Japan Cancer Vaccines Market Size, Share, Trends, Industry Analysis Report

: By Type (Prevention Vaccines, Treatment Vaccines, and Oncolytic Viruses), Indication, and Patient Type – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 125

- Format: PDF

- Report ID: PM1680

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

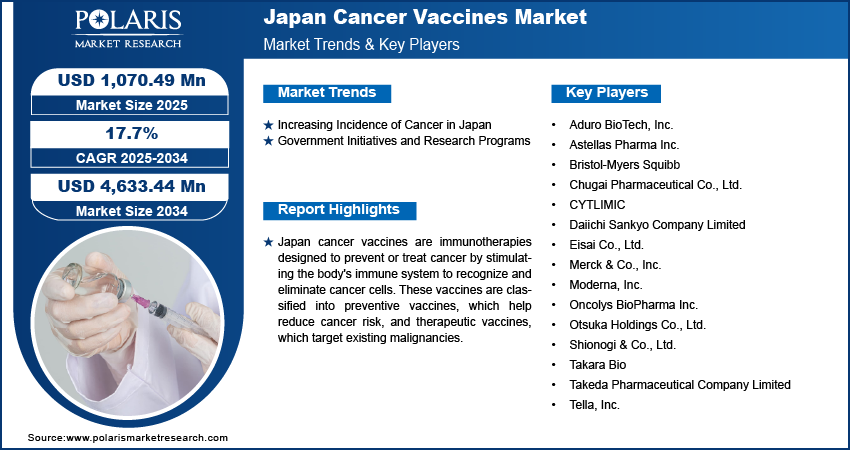

The Japan cancer vaccines market size was valued at USD 911.21 million in 2024, growing at a CAGR of 17.7% during 2025–2034. The market growth is primarily driven by rising incidence of cancer, continued research and development efforts, and the implementation of government policies promoting early cancer detection and immunization programs.

Key Insights

- The preventive vaccines segment led the market in 2024. This is primarily due to the widespread adoption of these vaccines in reducing the incidence of virus-related cancers in Japan.

- The cervical cancer segment dominated the market in 2024. The segment’s dominance is fueled by the rising adoption of preventive measures such as HPV vaccinations to prevent the risk of human papillomavirus (HPV) infections, which are strongly linked to cervical cancer development.

- The adult segment held a larger market share in 2024, owing to increasing incidence of HPV infections among adults, fueling the need for preventive vaccines targeting HPV-related cancers.

Industry Dynamics

- The rising incidence of cancer is Japan and the corresponding rise in mortality cases has fueled the need for effective preventive measures, including development of cancer vaccines.

- The introduction of significant research initiatives to combat cancer is another major factor fueling market expansion.

- Advancement in vaccine technology are expected to provide significant market opportunities in the coming years.

- Stringent regulatory approval processes may present challenges to market growth.

Market Statistics

Market Size in 2024: USD 911.21 million

2034 Projected Market Size: USD 4,633.44 million

CAGR (2025-2034): 17.7%

To Understand More About this Research: Request a Free Sample Report

The Japan cancer vaccines market demand is growing due to increasing cancer incidence rates, advancements in immunotherapy, and rising government initiatives to support cancer prevention and treatment. The aging population in Japan contributed to a higher prevalence of cancer, driving demand for effective immunotherapeutic solutions. Additionally, continuous research and development efforts, along with regulatory approvals for novel cancer vaccines, are further propelling Japan cancer vaccines market expansion. The integration of personalized cancer vaccines and combination therapies with immune checkpoint inhibitors is also fostering innovation in the market.

Key factors influencing the Japan cancer vaccines market trends include rising healthcare expenditure, growing awareness of cancer immunotherapy, and increasing investments by pharmaceutical companies in vaccine development. Government policies promoting early cancer detection and immunization programs are also playing a crucial role in market growth. However, challenges such as high development costs and stringent regulatory frameworks may impact market dynamics. Nonetheless, the increasing adoption of therapeutic cancer vaccines and ongoing oncology clinical trials targeting various cancer types are expected to enhance market prospects in the coming years.

