Lab Automation Market Size, Share, Trends, Industry Analysis Report

: By Product, Automation (Task Targeted Automation, Total Laboratory Automation, and Subtotal Automation), Application, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 114

- Format: PDF

- Report ID: PM3981

- Base Year: 2024

- Historical Data: 2020-2023

Lab Automation Market Overview

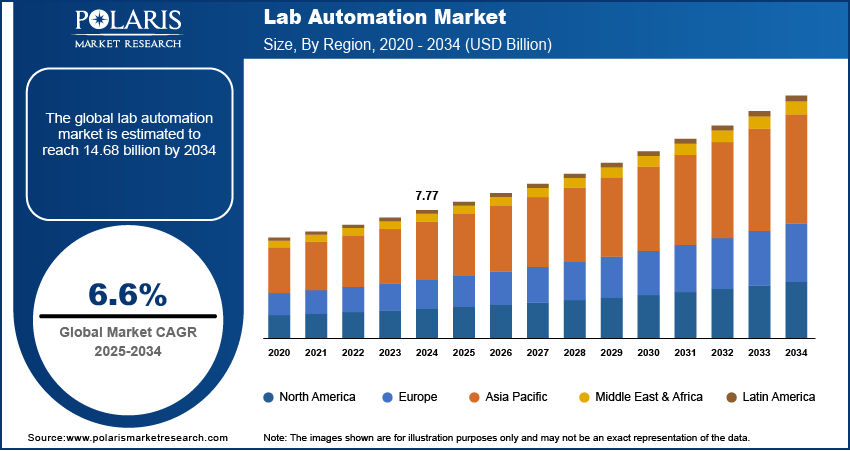

The lab automation market size was valued at USD 7.77 billion in 2024. The market is projected to grow from USD 8.26 billion in 2025 to USD 14.68 billion by 2034, exhibiting a CAGR of 6.6% during 2025–2034.

The lab automation market encompasses the integration of advanced technologies such as robotics, artificial intelligence, and automated systems to enhance efficiency, accuracy, and reproducibility in laboratory processes. This market is driven by the growing demand for high-throughput screening, the need to reduce human error, and increasing investments in pharmaceutical and biotechnology research. The adoption of automated solutions in clinical diagnostics, drug discovery, and genomics is accelerating due to the rising prevalence of chronic diseases and the need for faster, more reliable diagnostic procedures. Additionally, regulatory compliance requirements and the demand for cost-effective laboratory operations further contribute to lab automation market expansion.

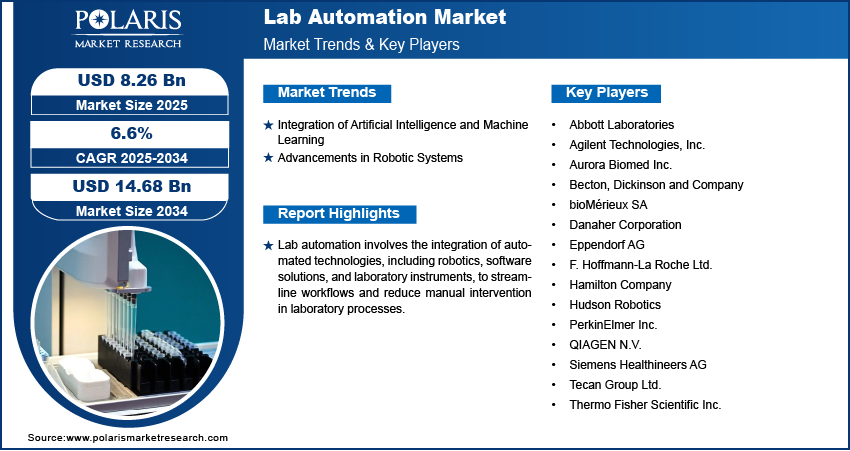

To Understand More About this Research: Request a Free Sample Report

Key drivers of the lab automation market include the growing need for precision and efficiency in laboratory workflows, rising labor costs, and a shortage of skilled professionals in the healthcare and research sectors. The integration of artificial intelligence and machine learning is enhancing data analysis and decision-making capabilities, further increasing the adoption of automated systems. Moreover, the increasing focus on personalized medicine and advancements in molecular diagnostics are fueling the demand for automated laboratory solutions. As laboratories strive to optimize operations and improve throughput, the market is expected to experience continuous growth, particularly in pharmaceutical, biotechnology, and clinical diagnostic applications.

Lab Automation Market Dynamics

Integration of Artificial Intelligence and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) into laboratory automation systems is significantly enhancing data analysis and operational efficiency. AI and ML algorithms facilitate predictive analytics and streamline workflows, reducing human error and increasing reproducibility. AI-driven software automates complex data interpretations, leading to more accurate and timely results in clinical diagnostics and research applications. This technological advancement is propelling the adoption of lab automation solutions across various sectors, including healthcare and pharmaceuticals.

