Asphalt Additive Market Size, Share, Trends, Industry Analysis Report

By Technology (Hot Mix, Cold Mix, Warm Mix), By Application, By Type, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 125

- Format: PDF

- Report ID: PM6044

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

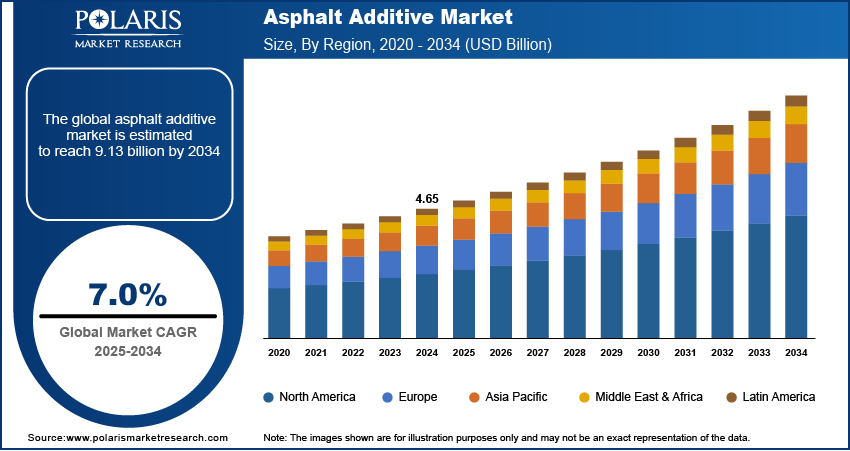

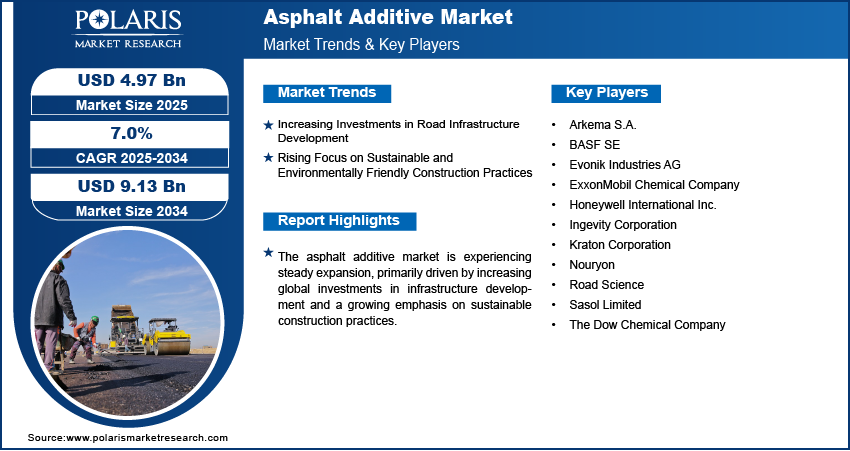

The global asphalt additive market size was valued at USD 4.65 billion in 2024 and is anticipated to register a CAGR of 7.0% from 2025 to 2034. The asphalt additive market is driven by rising infrastructure development, increasing demand for durable roads, and growing awareness of sustainable construction. Advancements in additive technologies and government initiatives for improved transportation networks further fuel market growth globally.