Japan Cancer Vaccines Market Dynamics

Increasing Incidence of Cancer in Japan

Japan has experienced a continuous rise in cancer incidence since the mid-1990s, leading to a corresponding rise in mortality rates. This upward trend highlights the growing need for effective preventive measures, including the development and deployment of cancer vaccines. The increasing cancer burden has heightened public health awareness and demand for innovative immunotherapeutic solutions, thereby driving the Japan cancer vaccines market growth in Japan.

Government Initiatives and Research Programs

The Japanese government has launched significant research initiatives to combat cancer. Notably, the Moonshot Research and Development Program, initiated in January 2023, aims to actualize a cancer-free society by regulating chronic inflammation. This program, led by Professor Hiroyoshi Nishikawa of Nagoya University, involves a consortium of Japanese and US research organizations focusing on ultra-early detection and intervention strategies. Such governmental initiatives and research programs are pivotal in advancing cancer vaccine research and development, thereby propelling the Japan cancer vaccines market expansion.

Japan Cancer Vaccines Market Segment Insights

Assessment by Type

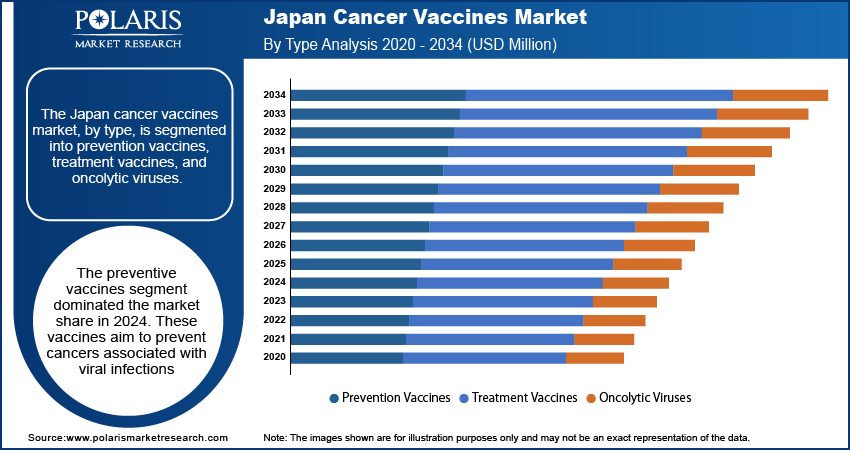

The Japan cancer vaccines market, by type, is segmented into prevention vaccines, treatment vaccines, and oncolytic viruses. The preventive vaccines segment dominated the Japan cancer vaccines market share in 2024. These vaccines aim to prevent cancers associated with viral infections, such as the human papillomavirus (HPV) vaccine, which reduces the risk of cervical cancer. The widespread adoption of such vaccines has been instrumental in decreasing the incidence of virus-related cancers in Japan.

Oncolytic viruses, which are engineered to selectively infect and destroy cancer cells, represent a rapidly emerging segment within the market. This innovative approach directly targets malignant cells and stimulates a systemic immune response against the tumor. The potential of oncolytic virotherapy has garnered significant attention, leading to increased research and development efforts aimed at harnessing these viruses for effective cancer treatment.

Evaluation by Indication

The Japan cancer vaccines market, by indication, is segmented into prostate, cervical, and others. The cervical cancer segment dominated the Japan cancer vaccines market revenue share in 2024. This prominence is attributed to the high prevalence of human papillomavirus (HPV) infections, which are strongly linked to cervical cancer development. Preventive measures, such as HPV vaccinations, have been widely adopted to mitigate this risk, leading to increased demand for cervical cancer vaccines. Government initiatives aimed at promoting vaccination programs have further bolstered the segment's growth.

