Trichloroethylene and Perchloroethylene Market Size, Share, Trends, & Industry Analysis Report

By Type (Trichloroethylene, Perchloroethylene), By Application, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 120

- Format: PDF

- Report ID: PM6033

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

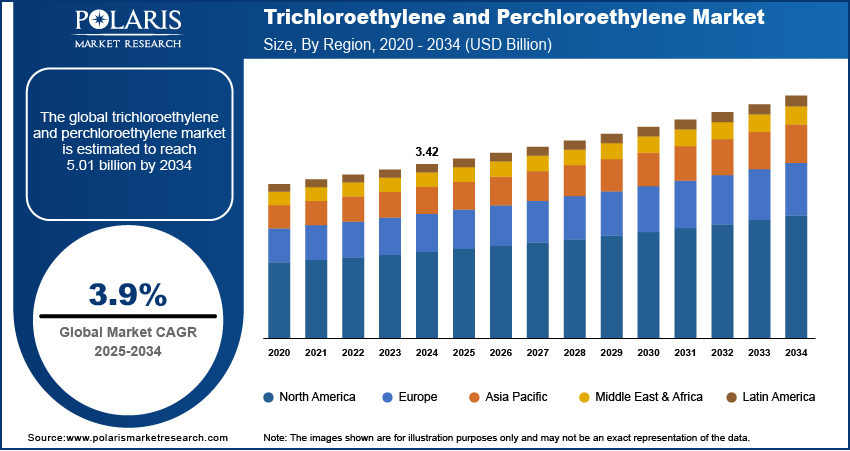

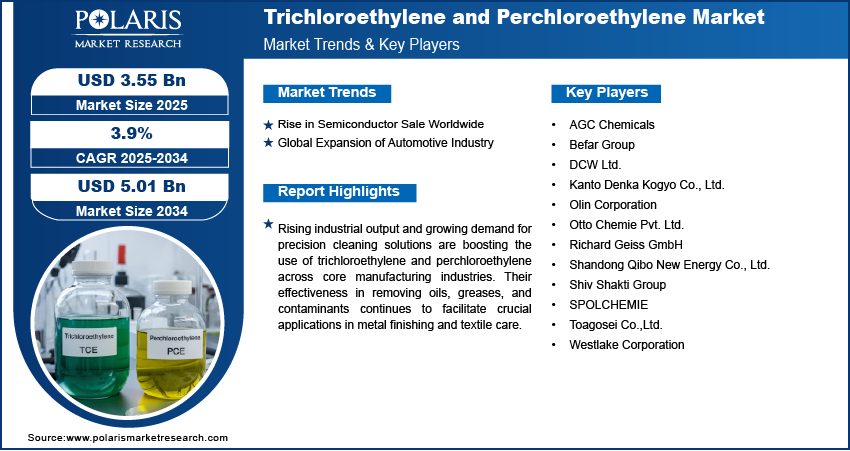

The global trichloroethylene and perchloroethylene market size was valued at USD 3.42 billion in 2024, growing at a CAGR of 3.9% during 2025–2034. Rising semiconductor sales and expanding automotive manufacturing are boosting demand for high-performance industrial solvents.

Key Insights

- The trichloroethylene segment accounted for 55% market share in 2024.

- The hydro-fluorocarbon refrigerants segment is projected to grow at a rapid pace in the coming years, driven by rising demand for efficient cooling systems and the need for high-purity solvents in refrigerant-grade manufacturing.