Key Insights

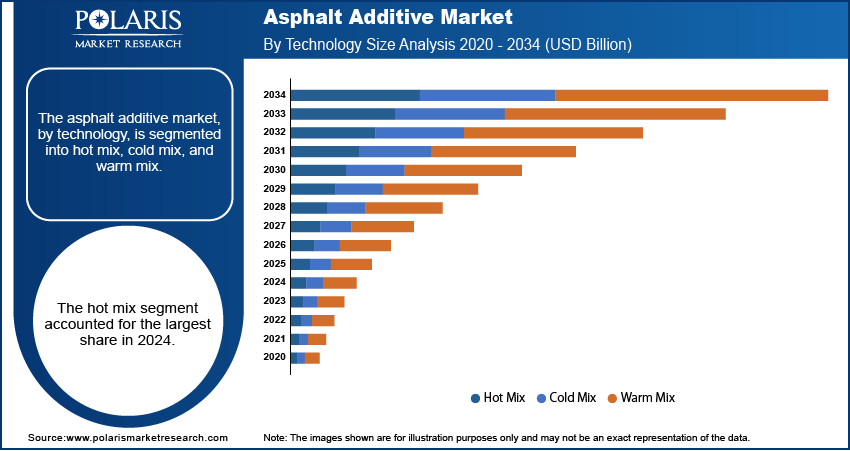

- By technology, the hot mix asphalt segment held the largest share in 2024, due to its long-standing use and proven performance in various infrastructure projects worldwide. Its established reliability and widespread application in road construction drive its continued dominance.

- By application, the road construction and paving segment held the largest share in 2024, driven by the extensive global network of roads requiring continuous building, maintenance, and repair.

- By type, the polymeric modifiers segment held the largest share in 2024, as they significantly enhance asphalt properties such as elasticity and resistance to rutting and cracking. Their crucial role in improving the longevity and performance of high-traffic pavements contributes to their widespread adoption and leadership.

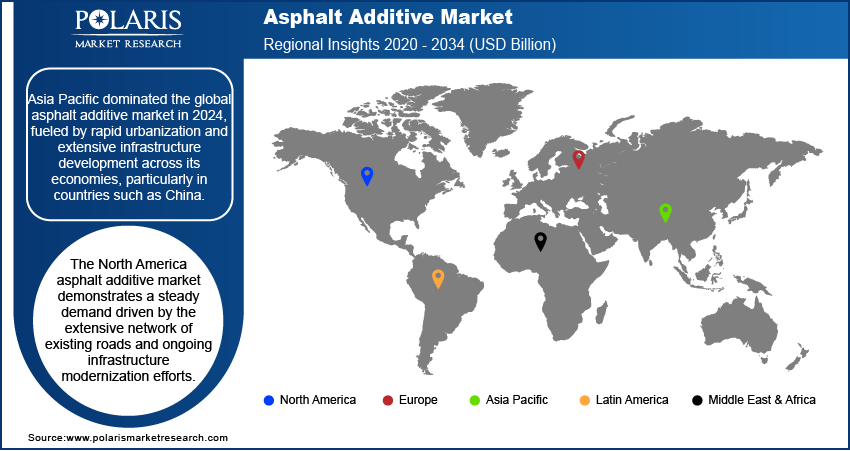

- By region, Asia Pacific dominated the global market in 2024, fueled by rapid urbanization and extensive infrastructure development across its economies, particularly in countries such as China.

Industry Dynamics

- Increasing investments in road infrastructure development are continuously boosting the demand for asphalt additives as governments focus on expanding and upgrading transportation networks.

- The growing demand for durable and high-performance pavements is a key driver, as these additives enhance the lifespan and resilience of roads against wear and tear.

- A rising focus on sustainable and environmentally friendly construction practices promotes the use of additives that support greener paving technologies and recycled materials.

- Ongoing technological advancements in asphalt additive formulations are leading to the development of innovative products that offer superior performance and cater to specific construction needs.

Market Statistics

- 2024 Market Size: USD 4.65 billion

- 2034 Projected Market Size: USD 9.13 billion

- CAGR (2025–2034): 7.0%

- Asia Pacific: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

Asphalt additives are specialized materials blended into asphalt binders or mixtures to enhance the performance and durability of pavements. These additives improve properties such as resistance to cracking, rutting, and moisture damage, ultimately extending the lifespan of roads and reducing maintenance needs.

The asphalt additive market is significantly driven by the increasing global focus on pavement preservation and maintenance rather than solely on new construction. As existing road networks age and face heavier traffic loads, the need to extend their service life and improve performance becomes critical. Preservation techniques, such as surface treatments, thin overlays, and crack sealing, often incorporate asphalt additives to enhance the effectiveness and durability of these interventions. This approach is more cost-effective and less disruptive than full reconstruction, leading governments and road authorities to invest heavily in preservation programs.

