Lateral Flow Assay Market Size, Share, Trends, Industry Analysis Report

: By Product (Kits & Reagents and Lateral Flow Readers), Application, Test Type, Technique, End-Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 114

- Format: PDF

- Report ID: PM3240

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

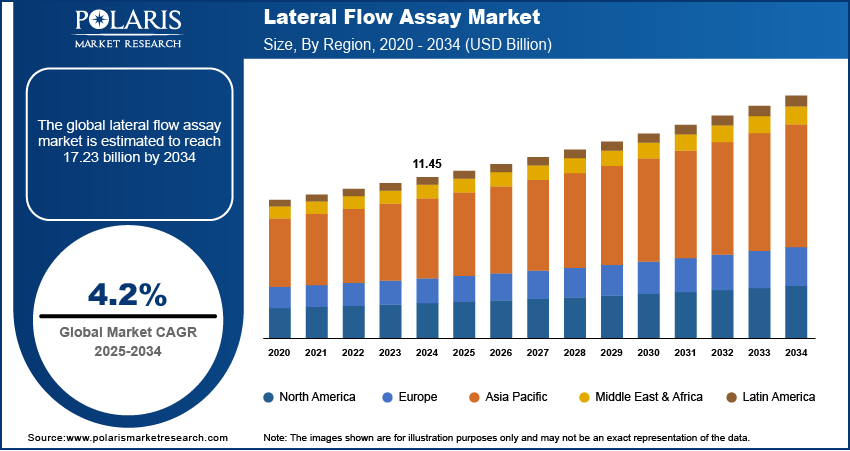

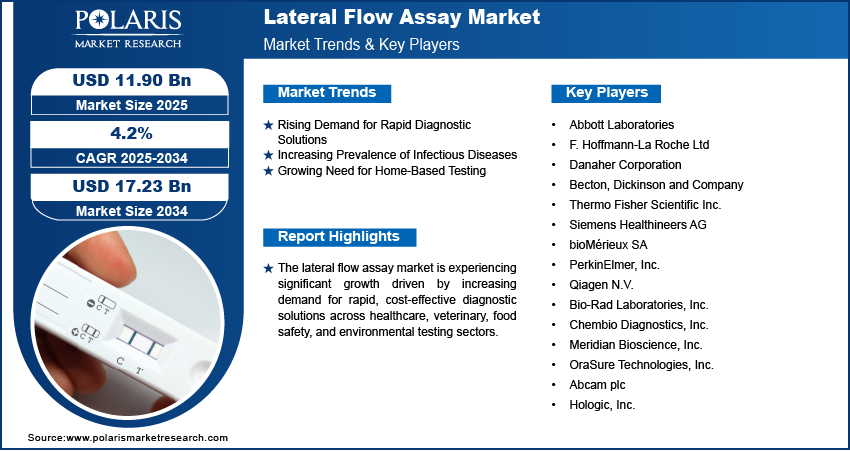

The lateral flow assay market size was valued at USD 11.45 billion in 2024, growing at a CAGR of 4.2% during 2025–2034. The market growth is primarily fueled by the rising prevalence of infectious diseases and the growing need for home-based testing.

Key Insights

- The kits & reagents segment accounts for the largest market share due to the high usage of test kits for various testing applications.

- The food safety & environment testing segment is witnessing the fastest growth. Stringent regulatory requirements and rising consumer awareness about food quality and environmental safety drive the segment’s growth.

- The lateral flow immunoassay segment dominated the market, primarily due to its widespread use in several diagnostic applications.

- The home care segment is witnessing the fastest growth. The segment’s growth is fueled by the shit towards self-monitoring and home-based diagnostics.

- North America holds the largest market share. The region’s advanced healthcare infrastructure and high prevalence of chronic diseases drive its leading market share.

- Asia Pacific is witnessing robust growth due to the region’s increasing prevalence of chronic conditions and rising focus on improving healthcare access.

Industry Dynamics

- The rising demand for rapid diagnostic solutions is fueling the usage of lateral flow assays as they offer quick results and support timely decision-making.

- The ease of use, portability, and minimal laboratory infrastructure requirements associated with lateral flow assays are driving their increased usage, especially in low-resource settings.

- The shift towards home-based testing is creating several opportunities for market participants.

- The high cost of investments associated with lateral flow assays may present market challenges.

