Knife Mills Market Share, Size, Trends, Industry Analysis Report

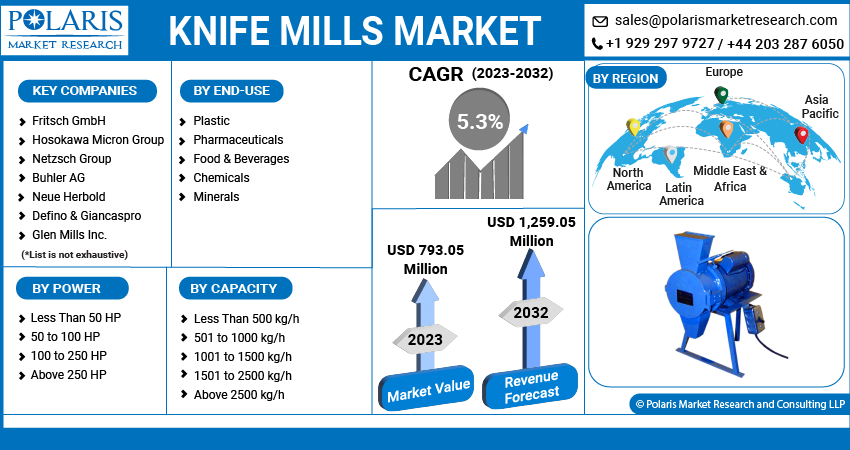

By Power (Less Than 50 HP, 50 to 100 HP, 100 to 250 HP, and Above 250 HP); By Capacity; By End-Use; By Region; Segment Forecast, 2023 - 2032

- Published Date:Jul-2023

- Pages: 117

- Format: PDF

- Report ID: PM3634

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

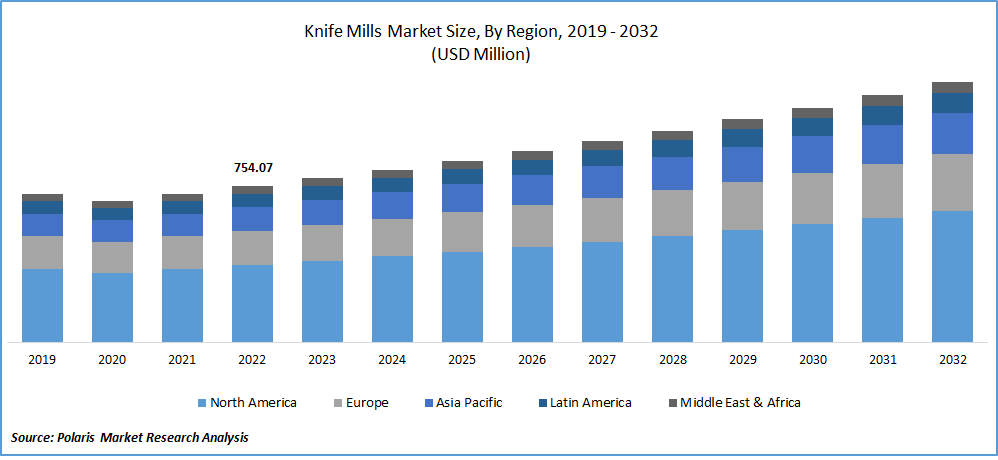

The global knife mills market was valued at USD 754.07 million in 2022 and is expected to grow at a CAGR of 5.3% during the forecast period.

The rapidly increasing demand for knife milling machines across a wide range of industries like food & beverages, metal & mining, construction, and chemical, along with the surging usage of these knives in various applications such as kitchenware and furniture making, among others, are key factors driving the demand and growth of the global market. In addition, manufacturers' growing focus and implementation towards the improvements in knife mill designs with advanced features, including detachable bowls and adjustable blades to enhance versatility and user-friendliness, are among the factors influencing the market growth at a rapid pace.

To Understand More About this Research: Request a Free Sample Report

For instance, in February 2022, WIDIA introduced its WCE solid-end milling machine that delivers affordable performance & reliability for both small and medium machine stops. It features WCE4, a four-flute geometry combining high-performance and advanced features with a versatile grade at a competitive price.

Moreover, emerging economies like India and China, with constantly expanding industrial sectors and ongoing research and development activities focused on improving the performance and versatility of knife mills, which results in innovations like improved blade design, enhanced material handling systems, energy efficiency, and customization options is gaining significant traction and pushing the market forward at an exponential rate.

The outbreak of the COVID-19 pandemic has positively impacted the growth of the knife mills market. The rapid spread of the deadly coronavirus led to increased demand for food products and pharmaceuticals, driving the need for efficient processing equipment like knife mills. The pandemic has also emphasized the importance of hygiene and safety in various industries; thus, knife mills designed with features to ensure easy cleaning, sterilization, and maintenance gained prominence during the pandemic.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

The surge in the number of industries having specific requirements for size reduction processes based on the characteristics of the materials is driving the demand for Knife mills, as it offers customization options to accommodate diverse needs of industries, such as adjustable speed, interchangeable screens, and variable feeding mechanisms. The integration of automation and digitalization in manufacturing processes resulting in increased productivity and reduced manual intervention, is further propelling the market growth.

