefin Compound Industry Developments

- June 2025: Clariant launched AddWorks PPA, a PFAS-free polymer processing aid for polyolefin extrusion. The product line offers sustainable alternatives to fluoropolymer-based aids while maintaining performance, responding to tightening global PFAS regulations.

- April 2025: WANHUA Chemical launched WANSUPER, a new polyolefin elastomer (POE) for modifying PE, PP, and EVA. It enhances flexibility, impact resistance, and processing in films, cables, automotive parts, and foams while serving as a cost-effective SBC alternative.

- June 2024: Borealis launched a semi-commercial rPO compounding line in Belgium, using Borcycle M to convert post-consumer waste into high-quality PP/PE. The project advances mechanical recycling scalability under its EverMinds circular economy initiative.

Polyolefin Compound Market Segmentation

By Polymer Type Outlook (Revenue, USD Billion, 2020–2034)

- PP Compounds

- PE Compounds

- Recycled Polyolefin Compounds

- Other Types

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Automotive

- Packaging

- Building & Construction

- Electrical & Electronics

- Consumer Goods

- Industrial

- Other Applications

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Polyolefin Compound Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 26.36 Billion |

|

Market Size in 2025 |

USD 27.53 Billion |

|

Revenue Forecast by 2034 |

USD 41.05 Billion |

|

CAGR |

4.54% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 26.36 billion in 2024 and is projected to grow to USD 41.05 billion by 2034.

The global market is projected to register a CAGR of 4.54% during the forecast period.

Asia Pacific accounted for a 45.31% share of the global polyolefin compound market revenue in 2024.

A few of the key players in the market are Avient Corporation; Borealis AG; Braskem; Dow Inc.; ExxonMobil Chemical; LyondellBasell Industries N.V.; Mitsui Chemicals, Inc.; Ravago Group; RTP Company; and SABIC.

The PP compounds segment accounted for 58.44% share in 2024.

The packaging segment is expected to witness a CAGR of 5.1% during the forecast period.