Market Statistics

2024 Market Size: USD 11.45 billion

2034 Projected Market Size: USD 17.23 billion

CAGR (2025-2034): 4.2%

North America: Largest Market in 2024

To Understand More About this Research: Request a Free Sample Report

The lateral flow assay (LFA) market encompasses diagnostic technologies widely used for point-of-care testing in various sectors, including healthcare, veterinary, environmental testing, and food safety. LFA devices are popular due to their simplicity, rapid results, and cost-effectiveness.

The rising demand for rapid diagnostic solutions, the increasing prevalence of infectious diseases, and the growing need for home-based testing are a few of the key factors driving the lateral flow assay market. Trends anticipated to influence the market include advancements in assay sensitivity and specificity, the integration of digital technology for result interpretation, and the expansion of applications in detecting biomarkers for chronic diseases and environmental monitoring. The market is also benefiting from increased investments in research and development to enhance the capabilities and accuracy of LFA devices.

Market Dynamics

Rising Demand for Rapid Diagnostic Solutions

LFA devices offer quick results, typically within minutes, which is crucial for timely decision-making in medical emergencies and outbreak situations. This demand has been particularly evident during the COVID-19 pandemic, when the need for rapid and mass testing surged. According to a 2023 report by the World Health Organization, rapid diagnostic tests, including lateral flow assays, played a critical role in managing the spread of COVID-19 by enabling widespread, quick, and accessible testing. Thus, the increasing need for rapid diagnostic solutions is a significant driver of the lateral flow assay market expansion.

Increasing Prevalence of Infectious Diseases

Diseases such as malaria, HIV, and tuberculosis continue to pose significant public health challenges, particularly in low-resource settings. Lateral flow assays provide a viable solution due to their portability, ease of use, and minimal requirement for laboratory infrastructure. For instance, the World Malaria Report 2021 highlights that rapid diagnostic tests, primarily lateral flow assays, accounted for nearly 74% of malaria tests conducted globally, underscoring their critical role in disease management. As a result, the growing prevalence of infectious diseases globally is driving the lateral flow assay market development.

Growing Need for Home-Based Testing

The shift towards home-based testing is another driver influencing the market, driven by consumer demand for convenience and privacy. Lateral flow assays have enabled individuals to conduct tests at home for various conditions, ranging from pregnancy to infectious diseases like COVID-19. The trend has been amplified by advancements in user-friendly test kits and digital connectivity, which allow users to receive results and consult healthcare providers remotely. A survey conducted by the National Health Service in the UK in 2021 found that over 60% of respondents preferred home-based testing options for routine health checks, reflecting the growing acceptance and reliance on such diagnostic solutions.

Segment Insights

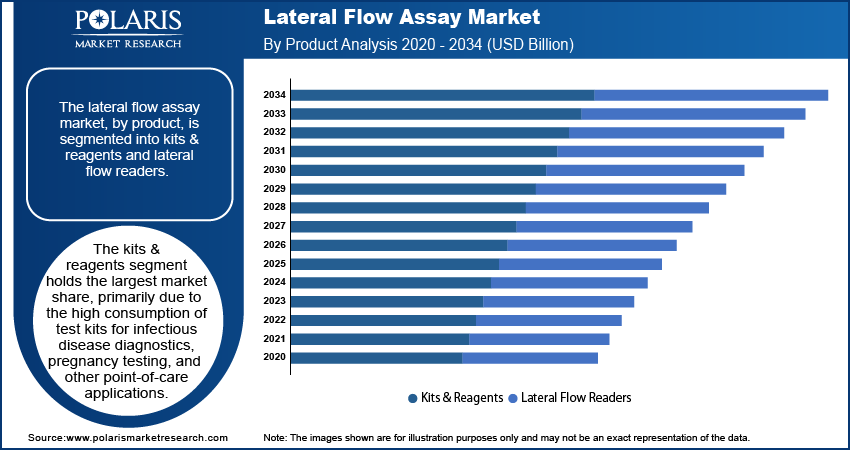

Assessment by Product Insights

The lateral flow assay market, by product, is segmented into kits & reagents and lateral flow readers. The kits & reagents segment holds the largest market share, primarily due to the high consumption of test kits for infectious disease diagnostics, pregnancy testing, and other point-of-care applications. The widespread adoption of these kits in both clinical and home-based settings drives their dominance, as they offer ease of use, rapid results, and cost efficiency. Additionally, the ongoing development of novel reagents to enhance the sensitivity and specificity of lateral flow tests supports the growth of this segment.