Furthermore, the rising incorporation of advanced technologies such as artificial intelligence, the Internet of Things, and machine learning into knife mills presents lucrative opportunities for enhanced performance and efficiency. Smart knife mills equipped with sensors and data analytics capabilities can provide real-time insights, predictive maintenance, and optimized operational parameters, improving overall productivity and customer satisfaction and fueling the growth of the global market.

Report Segmentation

The market is primarily segmented based on power, capacity, end-use, and region.

|

By Power |

By Capacity |

By End-Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

50 to 100 hp segment accounted for the largest market share in 2022

The 50 to 100 hp segment accounted for the largest market share in 2022 and is likely to retain its market position over the projected period, which is largely attributed to the widespread use of the power range in numerous industrial applications, including food processing, pharmaceuticals, chemicals, and recycling among others along with its capabilities to handle a wider range of materials like tough and fibrous substances.

These types of knife mills can efficiently handle moderate to high volumes of materials while maintaining a reasonable energy consumption level, thereby industries seeking enhanced productivity and efficient processing are highly preferring these knife mills within this power range, which in turn, creates lucrative growth opportunities for the segment market over the years.

1001 to 1500 kg/h segment is expected to hold substantial market share during forecast period

The 1001 to 1500 kg/h segment is expected to hold a significant market share in terms of revenue in 2022 on account of an increase in the demand for efficient and reliable equipment to handle larger volumes of materials and a surge in the number of companies across industries who are increasingly focused on improving operational efficiency and productivity to optimize their manufacturing processes. With the growing emphasis on sustainability and waste reduction, several industries worldwide are seeking equipment that can effectively process and recycle materials, thereby propelling the adoption of the segment market.

The 501 to 1000 kg/h segment led the industry market with a substantial share in 2022, mainly due to the rising need for moderate to high capacity reduction processes and the growing popularity of these knife mills due to their ability to provide consistent and uniform particle size reduction, which is very critical in industries that require precise control over product quality.

Plastic segment is anticipated to witness highest growth

The plastic segment is anticipated to grow at a healthy CAGR during the forecast period, which is highly attributable to the significant prevalence of processing plastic materials with the help of knife mills for reducing them into tiny small particles or powders to be used in various industrial applications. Moreover, with the increasing concern over plastic waste and environmental sustainability, there is a continuously surging need for effective waste management solutions, propelling the demand for efficient knife mills in plastic recycling, size reduction, and shredding plastic materials.

Advancements in knife mill technology, such as improved cutting mechanisms, enhanced control systems, and automation, are enabling higher processing capacities, energy efficiency, and productivity, meeting the increasing demands of the plastic industry and contributing positively towards the segment market.

Asia Pacific region dominated the global market in 2022

The Asia Pacific region dominated the market with considerable market share in 2022, driven by the rapid industrialization and infrastructure development mainly in countries like China, India, and Southeast Asian nations, and increased usage of these machines for various applications such as material processing, size reduction, and sample preparation in industries like chemicals, pharmaceuticals, food processing, and construction materials.

Additionally, the growing implementation of government authorities towards favorable policies, incentives, and investment-leading infrastructure development plans, smart city projects, and research & development activities are boosting the product demand as key equipment for manufacturing and scientific advancements across the region.

North America is expected to be the fastest-growing region with a significant growth rate over the coming years, owing to the quick adoption of higher technological advancements and increased focus on waste reduction and sustainability across numerous industries. The growing expansion of pharmaceutical and chemical sectors resulted in the higher utilization of knife mills for size reduction and blending of pharmaceutical ingredients and chemical compounds, fostering the regional market growth.

Competitive Insight

Some of the major players operating in the global market include Fritsch GmbH, Hosokawa Micron, Netzsch Group, Buhler AG, IKA-Werke, Mill Powder Tech Solutions, Neue Herbold, Defino & Giancaspro, IDEX Health & Science, Glen Mills, Brabender GmbH, Perten Instruments, Glen Creston, and Fritsch Mining.

Recent Developments

- In June 2021, Peak Spec announced the launch of its new multi-purpose pocket knife, which has a unique design made up of high-quality metal. The newly developed knife has a smooth finish and quality construction, which allows it to perform hard-core cutting tasks.

- In May 2021, ArcelorMittal Vega announced the expansion of its cold mill complex & supply for galvanizing and annealing lines, modifying its picking line cold mill and incorporating a new universal annealing line. The SMS group will supply both mechanical & process equipment & supervising the installation as well as the commissioning activities.

Knife Mills Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 793.05 million |

|

Revenue forecast in 2032 |

USD 1,259.05 million |

|

CAGR |

5.3% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments covered |

By Power, By Capacity, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Fritsch GmbH, Hosokawa Micron Group, Netzsch Group, Buhler AG, IKA-Werke GmbH & Co. KG, Mill Powder Tech Solutions, Neue Herbold, Defino & Giancaspro, IDEX Health & Science Inc., Glen Mills Inc., Brabender GmbH & Co. KG, Perten Instruments AB, Glen Creston Ltd., and Fritsch Mining & Sizing Inc. |

FAQ's

The Knife Mills market report covering key segments are power, capacity, end-use, and region

Knife Mills Market Size Worth $ 1,259.05 Million By 2032

The global knife mills market is expected to grow at a CAGR of 5.3% during the forecast period

Asia Pacific is leading the global market

key driving factors in Knife Mills Market are Increasing number of industries.