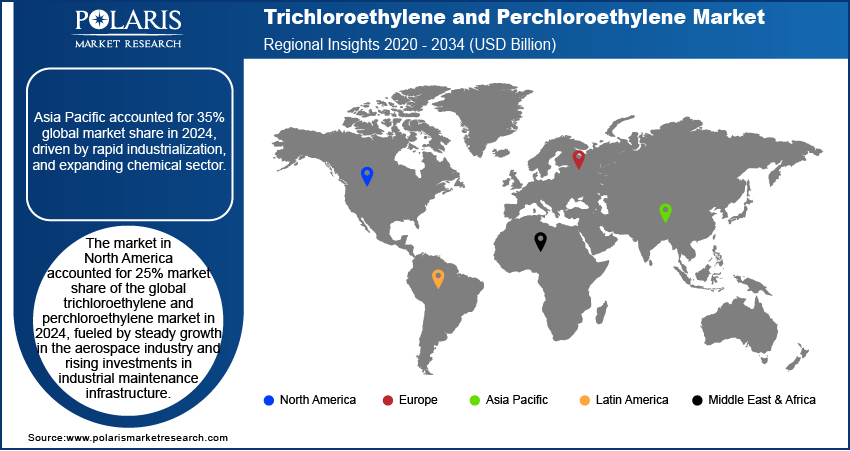

- North America accounted for 25% of the global trichloroethylene and perchloroethylene market share in 2024

- The U.S. trichloroethylene and perchloroethylene market held significant share of the North America landscape in 2024, backed by robust infrastructure in defense that require precision cleaning and metal surface treatment.

- The Asia Pacific trichloroethylene and perchloroethylene industry accounted for 35% share in 2024.

- Countries such as China and Japan are playing a key role in regional growth, due to their expanding industrial base and strong presence in electronics, chemical, and automotive production.

Industry Dynamics

- Rising global semiconductor sales worldwide is increasing demand for trichloroethylene and perchloroethylene due to its extensive use in precision cleaning during chip fabrication and electronics assembly.

- The expansion of the automotive industry worldwide is driving demand for trichloroethylene and perchloroethylene, driven by the increasing use in metal degreasing and component cleaning.

- The increasing focus on low-toxicity and high-purity grades of trichloroethylene (TCE) for hydrofluorocarbon (HFC) production is creating new market opportunities, as manufacturers aim to reduce processing-related emissions and meet environmental compliance standards.

- The health concerns linked to prolonged solvent exposure are enhancing stricter usage norms and shifting preference toward safer alternatives, potentially limiting market growth.

Market Statistics

- 2024 Market Size: 3.42 billion

- 2034 Projected Market Size: 3.55 billion

- CAGR (2025-2034): 3.9%

- Asia Pacific: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

Trichloroethylene (TCE) and perchloroethylene are chlorinated solvents widely used in industrial and commercial applications for their strong degreasing and cleaning properties. Trichloroethylene is primarily used for metal degreasing, chemical processing, and act as an intermediate in refrigerant production. Perchloroethylene is commonly used in dry cleaning operations, as well as in cleaning electronics, automotive parts, and precision components. These solvents are used across industries such as manufacturing, aerospace, automotive, and textiles for their strong cleaning ability, chemical stability and ease of use in vapor-based systems. Many industrial users and service providers are adopting improved handling systems and evaluating alternative formulations to meet compliance requirements while maintaining operational efficiency.

The rising pace of urbanization and infrastructure development is driving growth in the trichloroethylene and perchloroethylene market due to increasing demand for industrial solvents and degreasing agents in construction, HVAC accessories, and manufacturing operations. According to the United Nations, urban population accounted to 57% of the global population and it is expected to reach 68% by 2050. Therefore, the migration of more people to cities creates the need for efficient cleaning agents, degreasers and processing chemicals while driving market growth across urban-centric industries.

The rising investment in the global defense sector is driving demand for trichloroethylene and perchloroethylene due to their crucial use in cleaning and degreasing metal components in aerospace, weapons systems, and military vehicle manufacturing. According to the Stockholm International Peace Research Institute (SIPRI), global military spending reached over USD 2718 billion in 2024, reflecting an increase of 9.4% from 2023. This surge in defense expenditure is pushing manufacturers and maintenance providers to adopt high-performance solvents that meet stringent military-grade cleanliness standards. The expansion of defense production across regions is driving the use of these solvents, ensuring efficient maintenance, prolonging equipment lifespan coupled with meeting stringent defense procurement standards.

