Solid State Battery Market Size, Share, Trends, Industry Analysis Report

By Battery Type (Thin Film Battery, Portable Battery), By Capacity, By Application, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6041

- Base Year: 2024

- Historical Data: 2020-2023

Overview

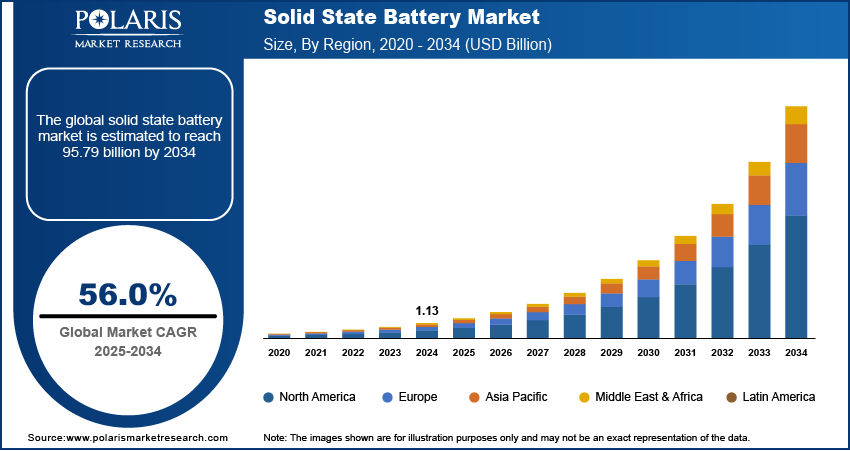

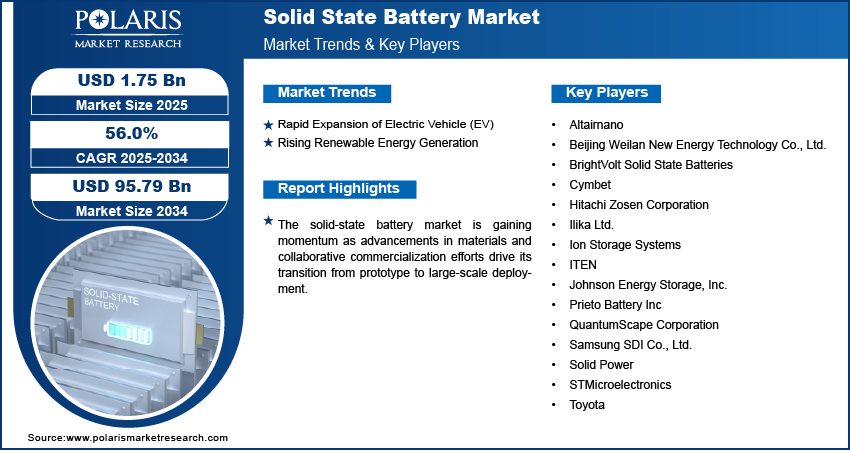

The global solid state battery market size was valued at USD 1.13 billion in 2024, growing at a CAGR of 56.0% from 2025 to 2034. Key factors driving demand solid state batteries include ongoing innovation and advancements in manufacturing, technological progress, robust government incentives, broad policy support, the rapid expansion of electric vehicles (EVs), and rising renewable energy generation.

Key Insights

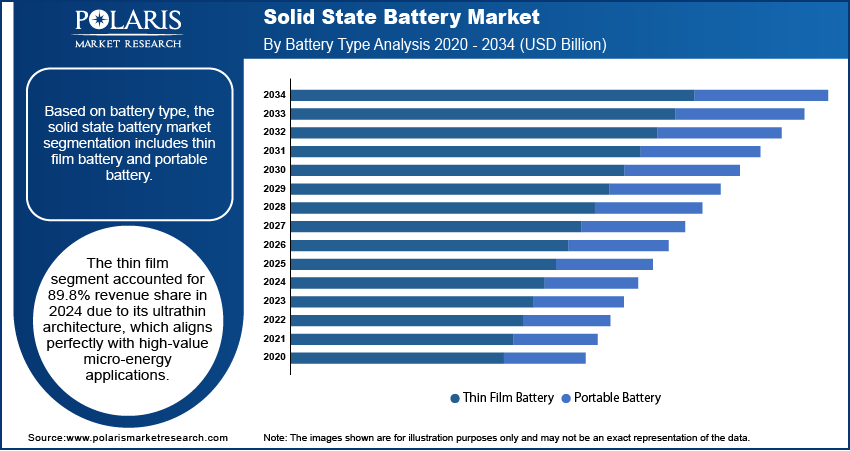

- The thin film segment accounted for 89.8% revenue share in 2024 due to their ultrathin architecture. which aligns perfectly with high‑value micro‑energy applications.

