X-ray Irradiation Market Size, Share, Trends, Industry Analysis Report

By Application (Medical Devices, Pharmaceuticals, Biotech & Laboratory Supplies, Others), By Size, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 130

- Format: PDF

- Report ID: PM6078

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

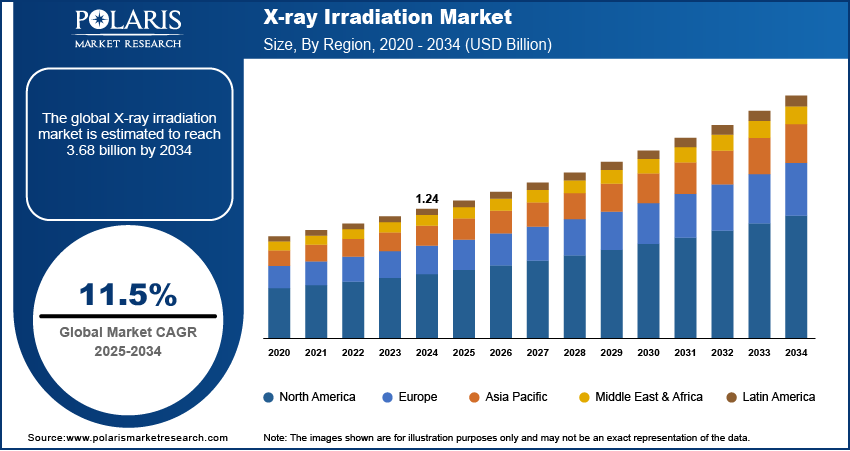

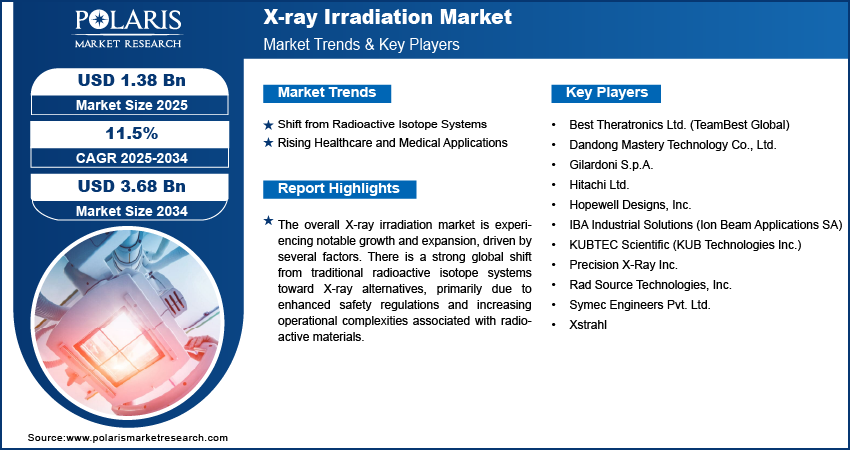

The global x-ray irradiation market size was valued at USD 1.24 billion in 2024 and is anticipated to register a CAGR of 11.5% from 2025 to 2034. The market is primarily driven by the increasing shift from traditional radioactive isotope systems to safer X-ray alternatives, spurred by growing safety concerns and stricter regulations.