Drivers & Opportunities/Trends

Rise in Semiconductor Sale Worldwide: Rising global semiconductor sales are driving growth in the trichloroethylene and perchloroethylene market due to increasing demand for ultra-clean processing agents in chip manufacturing and precision electronics assembly. According to the Semiconductor Industry Association (SIA), global semiconductor sales rose by 22.7% year-over-year, reaching over USD 57 billion in April 2025 from USD 46.4 billion in April 2024. This growth is creating the expanded use of high-purity solvents such as trichloroethylene and perchloroethylene for cleaning silicon wafers, removing residues, and maintaining cleanroom standards in fabrication plants.

Global Expansion of Automotive Industry: Growth in the automotive industry is fueling demand in the trichloroethylene and perchloroethylene market due to rising use of industrial solvents in component cleaning, degreasing and metal surface preparation. According to the International Organization of Motor Vehicle Manufacturers (OICA), global vehicle production reached over 93 million units in 2023 from 84 million units in 2022. This increase in production is driving the need for efficient maintenance and manufacturing processes, where trichloroethylene and perchloroethylene are widely adopted for their cleaning performance and compatibility with precision-engineered parts.

Segmental Insights

Type Analysis

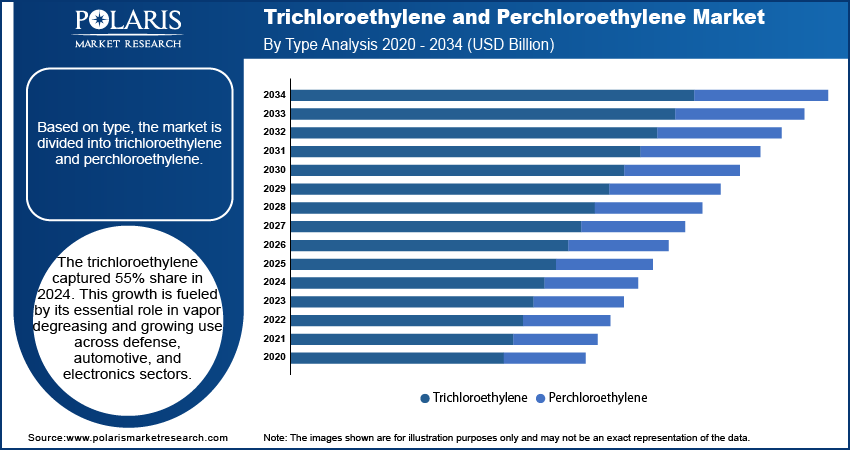

Based on type, the market is segmented into trichloroethylene and perchloroethylene. The trichloroethylene segment is captured 55% share in 2024. This growth is attributed to its widespread use in industrial degreasing operations and a chemical intermediate in the production of hydrofluorocarbon refrigerants. Trichloroethylene is favored for its high solvency power, fast evaporation rate and effectiveness in cleaning metal components across heavy machinery, automotive parts and aerospace systems.

The perchloroethylene segment is projected to expand at a notable pace through 2034, driven by its established role in the textile and dry-cleaning industries, as well as in degreasing and chemical processing applications. Its high chemical stability and non-flammability make it suitable for use in solvent-based cleaning systems in commercial laundries and maintenance operations. Increasing adoption of closed-loop systems that mitigate emissions is contributing to maintain market participation in countries with stringent environmental regulations.

Application Analysis

In terms of application, the segmentation includes hydro-fluorocarbon refrigerants, spot-removal solvents, degreasers, and other applications. The hydro-fluorocarbon refrigerants segment held the dominant market share in 2024, owing to the continuous use of trichloroethylene as a precursor in the synthesis of HFC-134a and other refrigerant compounds. The rising demand for trichloroethylene and perchloroethylene in HVAC manufacturing and automotive air conditioning systems is growing due to infrastructure modernization efforts across emerging markets. Moreover, chemical manufacturers are investing in advanced processing technologies to ensure refrigerant-grade purity to maintain the segment’s dominance in this market.

