Italy Influencer Marketing Market Size, Share, Trend, & Industry Analysis Report

By Component (Solution/Platform and Services), By Organization Size, By End User – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5823

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

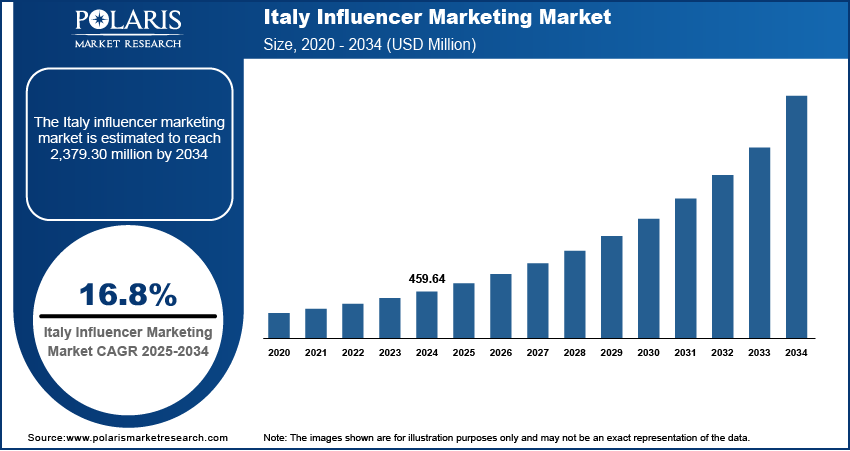

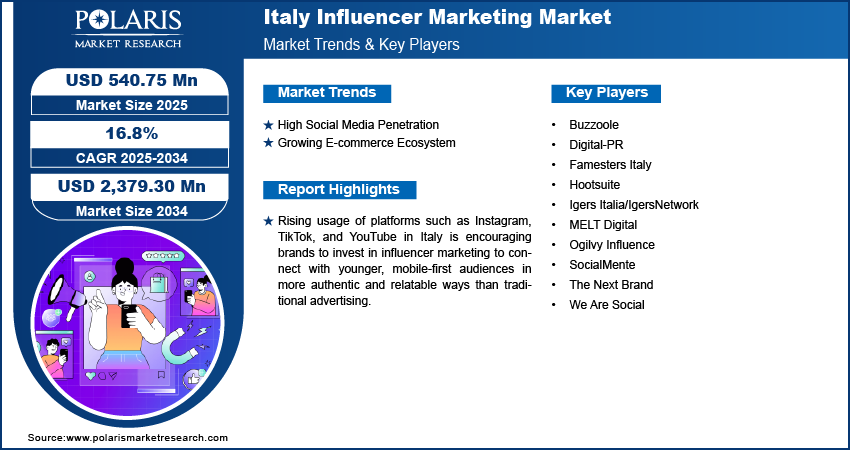

The Italy influencer marketing market size was valued at USD 459.64 million in 2024 and is projected to register a CAGR of 16.8% during 2025–2034. Rising usage of platforms such as Instagram, TikTok, and YouTube in Italy is encouraging brands to invest in influencer marketing to connect with younger, mobile-first audiences in more authentic and relatable ways than traditional advertising.

The Italy influencer marketing market comprises brand promotion and consumer engagement strategies executed through social media personalities who hold sway over specific audience segments. This market integrates content creation, digital video advertising, and analytics to drive product visibility, brand loyalty, and purchasing behavior within Italian digital ecosystems. Italian consumers increasingly seek genuine brand experiences and peer-led recommendations. Influencer-generated content, perceived as more trustworthy, is influencing purchase decisions across the beauty, fashion, travel, and food sectors.

To Understand More About this Research: Request a Free Sample Report

Local influencers with niche followings are gaining traction in Italy, offering higher engagement rates and localized brand messaging, which are appealing to small and mid-sized businesses. Additionally, the emergence of influencer marketing platforms and agencies in Italy is streamlining collaborations, performance tracking, and campaign scalability, making influencer marketing more accessible and professionalized.

Market Dynamics

High Social Media Penetration

Italy has seen a sharp rise in the adoption of platforms such as Instagram, TikTok, and YouTube, especially among younger, mobile-first users. For instance, In 2024, Instagram and YouTube have reported user growth up to 90% in Italy, with Instagram at around 30 million users and YouTube surpassing 35 million, indicating a notable shift in digital consumption trends. This surge has led to a shift in how brands approach advertising, placing greater emphasis on influencer-led content to maintain relevance and capture attention. Influencers are now seen as trusted figures whose recommendations carry more weight than traditional ads. Their ability to create visually engaging, lifestyle-based content helps brands build stronger emotional connections with consumers. This dynamic is boosting the influencer marketing strategies across sectors in Italy.