Key Insights

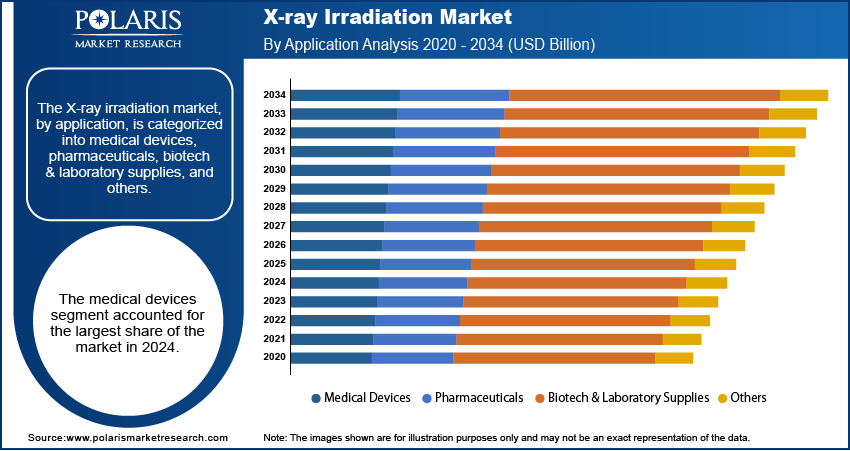

- By application, the medical devices segment held the largest share in 2024 due to the growing need for sterilization of a wide range of medical products, where X-ray technology offers a safe, non-thermal, and effective method, ensuring patient safety and regulatory compliance in healthcare.

- By size, the large-scale systems segment held the largest share in 2024. These systems are essential for high-volume operations in industrial settings and for the bulk sterilization of medical devices, offering robust capacity and efficiency for significant throughput demands.

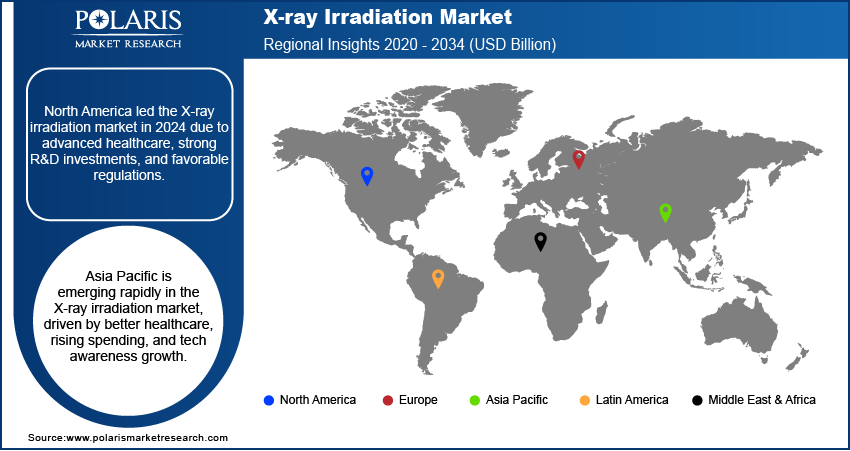

- By region, North America dominated the global X-ray irradiation market in 2024. This leadership is attributed to its highly developed healthcare infrastructure, substantial investments in research and development, and a strong regulatory environment that favors the adoption of advanced and safer X-ray irradiation technologies.

Industry Dynamics

- The growing need for safer alternatives to traditional radioactive isotope systems is a significant driver.

- Increased applications in healthcare, such as for blood transfusions and cancer research, are boosting demand.

- Technological advancements are leading to more efficient and easier-to-use radiation devices.

- Stringent safety regulations and guidelines are also encouraging the adoption of these modern systems.

Market Statistics

- 2024 Market Size: USD 1.24 billion

- 2034 Projected Market Size: USD 3.68 billion

- CAGR (2025–2034): 11.5%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

The X-ray irradiation industry involves the use of high-energy X-rays to treat or analyze various materials, from medical products to industrial components. This process is crucial for applications requiring precise control over radiation exposure, offering a non-radioactive alternative to other methods. The overall growth is driven by advancements in technology and expanding areas of use.

The increasing use of X-ray irradiators in specialized research fields and growing industrial applications, especially in quality control, boost the market expansion. The demand from specific research areas, such as radiobiology and genetics, is steadily increasing as scientists require precise tools to study the effects of radiation on biological samples.

X-ray irradiation is used for non-destructive testing (NDT), allowing for internal inspection of materials and structures without causing damage. For example, in the aerospace and automotive industries, X-ray inspection helps detect internal flaws in parts such as aircraft components and automobile tires, ensuring their safety and quality. This helps manufacturers maintain high standards and prevent potential failures, a key part of industrial development.

