Smart Labels Market for Healthcare and Pharmaceutical Industry Size, Share, & Industry Analysis Report

By Product (Passive RFID Labels, Active RFID Labels), By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6081

- Base Year: 2024

- Historical Data: 2020-2023

Overview

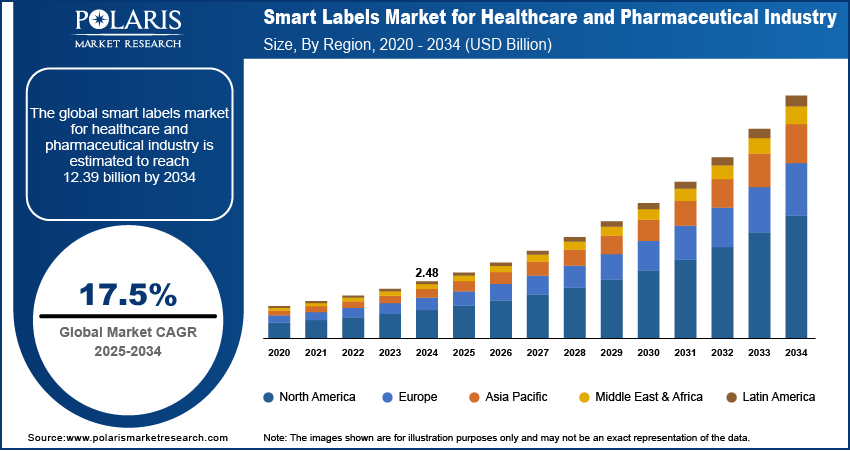

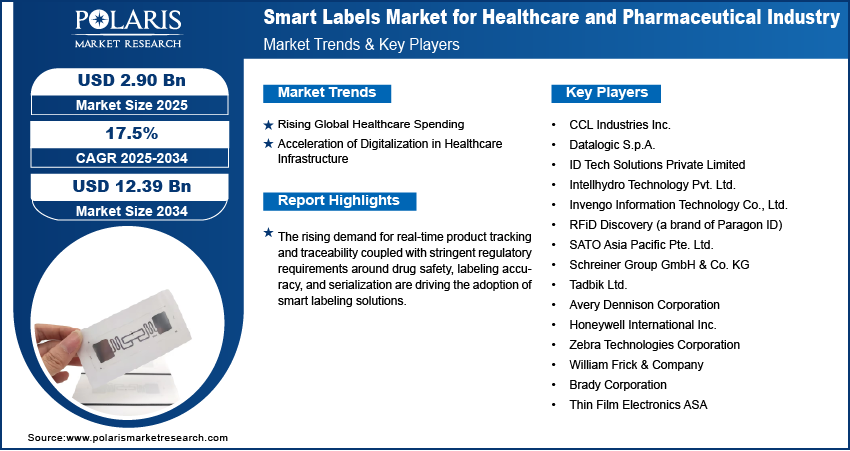

The global smart labels market for healthcare and pharmaceutical industry size was valued at USD 2.48 billion in 2024, growing at a CAGR of 17.5% from 2025–2034. Rising global healthcare spending coupled with acceleration of digitalization in healthcare infrastructure are driving the growth of the market.

Key Insights

- The passive RFID segment accounted for largest market share in 2024.

- The vaccine & biologics segment is projected to grow at the fastest rate over the forecast period, driven by rising initiatives targeting mass immunization and rising investments in biologic manufacturing.

