U.S. X-ray Irradiation Market Size, Share, Trends, Industry Analysis Report

By Application (Medical Devices, Pharmaceuticals, Biotech & Laboratory Supplies, Others), By Size – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 130

- Format: PDF

- Report ID: PM6079

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

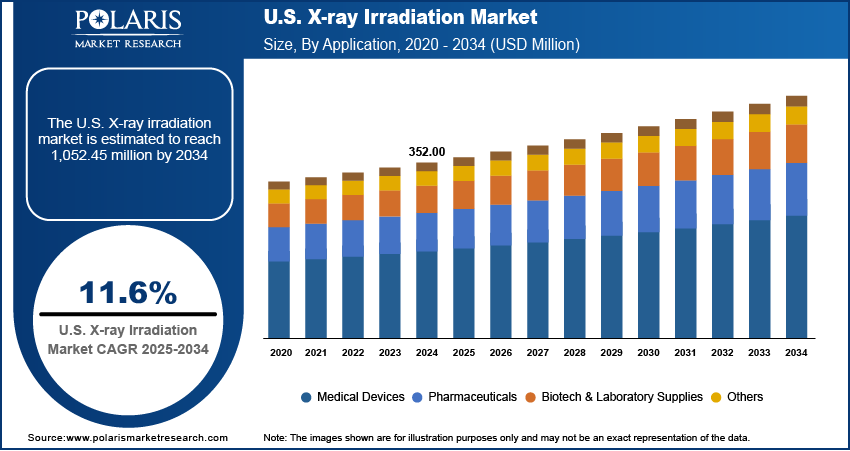

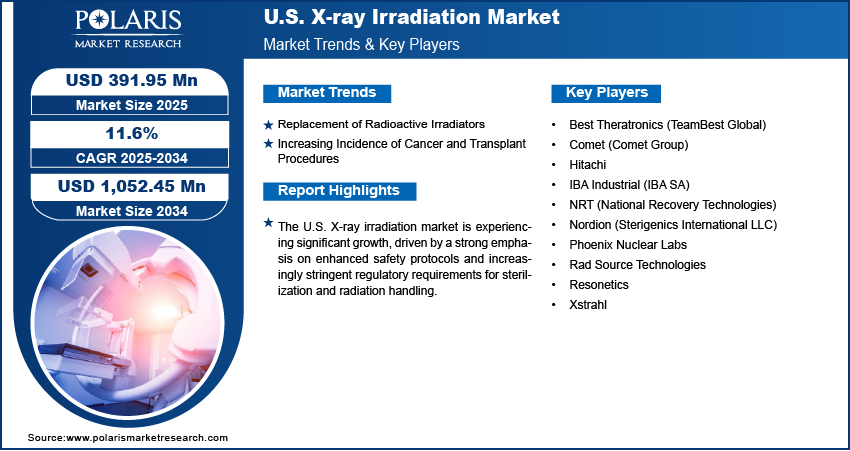

The U.S. x-ray irradiation market size was valued at USD 352.00 million in 2024 and is anticipated to register a CAGR of 11.6% from 2025 to 2034. The U.S. X-ray irradiation market is driven by advancements in medical imaging, increasing demand for non-invasive diagnostic procedures, and growing applications in cancer treatment. The rise in healthcare investments, aging population, and technological innovations like digital X-ray systems also fuel market growth, enhancing precision and patient outcomes across various healthcare settings.

Key Insights

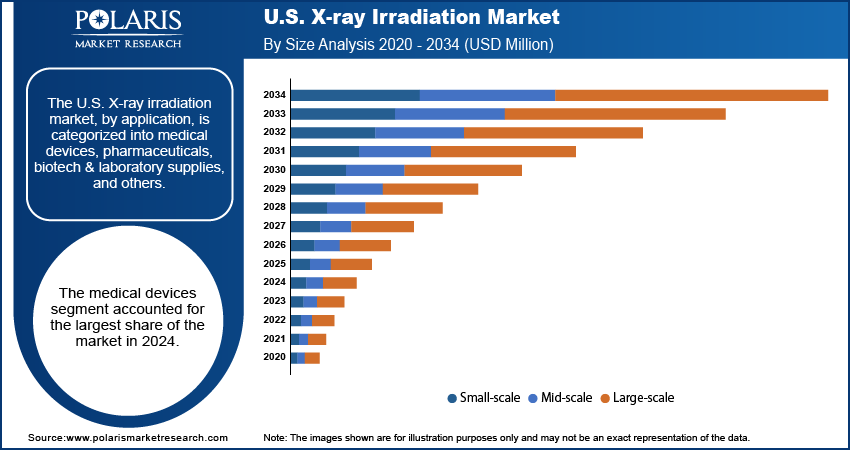

- By application, the medical devices segment held the largest share in 2024, primarily due to the critical need for sterile medical instruments and products.

- By size, the large-scale segment held the largest share in 2024, driven by its capacity to handle high volumes of products for industrial and centralized sterilization needs.

Industry Dynamics

- The shift from older, radioactive systems to safer X-ray-based alternatives is a significant factor.

