Large and Small Scale Bioprocessing Market Share, Size, Trends, Industry Analysis Report

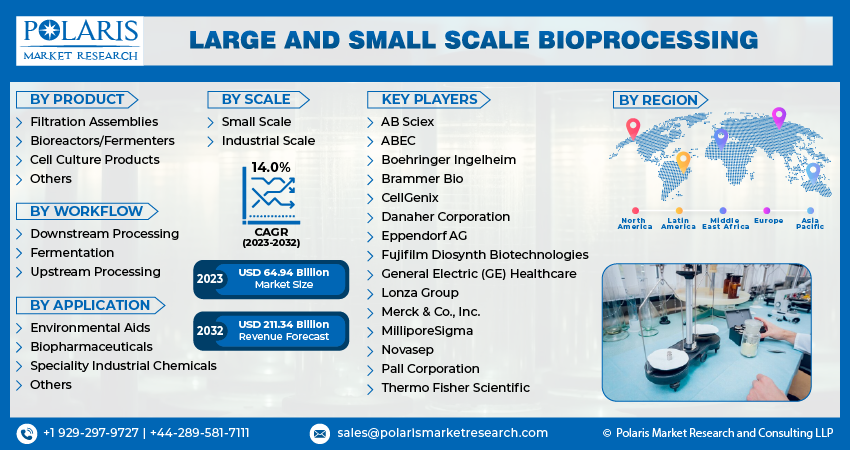

By Product (Filtration Assemblies, Bioreactors/Fermenters, Cell Culture Products, Others); By Scale; By Application; By Region; Segment Forecast, 2023- 2032