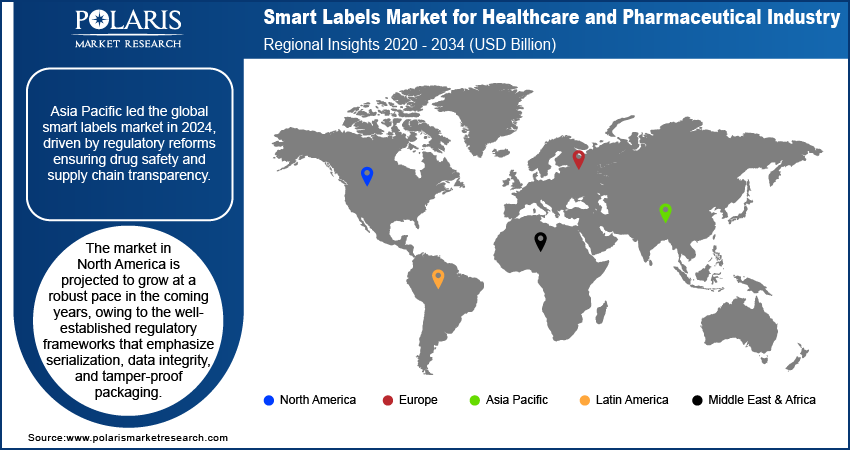

- The Asia Pacific smart labels market for healthcare and pharmaceutical industry accounted for largest global market share in 2024.

- India smart labels market for healthcare and pharmaceutical industry held largest regional Asia Pacific market share in 2024, driven by expanding pharmaceutical manufacturing hubs across the country.

- The market in North America is projected to grow with a significant CAGR from 2025-2034. This growth is owing to the well-established regulatory frameworks that emphasize serialization, data integrity, and tamper-proof packaging.

- The market in the US is expanding due the strong presence of global pharmaceutical and biotechnology firms investing in connected packaging innovation.

Smart labels refer to intelligent labeling solutions that incorporate technologies such as radio-frequency identification (RFID), near-field communication (NFC), quick response codes (QR) codes, and sensors to enable real-time data capture, tracking, and interaction across healthcare and pharmaceutical applications. These labels are designed to enhance product authentication, monitor environmental conditions, and support serialization for regulatory compliance. Smart labels impoves supply chain transparency, patient safety, and inventory management by enabling seamless communication between packaging, digital systems, and end users. These labels are widely adopted in applications including drug packaging, medical devices, biologics, and clinical trial logistics.

The rising demand for real-time product tracking and traceability to prevent counterfeiting and ensure supply chain transparency is propelling the growth of the market. According to data published by the World Health Organization, approximately 10% of medical products in low- and middle-income countries are substandard or falsified. Smart labels provide reliable mechanisms to verify product authenticity throughout the distribution cycle, mitigating the risk of counterfeit drug circulation and protecting brand reputation. In high-value therapies, such as biologics and temperature-sensitive vaccines, these labels are enabling continuous condition monitoring to ensure efficacy at the point of use.

To Understand More About this Research: Request a Free Sample Report

Stringent regulatory requirements around drug safety, labeling accuracy, and serialization, in regions such as the US and EU, are further driving the adoption of smart labeling solutions. The US Drug Supply Chain Security Act (DSCSA) and the EU Falsified Medicines Directive mandate end-to-end traceability and unit-level serialization for prescription drugs, compelling manufacturers and distributors to adopt smarter labeling systems. These regulations are expanding the market potential for RFID-enabled and barcode-integrated solutions that facilitate real-time compliance tracking.

Industry Dynamics

- Rising global healthcare spending is expanding the market for smart labels by accelerating investment in advanced packaging and digital traceability solutions.

- Increasing adoption of digital technologies in pharmaceutical logistics is increasing the demand for smart label applications in drug authentication and real-time monitoring.

- High cost of implementing RFID infrastructure and challenges in standardizing label formats across global supply chains are limiting market adoption in certain regions.

- AI-driven data analytics is emerging as a major opportunity, enabling smart labels to provide actionable insights by detecting usage patterns, predicting failures, and optimizing pharmaceutical inventory management.

Rising Global Healthcare Spending: The growing in healthcare budgets across developed and emerging economies is boosting the demand for smart labeling technologies that support safety, efficiency, and compliance in pharmaceutical supply chains. Health ministries, private insurers, and global aid organizations are actively investing in advanced drug distribution frameworks that rely on real-time data capture and automated product identification. According to the OECD, average healthcare expenditure as a share of GDP among member countries reached 9.2% in 2023. The allocation of these funds toward enhancing packaging infrastructure and traceability systems is boosting the deployment of smart labels that ensure dosage integrity, patient safety, and inventory management in healthcare settings.

