Japan Vapor Recovery Units Market Size, Share, Trends, Industry Analysis Report

By Technology (Absorption, Condensation, Membrane Separation, Adsorption, and Others), By Application, By End User – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6324

- Base Year: 2024

- Historical Data: 2020-2023

Overview

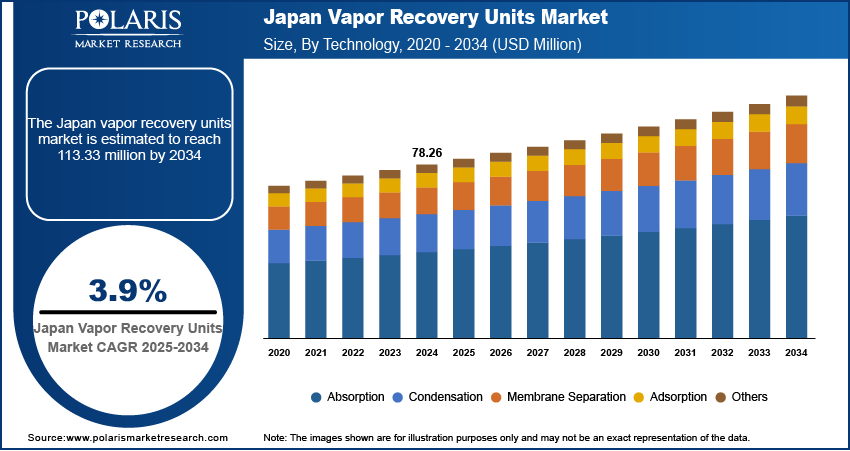

The Japan vapor recovery units (VRUs) market size was valued at USD 78.26 million in 2024, growing at a CAGR of 3.9% from 2025 to 2034. The Japan vapor recovery units (VRU) industry is being driven by increasing focus on emission control, environmental sustainability, and operational efficiency. In key sectors such as oil and gas, petrochemicals, and renewable energy, VRUs are essential for managing vapor emissions at critical points like storage tanks, refineries, and fuel terminals.

Key Insights

- The absorption segment accounted for USD 27.00 million revenue share in 2024, due its efficient ability to capture and recover vapors, making it a preferred choice for industries in Japan.

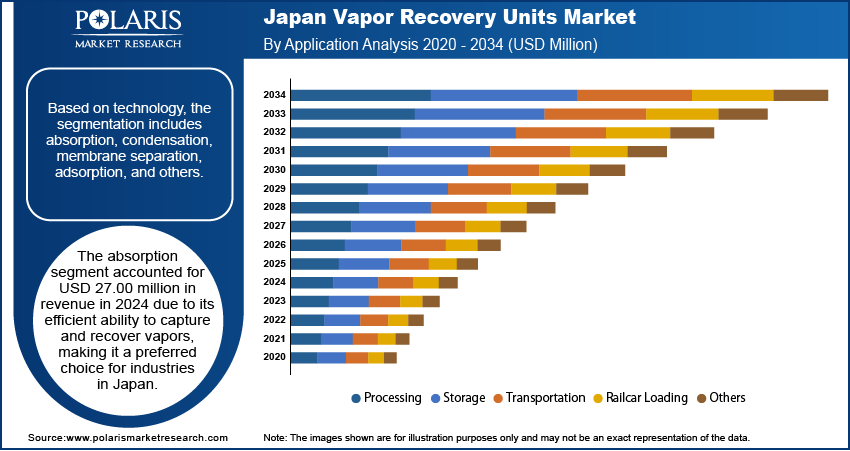

- The transportation segment is projected to register a CAGR of 4.4% during the forecast period, due to increasing demand for vapor recovery solutions in fuel transportation to comply with environmental regulations and reduce emissions.

- The oil & gas segment accounted for USD 51.16 million revenue share in 2024, attributed to the high demand for vapor recovery units to capture and manage hazardous emissions during the production, storage, and transportation of oil and gas.