- Published Date:Dec-2023

- Pages: 118

- Format: PDF

- Report ID: PM4130

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

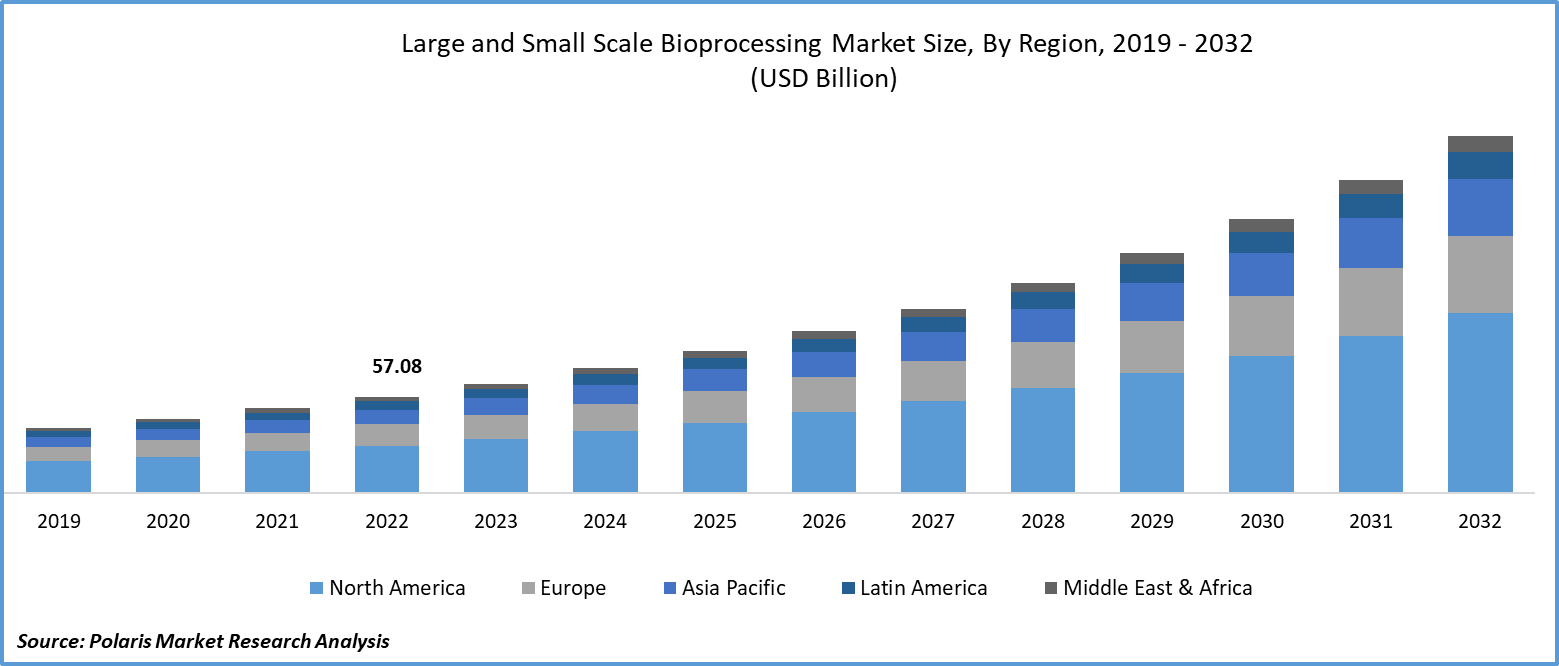

The global large and small scale bioprocessing market was valued at USD 57.08 billion in 2022 and is expected to grow at a CAGR of 14.0% during the forecast period.

Large-scale bioprocessing involves the industrial-scale production of biopharmaceuticals and bioproducts to meet the demands of a broad patient population. It employs bioreactors with capacities in the thousands to tens of thousands of liters and prioritizes efficiency, automation, and cost-effectiveness. Large-scale bioprocessing is crucial for the mass production of well-established biopharmaceuticals, such as vaccines and monoclonal antibodies.

To Understand More About this Research: Request a Free Sample Report

In contrast, small-scale bioprocessing occurs at laboratory or pilot-scale levels, using bioreactors with smaller volumes, typically ranging from a few liters to a few hundred liters. It is primarily employed in research, development, and process optimization stages, offering flexibility, resource efficiency, and a platform for innovation. Successful findings in small-scale processes can inform and improve large-scale production, making it an essential component of bioprocess development.

In addition, companies operating in the market are enhancing their capabilities to cater to the growing consumer demand.

- For instance, in April 2022, Merck entered into an agreement with the Administrative Management Committee of Wuxi National High-Tech Industrial Development Zone to substantially enhance the size and capabilities of Merck's inaugural Asia-Pacific Mobius Single-Use manufacturing facility located in China.

Beyond biopharmaceuticals, large-scale processes are essential in the production of biofuels, bio-based chemicals, and renewable energy sources. As the world seeks sustainable energy solutions, opportunities for growth in the bioprocessing market are opened. Regulatory requirements necessitate rigorous quality control measures. Large-scale bioprocessing integrates advanced quality assurance practices to ensure product safety and compliance with regulatory standards. Automation, data analytics, and bioprocess modeling play a pivotal role in large-scale bioprocessing. These technologies enhance control, monitoring, and optimization, ultimately improving product consistency and yield. The growing demand for bioproducts in emerging markets, alongside increasing consumer expectations in established regions, drives the expansion of the large-scale bioprocessing market. It offers opportunities to tap into evolving market needs and preferences.

For Specific Research Requirements: Request for Customized Report

In the post-COVID era, Large-Scale Bioprocessing has demonstrated its pivotal role in biopharmaceutical resilience, rapid vaccine production, and supply chain diversification. It has seen accelerated adoption of remote monitoring and automation, streamlined regulatory processes and expanded into emerging markets. Conversely, Small-Scale Bioprocessing has showcased its research agility, enabled swift vaccine development and fostered global collaboration. Its resource efficiency is now even more valued, and it's sought for customized, niche solutions. Both large and small-scale processes have adapted to a changing landscape, reinforcing their importance in addressing healthcare demands and global health crises, ultimately contributing to biopharmaceutical advancements and innovation.

Growth Drivers

- Global health challenges, biopharmaceutical demand, and biomanufacturing innovation

The rising demand for biopharmaceuticals, driven by factors like an aging population and the need for novel treatments, is a primary driver for large-scale bioprocessing. It encompasses the production of vaccines, monoclonal antibodies, and therapeutic proteins to cater to global healthcare requirements.

Research and development efforts in biomanufacturing continually introduce novel processes and techniques. This dynamic environment opens the door to the large-scale production of innovative bioproducts, including cutting-edge therapies and bio-based materials.

The COVID-19 pandemic exemplified the pivotal role of large-scale bioprocessing in rapid vaccine development and mass production. It showcased the market's capacity to respond swiftly to global health crises.