The degreasers segment is estimated to hold a significant market share in 2034, driven by rising demand across automotive, aerospace, and industrial equipment sectors where high-precision cleaning is essential for ensuring operational efficiency and equipment reliability. Trichloroethylene and perchloroethylene is widely utilized in vapor degreasing applications due to their proven efficacy in removing oils, waxes, and particulate contaminants from intricate components and assemblies. The segment is experiencing notable growth in manufacturing hubs, where expanding metal fabrication and electronics production are creating the need for dependable and high-performance cleaning solutions.

End User Analysis

Based on end user, the market is segmented into chemical manufacturing, automotive industry, aerospace & defense, electronics, and other end users. The chemical manufacturing segment held the dominant market share in 2024, driven by the widespread use of trichloroethylene and perchloroethylene as chemical intermediates, process solvents and cleaning agents in various industrial reactions and equipment maintenance cycles. Their effectiveness in removing contaminants from reactors, pipelines, and production tools supports process reliability and product integrity. Therefore, the expansion of chemical production capacity continues to drive demand for high-performance solvents across commodity and specialty chemical operations.

The automotive segment is projected to grow rapidly through 2034, due to the increasing need for precision cleaning in vehicle manufacturing and maintenance processes. Trichloroethylene and perchloroethylene are widely used in cleaning engine blocks, transmissions, and metal components due to their strong degreasing properties, ensuring surface cleanliness and compliance with stringent quality and safety standards. According to International Energy Agency, the number of electric cars sold increased from 13.7 million in 2023 to 17.5 million in 2024. The surge in electric vehicle (EV) sale is driving higher demand for high-purity solvents used in battery and electronic system assembly, driving growth prospects across developed and emerging automotive markets.

Regional Analysis

Asia Pacific Trichloroethylene and Perchloroethylene Market Trend

The Asia Pacific trichloroethylene and perchloroethylene industry accounted for 35% share in 2024. This is driven by expanding industrial manufacturing and strong demand from metal degreasing and dry-cleaning operations. Also, the growing use of chlorinated solvents in the automotive, electronics, and textile sectors is supported by rising production volumes and improved chemical processing infrastructure in countries such as China, Japan, and South Korea. Moreover, the development of localized chemical synthesis facilities and access to competitively priced raw materials are enhancing regional supply reliability and cost efficiency drives the market growth in this region.

India Trichloroethylene and Perchloroethylene Market Insight

Growing demand for industrial cleaning and textile processing is fueling the trichloroethylene and perchloroethylene market in India, due to rising use in vapor degreasing and large-scale equipment maintenance. Moreover, the expanding automotive manufacturing and component assembly operations across industrial hubs are enabling steady consumption of these solvents for precision cleaning and metal surface preparation in production workflows. According to the Society of Indian Automobile Manufacturers (SIAM), the Indian passenger car market was valued at USD 32.70 billion in 2021 and is projected to reach USD 54.84 billion by 2027, registering a CAGR of over 9% during 2022 to 2027. This projected growth highlights a strong market foundation for solvent-based applications, enabling sustained demand across the countries rapidly industrializing economy.

North America Trichloroethylene and Perchloroethylene Market Outlook

North America accounted for 25% of the global trichloroethylene and perchloroethylene market share in 2024, fueled by robust industrial activity and established manufacturing infrastructure, due to its reliance on these solvents for metal degreasing, dry cleaning, and chemical processing operations. Moreover, rapid upgrades in industrial equipment along with consistent demand from the automotive and aerospace sectors are contributing to steady market growth across the region.

US Trichloroethylene and Perchloroethylene Market Insight

The US dominated the regional market in 2024. This is due to the expansion of the aerospace and defense sector that is increasing demand for high-performance degreasing and precision cleaning agents used in component maintenance and manufacturing. According to the Aerospace Industries Association (AIA), the US aerospace and defense industry generated a revenue of USD 955 billion in the year 2023, an increase of 7.1% from the previous year. In addition, rising industrial momentum is pushing OEMs and MRO facilities to adopt reliable solvents such as trichloroethylene and perchloroethylene that support efficient cleaning of metal parts, engines and hydraulic systems in line with stringent safety and quality standards.