Drivers and Opportunities

Shift from Radioactive Isotope Systems: The increasing global movement from traditional radioactive isotope-based systems, such as those using cesium-137 and cobalt-60, is a major driver. This transition is largely attributed to rising safety concerns, stringent regulations, and the increasing costs associated with handling, licensing, and disposing of radioactive materials. X-ray irradiators offer a safer, non-radioactive alternative with comparable or even superior performance for many applications.

The U.S. Department of Energy's Cesium Irradiator Replacement Project (CIRP) provides funding and support for replacing cesium-137-based devices with non-radioactive X-ray systems in hospitals, research labs, and blood centers. As of a 2021 publication titled "Radiation Sources and Alternative Technologies in Medicine and Research" by the National Center for Biotechnology Information (NCBI), CIRP had already assisted in removing 165 cesium irradiators, with another 150 scheduled for removal. This clear governmental initiative and financial backing directly show how the shift away from radioactive sources is actively driving the growth of the X-ray irradiation market.

Rising Healthcare and Medical Applications: The growing demand for precise, reliable, and safe radiation tools within healthcare and medical applications is a significant driver. X-ray irradiators are increasingly used for critical procedures such as blood irradiation to prevent transfusion-associated graft-versus-host disease (TA-GvHD) in immunocompromised patients, for sterilizing medical devices, and in preclinical research for studying diseases such as cancer. The rising prevalence of chronic diseases and the expanding need for advanced diagnostic and therapeutic solutions contribute to this demand.

The need for blood transfusion and blood transfusion diagnostics has increased significantly due to the prevalence of chronic diseases, especially in oncology and autoimmune treatments. According to information found in a 2025 analysis on the blood irradiation sector, the adoption of X-ray-based irradiation systems has seen a 30% growth over the past ten years, driven by the healthcare sector's focus on minimizing radioactive exposure risks. This continuous increase in critical medical needs, coupled with a preference for safer technologies, strongly drives the expansion of the X-ray irradiation market.

Segmental Insights

Application Analysis

Based on application, the segmentation includes medical devices, pharmaceuticals, biotech & laboratory supplies, and others. The medical devices segment held the largest share in 2024. This dominance stems from the critical need for sterilization in the healthcare sector to ensure patient safety and prevent infections. X-ray technology provides an effective and increasingly preferred method for sterilizing a vast array of medical products, including single-use devices, implants, and complex surgical instruments. Unlike traditional methods that may involve heat or toxic chemicals, X-ray irradiation is a non-thermal process that helps maintain the integrity and functionality of sensitive materials and delicate device components. The continuous development of new and more intricate medical devices, coupled with rigorous regulatory standards for sterility, further solidifies this segment's leading position. This demand is also influenced by the global rise in surgical procedures and the increasing focus on minimizing hospital-acquired infections, making X-ray sterilization a vital part of the supply chain for safe healthcare products.

The biotechnology and laboratory supplies segment is anticipated to register the highest growth rate during the forecast period. This rapid expansion is driven by the dynamic nature of biomedical research, particularly in fields such as cell biology, immunology, genomics, and preclinical studies. Researchers and scientists require precise and reliable radiation sources for various applications, including cell irradiation for studies on immune responses, creating animal models for disease research, and sterilizing laboratory consumables and reagents. The shift from radioisotope-based irradiators to X-ray systems in research settings is a key driving factor, as X-ray alternatives offer enhanced safety, easier operational procedures, and the ability to be turned off when not in use. The continuous innovation in biotechnology, leading to new diagnostic tools, therapies, and research protocols, consistently fuels the demand for advanced irradiation solutions.

Size Analysis

Based on size, the segmentation includes small-scale, mid-scale, and large-scale. The large-scale segment held the largest share in 2024. These robust systems are employed in high-throughput environments where a significant volume of materials or products requires irradiation. Their substantial capacity makes them ideal for industrial applications such as the sterilization of large batches of medical devices, bulk food items, and the processing of materials for industrial use. Manufacturers of large-scale systems focus on optimizing efficiency, reliability, and dose uniformity across sizable treatment areas. The initial investment for these systems can be considerable, but their long-term operational cost-effectiveness for large-volume processing, coupled with stringent regulatory requirements for thorough sterilization in sectors such as healthcare, drives their widespread adoption.

