U.S. Microarray Market Size, Share, Trends, Industry Analysis Report

By Product and Services (Consumables, Software & Services, and Instruments), By Type, By Application, By End Use – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 128

- Format: PDF

- Report ID: PM6042

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

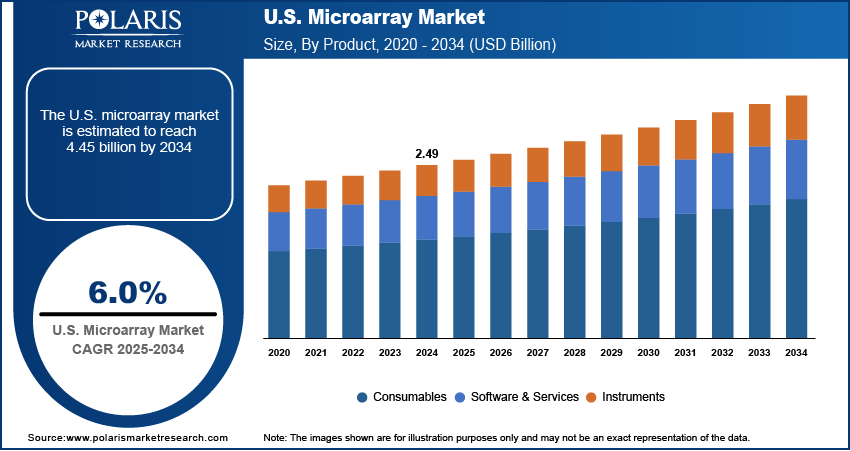

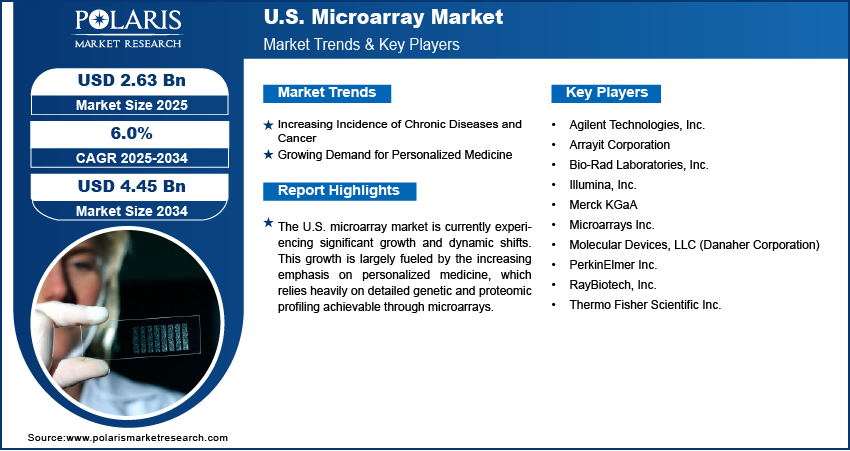

The U.S. microarray market size was valued at USD 2.49 billion in 2024 and is anticipated to register a CAGR of 6.0% from 2025 to 2034. The microarray landscape is primarily driven by the increasing demand for personalized medicine, especially in areas such as precision oncology.

Key Insights

- By product and services, the consumables segment held the largest share in 2024. This is due to the continuous and recurring demand for essential components such as slides, reagents, and kits needed for every experiment in research and diagnostic settings.

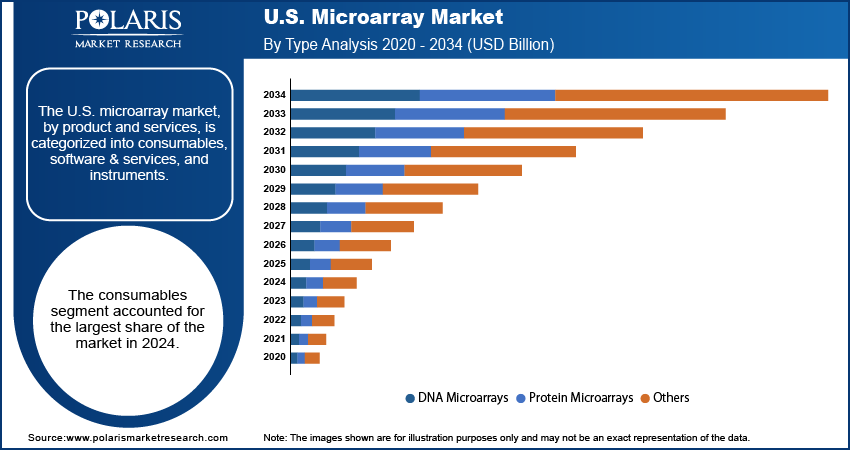

- By type, the DNA microarrays segment held the largest share in 2024. Its widespread and established applications in gene expression profiling, SNP genotyping, and comparative genomic hybridization for research and clinical diagnostics contribute significantly to the leading position of the segment.