Industry Dynamics

- In Japan, stringent environmental regulations have become a major catalyst for the adoption of Vapor Recovery Units (VRUs). Regulatory bodies such as the Ministry of the Environment and Japan Environmental Management Association (JEMA) have established stringent standards to limit the emission of volatile organic compounds (VOCs) and greenhouse gases.

- The increasing focus on renewable energy and the development of low-carbon fuels are pivotal in shaping Japan vapor recovery unit market.

- The high ongoing maintenance and operational costs associated with these systems are major challenges in the Japan vapor recovery units market.

- The Japanese government’s continued offering of incentives, grants, and carbon trading schemes is motivating businesses to adopt VRUs, contributing to both growth and environmental sustainability.

Market Statistics

- 2024 Market Size: USD 78.26 million

- 2034 Projected Market Size: USD 113.33 million

- CAGR (2025–2034): 3.9%

AI Impact on Japan Vapor Recovery Units Market

- Integration of AI and IoT with VRUs offers real-time monitoring, predictive maintenance, and autonomous optimization. It helps detect issues early and reduce downtime.

- There is a growing demand for AI-integrated VRUs that combine adsorption and membrane technologies for better VOC recovery.

- Various companies such as JXTG, Idemitsu, Chiyoda, and Mitsui integrate AI across numerous operations, including logistics, refineries, maintenance, and petrochemical operations, to tackle labor shortages and aging assets.

The Japan vapor recovery units market is experiencing strong growth, driven by significant technological advancements that are reshaping how industries capture and manage volatile organic compounds (VOCs). As industries seek more efficient, cost-effective, and environmentally friendly solutions, VRU technology has evolved to meet these needs. For instance, modern VRUs are available with advanced sensors, automated controls, and integration with data analytics systems to optimize the recovery and storage of vapors. These innovations have led to higher recovery rates and greater energy efficiency, making VRUs more attractive to businesses looking to reduce waste and improve profitability. The automotive industry, for example, uses VRUs at refueling stations to capture gasoline vapors, preventing them from being released into the atmosphere. Moreover, VRUs are being designed with modular features that allow for easier installation and scalability, making them suitable for a wider range of applications, from large-scale industrial facilities to smaller enterprises. As Japan's industrial sector continues to focus on improving operational efficiency and reducing emissions, the technological evolution of VRUs positions them as a critical part of the industrial landscape

While Japan VRU market has been historically dominated by the oil and gas industries, significant opportunities lie in emerging sectors that are increasingly aware of the environmental and economic benefits VRUs offer. For example, the food & beverage industry, which is one of Japan's largest sectors, is adopting VRUs to manage ethanol emissions during the fermentation process. The technology helps reduce operational losses and improve air quality, both of which are critical in an industry that is under pressure to meet stricter environmental regulations. The expanding waste management and landfill gas recovery sectors also present new opportunities. VRUs are being deployed at landfill sites to capture methane and other greenhouse gases, which can be processed into bioenergy.

Drivers & Opportunities

Growing Focus on Industrial Emissions Reduction: Japan has long been a global leader in environmental sustainability, and this is reflected in the country's increasing efforts to curb industrial emissions. This focus is driving the adoption of Vapor Recovery Units (VRUs), particularly in industries that contribute significantly to air pollution, such as oil, gas, and chemical manufacturing. For example, Japan's industrial sectors must comply with strict emissions guidelines established by the Ministry of the Environment. These guidelines regulate the release of volatile organic compounds (VOCs) and other harmful substances into the atmosphere. The enforcement of such regulations, combined with the need to mitigate environmental damage, has created a strong demand for VRUs, as they help capture and recycle hazardous vapors that would otherwise be released. The Japanese government’s continued investments in pollution control technologies and clean air initiatives ensure that VRUs remain integral to industries seeking to meet emissions standards. Companies across various sectors are increasingly adopting these systems, not just as a regulatory requirement but as a means of advancing corporate social responsibility (CSR) by reducing their environmental impact.