- The below 20mAh is expected to witness the highest CAGR of 62.7% during the forecast period, due to the needs of the expanding IoT technology.

- The electric vehicles segment is expected to register a CAGR of 64.2% during the forecast period, driven by the advantages of solid-state cells in addressing range, safety, and charging time.

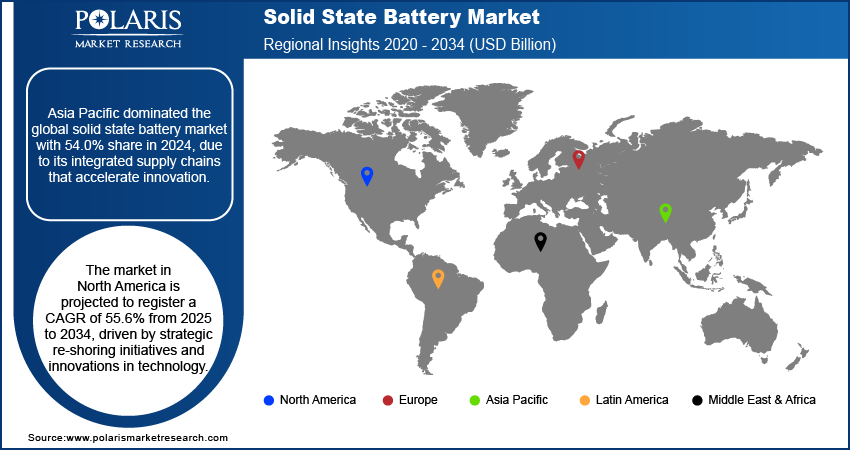

- The Asia Pacific solid state battery market dominated with 54.0% global revenue share in 2024. This dominance is attributed to its integrated supply chains that accelerate innovation.

- The market in North America is projected to register a CAGR of 55.6% from 2025 to 2034, driven by strategic re-shoring initiatives and technological innovations.

- The market in the U.S. is expanding due to the convergence of deep technological expertise, federal support for clean energy innovation, and rising demand for next-generation battery systems.

Industry Dynamics

- The rapid growth of the EV sector is accelerating demand for advanced energy storage, with solid-state batteries emerging as a superior alternative due to enhanced safety, faster charging, and longer lifespan than conventional lithium-ion batteries.

- The growing focus on adopting solar and wind power is increasing the need for reliable, long-lasting energy storage, positioning solid-state batteries as a promising solution due to their efficiency and scalability.

- The solid-state battery industry faces high costs and material scarcity, which limits its commercialization and adoption.

- Advancements in solid electrolytes and anode-free designs enhance energy density and lower costs. Collaborating with EV makers on pilot projects creates a path to dominance as demand for high-performance storage increases.

Market Statistics

- 2024 Market Size: USD 1.13 billion

- 2034 Projected Market Size: USD 95.79 billion

- CAGR (2025–2034): 56.0%

- Asia Pacific: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

Solid-state batteries are electrochemical energy-storage cells that utilize a solid electrolyte instead of the liquid or gel found in conventional lithium-ion designs, unlocking higher energy density and inherent safety advantages. The ongoing innovation and advancements in manufacturing are boosting growth opportunities. Continuous R&D is producing solid electrolytes with wider electrochemical windows and better ionic conductivity, while breakthroughs in anode engineering, such as stabilized lithium-metal interfaces, push capacity limits higher.