The escalating impacts of climate change, including more frequent extreme weather events and rising temperatures, are creating a strong demand for more resilient infrastructure, which drives the industry growth. Pavements are increasingly exposed to stressors as intense heat waves, heavy precipitation, and freeze-thaw cycles that can accelerate deterioration and lead to premature failure. Consequently, there is a growing imperative to design and construct roads that can better withstand these challenging environmental conditions, ensuring long-term performance and minimizing costly repairs and disruptions.

Drivers & Opportunities

Increasing Investments in Road Infrastructure Development: Governments worldwide are prioritizing the expansion, maintenance, and rehabilitation of their transportation networks to support economic growth, improve connectivity, and enhance public safety. This surge in construction and repair activities directly translates into a higher demand for asphalt, and consequently, for additives that can improve its performance and longevity.

The Government of India has shown a strong commitment to modernizing its road network, as highlighted in the Economic Times Government blog post "Sustainable Roads, Stronger Nation: Paving India's path to lasting infrastructure" in 2025, which states that roads are expected to account for 18% of the total capital expenditure in infrastructure. This substantial investment underscores the continuous need for advanced materials, including asphalt additives, to ensure the durability and efficiency of newly constructed and upgraded roads. This sustained investment in road infrastructure development is a key factor propelling the growth.

Rising Focus on Sustainable and Environmentally Friendly Construction Practices: There is a growing push to minimize the environmental impact of road construction, reduce carbon footprints, and conserve natural resources. This has led to a greater adoption of practices such as recycling old asphalt pavement (RAP) and using warm mix asphalt (WMA) technologies, both of which benefit from the incorporation of specific additives and asphalt pavers.

The Ministry of Rural Development, Government of India, in their "New Technologies Innovations In Rural Roads" document published in 2022, highlighted that over 70,000 km of rural roads have been constructed using new and green technologies under the Pradhan Mantri Gram Sadak Yojana (PMGSY). These technologies often involve materials and methods that reduce energy consumption and emissions, such as cold mix and stabilization using chemical or commercial stabilizers, which are types of asphalt additives. This rising emphasis on sustainable and eco-friendly construction methods is actively driving the demand for asphalt additives that facilitate these greener approaches, including green coatings.

Segmental Insights

Technology Analysis

Based on technology, the segmentation includes hot mix, cold mix, and warm mix. The hot mix segment held the largest share in 2024. Hot mix asphalt (HMA) has been the traditional and most widely used method for paving roads and other surfaces for decades due to its proven performance and durability under various traffic loads and environmental conditions. The widespread adoption of HMA in major infrastructure projects globally means that additives designed for this technology are in constant high demand. These additives enhance properties such as strength, resistance to rutting, and overall pavement lifespan, making HMA a preferred choice for large-scale, long-term road construction and rehabilitation efforts, thereby driving the sustained dominance of its associated additives.

The warm mix asphalt (WMA) segment is anticipated to register the highest growth rate during the forecast period, fueled by the increasing global focus on sustainability, environmental protection, and energy efficiency in the construction industry. WMA technologies allow asphalt mixtures to be produced and placed at lower temperatures compared to traditional HMA, leading to significant reductions in fuel consumption and greenhouse gas emissions. Governments and regulatory bodies worldwide are promoting the adoption of WMA through various initiatives and policies aimed at reducing the carbon footprint of infrastructure projects. The additives specifically formulated for WMA improve workability and compaction at these reduced temperatures, enabling smoother operations and extended paving seasons, which collectively boosts the penetration of WMA additives.

Application Analysis

Based on application, the segmentation includes road construction & paving, roofing, airport construction, and others. The road construction & paving segment held the largest share in 2024. This is primarily attributed to the sheer volume of road networks globally, which constantly require construction, maintenance, and repair. Asphalt is the material of choice for the vast majority of roads, from national highways to local streets, because of its cost-effectiveness, versatility, and ability to withstand heavy traffic loads. Additives are essential in these applications to improve pavement performance, enhance durability against wear and tear, prevent cracking and rutting, and extend the lifespan of roads, thereby reducing long-term maintenance costs. The continuous need for resilient and high-performance road infrastructure to support global transportation and economic activity ensures this segment's continued leadership in asphalt additive demand.