Advancements in Robotic Systems

Robotic systems are revolutionizing laboratory workflows by enabling high-throughput screening and automated sample handling. The deployment of advanced robotic platforms allows for the efficient processing of large volumes of samples with minimal human intervention, thereby enhancing operational efficiency and throughput. These systems are particularly beneficial in drug discovery and genomics, where the demand for rapid and precise analysis is critical. The continuous development of robotics technology is a key driver of the lab automation market.

Lab Automation Market Segment Insights

Lab Automation Market Evaluation by Automation

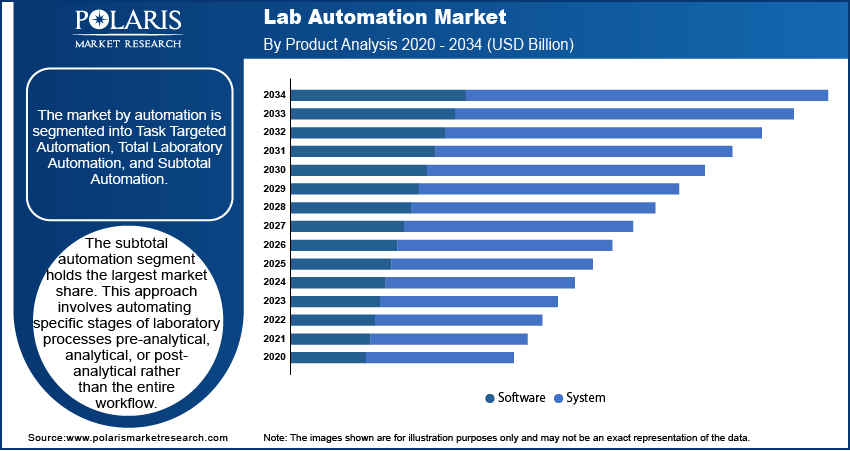

The lab automation market segmentation, based on automation, includes task targeted automation, total laboratory automation, and subtotal automation. The subtotal automation segment holds the largest lab automation market share. This approach involves automating specific stages of laboratory processes—pre-analytical, analytical, or post-analytical—rather than the entire workflow. Such targeted automation allows laboratories to enhance efficiency and accuracy in critical areas without the need for comprehensive system overhauls. For instance, automating sample preparation or data analysis can significantly reduce manual errors and processing time, leading to improved throughput and reliability in laboratory results. This selective implementation is particularly advantageous for laboratories with budget constraints or those seeking to upgrade incrementally, as it offers a cost-effective solution to improve operational performance.

Lab Automation Market Assessment by Application

The lab automation market is segmented by application into genomics solutions, microbiology, drug discovery, clinical diagnostics, and others. The drug discovery segment holds the largest market share. This prominence is due to the integration of automated systems that enhance the efficiency and accuracy of high-throughput screening processes, enabling rapid evaluation of numerous compounds. Automation in drug discovery reduces manual intervention, minimizes errors, and accelerates the identification of potential therapeutic candidates. The increasing complexity of drug development and the demand for novel therapeutics have further propelled the adoption of automation technologies in this segment. Additionally, the integration of artificial intelligence and machine learning with automated platforms is revolutionizing data analysis and predictive modeling, thereby streamlining the drug discovery pipeline.

Lab Automation Market Regional Insights

By region, the study provides lab automation market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest market share, primarily due to its well-established healthcare infrastructure and significant investments in research and development. The presence of major pharmaceutical and biotechnology companies in the region has accelerated the adoption of advanced automation technologies to enhance laboratory efficiency and accuracy. Additionally, supportive government initiatives and a favorable reimbursement environment further drive the integration of automated systems in laboratories across North America. The region's focus on high-throughput screening and precision medicine also contributes to the growing demand for lab automation solutions.

The lab automation market in Europe is experiencing significant growth, driven by substantial investments in research and development, particularly in countries such as Germany and the UK. The region's emphasis on precision medicine and advanced diagnostics has led to the adoption of automated laboratory systems to enhance efficiency and accuracy. Collaborative efforts between research institutions and industry players further bolster the integration of automation technologies in European laboratories.

Lab Automation Market – Key Players and Competitive Insights

In the lab automation market, several key players are actively contributing to advancements in laboratory technologies. Thermo Fisher Scientific Inc., Tecan Group Ltd., Danaher Corporation, Agilent Technologies, Inc., and F. Hoffmann-La Roche Ltd. are prominent companies offering a range of automation solutions. Other notable participants include PerkinElmer Inc., Siemens Healthineers AG, Abbott Laboratories, and Becton, Dickinson and Company, each providing specialized instruments and services. Additionally, Eppendorf AG, Hudson Robotics, Hamilton Company, bioMérieux SA, QIAGEN N.V., and Aurora Biomed Inc. are significant contributors, delivering innovative products to enhance laboratory efficiency and accuracy.

