Digital Video Advertising Market Share, Size, Trends, Industry Analysis Report

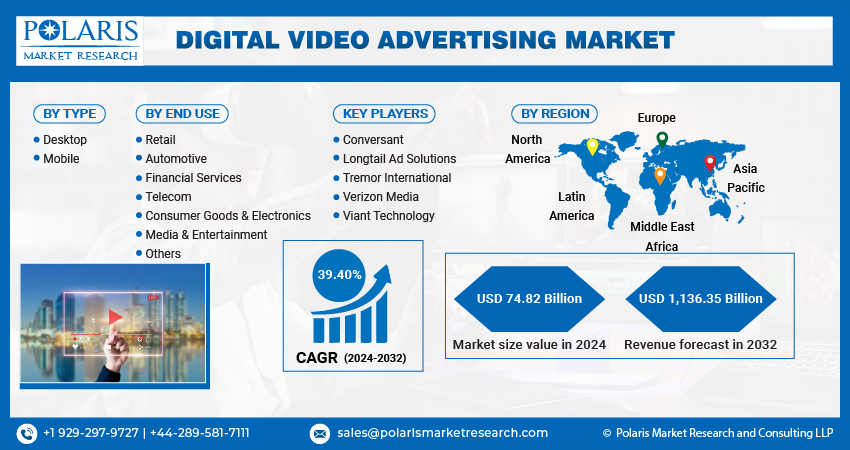

By Type (Desktop, Mobile), By End Use (Retail, Automotive, Financial Services, Telecom) By Region, And Segment Forecasts, 2024- 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM3781

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

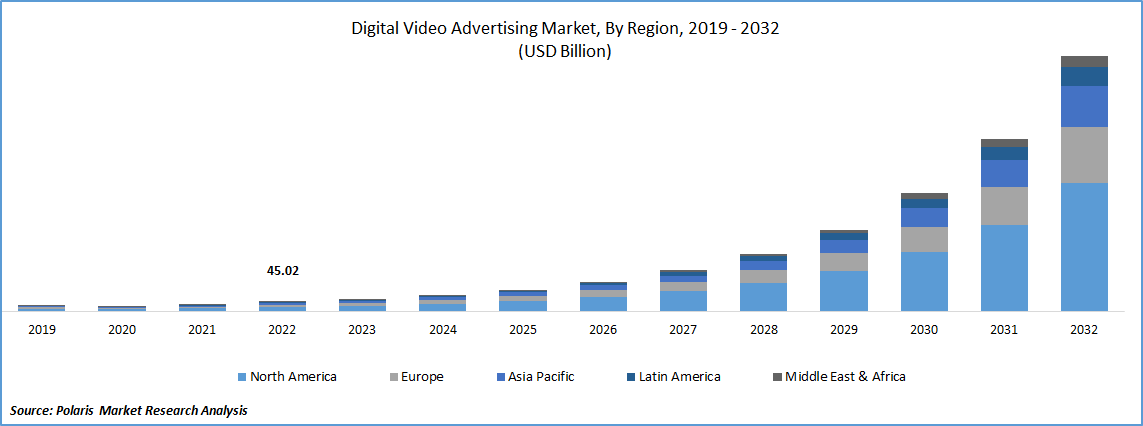

The global digital video advertising market was valued at USD 57.09 billion in 2023 and is expected to grow at a CAGR of 39.40% during the forecast period.

Increasing global usage of OTT platforms has become a favorable opportunity for advertisers to penetrate the market more effectively. With the availability of affordable high-speed internet and a growing demand for subscription-free content, marketers now have better prospects to expand their reach and generate revenue efficiently. The variety of advertising options, including pre, mid, and post-roll advertising, combined with the ability to prevent viewers from skipping ads, provides brands and agencies with increased opportunities to convey their message to audiences effectively.

To Understand More About this Research: Request a Free Sample Report

Additionally, in-banner digital video ads and companion ads enable marketers to run their marketing campaigns without compromising the viewers' experience, ensuring a seamless and uninterrupted viewing experience, thus creating a promising landscape for continued growth in the industry.

The emergence of innovative techniques like vertical filming and 360° digital videos has opened significant growth opportunities in the digital video advertising market. These cutting-edge videography methods offer a fresh and unique perspective on the advertised subject, setting them apart from traditional approaches and appealing to a broader audience. As a result, these methods empower advertisers to craft more compelling and successful advertising campaigns, encouraging brands to adopt digital video advertising strategies. Moreover, continuous advancements in video filming technology have introduced superior recording equipment capable of capturing high-quality, detailed videos in shorter durations. This enhanced capability allows advertisers to effectively deliver their brand messages to audiences, maximizing the impact of their advertising efforts.

Industry Dynamics

Growth Drivers

Increasing popularity of connected TVs

The increasing popularity of connected TVs among consumers is driving brands and marketers to embrace digital video advertising strategies. The capability of accessing individuals' social media accounts, analyzing viewing patterns, and leveraging effective search engine optimization empowers brands to deliver tailored advertisements to their target audience. Connected TV facilitates the transmission of personalized, targeted, and high-definition ads, resulting in enhanced brand exposure and increased brand loyalty. Moreover, the current trend of viewers being less inclined to skip ads on TVs provides marketers with an opportunity to convey brand messages more effectively, which, in turn, contributes to the growth of the market.