- By application, the research applications segment held the largest share in 2024. This is driven by extensive use in academic institutions, biotechnology, and pharmaceutical companies for fundamental genomic and proteomic studies, biomarker discovery, and understanding disease mechanisms, supported by consistent funding.

- By end use, the research & academic institutes segment held the largest share in 2024. Their pivotal role in basic and applied research, coupled with substantial funding for genomic and proteomic studies, drives their continuous and extensive adoption of microarray technologies.

Industry Dynamics

- The increasing prevalence of chronic diseases and cancer is a significant driver of the rising demand for microarray.

- Growing demand for personalized medicine and precision oncology greatly contributes to the market expansion.

- Rising investments and funding in genomic and proteomic research also play a key role in the market growth.

- Technological advancements in microarray platforms, including high-density arrays and the integration of AI, are propelling the growth.

Market Statistics

- 2024 Market Size: USD 2.49 billion

- 2034 Projected Market Size: USD 4.45 billion

- CAGR (2025–2034): 6.0%

To Understand More About this Research: Request a Free Sample Report

The U.S. microarray market involves the use of specialized laboratory tools that allow for the simultaneous detection and analysis of thousands of genes or genetic variations. These tools, often in the form of microscope slides with tiny spots of DNA, are crucial for understanding complex biological processes.

The integration of microarray technology with other advanced molecular biology techniques is a significant driver for the U.S. market. While microarrays excel at high-throughput screening for specific targets, combining them with technologies such as Next-Generation Sequencing (NGS) and single-cell genomics offers a more comprehensive view of biological systems. This synergistic approach enables researchers to leverage the strengths of each platform: microarrays for targeted, cost-effective screening, and NGS for deep, unbiased discovery.

Significant advancements in bioinformatics and data analysis tools are profoundly impacting the U.S. microarray landscape by enhancing the utility and interpretability of microarray data. Microarray experiments generate vast amounts of complex data, requiring sophisticated computational methods for proper analysis, visualization, and interpretation. The development of user-friendly software, advanced algorithms, and robust databases allows researchers to extract meaningful biological insights from these large datasets, thereby increasing the value proposition of microarray technology.

Drivers & Opportunities

Increasing Incidence of Chronic Diseases and Cancer: The rising burden of chronic diseases, especially cancer, is a significant driver for the U.S. microarray market growth. Microarrays play a crucial role in cancer research, diagnostics, and the development of targeted therapies by enabling the simultaneous analysis of thousands of genes. This technology helps in identifying cancer-specific biomarkers, profiling gene expression, and guiding personalized treatment regimens. For example, DNA microarrays are used for the diagnosis of various types of cancers, including breast cancer, by identifying mutations in genes such as BRCA1 and BRCA2, as highlighted in a 2022 article from Emergen Research titled "Top 10 Companies in Microarray Analysis Market in 2024." The escalating prevalence of cancer and other chronic conditions significantly enhances the reliance on high-throughput genomic tools such as microarrays for early detection and drug discovery.

Microarrays are also vital in understanding the molecular mechanisms of various diseases. They assist in classifying tumors, identifying target genes of tumor suppressors, and discovering cancer biomarkers. The ability of microarrays to examine thousands of genetic and protein interactions in a single assay makes them essential in discovering new targets and biomarkers in drug discovery research. This widespread application in disease research and diagnostics continues to propel the U.S. microarray forward.

Growing Demand for Personalized Medicine: The increasing demand for personalized medicine propels the demand for microarray across the U.S. Personalized medicine aims to customize medical treatments based on an individual's genetic makeup, enhancing treatment outcomes and minimizing side effects. Microarrays play a crucial role in this field, as they enable comprehensive genomic profiling, which is essential for identifying specific genetic variations that influence disease susceptibility, progression, and response to drug treatment. This capability to tailor therapies based on individual genetic profiles is a key factor driving the rising adoption of microarray technology in the U.S.