On the other hand, the lateral flow readers segment is registering the fastest growth, driven by technological advancements and the increasing need for accurate, quantitative results. These readers, which complement traditional LFA kits, offer improved diagnostic accuracy by minimizing human error and providing digital integration for result interpretation. This makes them particularly important in applications requiring precise quantitative data, such as chronic disease management and environmental testing. The growing demand for connected healthcare solutions and the trend toward remote patient monitoring are contributing to the rapid expansion of this segment.

Evaluation by Application Insights

The lateral flow assay market, by application, is segmented into clinical testing, veterinary diagnostics, food safety & environment testing, and drug development & quality testing. The clinical testing segment holds the largest market share, driven by the extensive use of lateral flow tests for diagnosing infectious diseases, monitoring chronic conditions, and conducting routine health screenings. The convenience, speed, and cost-effectiveness of these tests have led to their widespread adoption in both hospital and home-care settings. Additionally, the surge in demand for point-of-care testing, especially during the COVID-19 diagnostics, has significantly boosted the utilization of lateral flow assays in clinical diagnostics.

The food safety & environment testing segment is registering the fastest growth, fueled by increasing regulatory requirements and rising consumer awareness regarding food quality and environmental safety. Lateral flow assays are becoming essential tools in detecting contaminants, pathogens, and allergens in food products, as well as monitoring environmental pollutants. The rise in foodborne illnesses and the need for rapid, on-site testing solutions are key factors driving the expansion of this application segment. The adoption of lateral flow assays in ensuring compliance with safety standards is further fueling the segment’s growth.

Outlook by Test Type Insights

The lateral flow assay market, by test type, is segmented into lateral flow immunoassay and nucleic acid lateral flow assay. The lateral flow immunoassay segment holds the largest market share in the lateral flow assay market, attributed to its widespread use in various diagnostic applications, including infectious disease testing, pregnancy detection, and chronic disease monitoring. The popularity of these immunoassays stems from their simplicity, rapid result delivery, and cost-effectiveness, making them suitable for point-of-care and home-based testing. Continuous innovations in antibody development and the increasing availability of a diverse range of immunoassay kits further support the dominance of this segment.

The nucleic acid lateral flow assay segment is experiencing the fastest growth, driven by the growing demand for molecular diagnostics and the need for highly sensitive and specific tests. These assays combine the advantages of nucleic acid amplification with the simplicity of lateral flow technology, enabling accurate detection of genetic material from pathogens. The segment’s growth is propelled by advancements in molecular diagnostics and the rising prevalence of genetic and infectious diseases. The adoption of nucleic acid lateral flow assays is particularly increasing in applications requiring high precision, such as oncology and personalized medicine.

Assessment by End-Use Insights

The lateral flow assay market, by end-use, is segmented into hospitals & clinics, diagnostic laboratories, home care, pharmaceutical & biotechnology companies, and others. The hospitals & clinics segment holds the largest market share, primarily due to the high volume of diagnostic tests performed in these settings. Lateral flow assays are widely used in hospitals and clinics for rapid diagnosis of infectious diseases, cardiac markers, and pregnancy testing, among others. The segment benefits from the increasing demand for point-of-care testing, which allows for quick decision-making and immediate treatment initiation. Additionally, the adoption of lateral flow tests in emergency and outpatient departments contributes to the robust growth of this segment.

The home care segment is registering the fastest growth, driven by the rising trend of self-monitoring and home-based diagnostics. The convenience, ease of use, and rapid results provided by lateral flow assays make them ideal for home care settings. Factors such as the growing aging population, increasing prevalence of chronic diseases, and a shift towards personalized healthcare support the growth of this segment. The COVID-19 pandemic has also accelerated the adoption of home testing kits, highlighting the importance of accessible and reliable diagnostic solutions for individuals managing their health from home.