The airport construction segment is anticipated to record the highest growth rate during the forecast period. This growth is driven by increasing air traffic globally, along with air traffic management, which necessitates the expansion and modernization of existing airport infrastructure and the construction of new runways and taxiways. Airport pavements are subjected to extremely heavy loads from aircraft and require superior structural integrity, flexibility, and resistance to deformation compared to typical roads. Asphalt additives play a crucial role in meeting these stringent performance requirements by enhancing the pavement's resistance to extreme temperatures, jet fuel spills, and constant heavy-duty cycles.

Type Analysis

Based on type, the segmentation includes polymeric modifiers, anti-strip & adhesion promoters, emulsifiers, rejuvenators, chemical modifiers, fibers, flux oil, colored asphalt, and others. The polymeric modifiers segment held the largest share in 2024. These additives, often based on polymers such as styrene-butadiene-styrene (SBS) or ethylene-vinyl acetate (EVA), are widely used to significantly enhance the performance characteristics of asphalt pavements. They improve elasticity, resistance to permanent deformation such as rutting, and reduce low-temperature cracking, making roads more durable and capable of withstanding heavy traffic loads and varying climatic conditions. The widespread and long-standing acceptance of polymer-modified asphalt in critical infrastructure projects, particularly for high-traffic highways and demanding applications, underscores the sustained demand and dominant position of these types of additives.

The rejuvenators segment is anticipated to exhibit the highest growth rate during the forecast period. This accelerated growth is largely driven by the increasing global emphasis on sustainable construction practices and the growing trend of recycling asphalt pavements. As more recycled asphalt pavement (RAP) is incorporated into new asphalt mixtures, rejuvenators become crucial for restoring the original properties of the aged binder. These additives help soften and revitalize the stiff, brittle asphalt from RAP, improving its workability and ensuring that the final pavement performs comparably to those made with virgin materials. The push for circular economy principles and reduced environmental impact in road construction, coupled with the economic benefits of using recycled materials, is strongly propelling the demand and market penetration of rejuvenators.

Regional Analysis

The Asia Pacific asphalt additive market accounted for the largest share in 2024, propelled by extensive infrastructure development across its diverse economies. Rapid urbanization, population growth, and increasing industrial activities are driving massive investments in building new roads, highways, and transportation hubs. This high volume of new construction projects creates substantial demand for asphalt and, consequently, for additives to ensure the durability and performance of these rapidly expanding networks. The region also sees a growing awareness of pavement longevity and maintenance efficiency, encouraging the adoption of advanced additive technologies to meet evolving infrastructure requirements.

China Asphalt Additive Market Overview

In Asia Pacific, China stands out as a key driver. The country has undertaken monumental infrastructure expansion projects over the past decades, including an extensive network of expressways, and continues to invest heavily in modernizing its transportation systems. This ongoing focus on infrastructure development, coupled with an increasing emphasis on improving road quality and incorporating sustainable construction practices, fuels a significant demand for asphalt additives. China's large scale of construction activities and its efforts to implement advanced paving technologies position it as a major consumer and innovator in the regional asphalt additive landscape.

North America Asphalt Additive Market Insights

The North America market witnesses a steady demand driven by the extensive network of existing roads and ongoing infrastructure modernization efforts. A significant focus on maintaining and upgrading aging infrastructure across the region, coupled with the need to enhance pavement durability against varying climate conditions, fuels the use of these additives. The region also shows a growing inclination toward sustainable paving solutions, which is encouraging the adoption of additives that support warm mix asphalt technologies and the incorporation of recycled materials in road construction projects. This emphasis on long-term performance and environmental responsibility contributes to the stable outlook for asphalt additives in North America.

U.S. Asphalt Additive Market Trends

The U.S. holds a substantial share of the North America asphalt additive market. The country's vast road network necessitates continuous investments in repair, rehabilitation, and new construction. Recent government initiatives aimed at boosting infrastructure spending, such as significant legislative acts, are providing a strong impetus for the demand for asphalt additives. These policies prioritize the improvement of road quality and longevity, leading to increased adoption of additives that enhance pavement resistance to cracking, rutting, and moisture damage. Furthermore, a rising focus on the carbon footprint management of construction projects is driving the use of additives that enable lower temperature asphalt production and greater use of recycled content, shaping the demand trends across the U.S.