Microarray technology supports personalized medicine by enabling pharmacogenomics, where researchers can identify biomarkers and tailor medication regimens to individual patients. This leads to more effective treatments and reduced adverse drug reactions. The continuous advancements in microarray technology, such as enhanced sensitivity and multiplexing capabilities, further support its integration into personalized medicine initiatives. The increasing focus on precision medicine, especially in areas such as precision oncology, continues to drive the demand for microarray instruments and reagents.

Segmental Insights

Product and Services Analysis

Based on product and services, the segmentation includes consumables, software & services, and instruments. The consumables segment held the largest share in 2024, due to the continuous and recurring need for various essential components required to perform microarray experiments. These include specialized microarray slides or chips, a wide array of reagents, labeling kits, and buffers, all of which are expended during each test. Whether in large research laboratories, academic institutions, or diagnostic centers, the volume of experiments conducted necessitates a steady supply of these items. As the applications of microarray technology expand across genomics, proteomics, and clinical diagnostics, the consistent demand for high-quality, reliable consumables remains a primary driver for this segment's substantial contribution to the overall market.

The instruments segment is anticipated to exhibit the highest growth rate during the forecast period. This anticipated growth is largely fueled by the increasing need for advanced automation, enhanced precision, and greater scalability in both molecular diagnostics and complex research applications. Newer instruments often feature improved resolution, faster scanning capabilities, and more integrated data analysis tools, which significantly streamline workflows and improve efficiency. As laboratories aim to process more samples with higher accuracy and reduce manual intervention, the adoption of sophisticated microarray instruments becomes crucial.

Type Analysis

Based on type, the segmentation includes DNA microarrays, protein microarrays, and others. The DNA microarrays segment held the largest share in 2024. These microarrays are fundamental in gene expression profiling, single nucleotide polymorphism (SNP) genotyping, and comparative genomic hybridization (CGH), which are crucial for understanding genetic variations and their impact on health. The maturity and affordability of DNA microarray technology make it a preferred choice for large-scale genomic research and clinical diagnostics. Its extensive utility in identifying genetic markers linked to diseases, facilitating precise treatment decisions in personalized medicine, and supporting the diagnosis of genetic disorders continues to drive its strong presence and dominance in the market.

The protein microarrays segment is anticipated to register the highest growth rate during the forecast period. This accelerated growth is primarily driven by the increasing focus on proteomics, biomarker discovery, and the study of protein interactions, which are critical for understanding disease mechanisms and developing new therapies. Protein microarrays offer unique advantages in analyzing protein expression levels, identifying protein-protein interactions, and screening for potential drug targets. As research shifts toward a more comprehensive understanding of biological systems beyond just genes, the demand for proteome-wide analysis tools becomes paramount.

Application Analysis

Based on application, the segmentation includes research applications, drug discovery, disease diagnostics, and others. The research applications segment held the largest share in 2024. This segment's dominance is driven by the extensive use of microarray technology in various scientific studies conducted by academic institutions, government laboratories, and biotechnology companies. Additionally, microarrays are vital for genotyping, enabling the analysis of genetic variations across populations, and for epigenetics research, which examines changes in gene expression without altering the underlying DNA sequence. These organizations heavily rely on microarrays for fundamental genomics and proteomics research, including gene expression analysis, genetic analysis, genetic variation studies, and biomarker discovery, all of which are crucial for advancing biological understanding and disease insights.

The disease diagnostics segment is anticipated to register the highest growth rate during the forecast period. This accelerated growth is primarily fueled by the increasing integration of microarray technology into clinical settings for advanced diagnostic purposes. Microarrays offer highly multiplexed and accurate methods for diagnosing genetic disorders, detecting infectious diseases, and guiding personalized treatment strategies, particularly in oncology. The rising demand for precise and early disease detection, combined with continuous advancements in diagnostic capabilities and personalized medicine initiatives, is a significant factor propelling the rapid expansion and adoption of microarray-based tests in diagnostic laboratories across the country.

End Use Analysis

Based on end use, the segmentation includes research & academic institutes, pharmaceutical & biotechnology companies, diagnostic laboratories, and others. The research & academic institutes segment held the largest share in 2024. This segment's dominance is attributed to the continuous and extensive use of microarray technology in basic and applied research across universities, government laboratories, and nonprofit research organizations. These institutions are at the forefront of genomic and proteomic studies, disease mechanism elucidation, and biomarker discovery, all of which heavily rely on microarray platforms for high-throughput analysis. The consistent funding for scientific research, often from government sources such as the NIH, also contributes significantly to this segment's leading position. Microarrays are indispensable tools for genetic profiling, gene expression analysis, and understanding complex biological pathways, making them a cornerstone of academic and research endeavors.