The combination of technological advancements and shifts in consumer behavior has prompted advertisers to explore creative approaches to digital video advertising. Increasingly, people are favoring visual media on alternative platforms beyond traditional cable and satellite TV. These non-conventional platforms include desktops, mobile phones, Over the Top (OTT) media platforms, & social media applications. By leveraging these platforms, advertisers can improve their service delivery methods, creating new revenue opportunities for marketers and broadcasters. Moreover, digital video content is now designed to be compatible with various platforms and formats, ensuring widespread exposure and higher engagement rates.

Report Segmentation

The market is primarily segmented based on type, end use, and region.

|

By Type |

By End Use |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

Desktops segment accounted for the largest share in 2022

Desktop segment accounted for major global share. A change in consumer lifestyles and preferences has resulted in a shift from traditional TV viewership to digital media platforms. With users increasingly accessing multimedia content through desktops and laptops, advertisers are recognizing the advantages of utilizing desktops as a preferred channel for their advertising practices. By advertising on desktops, advertisers can leverage the larger screen size to create a more significant impact on their target audiences, motivating them to take specific actions like making purchases or signing up for particular services.

Mobile segment is likely to register highest growth rate. This growth can be attributed to the widespread adoption of affordable smartphones and a rising trend among individuals to access content at their convenience through mobile devices. Mobile games have become a lucrative avenue for advertisers as they offer game credits or coins to players in exchange for watching digital video ads between gameplay sessions. This novel approach provides advertisers with a fresh channel to expand their reach and engage with their target audience effectively.

By End-Use Analysis

Retail segment expected to hold substantial market share over the forecast period

Retail segment is projected to hold significant market share. Through mobile and desktop platforms, brands and marketers can leverage cookies to identify and analyze search results, gaining valuable insights into people's preferences and demands. This deep understanding of customer needs enables offline retailers to enhance the in-store experience by offering products tailored to individual requirements.

Moreover, digital video advertising can be utilized within stores to facilitate interactive customer experiences, leading to more effective advertisement campaigns and a higher rate of consumer acquisition. By utilizing data-driven strategies, retailers can create personalized advertising content that resonates with their target audience, fostering brand loyalty and ensuring a seamless and engaging shopping experience.

Media & entertainment segment witnessed steady growth. Video advertising has proven to be an effective tool for the entertainment providers to promote their content by show-casing trailers & teasers of their upcoming releases. The increasing prevalence of social media platforms has further empowered media houses to extend their content distribution through digital content licensing and production rights, creating promising growth opportunities for the market.

Additionally, the emergence and popularity of OTT media platforms have led media houses to embrace digital video advertising practices as content providers. Utilizing these platforms, they can efficiently incorporate pre-roll digital video advertisements, reaching a broader audience and enhancing their promotional efforts. By leveraging these innovative advertising methods, media and entertainment providers can establish stronger connections with their target audience and maximize the impact of their content promotion strategies.

Regional Insights

North America region dominated the global market in 2022

North America region dominated the global market. his leadership position can be attributed to the widespread adoption of smartphones in the region. As the number of digital viewers continues to rise, brands and agencies are increasingly motivated to capitalize on this trend and secure a larger portion of screen time by adopting digital video advertising practices. Moreover, the prevalence of cord-cutting, where consumers opt to cancel traditional cable TV subscriptions in favor of OTT media delivery platforms, has contributed to the market's growth in North America. This incremental shift towards OTT platforms offers new and promising opportunities for marketers to reach their target audience effectively.

APAC is likely to emerge as fastest growing region. The region's availability of affordable high-speed internet services has led to widespread adoption among the population, making digital media a prime platform for video advertising. The increasing usage of social media in this area has created a new avenue for revenue generation for advertisers, further stimulating market growth opportunities.

Furthermore, the rise of short video applications like Kuaishou & TikTok, with their large user base in the subcontinent, has caught the attention of marketers and brands, prompting them to tap into these platforms for digital video advertising purposes. As these platforms gain immense popularity and user engagement, advertisers are keen to leverage their reach and captivate audiences through innovative and engaging video advertisements.

Key Market Players & Competitive Insights

The digital video advertising market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market are

- Conversant

- Longtail Ad Solutions

- Tremor International

- Verizon Media

- Viant Technology

Recent Developments

- In June 2023, JW Player has recently formed a strategic partnership with the Magnite to offer its customers enhanced revenue opportunities. Through this collaboration, JWP customers can benefit from improved ad delivery and fill rates, ensuring greater transparency and optimized revenue generation.

- In May 2023, PubMatic has recently teamed up with SeenThis to revolutionize digital advertising by focusing on speed, quality, and environmental impact. Through this partnership, they aim to deliver faster digital advertising while maintaining higher quality standards and minimizing carbon emissions.

- In February 2023, Viant Technology has partnered with Scope3 to address the carbon footprint associated with running digital advertising campaigns. This collaboration is aimed at enhancing the environmental impact of their operations, with a clear commitment to achieving carbon neutrality in energy usage by the year 2023.

Digital Video Advertising Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 74.82 billion |

|

Revenue forecast in 2032 |

USD 1,136.35 billion |

|

CAGR |

39.40% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Conversant, Longtail Ad Solutions, Tremor International, Verizon Media, and Viant Technology. |

FAQ's

The digital video advertising market report covering key segments are type, end use, and region.

Digital Video Advertising Market Size Worth $1,136.35 Billion by 2032.

The global digital video advertising market is expected to grow at a CAGR of 39.4% during the forecast period.

North America is leading the global market.

key driving factors in digital video advertising market are incremental penetration of OTT media streaming platforms.