The rising incidence of cervical cancer in Japan has prompted heightened awareness and proactive healthcare measures. This includes regular screening programs and public health campaigns emphasizing the importance of early detection and prevention. Such efforts have contributed to the sustained dominance of the cervical cancer segment within the cancer vaccines market, reflecting a comprehensive approach to addressing this public health concern.

Insight by Patient Type

The Japan cancer vaccines market, by patient type, is segmented into pediatric and adult. The adult segment held a larger market share in 2024. This prominence is primarily attributed to the increasing incidence of human papillomavirus (HPV) infections among adults, which has created the demand for preventive vaccines targeting HPV-related cancers. Additionally, the rising number of cancer cases in Japan, leading to ∼380,400 deaths in 2022, has highlighted the necessity for prophylactic and therapeutic cancer vaccines within the adult population.

The adult demographic's higher susceptibility to various cancer types has prompted healthcare authorities to prioritize vaccination programs aimed at this group. Government initiatives and public health campaigns have been instrumental in promoting vaccine uptake among adults, further bolstering this segment's expansion.

Key Players and Competitive Analysis Report

The Japan cancer vaccines market features several active companies contributing to advancements in oncology. A few notable players include Aduro BioTech, Inc.; Astellas Pharma, Inc.; Bristol-Myers Squibb; Tella, Inc.; Oncolys BioPharma Inc.; CYTLIMIC; Takeda Pharmaceutical Company Limited; Takara Bio; Daiichi Sankyo Company Limited; Merck & Co., Inc.; Moderna, Inc.; Chugai Pharmaceutical Co., Ltd.; Otsuka Holdings Co., Ltd.; Eisai Co., Ltd.; and Shionogi & Co., Ltd.

These companies are actively engaged in developing innovative cancer vaccines and immunotherapies, leveraging their extensive research and development capabilities. For instance, Takeda Pharmaceutical Company Limited focuses on novel oncology treatments, including vaccine-based therapies. Similarly, Daiichi Sankyo Company, Limited is advancing its pipeline with cancer vaccine candidates targeting various malignancies. Astellas Pharma Inc. is investing in immuno-oncology, exploring vaccine approaches to stimulate anti-tumor immune responses.

Collaborations and strategic partnerships are common among these companies to enhance their cancer vaccine portfolios. Chugai Pharmaceutical Co., Ltd., a member of the Roche Group, benefits from global research networks to accelerate vaccine development. Eisai Co., Ltd. collaborates with biotech firms to integrate novel vaccine technologies into its oncology pipeline. Additionally, Kyowa Kirin Co., Ltd. emphasizes antibody-based therapies, complementing vaccine strategies to improve cancer treatment outcomes.

Takeda Pharmaceutical Company Limited, established in 1781 and headquartered in Osaka, Japan, is one of the largest pharmaceutical companies in Japan and among the top 20 globally. With a focus on oncology, rare diseases, neuroscience, gastroenterology, plasma-derived therapies, and vaccines, Takeda has positioned itself as a leader in innovative biopharmaceuticals. The company has expanded its global footprint significantly through strategic acquisitions, including Millennium Pharmaceuticals and Shire, which have enhanced its oncology portfolio and research capabilities. Takeda’s commitment to cancer treatment extends to various therapies, including immuno-oncology and hematological malignancies.

Astellas Pharma Inc., headquartered in Chuo-Ku, Tokyo, Japan, is a major multinational pharmaceutical company formed in 2005 through the merger of Yamanouchi Pharmaceutical Co., Ltd. and Fujisawa Pharmaceutical Co., Ltd. The company focuses on discovering, developing, manufacturing, and commercializing innovative pharmaceuticals across therapeutic areas such as oncology, urology, nephrology, infectious diseases, and metabolic disorders. Astellas is committed to addressing unmet medical needs by leveraging advanced biology and modality-focused approaches. Its robust pipeline includes treatments for urothelial cancer, gastric cancer, gastroesophageal junction cancer, acute myeloid leukemia (AML), and anemia associated with chronic kidney disease (CKD). With operations spanning the Americas, Europe, Asia, and Oceania, Astellas employs advanced research facilities and global collaborations to strengthen its position in the pharmaceutical industry.