Report Segmentation

The market is primarily segmented based on product, scale, workflow, application, and region.

|

By Product |

By Workflow |

By Scale |

By Application |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Analysis

- Bioreactors/Fermenters emerged as the largest segment in 2022

The bioreactors/fermenters segment accounted for the largest market share in 2022. Bioreactors are essential in the production of biopharmaceuticals, including vaccines and monoclonal antibodies, responding to global healthcare requirements. Ongoing innovations in bioprocessing techniques and bioreactor design enhance efficiency and scalability, making them indispensable for a multitude of applications. The emergence of biotechnology startups fuels innovation, creating opportunities for new bioprocesses and amplifying the demand for bioreactors.

By Scale Analysis

- Industrial Scale emerged as the largest segment in 2022

The industrial scale emerged as the largest segment in 2022. The demand for biopharmaceuticals, especially monoclonal antibodies and vaccines, has propelled the expansion of biomanufacturing processes. Advances in bioprocessing technology and bioreactor design have enhanced efficiency and scalability, while the rise of biotech startups fosters innovation. Global health challenges, like the COVID-19 pandemic, highlight the importance of rapid vaccine development and production. Furthermore, sustainability considerations, the biofuel sector, food and beverage production, regulatory compliance, technological integration, and large and small scale bioprocessing market expansion have all contributed to the growth of industrial-scale bioprocessing, underlining its vital role in addressing global challenges and producing diverse bioproducts.

By Application Analysis

- Biopharmaceuticals segment held significant market revenue share in 2022

The biopharmaceuticals segment held a significant market share in revenue share in 2022. Large-scale bioprocessing entails the high-volume production of biopharmaceuticals using massive bioreactors, advanced automation, and rigorous quality control. It benefits from economies of scale and is essential for meeting the demands of a wide patient population. In contrast, small-scale bioprocessing is employed in research and development, utilizing smaller bioreactors for process optimization, flexibility, and reduced resource requirements. It allows for customization, simultaneous evaluation of multiple conditions, and the exploration of various biopharmaceuticals. Successful small-scale processes inform and optimize large-scale production, ensuring the quality and availability of biopharmaceuticals while reducing resource consumption.

Regional Insights

- North America region dominated the global market in 2022

The North American region dominated the global market in 2022. North America's Large and Small Scale Bioprocessing Market thrives with a dominant biopharmaceutical sector and cutting-edge technology. The region, led by the United States, houses major pharmaceutical and biotech players, fueling demand for advanced bioprocessing. Ongoing research and development efforts drive innovation, resulting in improved single-use systems, bioreactors, and analytical tools. Strict regulatory standards ensure top-notch facilities, maintaining a competitive edge. With bioprocessing clusters, collaborative ecosystems, and the sector's pivotal role in addressing the COVID-19 pandemic, North America's bioprocessing market continues to expand.

The Asia Pacific region is anticipated to experience significant growth during the projected period. Asia's pharmaceutical and biotechnology sectors are rapidly expanding, creating a growing need for bioprocessing solutions in drug development and manufacturing. Substantial investments in bioprocessing infrastructure, coupled with a skilled and educated workforce, enhance the region's capabilities. Ongoing research and development efforts, regulatory advancements, and global partnerships contribute to technological innovation and international collaboration. Government support and incentives further stimulate industry growth, while the rising demand for advanced healthcare solutions due to increasing populations positions Asia as a significant player in the global bioprocessing sector.

Key Market Players & Competitive Insights

The large and small scale bioprocessing market is fragmented and is anticipated to witness competition due to several players' presence. Major market players are constantly introducing new products to strengthen their position in the market. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- AB Sciex

- ABEC

- Boehringer Ingelheim

- Brammer Bio

- CellGenix

- Danaher Corporation

- Eppendorf AG

- Fujifilm Diosynth Biotechnologies

- General Electric (GE) Healthcare

- Lonza Group

- Merck & Co., Inc.

- MilliporeSigma

- Novasep

- Pall Corporation

- Thermo Fisher Scientific

Recent Developments

- In March 2023, Sartorius Stedim Biotech announced the acquisition of Polyplus with the aim of expanding its product portfolio and bolstering its position in the market.

Large and Small Scale Bioprocessing Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 64.94 billion |

|

Revenue forecast in 2032 |

USD 211.34 billion |

|

CAGR |

14.0% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019-2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Product, By Scale, By Workflow, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The large and small scale bioprocessing market report covering key segments are product, scale, workflow, application, and region.

Large and Small Scale Bioprocessing Market Size Worth $211.34 Billion By 2032

The global large and small scale bioprocessing market is expected to grow at a CAGR of 14.0% during the forecast period.

North America is leading the global market

key driving factors in large and small scale bioprocessing market are Increasing demand for biopharmaceuticals