Technological Advancements in VRU Systems: Technological advancements are one of the driving forces behind the growing demand for VRUs in Japan. As industries seek more efficient, cost-effective, and environmentally friendly solutions, VRU technology has evolved to meet these needs. For instance, modern VRUs are available with advanced sensors, automated controls, and integration with data analytics systems to optimize the recovery and storage of vapors. These innovations have led to higher recovery rates and greater energy efficiency, making VRUs more attractive to businesses looking to reduce waste and improve profitability. The automotive industry, for example, uses VRUs at refueling stations to capture gasoline vapors, preventing them from being released into the atmosphere. Moreover, VRUs are now being designed with modular features that allow for easier installation and scalability, making them suitable for a wider range of applications, from large-scale industrial facilities to smaller enterprises. A recent development in this area is the integration of Internet of Things (IoT) technology into VRU systems, allowing for real-time monitoring and predictive maintenance. This development enhances the efficiency of vapor recovery and reduces downtime and maintenance costs. As Japan's industrial sector continues to focus on improving operational efficiency and reducing emissions, the technological evolution of VRUs positions them as a critical part of the industrial landscape, driving further growth and adoption.

Segmental Insights

Technology Analysis

Based on technology, the Japan vapor recovery units market segmentation includes absorption, condensation, membrane separation, adsorption, and others. The absorption technology segment held the largest revenue share in 2024 due to its proven effectiveness and cost-efficiency in vapor recovery applications. This method involves the dissolution of vapors into a liquid solvent, making it highly suitable for industries dealing with a variety of volatile organic compounds (VOCs). Absorption systems are particularly effective in industries such as petrochemicals and pharmaceuticals, where capturing and recycling vapors is essential for both environmental compliance and cost reduction. For instance, absorption technology is often used in natural gas processing to capture methane and other hydrocarbon vapors, enabling their reuse. Its ability to handle high volumes of vapors with minimal energy consumption makes it a preferred choice in Japan's industrial sectors.

The membrane separation segment is projected to register a substantial pace in the coming years due to its high efficiency, versatility, and environmental benefits. This technology uses selective permeable membranes to separate vapor from gas mixtures, offering advantages such as low energy consumption, compact design, and minimal operational maintenance. The growing demand for cleaner production processes and reduced emissions in industries like food processing, chemicals, and even wastewater treatment is fueling this growth. For example, in the chemical industry, membrane separation systems are used to separate solvents from vapors during distillation processes, reducing both energy costs and environmental impact.

Application Analysis

In terms of application, the Japan vapor recovery units market segmentation includes processing, storage, transportation, railcar loading, and others. The storage segment held a 31.39% share in 2024 due to the critical need for vapor recovery in storage facilities, particularly in industries dealing with volatile liquids and gases. During the storage of fuels, chemicals, or other volatile substances, vapors are often released into the atmosphere, posing both environmental and economic risks. Vapor recovery units in storage tanks prevent the release of these harmful emissions by capturing and condensing them for reuse, reducing operational losses and helping meet regulatory standards. For example, in the oil & gas industry, VRUs are widely used at fuel storage facilities to recover gasoline vapors, minimizing VOC emissions and improving cost efficiency.

The transportation segment is projected to register a CAGR of 4.4% during the forecast period due to increasing regulatory pressure on the reduction of emissions from vehicles and transportation systems. As Japan continues to tighten its environmental laws, especially in sectors such as oil, gas, and chemicals, the need for effective vapor recovery during transportation of volatile liquids and gases is growing. Vapor recovery units (VRUs) are being increasingly deployed on transport trucks, pipelines, and marine vessels to capture and prevent the release of harmful vapors during fuel transfer.

