U.S. Liquid Sodium Silicate Market Size, Share, Trends, Industry Analysis Report

By Grade (LSS A, LSS B, LSS C, Other Grades), By Application – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 125

- Format: PDF

- Report ID: PM6039

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

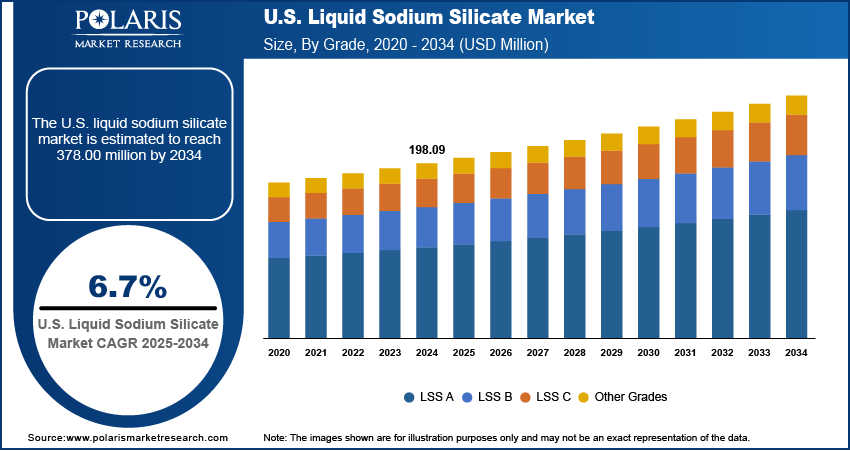

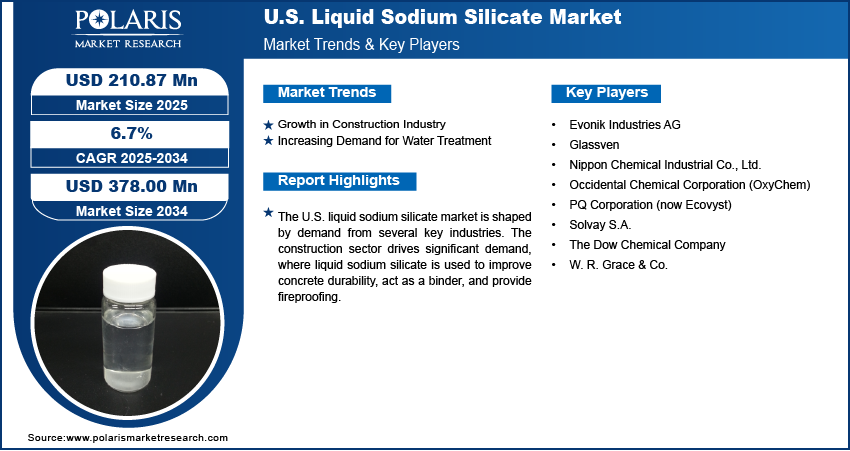

The U.S. liquid sodium silicate market size was valued at USD 198.09 million in 2024 and is anticipated to register a CAGR of 6.7% from 2025 to 2034. The market is mainly driven by increasing demand from the construction industry for its use in concrete and as an adhesive.

Key Insights

- By grade, the LSS C segment held the largest share in 2024. This grade, characterized by a low silica-to-sodium ratio and higher alkalinity, is primarily used in construction chemical admixtures, cementitious grouts, and as a deflocculant in mining and drilling operations.

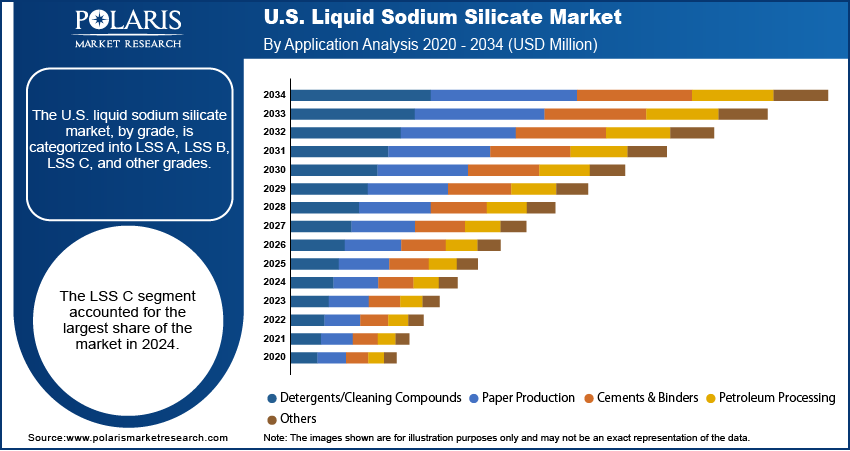

- By application, the detergents/cleaning compounds segment accounted for the largest revenue share in 2024. This is due to liquid sodium silicate's crucial role as a builder, emulsifier, and corrosion inhibitor, enhancing the effectiveness of various cleaning products.