Scalable techniques such as dry-film casting, roll-to-roll deposition, and multi-layer ceramic lamination are being developed, which improve production yields and reduce defect rates compared to lab-scale methods. For instance, in June 2024, TDK Corporation developed a high-energy-density material for its CeraCharge solid-state battery, achieving 1,000 Wh/L, which is 100 times denser than its previous versions. Moreover, equipment vendors are integrating inline quality-control analytics and AI-driven process optimization, accelerating the transition from pilot lines to gigafactory-scale output. These manufacturing efficiencies shorten the time-to-market, lower per-kilowatt-hour costs, and strengthen the commercial viability of solid-state solutions across automotive, consumer electronics, and stationary storage applications.

Rapid technological advancements, robust government incentives, and broad policy support for sustainable technologies drive the expansion opportunities. De-carbonization roadmaps in major economies include strategies such as subsidies, tax credits, and low-interest financing that help offset the capital expenditures required for next-generation battery cell plants. At the same time, targeted research and development grants promote collaborative research on solid electrolytes, interface chemistry, and high-volume fabrication. Zero-emission vehicle mandates create predictable demand, thereby reducing investment risks in advanced battery technologies as vehicle emission standards become increasingly strict. Additionally, public procurement programs for grid storage and defense applications serve as anchor customers, providing long-term offtake agreements that stabilize revenue forecasts.

Drivers and Opportunities

Rapid Expansion of Electric Vehicle (EV): The rapid expansion of electric vehicles (EVs) is driven by increasing demand for safer, longer-lasting, and higher-energy-density storage solutions. According to a 2025 IEA report, global electric vehicle sales surpassed 17 million units in 2024, representing a year-over-year growth rate of over 25%. Solid-state batteries offer considerable advantages over traditional lithium-ion technologies, such as improved thermal stability, faster charging capabilities, and extended lifecycle performance, characteristics that align with the evolving needs of the EV sector. Solid-state technology is emerging as a major enabler of next-generation EV platforms as automakers aim to enhance vehicle range and safety while optimizing battery weight and size. This growing alignment between EV performance requirements and the benefits of solid-state batteries is accelerating research, investments, and integration across the automotive environment.

Rising Renewable Energy Generation: The rising renewable energy generation across solar and wind infrastructure drives the demand for efficient, durable, and scalable energy storage systems, making solid-state batteries an attractive option. According to a 2024 IEA report, renewable energy use across power, heat, and transport is expected to surge nearly 60% by 2030, increasing the renewables share of global energy consumption from 13% in 2023 to nearly 20%. Renewable energy sources are inherently unstable, necessitating robust storage solutions to maintain grid reliability and ensure energy availability during periods when they are not generating power. These batteries provide higher energy density, reduced degradation, and improved cycle life, which are critical for supporting long-duration storage and frequent charge-discharge cycles in renewable-integrated systems. Their potential for safer and more compact storage also aligns with the spatial and operational needs of modern renewable installations, positioning them as a strategic component in the global transition toward low-carbon energy ecosystems.

Segmental Insights

Battery Type Analysis

Based on battery type, the segmentation includes thin film battery and portable battery. The thin film segment accounted for 89.8% revenue share in 2024 due to their ultrathin architecture. which aligns perfectly with high‑value micro‑energy applications. Vacuum deposition techniques such as sputtering and atomic‑layer deposition allow electrodes and solid electrolytes to be applied directly onto semiconductor wafers, delivering seamless integration with ICs and sensors. The resulting cells achieve superior volumetric energy density at sub-millimeter thickness, enabling always-on power inside smart cards, RF tags, and implantable devices where space is at a premium. Their inorganic, non-flammable electrolytes also mitigate leakage and thermal-runaway risks that disqualify liquid-filled coin cells in miniaturized electronics. Collectively, these technical and manufacturing advantages focus market value on thin-film formats, despite their relatively small absolute capacity.

Capacity Analysis

In terms of capacity, the segmentation includes below 20mAh, 20mAh–500mAh, and above 500mAh. The below 20mAh is expected to witness the highest CAGR of 62.7% during the forecast period, due to the needs of the expanding IoT technology. Microwatt-level duty cycles in devices such as edge sensors and biomedical patches prioritize energy efficiency over bulk storage. Solid-state micro batteries in this range offer high pulse currents, rapid recharging from ambient energy, and extended cycle life, thereby reducing maintenance needs. Their sealed construction meets biocompatibility and transport standards, broadening applications from disposable diagnostics to secure packaging. Therefore, as designers move from coin cells to integrated power chips, demand in the lowest-capacity segment is increasing, significantly boosting overall growth.