Europe Asphalt Additive Market Outlook

The Europe market growth is fueled by a strong emphasis on high-quality infrastructure and increasing environmental regulations. Countries across the region are committed to maintaining advanced road networks while also pursuing ambitious sustainability goals. This dual focus drives the demand for asphalt additives that improve pavement performance and lifespan, as well as support greener construction practices, such as the use of warm mix asphalt and increased recycling of materials. The region's mature infrastructure and stringent quality standards ensure a consistent need for innovative additive solutions to address challenges such as heavy traffic, diverse weather patterns, and the desire for quieter pavements.

The Germany asphalt additive market has a robust infrastructure and strong commitment to engineering excellence and environmental protection. German road authorities and construction companies prioritize durable and long-lasting road surfaces that can withstand significant traffic loads and harsh winter conditions. This focus on performance naturally leads to a high demand for asphalt additives that improve properties such as rutting resistance and low-temperature cracking. Moreover, Germany has been at the forefront of adopting sustainable technologies in construction, including efforts to reduce energy consumption and emissions in asphalt production, which further supports the use of specific additives that facilitate these greener methods.

Key Players and Competitive Insights

The field of asphalt additive features a competitive landscape with the presence of several key players, including Dow, Arkema, BASF, Evonik, Ingevity, and Kraton Corporation. These companies often compete on factors such as product innovation, technical support, global reach, and the ability to offer specialized solutions for various asphalt applications. The market is characterized by ongoing research and development aimed at creating more sustainable and higher-performance additives, driving continuous product evolution. Competition also revolves around forming strategic partnerships with road construction firms and government agencies to ensure product adoption and specification in major infrastructure projects.

A few prominent companies in the landscape include The Dow Chemical Company, Arkema S.A., BASF SE, Evonik Industries AG, Ingevity Corporation, Kraton Corporation, Honeywell International Inc., Nouryon, ExxonMobil Chemical Company, Sasol Limited, and Road Science.

Key Players

- Arkema S.A.

- BASF SE

- Evonik Industries AG

- ExxonMobil Chemical Company

- Honeywell International Inc.

- Ingevity Corporation

- Kraton Corporation

- Nouryon

- Road Science

- Sasol Limited

- The Dow Chemical Company

Asphalt Additive Industry Developments

April 2025: Kraton Corporation launched its new CirKular+ Paving Circularity Series, with an aim to maximize the reuse of reclaimed asphalt.

May 2024: BASF announced an investment in the expansion of its advanced additives plant at its Nanjing site in China. This expansion includes a new production line for high-performance dispersants, driven by the rapidly growing market demand in Asia.

Asphalt Additive Market Segmentation

By Technology Outlook (Revenue – USD Billion, 2020–2034)

- Hot Mix

- Cold Mix

- Warm Mix

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Road Construction & Paving

- Roofing

- Airport Construction

- Others

By Type Outlook (Revenue – USD Billion, 2020–2034)

- Polymeric Modifiers

- Anti-strip & Adhesion Promoters

- Emulsifiers

- Rejuvenators

- Chemical Modifiers

- Fibers

- Flux Oil

- Colored Asphalt

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Asphalt Additive Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 4.65 billion |

|

Market Size in 2025 |

USD 4.97 billion |

|

Revenue Forecast by 2034 |

USD 9.13 billion |

|

CAGR |

7.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 4.65 billion in 2024 and is projected to grow to USD 9.13 billion by 2034.

The global market is projected to register a CAGR of 7.0% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few key players include The Dow Chemical Company, Arkema S.A., BASF SE, Evonik Industries AG, Ingevity Corporation, Kraton Corporation, Honeywell International Inc., Nouryon, ExxonMobil Chemical Company, Sasol Limited, and Road Science.

The hot mix segment accounted for the largest share of the market in 2024.

The road construction and paving segment is expected to witness the fastest growth during the forecast period.