Growing E-commerce Ecosystem

The Italy e-commerce sector has expanded rapidly, prompting businesses to seek new ways to influence online purchasing decisions. According to the International Trade Administration, in 2024, approximately 50 million individuals in Italy, accounting for 85% of the population, engaged with the Internet, while almost 40 million engaged in e-commerce activities. Influencers play a key role in bridging the gap between product visibility and conversion. Their content often includes product demos, reviews, or affiliate links that lead directly to online stores, creating a seamless path from inspiration to transaction. Brands leverage influencers especially during festive sales, new launches, or limited-time offers to generate buzz and urgency. Influencers help brands reach broader audiences and also bring credibility that enhances consumer trust. This collaboration between e-commerce and influencer marketing is driving measurable returns and reinforcing digital retail strategies in Italy.

Segment Insights

Market Assessment by Component

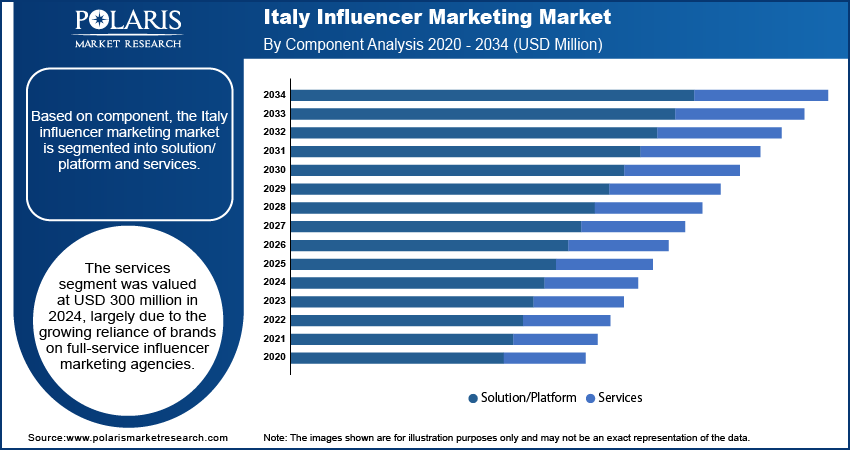

Based on component, the Italy influencer marketing market is bifurcated into solution/platform and services. The services segment was valued at USD 300 million in 2024, largely due to the growing reliance of brands on full-service influencer marketing agencies. These agencies offer tailored campaign strategies, content creation, talent sourcing, and performance analytics, allowing brands to execute multi-channel campaigns without the need for in-house teams. The demand is especially high from sectors such as fashion, food, and beauty, where storytelling and aesthetic content are critical. Italian brands are focusing on personalized influencer matchmaking and ROI-driven campaign design, which is prompting continued investments in managed services. Additionally, the legal and regulatory support provided by agencies for contract and compliance management is helping businesses mitigate risks, thereby boosting the services segment further.

The solution/platform segment is expected to register a CAGR of 19.2% from 2025 to 2034 due to the rising adoption of automated influencer discovery, campaign management, and analytics tools. Italian companies are investing in influencer marketing platforms to streamline partnerships, track real-time engagement metrics, and manage large-scale campaigns efficiently. These platforms offer end-to-end functionalities ranging from influencer outreach and budget control to content approval and ROI analysis making them indispensable for scaling operations. Growth is also supported by the demand from SMEs and direct-to-consumer brands that prefer cost-effective, data-driven marketing tools over full-service agencies. Enhanced integration capabilities with e-commerce platforms and customer relationship management tools are making these solutions more versatile, driving sustained adoption across verticals.

Market Assessment by Organization Size

Based on organization size, the Italy influencer marketing market is segmented into SME and large enterprises. In 2024, the large enterprise segment accounted for USD 321 million of the revenue share, driven by their substantial marketing budgets and strategic focus on omnichannel brand building. These companies are increasingly integrating influencer marketing into broader media plans, leveraging macro and celebrity influencers to amplify brand identity and increase consumer loyalty. Multinational corporations in Italy are also engaging influencers for cross-market campaigns aimed at regional and global audiences. Their preference for detailed performance analytics, brand safety tools, and compliance support is further fueling demand for both platforms and services. The growing importance of brand authenticity and customer trust in the luxury, automotive, and consumer electronics industries has positioned influencer marketing as a critical tool for large businesses, strengthening this segment’s dominance.