The mid-scale segment is anticipated to register the highest growth rate during the forecast period. This accelerated expansion is largely attributed to their versatility and the ability to serve a broader range of users compared to their large-scale counterparts. Mid-scale systems offer a balance between the high capacity of large units and the compact nature of small ones, making them highly suitable for various applications in research institutions, smaller medical facilities, and specialized industrial processes. For instance, many academic laboratories and pharmaceutical companies that require precise irradiation for cell studies, preclinical research, or small-batch sterilization find mid-scale systems to be an ideal fit. Their relatively lower footprint and more manageable operational costs, compared to large-scale systems, make them more accessible to a wider array of organizations.

Regional Analysis

The North America x-ray irradiation market accounted for the largest share in 2024, driven by its advanced healthcare infrastructure, high research and development spending, and a strong emphasis on regulatory compliance. The widespread adoption of X-ray irradiators in hospitals, blood banks, and research institutions across the region is a key factor. There is a notable trend toward replacing older, radioactive isotope-based systems with safer digital X-ray alternatives, supported by various government initiatives aimed at enhancing radiation safety. This region also benefits from the presence of leading technology providers and a proactive approach to technological innovation in both medical and industrial applications. The increasing prevalence of chronic diseases and the subsequent demand for advanced medical treatments further contribute to the adoption of X-ray irradiation solutions in North America.

U.S. X-ray Irradiation Market Insights

In North America, the U.S. stands out as a major contributor to the X-ray irradiation sector. The market is fueled by substantial investments in medical research, particularly in areas such as cancer treatment and cell biology, which require precise irradiation techniques. The country's robust healthcare system, coupled with a high volume of blood transfusion procedures, creates a consistent demand for X-ray blood irradiators to ensure safety and prevent transfusion-associated complications. Furthermore, the U.S. exhibits a strong inclination toward adopting advanced radiation safety technologies, influenced by rigorous federal regulations and a continuous drive for operational efficiency in the healthcare and pharmaceutical sectors. This environment encourages innovation and the rapid uptake of new X-ray irradiation systems, reinforcing the nation's prominent position.

Europe X-ray Irradiation Market Trends

Europe represents another important region for the X-ray irradiation sector, characterized by its well-developed healthcare systems, increasing focus on medical device sterilization, and a strong research community. Countries across Europe are progressively transitioning from traditional radioactive sources to X-ray technology, driven by similar safety concerns and evolving regulatory frameworks, often aligned with international standards. The region also benefits from significant investments in life sciences and biotechnology research, where X-ray irradiators are essential tools for various laboratory applications. The emphasis on high-quality medical device manufacturing and the need for sterile products further propel the adoption of X-ray irradiation solutions across Europe, contributing to its overall market expansion.

The Germany X-ray irradiation market is prominent in Europe. Its strong economy, advanced research institutions, and a robust medical device manufacturing sector contribute to a high demand for X-ray irradiation systems. German healthcare facilities and research centers are early adopters of innovative technologies, particularly those that enhance safety and efficiency. The country’s commitment to stringent quality control standards in both medical and industrial applications also plays a crucial role. For instance, the German healthcare system's continuous need for sterile medical equipment and its active participation in biomedical research drive the ongoing demand for modern X-ray irradiation solutions.

Asia Pacific X-Ray Irradiation Market Overview

Asia Pacific is rapidly emerging as a dynamic and high-growth area for the X-ray irradiation sector. This growth is primarily fueled by improving healthcare infrastructure, rising healthcare expenditure, and increasing awareness regarding advanced medical technologies across developing economies. Countries in this region are experiencing a significant expansion in their pharmaceutical and biotechnology sectors, which, in turn, drives the demand for X-ray irradiators for sterilization, research, and quality assurance. The shift toward non-radioactive irradiation methods is gaining momentum as regulatory bodies become more focused on safety, coupled with the increasing volume of medical procedures and research activities being conducted throughout the region.