Regional Analysis

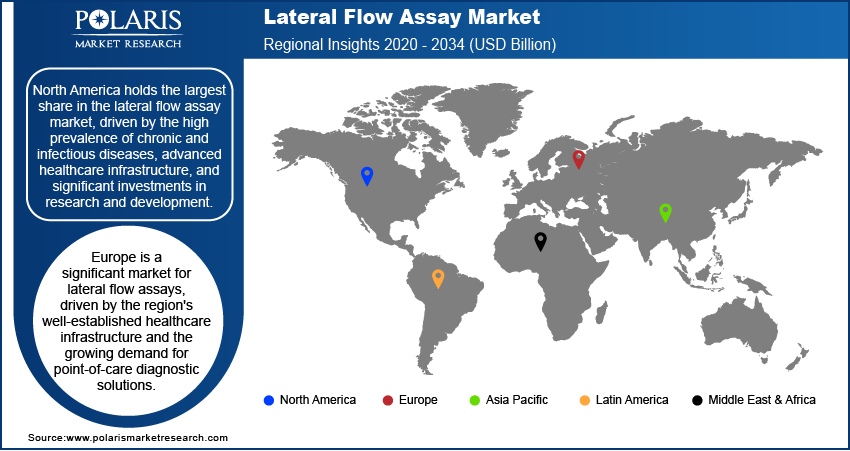

By region, the study provides the lateral flow assay market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest share in the lateral flow assay market, driven by the high prevalence of chronic and infectious diseases, advanced healthcare infrastructure, and significant investments in research and development. The region's strong emphasis on point-of-care diagnostics and the widespread adoption of home-based testing solutions further contribute to its dominant market position. The presence of key market players and favorable regulatory frameworks supporting the rapid approval and commercialization of diagnostic products also play a crucial role in North America's leadership in the market. Additionally, the increasing demand for advanced diagnostic technologies and rising health awareness among individuals support market growth in this region.

Europe is a significant market for lateral flow assays, driven by the region's well-established healthcare infrastructure and the growing demand for point-of-care diagnostic solutions. The increasing prevalence of chronic diseases, such as cardiovascular conditions and diabetes, and the rising need for early and rapid diagnostics contribute to the regional market growth. Furthermore, supportive government initiatives and regulatory policies, along with substantial investments in healthcare, enhance the adoption of lateral flow assays across various healthcare settings. Key countries such as Germany, the UK, and France play a pivotal role in the market due to their advanced medical technologies and high healthcare expenditure.

Asia Pacific is experiencing rapid growth in the lateral flow assay market, fueled by the rising prevalence of infectious diseases and an increasing focus on improving healthcare access in developing countries. The growing population, particularly in countries like China and India, and the rising awareness of point-of-care testing drive demand for lateral flow assays. Additionally, the expansion of healthcare infrastructure, along with government initiatives to enhance disease management and control, supports market growth. The region also benefits from the presence of local manufacturers offering cost-effective diagnostic solutions.

Key Players and Competitive Insights

Key players in the lateral flow assay market include Abbott Laboratories; F. Hoffmann-La Roche Ltd; Danaher Corporation; Becton, Dickinson and Company; Thermo Fisher Scientific Inc.; Siemens Healthineers AG; bioMérieux SA; PerkinElmer, Inc.; Qiagen N.V.; Bio-Rad Laboratories, Inc.; Chembio Diagnostics, Inc.; Meridian Bioscience, Inc.; OraSure Technologies, Inc.; Abcam plc; and Hologic, Inc. These companies are actively engaged in the development and commercialization of lateral flow assays across various applications, including clinical diagnostics, food safety, and veterinary diagnostics. Some of these companies, such as Abbott Laboratories and F. Hoffmann-La Roche Ltd, have a significant presence due to their extensive product portfolios and global distribution networks.

The competitive landscape of the lateral flow assay market is marked by continuous innovation and the introduction of advanced diagnostic solutions. Companies are focusing on enhancing the sensitivity and specificity of their assays, incorporating digital technology for better result interpretation, and expanding their product offerings to cater to diverse applications. For instance, Qiagen N.V. and bioMérieux SA are known for their strong focus on molecular diagnostics, while Abbott Laboratories and Siemens Healthineers AG are prominent in the development of point-of-care testing solutions. The market also sees considerable collaboration and partnerships among companies to strengthen their research capabilities and market reach.

In terms of competitive insights, the market is highly dynamic, with players engaging in strategic initiatives such as mergers and acquisitions, product launches, and regional expansions. For example, Thermo Fisher Scientific Inc. and PerkinElmer, Inc. have been actively expanding their presence in emerging markets to capture new growth opportunities. The presence of a mix of established multinational corporations and emerging local players contributes to a competitive environment, fostering continuous advancements and catering to the evolving needs of healthcare providers and consumers.