Application Analysis

The segmentation, based on application, includes consumer & portable electronics, electric vehicles, energy harvesting, wearable & medical devices, and others. The electric vehicles segment is expected to register a CAGR of 64.2% during the forecast period, driven by the advantages of solid-state cells in addressing range, safety, and charging time. These cells enhance energy density without increasing the weight of EV and provide a naturally safer design that simplifies thermal management by replacing flammable liquid electrolytes with solid ceramics. Improved ion mobility reduces charging times, which is crucial for consumer acceptance. Investments in solid-state production, packaging, and recycling further strengthen its position in the EV sector, making it the primary driver of demand for propulsion batteries.

Regional Analysis

The Asia Pacific solid state battery market dominated with 54.0% global revenue share in 2024. This dominance is attributed to its integrated supply chains that accelerate innovation. A strong network of material suppliers and manufacturing service providers facilitates quick transitions from prototypes to production. Government support for next-generation energy storage promotes the development of local pilot lines, which are subsequently scaled up to large-scale facilities. According to a June 2025 report by the Ministry of New and Renewable Energy, India's energy storage sector is projected to attract USD 57.4 billion in investments by 2032. The CEA estimates a requirement of 411.4 GWh of storage systems, combining pumped hydro and battery storage. High domestic demand for smartphones, wearables, and electric vehicles also stabilizes utilization rates as production ramps up. At the same time, established logistics infrastructure lowers distribution costs, thereby solidifying the region's role in the deployment of solid-state batteries.

China Solid State Battery Market Insights

China held a 77.79% share of the Asia Pacific solid state battery landscape in 2024 due to its strong manufacturing ecosystem, proactive industrial policies, and large-scale domestic demand. The country benefits from a vertically integrated battery supply chain, spanning raw materials, cell production, and EV assembly, which enables rapid scaling of advanced battery technologies. Additionally, government-backed programs and extensive R&D investments have positioned China at the forefront of solid-state battery commercialization, with strong pull from its fast-growing consumer electronics and electric mobility sectors reinforcing domestic adoption.

North America Solid State Battery Market Assessment

The market in North America is projected to register a CAGR of 55.6% from 2025 to 2034, driven by strategic re-shoring initiatives and technological innovations. Federal and state incentives mitigate risks for cell-manufacturing start-ups, while long-term agreements with automakers ensure stable demand. A robust venture capital environment encourages breakthroughs in electrolytes and interfaces, enabling the rapid translation of research into pilot-scale validation. Additionally, grid modernization programs require resilient storage solutions for renewable energy, creating strong demand in both mobility and stationary sectors. These factors contribute to sustained double-digit growth, reflecting the global average.

U.S. Solid State Battery Market Overview

The market in the U.S. is expanding due to the convergence of deep technological expertise, federal support for clean energy innovation, and rising demand for next-generation battery systems. Public and private investments are accelerating pilot-scale production and advanced materials research, particularly in solid electrolytes and lithium-metal anodes. Simultaneously, the growing adoption of EVs and grid storage solutions is creating a favorable environment, encouraging domestic firms to develop solid-state battery technologies for both mobility and energy infrastructure applications.

Europe Solid State Battery Market Trend

The market in Europe is projected to hold a substantial share by 2034, driven by regulatory, industrial, and sustainability trends that favor the adoption of solid-state batteries. The region's strict carbon reduction policies encourage battery chemistries with greater energy density and extended lifespan, which are essential features of solid-state designs. Collaborative R&D initiatives and pilot-line scaling, backed by public–private partnerships, are underway as the automotive and aerospace sectors seek solid-state solutions to meet their emissions targets. This development positions Europe for a strong presence as it continues to develop.