Industry Dynamics

- The increasing growth of the construction sector is a significant driver for the U.S. liquid sodium silicate market.

- There is a rising demand for water and wastewater treatment solutions, which boosts the consumption of liquid sodium silicate.

- The expanding production of detergents and cleaning compounds contributes to the growing demand for liquid sodium silicate.

- The ongoing expansion in the pulp & paper sector also drives the use of liquid sodium silicate.

Market Statistics

- 2024 Market Size: USD 198.09 million

- 2034 Projected Market Size: USD 378.00 million

- CAGR (2025–2034): 6.7%

To Understand More About this Research: Request a Free Sample Report

The U.S. liquid sodium silicate market involves the production, distribution, and use of liquid sodium silicate, a chemical compound made with silica and sodium oxide. This versatile material finds application across various industries due to its unique properties.

The pulp & paper sector is a significant driver for the U.S. liquid sodium silicate market due to its versatile applications in various papermaking processes. Liquid sodium silicate is crucial in the bleaching of both virgin and recycled fibers, where it acts as a stabilizer for hydrogen peroxide. This stabilization prevents the premature breakdown of peroxide, leading to more efficient and effective bleaching, which is essential for achieving desired paper brightness.

The ceramics manufacturing sector represents an important driver for the U.S. liquid sodium silicate market expansion. In ceramic production, liquid sodium silicate is widely used as a deflocculant in slip casting. It helps disperse clay particles in water, creating a more fluid and manageable suspension (slip) with lower water content. This leads to reduced shrinkage during drying and firing, minimizes cracking, and improves the overall quality and strength of ceramic products. Beyond deflocculation, it also functions as a binder in ceramic bodies, providing green strength to unfired pieces, making them easier to handle before firing.

Drivers & Opportunities

Growth in Construction Industry: The construction sector is a significant consumer of liquid sodium silicate, primarily due to its role in enhancing the properties of concrete and other building materials. It is widely used as a concrete densifier, hardener, and dust-proofer, which helps improve the durability and longevity of concrete surfaces. Furthermore, it functions as a binding agent and can be used in fireproofing applications, making buildings safer and more resilient.

The U.S. construction sector saw employment reach an all-time high of 8.0 million workers in 2023, surpassing the previous peak from 2006, as reported by the U.S. Bureau of Labor Statistics in their March 2025 article, "What's behind the projected construction employment growth from 2023 to 2033." This increase in the workforce directly indicates a robust and active construction sector, requiring a steady supply of essential materials such as liquid sodium silicate for various building projects. The continued increase in the construction workforce signifies ongoing activity and investments in new projects and infrastructure, thereby sustaining the demand for liquid sodium silicate and driving the market growth.

Increasing Demand for Water Treatment: The growing need for effective wastewater and water treatment chemicals and solutions across the U.S. is a substantial driver for the market. This chemical compound is highly effective as a coagulant and flocculant, playing a crucial role in removing impurities from water. It helps in the aggregation of small particles, allowing them to settle and be removed more easily, which is essential for municipal and industrial water purification systems.

According to the U.S. Census Bureau's "Monthly Construction Spending, May 2025" report, total public construction spending was estimated at $511.6 billion in May 2025, which often includes significant investments in water infrastructure projects. As the focus on clean water access and environmental regulations intensifies, the use of liquid sodium silicate in treating wastewater and ensuring safe drinking water continues to expand, thus driving the market growth.

Segmental Insights

Grade Analysis

Based on grade, the segmentation includes LSS A, LSS B, LSS C, and other grades. The LSS C segment held the largest share in 2024. This grade of liquid sodium silicate is known for its lower silica-to-sodium oxide ratio, making it more alkaline. This characteristic makes it highly suitable for applications that benefit from a strong alkaline environment. A significant portion of its demand comes from the construction sector, where it is used in various chemical admixtures for concrete and cementitious grouts, enhancing material properties such as strength and durability. Furthermore, LSS C plays a vital role as a deflocculant in mining and drilling operations, helping to keep solid particles dispersed in liquid mixtures. Its widespread and established use in these heavy industries, where its specific alkaline properties are crucial for product performance and process efficiency, contributes significantly to its dominant position in the overall liquid sodium silicate landscape. This consistent and essential demand across multiple industrial applications underpins its leading position in the U.S. market.