End User Analysis

The Japan vapor recovery units market segmentation, based on end user, includes oil & gas, chemicals & petrochemicals, landfills, and others. The oil & gas segment accounted for USD 51.16 million in revenue in 2024, driven by the industry's high demand for vapor recovery systems to manage emissions and ensure compliance with stringent environmental regulations. The oil and gas sector is one of the largest contributors to volatile organic compound (VOC) emissions, particularly during storage, transportation, and refining processes. VRUs are essential in capturing and recovering these vapors, reducing environmental impact, and recovering valuable products. VRUs are extensively used in gas stations, oil refineries, and tanker trucks to prevent the release of harmful vapors into the atmosphere. Additionally, the sector's push toward sustainability and adherence to Japan's strict environmental standards fuels the demand for VRUs.

The landfills segment is projected to capture 10.35% share of the market by 2034 due to its growing need for effective methane and gas emission management. With Japan's focus on waste management and carbon neutrality, the demand for VRUs in landfills is expected to rise significantly. This shift aligns with global efforts to reduce landfill emissions and improve waste-to-energy practices, driving growth in this segment.

Key Players & Competitive Analysis

The VRUs market is experiencing growing competition, driven by the rapid expansion of industries such as oil & gas, petrochemicals, and renewable energy. Leading players in the market are adopting a variety of strategies to maintain and enhance their position, including forming strategic partnerships, investing in the development of advanced VRU technologies, and expanding their presence in key regions with high demand. Companies are focusing on developing next-generation VRUs that incorporate features such as automation, remote monitoring, and modular designs, allowing them to meet Japan's stringent environmental regulations and operational needs. Furthermore, there is a strong emphasis on improving system efficiency, reducing long-term maintenance costs, and providing tailored solutions for sectors such as fuel storage facilities, refineries, and renewable energy infrastructure. The entry of tech-driven startups offering innovative emission monitoring and digital control technologies is intensifying the competition, prompting established players to continually innovate and upgrade their offerings to stay ahead in the market.

A few key players such as Dover Corporation (OPW & Blackmer); John Zink Hamworthy Combustion; Cimarron Energy, Inc.; Petrogas Systems; Zeeco, Inc.; Kappa GI; Kilburn Engineering Ltd; Cool Sorption A/S; VOCZero Ltd.; and Aereon dominate the Japan vapor recovery units market through their extensive fleets and nationwide service networks.

Key Players

- Aereon

- Cimarron Energy, Inc.

- Cool Sorption A/S

- Dover Corporation (OPW & Blackmer)

- John Zink Hamworthy Combustion

- Kappa GI

- Kilburn Engineering Ltd

- Petrogas Systems

- VOCZero Ltd.

- Zeeco, Inc.

Japan Vapor Recovery Units Market Segmentation

By Technology Outlook (Revenue, USD Million, 2020–2034)

- Absorption

- Condensation

- Membrane Separation

- Adsorption

- Others

By Application Capacity Outlook (Revenue, USD Million, 2020–2034)

- Processing

- Storage

- Transportation

- Railcar Loading

- Others

By End User Outlook (Revenue, USD Million, 2020–2034)

- Oil & Gas

- Upstream (Wellhead, Tank Batteries)

- Midstream

- Downstream

- Chemicals & Petrochemicals

- Landfills

- Others

Japan Vapor Recovery Units Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 78.26 Million |

|

Market Size in 2025 |

USD 80.63 Million |

|

Revenue Forecast by 2034 |

USD 113.33 Million |

|

CAGR |

3.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 78.26 million in 2024 and is projected to grow to USD 113.33 million by 2034.

The market is projected to register a CAGR of 3.9% during the forecast period.

A few of the key players in the market include Dover Corporation (OPW & Blackmer); John Zink Hamworthy Combustion; Cimarron Energy, Inc.; Petrogas Systems; Zeeco, Inc.; Kappa GI; Kilburn Engineering Ltd; Cool Sorption A/S; VOCZero Ltd.; and Aereon.

The absorption segment accounted for USD 27.00 million in revenue in 2024.

The transportation segment is projected to register a CAGR of 4.4% during the forecast period.