China X-Ray Irradiation Market Overview

China stands out as a leading country in the Asia Pacific X-ray irradiation industry, demonstrating substantial growth and adoption. The country's large population, coupled with continuous governmental investments in healthcare modernization and expansion, significantly boosts the demand for advanced medical technologies, including X-ray irradiators. The rapid growth of the biopharmaceutical sector and extensive research initiatives in life sciences also contribute to the increased demand for X-ray systems for laboratory and sterilization purposes. Furthermore, China's manufacturing prowess and increasing focus on domestic production of high-quality medical devices mean a growing need for efficient and safe sterilization methods, which X-ray irradiation readily provides, solidifying its dominant position in the regional landscape.

Key Players and Competitive Insights

The X-ray irradiation industry features a competitive landscape with several established players and emerging innovators. Major companies such as STERIS, IBA Industrial Solutions, KUB Technologies Inc., and Precision X-Ray are key contenders. These companies strive for market dominance through continuous product development, strategic partnerships, and expanding their global presence. The competitive environment is shaped by advancements in technology, the growing demand for safer non-radioactive solutions, and the increasing adoption of X-ray systems across various applications in the healthcare and industrial sectors.

A few prominent companies in the industry include KUBTEC Scientific (KUB Technologies Inc.); Precision X-Ray Inc.; Rad Source Technologies, Inc.; IBA Industrial Solutions (Ion Beam Applications SA); Gilardoni S.p.A.; Symec Engineers Pvt. Ltd.; Hitachi, Ltd.; Best Theratronics Ltd. (TeamBest Global); Hopewell Designs, Inc.; and Dandong Mastery Technology Co., Ltd.

Key Players

- Best Theratronics Ltd. (TeamBest Global)

- Dandong Mastery Technology Co., Ltd.

- Gilardoni S.p.A.

- Hitachi Ltd.

- Hopewell Designs, Inc.

- IBA Industrial Solutions (Ion Beam Applications SA)

- KUBTEC Scientific (KUB Technologies Inc.)

- Precision X-Ray Inc.

- Rad Source Technologies, Inc.

- Symec Engineers Pvt. Ltd.

- Xstrahl

X-ray Irradiation Industry Developments

April 2025: KUBTEC Scientific launched its XSEED X-ray Imaging Systems family, a new line of high-resolution X-ray imaging systems and software solutions designed specifically for seed and agricultural analysis applications.

October 2024: Precision X-Ray, Inc. announced an exclusive distribution partnership with Gilardoni SpA to deliver the RADGIL2 X-Ray Blood Irradiator in the U.S.

X-ray Irradiation Market Segmentation

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Medical Devices

- Pharmaceuticals

- Biotech & Laboratory Supplies

- Others

By Size Outlook (Revenue – USD Billion, 2020–2034)

- Small-Scale

- Mid-Scale

- Large-Scale

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

X-ray Irradiation Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.24 billion |

|

Market Size in 2025 |

USD 1.38 billion |

|

Revenue Forecast by 2034 |

USD 3.68 billion |

|

CAGR |

11.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.24 billion in 2024 and is projected to grow to USD 3.68 billion by 2034.

The global market is projected to register a CAGR of 11.5% during the forecast period.

North America dominated the market share in 2024.

A few key players in the market KUBTEC Scientific (KUB Technologies Inc.); Precision X-Ray Inc.; Rad Source Technologies, Inc.; IBA Industrial Solutions (Ion Beam Applications SA); Gilardoni S.p.A.; Symec Engineers Pvt. Ltd.; Hitachi, Ltd.; Best Theratronics Ltd. (TeamBest Global); Hopewell Designs, Inc.; and Dandong Mastery Technology Co., Ltd.

The medical devices segment accounted for the largest share of the market in 2024.

The mid-scale segment is expected to witness the fastest growth during the forecast period.