Acceleration of Digitalization in Healthcare Infrastructure: The integration of technologies such as AI, IoT technology, and big data analytics in the pharmaceutical sector is strengthening the adoption of smart packaging solutions. Modernization of healthcare systems is pushing stakeholders across the value chain to adopt intelligent labeling technologies for faster decision-making, improved regulatory compliance, and streamlined cold chain management. For instance, in January 2025, Giesecke + Devrient launched its G+D Smart Label, an ultra-thin IoT-enabled tracking label combining GPS, motion sensors, temperature monitoring, and tamper detection designed for accurate asset and cold-chain parcel tracking. The labels are certified for air travel and include iSIM connectivity and cloud-based management, improving traceability and reducing risk in pharma logistics. This digital transformation is enabling predictive insights and remote quality assurance, thereby enhancing the operational efficiency of pharmaceutical packaging and logistics systems. Modernization of healthcare systems is propelling stakeholders across the value chain to adopt intelligent labeling technologies for faster decision-making, improved regulatory compliance, and streamlined cold chain management.

Segmental Insights

Product Type Analysis

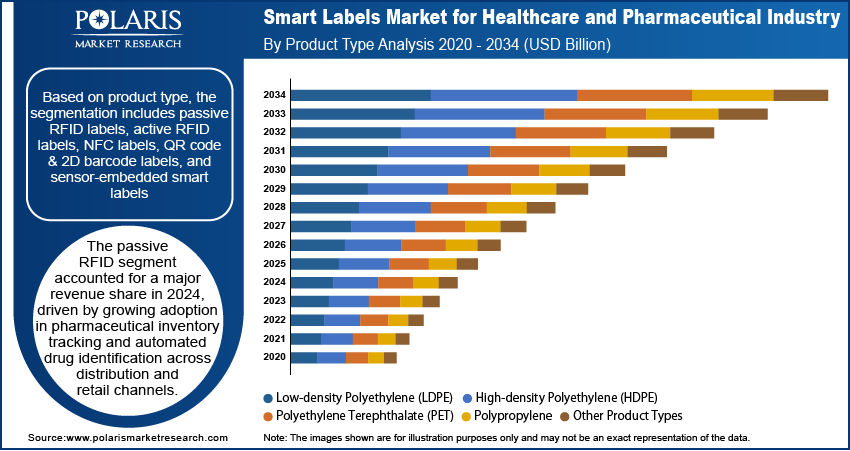

Based on product type, the segmentation includes RFID labels, active RFID labels, NFC labels, QR code & 2D barcode labels, and sensor-embedded smart labels. The passive RFID segment accounted for largest revenue share in 2024, driven by growing adoption in pharmaceutical inventory tracking and automated drug identification across distribution and retail channels. The cost-effectiveness, low power requirements, and ease of integration into existing packaging lines made them preferred solution for high-volume applications. Pharmaceutical companies and healthcare distributors are implementing passive RFID systems to enhance supply chain efficiency and meet global serialization standards, for prescription drugs and medical supplies.

The sensor-embedded smart labels segment is projected to grow at the fastest CAGR from 2025 to 2034. These labels provide real-time environmental condition monitoring, such as temperature, shock, and humidity, that are crucial for shipment of temperature-sensitive pharmaceuticals, biologics, and vaccines. Growing concerns about cold chain integrity, in global vaccine distribution and advanced therapy logistics, are accelerating the demand for sensor-based labeling solutions. Thus, the rising emphasis on quality assurance and risk mitigation during transport by healthcare providers and logistics operators is expected to drive significant growth in the adoption of sensor-embedded smart labels.

End Use Analysis

Based on end use, the segmentation includes prescription drug packaging, vaccine & biologics shipment, medical devices & instrumentation, hospital asset management, and clinical trial logistics. The prescription drug packaging accounted for largest revenue share in 2024, by rising requirements for drug serialization, traceability, and anti-counterfeiting measures under regulations such as the US Drug Supply Chain Security Act and the EU Falsified Medicines Directive. Pharmaceutical manufacturers are deploying smart labeling technologies such as RFID, barcodes, and tamper-evident features on unit-level packaging to ensure authenticity, improve medication tracking, and streamline regulatory audits.