List of Key Companies

- Aduro BioTech, Inc.

- Astellas Pharma Inc.

- Bristol-Myers Squibb

- Chugai Pharmaceutical Co., Ltd.

- CYTLIMIC

- Daiichi Sankyo Company Limited

- Eisai Co., Ltd.

- Merck & Co., Inc.

- Moderna, Inc.

- Oncolys BioPharma Inc.

- Otsuka Holdings Co., Ltd.

- Shionogi & Co., Ltd.

- Takara Bio

- Takeda Pharmaceutical Company Limited

- Tella, Inc.

Japan Cancer Vaccines Industry Developments

- April 2022: Japan relaunched its HPV vaccination drive for thousands of women. HPV vaccine protects against infection with certain strains of HPV, which can cause cervical cancer, genital warts, and other cancers.

Japan Cancer Vaccines Market Segmentation

By Type Outlook (Revenue – USD Million, 2020–2034)

- Prevention Vaccines

- Treatment Vaccines

- Oncolytic Viruses

By Indication Outlook (Revenue – USD Million, 2020–2034)

- Prostate

- Cervical

- Others

By Patient Type Outlook (Revenue – USD Million, 2020–2034)

- Pediatric

- Adult

Japan Cancer Vaccines Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 911.21 million |

|

Market Value in 2025 |

USD 1,070.49 million |

|

Revenue Forecast by 2034 |

USD 4,633.44 million |

|

CAGR |

17.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The Japan cancer vaccines market has been segmented on the basis of type, indication, and patient type. Moreover, the study provides the reader with a detailed understanding of the different segments.

Growth/Marketing Strategy

Companies in the Japan cancer vaccines market focus on research-driven growth strategies, emphasizing clinical advancements, regulatory approvals, and strategic collaborations. Firms invest in expanding their oncology pipelines through partnerships with biotech companies and research institutions to enhance vaccine development. Marketing strategies include physician awareness programs, participation in global oncology conferences, and digital outreach to educate healthcare professionals and patients. Additionally, companies leverage government initiatives and reimbursement policies to strengthen market penetration. Expansion into personalized cancer vaccine development is also a key focus, aligning with the growing demand for precision medicine.

FAQ's

The Japan cancer vaccines market size was valued at USD 911.21 million in 2024 and is projected to grow to USD 4,633.44 million by 2034.

The market is projected to register a CAGR of 17.7% during the forecast period.

The Japan cancer vaccines market features several active companies contributing to advancements in oncology. A few notable players are Aduro BioTech, Inc.; Astellas Pharma, Inc.; Bristol-Myers Squibb; Tella, Inc.; Oncolys BioPharma Inc.; CYTLIMIC; Takeda Pharmaceutical Company Limited; Takara Bio; Daiichi Sankyo Company Limited; Merck & Co., Inc.; Moderna, Inc.; Chugai Pharmaceutical Co., Ltd.; Otsuka Holdings Co., Ltd.; Eisai Co., Ltd.; and Shionogi & Co., Ltd.

The preventive vaccines segment accounted for the largest share of the market in 2024.

Cancer vaccines refer to immunotherapeutic treatments designed to stimulate the body's immune system to prevent or treat cancer. These vaccines work by targeting specific cancer-associated antigens, enhancing the immune response against malignant cells. They are categorized into preventive vaccines, which help reduce cancer risk, and therapeutic vaccines, which assist in treating existing cancers by boosting immune recognition and attack on tumor cells. In Japan, cancer vaccines are a growing area of oncology research, supported by advancements in biotechnology, increasing cancer prevalence, and government initiatives promoting immunotherapy-based treatments.