- An increase in cancer diagnoses, including gastric cancer diagnostics, and the number of organ transplant procedures contribute to higher demand for reliable irradiation methods.

- Continuous improvements in technology are leading to the development of more effective and precise irradiation equipment.

- Growing research activities in fields such as biology and medicine also drive the need for controlled irradiation tools.

Market Statistics

- 2024 Market Size: USD 352.00 million

- 2034 Projected Market Size: USD 1,052.45 million

- CAGR (2025–2034): 11.6%

To Understand More About this Research: Request a Free Sample Report

The X-ray irradiation market involves systems and services that use X-rays or digital x-ray to expose materials or biological samples to radiation. This process is applied across various sectors for purposes such as sterilization, materials modification, and research, providing a non-radioactive alternative to traditional sources.

A few drivers for the U.S. X-ray irradiation market growth include the expansion of academic and biomedical research and the increasing adoption of X-ray technology in industrial applications. As research institutions and universities continue to advance studies in fields such as cell biology, immunology, and oncology, the demand for precise and safe irradiation tools for laboratory use rises.

The growing emphasis on academic and biomedical research is a significant, albeit sometimes overlooked, driver for the U.S. X-ray irradiation market. These irradiators are essential for various scientific investigations, including studies on radiation biology, preclinical drug development, preclinical CRO, and genetic research. X-ray irradiators are used to create immunocompromised animal models for transplant studies or to induce specific genetic mutations in cell lines to understand disease mechanisms. The National Institutes of Health (NIH) frequently funds research that relies on such equipment for experiments, highlighting its critical role in advancing medical knowledge and developing new therapies. This continuous need for controlled radiation in diverse scientific inquiries supports the steady demand for X-ray irradiation systems.

Drivers and Opportunities

Replacement of Radioactive Irradiators: A major driver for the U.S. X-ray irradiation market is the ongoing push to replace older, radioactive isotope-based irradiators, especially those using Cesium-137. These traditional systems pose significant security and safety concerns due to the potential for the radioactive material to be stolen or mishandled, leading to severe public health risks. The Department of Energy's National Nuclear Security Administration (NNSA) Office of Radiological Security (ORS) has initiatives to reduce reliance on high-activity radioactive sources, actively promoting the switch to non-radioisotopic technologies.

X-ray irradiators offer a safer alternative as they only produce radiation when switched on and do not contain radioactive materials that could be misused. This inherently safer profile reduces the security risks, regulatory burdens, and liability for facilities. For instance, the Nuclear Threat Initiative (NTI) highlights in its analysis "Replacing Cesium-137 Research Irradiators" that replacing Cesium-137 sources with X-ray technology protects institutions from potential financial devastation linked to a radiological attack and eases compliance with increasing regulations, as seen by the University of Southern California's switch. This strong focus on enhancing safety and security by moving away from radioactive sources is a primary factor driving the demand for X-ray irradiation systems.

Increasing Incidence of Cancer and Transplant Procedures: The rising number of cancer cases and organ transplant procedures in the U.S. directly increases the demand for irradiated blood products. Patients undergoing chemotherapy, radiation therapy, or organ transplantation often have compromised immune systems, making them highly susceptible to transfusion-associated graft-versus-host disease (TA-GVHD). This severe and often fatal complication occurs when viable donor lymphocytes in transfused blood attack the recipient's tissues.

To prevent TA-GVHD, blood components must be irradiated to inactivate donor lymphocytes while preserving the functionality of other blood cells such as red blood cells and platelets. The continued increase in the patient population requiring these critical treatments directly correlates with the need for more irradiated blood. According to the National Cancer Institute (NCI) in "Cancer Statistics" published in May 2025, an estimated 2,041,910 new cancer cases are projected to occur in the U.S. by 2025. Similarly, the Organ Procurement and Transplantation Network (OPTN) reported in July 2025 that organ transplants in the U.S. exceeded 48,000 in 2024, a 3.3% increase from 2023. These growing numbers of immunocompromised patients undergoing cancer treatments, including prostate cancer treatment, and organ transplant continue to fuel the expansion of the U.S. X-ray irradiation market for blood safety.

Segmental Insights

Application Analysis

Based on application, the U.S. X-ray irradiation market segmentation includes medical devices, pharmaceuticals, biotech & laboratory supplies, and others. The medical devices segment held the largest share in 2024. The widespread use of X-ray irradiation in sterilizing a broad range of medical equipment is a primary factor contributing to its dominance. This includes everything from single-use surgical instruments, implants, and syringes to bandages and other sterile consumables that are crucial for patient safety in healthcare settings. The robust regulatory landscape, which mandates high sterility standards for products used in or on the human body, further underpins the need for effective sterilization methods. X-ray irradiation offers a reliable and efficient process that can penetrate packaging, ensuring the sterility of packaged devices without leaving chemical residues or requiring extensive quarantine periods, unlike some alternative sterilization techniques.