The vaccine & biologics shipment segment is expected to grow at the fastest rate over the forecast period. The handling of biologics, gene therapies, and vaccines demands high levels of precision in temperature control and compliance documentation. Smart labels equipped with sensors and data loggers are deployed to monitor transit conditions and trigger alerts when thresholds are breached. Global health initiatives targeting mass immunization and rising investments in biologic manufacturing are pushing pharmaceutical companies to adopt smart label systems. These technologies enhance cold chain visibility, reduce product spoilage, and support real-time logistics decision-making.

Regional Analysis

Asia Pacific Smart Labels Market for healthcare and pharmaceutical industry accounted for largest global market share in 2024. This dominance is due to growing regulatory scrutiny and reforms introduced to ensure drug safety and supply chain transparency. Regional authorities are implementing policies that boost the integration of track-and-trace technologies within pharmaceutical distribution networks. This regulatory shift is contributing to the accelerated adoption of smart labeling solutions in prescription drug authentication and temperature-sensitive shipments. In addition, the rapid development of healthcare infrastructure, alongside government-backed digital health initiatives across Southeast Asia, is increasing the deployment of smart labels in hospital and retail pharmacy operations.

India Smart Labels Market for Healthcare and Pharmaceutical Industry Insight

India held largest regional share in Asia Pacific smart labels landscape in 2024, driven by expanding pharmaceutical manufacturing hubs across the country. The growth of domestic production capacity is increasing the need for advanced labeling solutions that support compliance, traceability, and secure product handling. According to the India Brand Equity Foundation, India's pharmaceutical industry is valued at around USD 50 billion, with exports contributing over USD 25 billion. The country accounts for approximately 20% of global generic drug exports and supplies more than 50% of the worldwide demand for various vaccines. Additionally, India fulfills 40% of the generic drug demand in the US and provides 25% of all medicines consumed in the UK. Rising pharmaceutical exports and scaled-up production are pushing manufacturers to adopt smart labels that improve supply chain efficiency, ensure product authenticity, and comply with domestic and international regulations.

North America Smart Labels Market for Healthcare and Pharmaceutical Industry

The market in North America is projected to grow at a significant CAGR from 2025-2034. This growth is owing to the well-established regulatory frameworks that emphasize serialization, data integrity, and tamper-proof packaging. Implementation of the US Drug Supply Chain Security Act (DSCSA) is compelling pharmaceutical manufacturers and distributors to adopt smart labeling technologies capable of supporting full product traceability across the supply chain. Furthermore, rising prevalence of chronic diseases such as diabetes, cardiovascular disorders, and cancer is fueling demand for intelligent packaging that ensures accurate medication dispensing and adherence monitoring.

The US Smart Labels Market for Healthcare and Pharmaceutical Industry Overview

The market in the US is expanding due the strong presence of global pharmaceutical and biotechnology firms investing in connected packaging innovation. Companies are integrating RFID, NFC, and sensor-based labels to support real-time drug authentication, monitor storage conditions, and automate inventory management. For instance, in August 2024, Avery Dennison launched the AD Minidose U9XM, a high-memory UHF RFID inlay designed for tagging small medical items such as syringes, vials, and other compact pharmaceutical packaging. The solution’s memory capacity allows storage of batch, expiry, and usage data on-device, reducing reliance on cloud lookups and strengthening supply chain integrity. These innovations are aligned with industry efforts to improve patient safety and enhance the efficiency of high-value therapeutic delivery. The increasing shift toward personalized medicine and specialty drugs is further contributing to the demand for smart labels that offer actionable data throughout the product lifecycle.

Europe Smart Labels Market for Healthcare and Pharmaceutical Industry

The smart labels landscape in Europe is projected to hold a substantial share in 2034, due to the enforcement of the EU Falsified Medicines Directive (FMD), which mandates serialization and tamper-evident features on all prescription drugs sold within the region. This regulation has accelerated the deployment of smart labeling technologies across pharmaceutical packaging lines to comply with authentication and traceability requirements. In addition, rising interest in sustainable packaging is pushing pharmaceutical manufacturers to adopt smart labels that reduce material waste and improve visibility across the packaging lifecycle.