The LSS A grade segment is anticipated to register the highest growth rate during the forecast period. This particular grade features a higher silica-to-sodium oxide ratio, which gives it distinct properties, making it ideal for specialized applications. LSS A is increasingly in demand for use in passive fire protection systems, offering enhanced thermal resistance and safety in various structures. It is also a key component in refractory materials, which are designed to withstand very high temperatures, and in precision casting processes, where its superior bonding capabilities are highly valued. As industries continue to innovate and require materials with advanced performance characteristics, the unique properties of LSS A, particularly its strong bonding and thermal resistance, are driving its expanding adoption.

Application Analysis

Based on application, the segmentation includes detergents/cleaning compounds, paper production, cements & binders, petroleum processing, ceramics, food & healthcare, metal treatment, and others. The metal treatment segment held the largest share in 2024. Liquid sodium silicate is widely utilized in various metal processing operations due to its beneficial properties as a corrosion inhibitor, cleaner, and binder. It is crucial in preparing metal surfaces for further processing, such as painting or plating, by removing impurities and preventing rust formation. Additionally, it finds extensive use in foundry operations as a binder for sand molds, contributing to the production of high-quality metal castings. The consistent demand from the robust manufacturing sector, particularly in automotive and machinery production where metal treatment is a critical step, underpins this segment's leading position. Its ability to protect metal infrastructure and improve manufacturing efficiency makes it an indispensable component in this landscape.

The detergents and cleaning compounds application segment is anticipated to register the highest growth rate during the forecast period. This growth is largely driven by the increasing consumer and industrial cleaning solvents demand for efficient and environmentally friendly cleaning solutions. Liquid sodium silicate acts as a powerful builder in laundry detergents, enhancing their cleaning performance by softening water, emulsifying oils and fats, and preventing the redeposition of dirt onto cleaned surfaces. Furthermore, its ability to inhibit corrosion helps protect washing machine parts and surfaces being cleaned. As there is a rising preference for phosphate-free and sustainable cleaning formulations, liquid sodium silicate, with its nontoxic and biodegradable nature, is becoming a favored alternative. Innovations in detergent formulations aiming for improved efficacy and reduced environmental impact are significantly contributing to the rapid expansion of this application segment.

Key Players and Competitive Insights

The U.S. liquid sodium silicate market features a competitive landscape with several established players and a few emerging companies. These firms compete on factors such as product quality, diverse product portfolios tailored for specific applications, pricing strategies, and their ability to ensure consistent supply. Technological advancements and efforts toward sustainable production are also key areas of competition. Companies often focus on strengthening their distribution networks and providing strong customer support to gain an edge in this essential chemical sector. The market witnesses both large multinational chemical corporations and more specialized producers vying for share, each bringing their unique strengths in terms of research, production capacity, and market reach.

A few prominent companies in the industry include PQ Corporation, Occidental Chemical Corporation (OxyChem), Nippon Chemical Industrial Co., Ltd., Evonik Industries AG, Solvay S.A., The Dow Chemical Company, W. R. Grace & Co., and Glassven.

Key Players

- Evonik Industries AG

- Glassven

- Nippon Chemical Industrial Co., Ltd.

- Occidental Chemical Corporation (OxyChem)

- PQ Corporation (now Ecovyst)

- Solvay S.A.

- The Dow Chemical Company

- W. R. Grace & Co.

U.S. Liquid Sodium Silicate Industry Developments

December 2024: PQ Corporation acquired Sibelco Group’s specialty silicate operations in Sweden. This acquisition enhances PQ’s presence in the Nordic region and expands its sodium and potassium silicate product range across key industries, including pulp and paper, construction, and mining.

November 2024: PPG Industries, Inc. finalized the sale of its silica products business to QEMETICA, a prominent silicates producer in Europe. The transaction includes production and R&D facilities in the U.S., providing QEMETICA with a strategic entry into the American market.

U.S. Liquid Sodium Silicate Market Segmentation

By Grade Outlook (Revenue – USD Million, 2020–2034)

- LSS A

- LSS B

- LSS C

- Other Grades

By Application Outlook (Revenue – USD Million, 2020–2034)

- Detergents/Cleaning Compounds

- Paper Production

- Cements & Binders

- Petroleum Processing

- Ceramics

- Food & Healthcare

- Metal Treatment

- Others

U.S. Liquid Sodium Silicate Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 198.09 million |

|

Market Size in 2025 |

USD 210.87 million |

|

Revenue Forecast by 2034 |

USD 378.00 million |

|

CAGR |

6.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 198.09 million in 2024 and is projected to grow to USD 378.00 million by 2034.

The market is projected to register a CAGR of 6.7% during the forecast period.

A few key players in the market include PQ Corporation, Occidental Chemical Corporation (OxyChem), Nippon Chemical Industrial Co., Ltd., Evonik Industries AG, Solvay S.A., The Dow Chemical Company, W. R. Grace & Co., and Glassven.

The LSS C segment accounted for the largest share of the market in 2024.

The detergents and cleaning compounds segment is expected to witness the fastest growth during the forecast period.