Germany Solid State Battery Market Analysis

The growth of the Germany solid state battery sector is driven by its strong automotive engineering base, environmental policy mandates, and focus on advanced manufacturing. Leading OEMs and Tier-1 suppliers are actively investing in solid-state battery research and development (R&D) to meet future emission targets and performance standards. Additionally, Germany’s commitment to industrial innovation and digitalized production supports the integration of solid-state technology into existing manufacturing workflows, thereby strengthening the country’s position as an essential European hub for next-generation battery development.

Key Players and Competitive Analysis

The solid-state battery industry is poised for revenue growth, driven by the emerging sector and technological advancements. Key players are leveraging competitive intelligence and strategy to capitalize on latent demand and opportunities, particularly in developed markets where sustainable value chains are prioritized. Strategic investments in R&D and partnerships are accelerating innovation, while economic and geopolitical shifts influence supply chain dynamics. Disruptions and trends, such as the push for higher energy density and safety, are reshaping industry trends, with small and medium-sized businesses playing a crucial role in niche applications. Growth projections indicate strong adoption in EVs and consumer electronics, supported by expert insights on the future of the industry. Leading companies are focusing on expansion opportunities, regional footprint optimization, and product offerings to maintain a competitive positioning in this rapidly evolving sector. However, market players face challenges such as high production costs and scalability.

A few major companies operating in the solid state battery industry include Altairnano; Beijing Weilan New Energy Technology Co., Ltd.; BrightVolt Solid State Batteries; Cymbet; Hitachi Zosen Corporation; Ilika Ltd.; Ion Storage Systems; ITEN; Johnson Energy Storage, Inc.; Prieto Battery Inc; QuantumScape Corporation; Samsung SDI Co., Ltd.; Solid Power; STMicroelectronics; and Toyota.

Key Players

- Altairnano

- Beijing Weilan New Energy Technology Co., Ltd.

- BrightVolt

- Cymbet

- Hitachi Zosen Corporation

- Ilika Ltd.

- Ion Storage Systems

- ITEN

- Johnson Energy Storage, Inc.

- Prieto Battery Inc

- QuantumScape Corporation

- Samsung SDI Co., Ltd.

- Solid Power

- STMicroelectronics

- Toyota

Solid State Battery Industry Developments

- April 2025: Stellantis and Factorial Energy developed solid-state battery cells (375Wh/kg) with fast charging (-30°C to 45°C range). The FEST tech enables 15–90% charge in 18 minutes.

- February 2025: Mercedes-Benz and Factorial Energy successfully tested a lithium-metal solid-state battery in a modified EQS. Developed with F1 expertise, the prototype underwent lab and road tests after integration in late 2024.

- January 2025: Microvast developed all-solid-state battery (ASSB) tech, enhancing safety and energy density. The development targets data centers, electric school buses, and future applications in robotics and EVs, marking progress in advanced energy storage solutions.

Solid State Battery Market Segmentation

By Battery Type Outlook (Revenue, USD Billion, 2020–2034)

- Thin Film Battery

- Portable Battery

By Capacity Outlook (Revenue, USD Billion, 2020–2034)

- Below 20mAh

- 20mAh–500mAh

- Above 500mAh

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Consumer & Portable Electronics

- Electric Vehicles

- Energy Harvesting

- Wearable & Medical Devices

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Solid State Battery Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.13 Billion |

|

Market Size in 2025 |

USD 1.75 Billion |

|

Revenue Forecast by 2034 |

USD 95.79 Billion |

|

CAGR |

56.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.13 billion in 2024 and is projected to grow to USD 95.79 billion by 2034.

The global market is projected to register a CAGR of 56.0% during the forecast period.

Asia Pacific dominated the market with 54.0% revenue share in 2024.

A few of the key players in the market are Altairnano; Beijing Weilan New Energy Technology Co., Ltd.; BrightVolt Solid State Batteries; Cymbet; Hitachi Zosen Corporation; Ilika Ltd.; Ion Storage Systems; ITEN; Johnson Energy Storage, Inc.; Prieto Battery Inc; QuantumScape Corporation; Samsung SDI Co., Ltd.; Solid Power; STMicroelectronics; and Toyota.

The thin film segment dominated the market with 89.8% revenue share in 2024.

The below 20mAh segment is expected to witness the highest CAGR of 62.7% during the forecast period.