Europe Trichloroethylene and Perchloroethylene Market Overview

The market in Europe accounted for substantial market share of the global trichloroethylene and perchloroethylene market in 2024, driven by urban population growth that is increasing demand for industrial cleaning and textile care solutions across expanding commercial and industrial operations. According to United Nations data, the urban population in the European Union rose from 75% in 2022 to 76% in 2024, with Denmark and the Netherlands reporting urban shares of 89% and 93% respectively in 2024. This demographic shift is expanding the operational footprint for industries dependent on chlorinated solvents, amid expanding urban infrastructure that continues to drive demand for degreasing and fabric care chemicals.

Key Players & Competitive Analysis Report

The trichloroethylene and perchloroethylene market is moderately consolidated, with major players such as AGC Chemicals, Befar Group, DCW Ltd., Kanto Denka Kogyo Co., Ltd., Olin Corporation, Otto Chemie Pvt. Ltd., Richard Geiss GmbH, Shandong Qibo New Energy Co., Ltd., Shiv Shakti Group, and SPOLCHEMIE. These companies serve diverse end-use sectors such as metal degreasing, dry cleaning, chemical intermediates, and refrigerant manufacturing, while investing in environmentally compliant technologies and reformulated blends to address rising concerns over emissions and toxicity. Additionally, partnerships with downstream users and technological upgrades in handling and storage infrastructure are shaping long-term competitiveness in the global market.

Key companies in the industry include AGC Chemicals, Befar Group, DCW Ltd., Kanto Denka Kogyo Co., Ltd., Olin Corporation, Otto Chemie Pvt. Ltd., Richard Geiss GmbH, Shandong Qibo New Energy Co., Ltd., Shiv Shakti Group, SPOLCHEMIE, Toagosei Co., Ltd., and Westlake Corporation.

Key Players

- AGC Chemicals

- Befar Group

- DCW Ltd.

- Kanto Denka Kogyo Co., Ltd.

- Olin Corporation

- Otto Chemie Pvt. Ltd.

- Richard Geiss GmbH

- Shandong Qibo New Energy Co., Ltd.

- Shiv Shakti Group

- SPOLCHEMIE

- Toagosei Co.,Ltd.

- Westlake Corporation

Industry Developments

Trichloroethylene and Perchloroethylene Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Trichloroethylene

- Perchloroethylene

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Hydro-fluorocarbon Refrigerants

- Spot-removal Solvents

- Degreasers

- Other Applications

By End User (Revenue, USD Billion, 2020–2034)

- Chemical Manufacturing

- Automotive Industry

- Aerospace & Defense

- Electronics

- Other End User

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Trichloroethylene and Perchloroethylene Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 3.42 Billion |

|

Market Size in 2025 |

USD 3.55 Billion |

|

Revenue Forecast by 2034 |

USD 5.01 Billion |

|

CAGR |

3.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

Trichloroethylene and Perchloroethylene Industry Trend Analysis (2024) Company Profiles/Industry participants profiling includes company overview, financial information, product/service benchmarking, and recent developments |

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 3.42 billion in 2024 and is projected to grow to USD 5.01 billion by 2034.

The global market is projected to register a CAGR of 3.9% during the forecast period.

Asia Pacific dominated with 35% market share in 2024.

A few of the key players in the market are AGC Chemicals, Befar Group, DCW Ltd., Kanto Denka Kogyo Co., Ltd., Olin Corporation, Otto Chemie Pvt. Ltd., Richard Geiss GmbH, Shandong Qibo New Energy Co., Ltd., Shiv Shakti Group, SPOLCHEMIE, Toagosei Co., Ltd., and Westlake Corporation.

The trichloroethylene segment dominated the market with 55% share in 2024 driven by its widespread use as an effective industrial solvent in metal degreasing and chemical processing applications.

The degreasers segment is expected to witness the fastest growth during the forecast period, owing to increasing demand for efficient cleaning agents in automotive, aerospace, and heavy machinery manufacturing operations.