The SME segment is expected to register a CAGR of 19.2% during the forecast period, driven by rising awareness of cost-effective marketing models that influencer collaborations offer. Small and medium businesses in Italy are increasingly working with micro and nano influencers who can deliver high engagement rates at a lower cost. These partnerships allow SMEs to target niche audiences more effectively, especially in sectors such as fashion accessories, regional food products, and handmade goods. The availability of user-friendly influencer platforms and pay-per-performance pricing models is helping SMEs overcome budget constraints. These businesses are also leveraging influencer content across multiple channels to maximize exposure, leading to wider adoption and sustained growth in this segment.

Market Evaluation by End User

Based on end user, the segmentation includes fashion, luxury & cosmetics, retail & e-commerce, consumer goods, advertising & PR, food & beverages, travel & tourism, automobile, and others. In 2024, the luxury & cosmetics segment was valued at USD 115 million of the revenue share, driven by deep influencer-brand integration in product storytelling, limited-edition launches, and aesthetic-driven campaigns. Italian luxury and beauty brands rely heavily on influencers for visual content that embodies brand heritage and aspirational lifestyles. For instance, Guerlain partnered with seven influencers from Style Coalition to create branded content that showcases its beauty products. This collaboration highlights a diverse range of cosmetics while strategically engaging consumers through influencers representing various ages, ethnicities, and skin tones. Collaborations often include fashion weeks, exclusive events, and personalized experiences, amplifying reach through both macro and micro-influencers. Social media platforms such as Instagram and TikTok remain central to campaign strategies, where influencer content boosts visibility and drives direct e-commerce sales through swipe-up links and discount codes. This segment's high consumer engagement and product placement precision continue to attract premium investments from leading brands.

The retail & e-commerce segment is projected to register a CAGR of 22% during the forecast period, driven by their need to engage digital-native consumers and reduce reliance on paid ads. Influencers are increasingly becoming core to product discovery, unboxing videos, and real-time reviews, helping brands convert impressions into sales. Many e-commerce players are integrating influencer-led content directly onto product pages, enhancing credibility and boosting click-through rates. User-generated content, often repurposed from influencer collaborations, is also helping brands strengthen authenticity. Frequent product launches, dynamic pricing models, and seasonal promotions are making influencer engagement a vital part of digital marketing strategies for online retailers across Italy.

Key Players and Competitive Analysis

The competitive landscape of the Italy influencer marketing market is characterized by dynamic industry analysis, with brands and agencies leveraging market expansion strategies to capture growing demand. Key players are increasingly adopting mergers and acquisitions to consolidate market share, while post-merger integration efforts ensure seamless operational synergies. Strategic alliances and joint ventures are also on the rise, enabling collaborations between influencers, agencies, and brands to enhance reach and engagement. The sector is witnessing frequent new launches, with innovative campaigns tailored to niche audiences. Technology advancements, including AI-driven analytics and performance tracking tools, are reshaping campaign optimization and audience targeting. As competition intensifies, differentiation through data-driven insights and authentic content remains critical. Emerging trends such as micro-influencer partnerships and localized campaigns further drive market growth, positioning Italy as a key hub for influencer marketing innovation in Europe.

List of Key Companies

- Buzzoole

- Digital-PR

- Famesters Italy

- Hootsuite

- Igers Italia/IgersNetwork

- MELT Digital

- Ogilvy Influence

- SocialMente

- The Next Brand

- We Are Social

Italy Influencer Marketing Industry Developments

In September 2021, Hivency, a major SaaS platform for influencer marketing in Europe, announced its launch in the Italian market.

Italy Influencer Marketing Market Segmentation

By Component Outlook (Revenue USD Million, 2020–2034)

- Solution/Platform

- Services

By Organization Size Outlook (Revenue USD Million, 2020–2034)

- SME

- Large Enterprise

By End User Outlook (Revenue USD Million, 2020–2034)

- Fashion

- Luxury & Cosmetics

- Retail & E-Commerce

- Consumer Goods

- Advertising & PR

- Food & Beverages

- Travel & Tourism

- Automobile

- Others

Italy Influencer Marketing Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 459.64 million |

|

Market Size in 2025 |

USD 540.75 million |

|

Revenue Forecast by 2034 |

USD 2,379.30 million |

|

CAGR |

16.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The US market size was valued at USD 459.64 million in 2024 and is projected to grow to USD 2,379.30 million by 2034.

The US market is projected to register a CAGR of 16.8% during the forecast period.

A few of the key players are Buzzoole, Digital-PR, We Are Social, Ogilvy Influence, Hootsuite, SocialMente, MELT Digital, Igers Italia/IgersNetwork, The Next Brand, and Famesters Italy.

The services segment was valued at USD 300 million in 2024, largely due to the growing reliance of brands on full-service influencer marketing agencies.

In 2024, the large enterprise segment accounted for USD 321 million of the revenue share, driven by their substantial marketing budgets and strategic focus on omnichannel brand building.