The diagnostic laboratories segment is anticipated to register the highest growth rate during the forecast period. This rapid expansion is primarily driven by the increasing adoption of microarray technology for advanced disease diagnostics, including personalized medicine, prenatal screening, and infectious disease testing. Microarrays offer highly multiplexed and accurate methods for detecting genetic abnormalities, identifying pathogens, and assessing an individual's predisposition to certain conditions. As the healthcare landscape shifts toward more precise and tailored diagnostic approaches, the use of microarrays in providing comprehensive genetic insights becomes increasingly valuable. The rising prevalence of chronic and genetic diseases, coupled with advancements in diagnostic capabilities, further propels the demand for microarray-based testing in clinical settings.

Key Players and Competitive Insights

The U.S. microarray market is characterized by a competitive landscape dominated by several established players, including Thermo Fisher Scientific, Agilent Technologies, Illumina, PerkinElmer, and Merck KGaA. These companies often compete on factors such as technological innovation, product breadth, and the ability to provide integrated solutions from sample preparation to data analysis. The market also sees competition from smaller, specialized firms that focus on niche applications or offer highly customized microarray services. The ongoing rivalry is driven by the continuous demand for advanced genomic tools in research, diagnostics, and drug discovery, pushing companies to invest in R&D to enhance microarray sensitivity, throughput, and data interpretation capabilities. A few prominent companies in the industry include Thermo Fisher Scientific Inc.; Agilent Technologies, Inc.; Illumina, Inc.; PerkinElmer Inc.; Merck KGaA; Bio-Rad Laboratories, Inc.; Arrayit Corporation; Microarrays Inc.; Molecular Devices, LLC (Danaher Corporation); and RayBiotech, Inc.

Key Players

- Agilent Technologies, Inc.

- Arrayit Corporation

- Bio-Rad Laboratories, Inc.

- Illumina, Inc.

- Merck KGaA

- Microarrays Inc.

- Molecular Devices, LLC (Danaher Corporation)

- PerkinElmer Inc.

- RayBiotech, Inc.

- Thermo Fisher Scientific Inc.

U.S. Microarray Industry Developments

April 2025: AliveDx submitted a 510(k) premarket notification to the U.S. Food and Drug Administration (FDA) for its MosaiQ Autoimmune Plex (AIPlex) Connective Tissue Diseases (CTDplus) Multiplex Microarray.

February 2025: PathogenDx introduced its rebranded D3 Array assays—Combined, Bacterial, and Fungal—replacing the previous DetectX product line. The D3 Array platform supports multiplex detection of up to 100 targets in a single assay, delivering fast, cost-efficient, and high-throughput testing solutions across agriculture, food safety, environmental, and clinical applications.

U.S. Microarray Market Segmentation

By Product and Services Outlook (Revenue – USD Billion, 2020–2034)

- Consumables

- Software & Services

- Instruments

By Type Outlook (Revenue – USD Billion, 2020–2034)

- DNA Microarrays

- Protein Microarrays

- Others

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Research Applications

- Drug Discovery

- Disease Diagnostics

- Others

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- Research & Academic Institutes

- Pharmaceutical & Biotechnology Companies

- Diagnostic Laboratories

- Others

U.S. Microarray Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.49 billion |

|

Market Size in 2025 |

USD 2.63 billion |

|

Revenue Forecast by 2034 |

USD 4.45 billion |

|

CAGR |

6.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 2.49 billion in 2024 and is projected to grow to USD 4.45 billion by 2034.

The market is projected to register a CAGR of 6.0% during the forecast period.

A few key players in the market include Thermo Fisher Scientific Inc.; Agilent Technologies, Inc.; Illumina, Inc.; PerkinElmer Inc.; Merck KGaA; Bio-Rad Laboratories, Inc.; Arrayit Corporation; Microarrays Inc.; Molecular Devices, LLC (Danaher Corporation); and RayBiotech, Inc

The consumables segment accounted for the largest share of the market in 2024.

The protein microarrays segment is expected to witness the fastest growth during the forecast period.