Key Players & Competitive Analysis Report

The smart labels market for the healthcare and pharmaceutical industry is moderately competitive, with prominent players focusing on technological innovation, strategic partnerships, and geographic expansion to strengthen their market presence. Companies are investing in the development of next-generation smart labels that integrate RFID, NFC, and sensor technologies to meet the growing demand for real-time tracking, serialization, and anti-counterfeiting features in pharmaceutical packaging. Leading players are forming collaborations with pharmaceutical manufacturers, logistics providers, and regulatory bodies to support end-to-end supply chain transparency and compliance with global standards. Product diversification into tamper-evident labels, temperature-sensitive tags, and interactive smart packaging is helping companies cater to the specific needs of biologics, personalized medicine, and controlled substances.

Major companies operating in the smart labels market for healthcare and pharmaceuticals include CCL Industries Inc., Datalogic S.p.A., ID Tech Solutions Private Limited, Intellhydro Technology Pvt. Ltd., Invengo Information Technology Co., Ltd., RFiD Discovery (a brand of Paragon ID), SATO Asia Pacific Pte. Ltd., Schreiner Group GmbH & Co. KG, Tadbik Ltd., Avery Dennison Corporation, Honeywell International Inc., Zebra Technologies Corporation, William Frick & Company, Brady Corporation, and Thin Film Electronics ASA.

Key Players

- CCL Industries Inc.

- Datalogic S.p.A.

- ID Tech Solutions Private Limited

- Intellhydro Technology Pvt. Ltd.

- Invengo Information Technology Co., Ltd.

- RFiD Discovery

- SATO Asia Pacific Pte. Ltd.

- Schreiner Group GmbH & Co. KG

- Tadbik Ltd.

- Avery Dennison Corporation

- Honeywell International Inc.

- Zebra Technologies Corporation

- William Frick & Company

- Brady Corporation

- Thin Film Electronics ASA

Industry Developments

- May 2025: Identiv and InPlay developed next-generation BLE-enabled smart labels for cold-chain, logistics, and healthcare applications, integrating ultra-low-power NanoBeacon, temperature, humidity, and motion sensors, with AES-EAX encryption and support for low-cost BLE gateways and smartphones.

- January 2025: Linxens IoT Solutions launched a comprehensive smart label program aimed at transforming supply chains, including healthcare, with ultra-thin, eco-friendly IoT smart labels offering global location tracking and indoor precision inventory management capabilities. The labels employed bio-sourced, recyclable materials and energy-harvesting technologies, helping reduce waste while ensuring autonomous, long-lasting performance in clinical settings.

Smart Labels Market for Healthcare and Pharmaceutical Industry Segmentation

By Product Type Outlook (Revenue, USD Billion, 2020–2034)

- Passive RFID Labels

- Active RFID Labels

- NFC Labels

- QR Code & 2D Barcode Labels

- Sensor-Embedded Smart Labels

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Prescription Drug Packaging

- Vaccine & Biologics Shipment

- Medical Devices & Instrumentation

- Hospital Asset Management

- Clinical Trial Logistics

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Smart Labels Market for Healthcare and Pharmaceutical Industry Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.48 Billion |

|

Market Size in 2025 |

USD 2.90 Billion |

|

Revenue Forecast by 2034 |

USD 12.39 Billion |

|

CAGR |

17.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 2.48 billion in 2024 and is projected to grow to USD 12.39 billion by 2034.

The global market is projected to register a CAGR of 17.5% during the forecast period.

Asia Pacific dominated the market in 2024.

A few of the key players in the market are CCL Industries Inc., Datalogic S.p.A., ID Tech Solutions Private Limited, Intellhydro Technology Pvt. Ltd., Invengo Information Technology Co., Ltd., RFiD Discovery (a brand of Paragon ID), SATO Asia Pacific Pte. Ltd., Schreiner Group GmbH & Co. KG, Tadbik Ltd., Avery Dennison Corporation, Honeywell International Inc., Zebra Technologies Corporation, William Frick & Company, Brady Corporation, and Thin Film Electronics ASA.

The passive RFID segment dominated the market in 2024. This dominance is attributed the growing adoption in pharmaceutical inventory tracking and automated drug identification across distribution and retail channels.

The vaccine & biologics segment is expected to witness the fastest growth during the forecast period, driven by rising initiatives targeting mass immunization and rising investments in biologic manufacturing.