The biotech and laboratory supplies segment is anticipated to register the highest growth rate during the forecast period. This accelerated growth is primarily fueled by the burgeoning research and development activities across biotechnology, pharmaceuticals, and academic institutions. X-ray irradiators are increasingly indispensable tools in various scientific applications, such as cell and tissue irradiation for research, creating animal models for preclinical studies, and sterilizing laboratory consumables that cannot withstand traditional heat or chemical sterilization. The rising investments in life sciences research, coupled with advancements in genomics, proteomics, and drug discovery, generate a growing need for precise and controllable irradiation methods. Furthermore, the increasing demand for sterile cell culture media, research reagents, and other sensitive laboratory materials, where maintaining biological integrity is paramount, drives the adoption of X-ray technology.

Size Analysis

Based on size, the U.S. X-ray irradiation market segmentation includes small-scale, mid-scale, and large-scale. The large-scale segment held the largest share in 2024. These large-scale systems, often found in centralized sterilization facilities, contract manufacturing organizations, and major healthcare networks, are designed to handle significant throughput of products. They are crucial for sterilizing vast quantities of medical devices, pharmaceutical products, and large batches of laboratory supplies where efficiency and consistent dose delivery across massive volumes are paramount. The ability of these systems to process entire pallets or large containers of goods efficiently, coupled with their robust penetration capabilities for dense products, makes them the preferred choice for industries requiring high capacity and stringent regulatory compliance. The economies of scale offered by large-scale operations also contribute to their dominance, as they can manage the extensive initial investment and operational costs more effectively than smaller entities, thereby maintaining a leading position in servicing the widespread demand for irradiation.

The small-scale segment is projected to exhibit the highest growth rate during the forecast period. This growth is largely attributed to the increasing adoption of compact, benchtop X-ray irradiators in diverse settings, including academic research laboratories, biotechnology startups, and specialized clinical facilities. These smaller systems offer a convenient and accessible alternative to larger, more complex units, especially for applications requiring lower throughput, precise dose control for sensitive samples, or a non-radioactive solution within a confined space. The rising demand for in-house irradiation capabilities, driven by the need for quick turnaround times for research samples, cell lines, and small batches of personalized medical products, fuels this segment's expansion. Furthermore, the continuous development of user-friendly interfaces and integrated dosimetry features in small-scale units enhances their appeal, allowing a broader range of users to perform irradiation safely and effectively, without the extensive infrastructure required by larger systems.

Key Players and Competitive Insights

The U.S. X-ray irradiation market features a competitive landscape with several key players striving for market share through product innovation, strategic partnerships, and expansions in service offerings. Companies are focusing on developing more efficient, compact, and automated X-ray irradiation systems to meet the evolving demands of various end-user industries, including healthcare, life sciences, and industrial applications. The competitive environment is shaped by the continuous drive to replace older, radioactive source-based irradiators with safer and more technologically advanced X-ray alternatives, pushing companies to invest in research and development to enhance system capabilities and address specific application needs.

A few prominent companies in the industry include Rad Source Technologies, Xstrahl, Best Theratronics (TeamBest Global), Hitachi, Comet Group, Nordion (Sterigenics International LLC), IBA Industrial, Phoenix Nuclear Labs, Resonetics, and NRT (National Recovery Technologies).

Key Players

- Best Theratronics (TeamBest Global)

- Comet Group

- Hitachi

- IBA Industrial

- NRT (National Recovery Technologies)

- Nordion (Sterigenics International LLC)

- Phoenix Nuclear Labs

- Rad Source Technologies

- Resonetics

- Xstrahl

U.S. X-ray Irradiation Industry Developments

October 2024: Precision X-Ray, Inc. and Gilardoni SpA formed an exclusive partnership to distribute the RADGIL2 X-ray blood irradiator in the U.S. This system is designed to safely and efficiently irradiate blood and its components, which is crucial for preventing complications such as Transfusion-associated Graft versus Host Disease (TA-GvHD).

U.S. X-ray Irradiation Market Segmentation

By Application Outlook (Revenue – USD Million, 2020–2034)

- Medical Devices

- Pharmaceuticals

- Biotech & Laboratory Supplies

- Others

By Size Outlook (Revenue – USD Million, 2020–2034)

- Small-Scale

- Mid-Scale

- Large-Scale

U.S. X-ray Irradiation Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 352.00 million |

|

Market Size in 2025 |

USD 391.95 million |

|

Revenue Forecast by 2034 |

USD 1,052.45 million |

|

CAGR |

11.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 352.00 million in 2024 and is projected to grow to USD 1,052.45 million by 2034.

The market is projected to register a CAGR of 11.6% during the forecast period.

A few key players in the market include Rad Source Technologies, Xstrahl, Best Theratronics (TeamBest Global), Hitachi, Comet (Comet Group), Nordion (Sterigenics International LLC), IBA Industrial (IBA SA), Phoenix Nuclear Labs, Resonetics, and NRT (National Recovery Technologies).

The medical devices segment accounted for the largest share of the market in 2024.

The small-scale segment is expected to witness the fastest growth during the forecast period.