These companies are recognized for their extensive portfolios in laboratory automation, which encompass automated liquid handling systems, laboratory information management systems (LIMS), and advanced diagnostic instruments. Their global presence and continuous investment in research and development have solidified their positions in the market. Collaborations with research institutions and healthcare providers further enable these organizations to address laboratories' evolving needs, ensuring the delivery of cutting-edge solutions that enhance workflow efficiency and data precision.

The competitive landscape is marked by a focus on innovation, with companies striving to integrate artificial intelligence and machine learning into their automation platforms. This integration aims to improve data analysis capabilities and streamline laboratory processes. Moreover, strategic acquisitions and partnerships are common, allowing these key players to expand their technological capabilities and market reach. As the demand for high-throughput screening and personalized medicine grows, these organizations are well-positioned to provide the necessary automated solutions to meet the increasing complexity and volume of laboratory tasks.

Thermo Fisher Scientific Inc. is a prominent provider of scientific instrumentation, reagents, and consumables. It serves various sectors, including healthcare, life sciences, and pharmaceuticals. The company offers a comprehensive range of laboratory automation solutions designed to enhance efficiency and accuracy in research and diagnostic settings.

Tecan Group Ltd., headquartered in Switzerland, specializes in laboratory instruments and solutions, particularly in automation and robotics for life sciences and clinical diagnostics. Tecan's products are widely utilized in genomics, proteomics, and drug discovery applications, contributing to streamlined laboratory workflows.

List of Key Companies in Lab Automation Market

- Abbott Laboratories

- Agilent Technologies, Inc.

- Aurora Biomed Inc.

- Becton, Dickinson and Company

- bioMérieux SA

- Danaher Corporation

- Eppendorf AG

- F. Hoffmann-La Roche Ltd.

- Hamilton Company

- Hudson Robotics

- PerkinElmer Inc.

- QIAGEN N.V.

- Siemens Healthineers AG

- Tecan Group Ltd.

- Thermo Fisher Scientific Inc.

Lab Automation Market Developments

- January 2025: Tecan's Veya liquid handling platform was launched, designed to enhance laboratory efficiency and precision. The platform, showcased at SLAS, featured AI-enhanced automation and seamless integration for improved productivity and compliance.

- July 2024: Inpeco's FlexLab X, a next-generation total lab automation system, was launched at ADLM 2024 in Chicago. The system offered enhanced flexibility, performance, and user experience, revolutionizing clinical laboratory workflows.

Lab Automation Market Segmentation

By Product Outlook (Revenue-USD Billion, 2020–2034)

- Automated Workstation

- Off-The-Shelf Automated Work Cell

- Software

- Robotic System

- Others

By Automation Outlook (Revenue-USD Billion, 2020–2034)

- Task Targeted Automation

- Total Laboratory Automation

- Subtotal Automation

By Application Outlook (Revenue-USD Billion, 2020–2034)

- Genomics Solutions

- Microbiology

- Drug Discovery

- Clinical Diagnostics

- Others

By End Use Outlook (Revenue-USD Billion, 2020–2034)

- Hospitals & Diagnostic Laboratories

- Forensic Laboratories

- Environmental Testing Laboratories

- Food and Beverages

- Research & Academic Institutes

- Biotechnology & Pharma Companies

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest f Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest f Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest f Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest f Latin America

Lab Automation Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 7.77 billion |

|

Market Size Value in 2025 |

USD 8.26 billion |

|

Revenue Forecast by 2034 |

USD 14.68 billion |

|

CAGR |

6.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The lab automation market has been segmented into detailed segments of product, automation, application, and end use. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy: Companies in the lab automation market focus on strategic initiatives such as product innovation, collaborations, and acquisitions to expand their market presence. Investments in artificial intelligence and machine learning integration enhance automation capabilities, improving efficiency and accuracy in laboratory workflows. Market participants also engage in partnerships with research institutions and healthcare providers to drive technological advancements. Additionally, expanding distribution networks and targeting emerging markets help companies cater to the growing demand for automated solutions. Regulatory compliance and quality assurance remain key priorities to ensure reliability and adoption across diverse end-use industries.

FAQ's

The lab automation market size was valued at USD 7.77 billion in 2024 and is projected to grow to USD 14.68 billion by 2034.

The market is projected to register a CAGR of 6.6% during the forecast period, 2024-2034.

North America had the largest share of the market.

Key players in the market are Abbott Laboratories; Agilent Technologies, Inc.; Aurora Biomed Inc.; Becton, Dickinson and Company; bioMérieux SA; Danaher Corporation; Eppendorf AG; F. Hoffmann-La Roche Ltd.; Hamilton Company; Hudson Robotics; PerkinElmer Inc.; QIAGEN N.V.; Siemens Healthineers AG; Tecan Group Ltd.; and Thermo Fisher Scientific Inc.

The subtotal automation segment holds the largest market share in 2024.

The drug discovery segment holds the largest lab automation market share in 2024.