Abbott Laboratories is a prominent player in the lateral flow assay market, known for its broad range of diagnostic solutions, particularly in point-of-care testing. The company’s products are widely used in various healthcare settings for rapid diagnostics of infectious diseases, including COVID-19.

F. Hoffmann-La Roche Ltd, commonly known as Roche, is another key player in the market, offering innovative diagnostic solutions across clinical and molecular diagnostics. The company is actively involved in the development of lateral flow assays for various applications, including infectious disease detection and oncology.

List of Key Companies

- Abbott Laboratories

- F. Hoffmann-La Roche Ltd

- Danaher Corporation

- Becton, Dickinson and Company

- Thermo Fisher Scientific Inc.

- Siemens Healthineers AG

- bioMérieux SA

- PerkinElmer, Inc.

- Qiagen N.V.

- Bio-Rad Laboratories, Inc.

- Chembio Diagnostics, Inc.

- Meridian Bioscience, Inc.

- OraSure Technologies, Inc.

- Abcam plc

- Hologic, Inc.

Lateral Flow Assay Industry Developments

- In November 2024, Roche launched its Elecsys HCV Duo test, which is designed to improve the diagnosis of hepatitis C by simultaneously detecting antibodies and the virus itself, enhancing early detection and treatment.

- In October 2024, Abbott announced the expansion of its BinaxNOW COVID-19 test to include a digital health platform that allows users to receive test results via a mobile app, improving accessibility and ease of use for consumers.

Lateral Flow Assay Market Segmentation

By Product Outlook

- Kits & Reagents

- Lateral Flow Readers

By Application Outlook

- Clinical Testing

- Veterinary Diagnostics

- Food Safety & Environment Testing

- Drug Development & Quality Testing

By Test Type Outlook

- Lateral Flow Immunoassay

- Nucleic Acid Lateral Flow Assay

By Technique Outlook

- Sandwich Technique

- Competitive Technique

- Multiplex Detection

By End-Use Outlook

- Hospitals & Clinics

- Diagnostic Laboratories

- Home Care

- Pharmaceutical & Biotechnology Companies

- Others

- By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Lateral Flow Assay Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 11.45 billion |

|

Market Size Value in 2025 |

USD 11.90 billion |

|

Revenue Forecast by 2034 |

USD 17.23 billion |

|

CAGR |

4.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The lateral flow assay market size was valued at USD 11.45 billion in 2024 and is projected to grow to USD 17.23 billion by 2034.

The market is projected to register a CAGR of 4.2% during the forecast period.

North America had the largest share of the market in 2024.

A few of the key players in the lateral flow assay market include Abbott Laboratories; F. Hoffmann-La Roche Ltd; Danaher Corporation; Becton, Dickinson and Company; Thermo Fisher Scientific Inc.; Siemens Healthineers AG; bioMérieux SA; PerkinElmer, Inc.; Qiagen N.V.; Bio-Rad Laboratories, Inc.; Chembio Diagnostics, Inc.; Meridian Bioscience, Inc.; OraSure Technologies, Inc.; Abcam plc; and Hologic, Inc.

The lateral flow assay market report covering key segments are product, application, techniques and region.

The clinical testing segment accounted for the largest share of the market in 2024.

A lateral flow assay (LFA) is a simple and rapid diagnostic test used to detect the presence of specific substances, such as pathogens, proteins, or other biomolecules, in a sample. It works based on the principles of immunochromatography, where a liquid sample (such as blood, urine, or saliva) is applied to a test strip. The sample then flows along the strip, passing through areas that contain immobilized reagents, such as antibodies or antigens. When the target substance is present, it binds to these reagents, producing a visible signal, such as a colored line, indicating the presence or absence of the substance being tested for. LFAs are widely used in clinical diagnostics, food safety, environmental testing, and veterinary diagnostics due to their simplicity, speed, and ease of use.

A few key trends in the market are described below: Integration with Digital Technology: Increased use of digital platforms for result interpretation and remote monitoring of test results. Focus on Sensitivity and Specificity: Ongoing improvements in assay accuracy, enhancing detection capabilities for a wider range of diseases and conditions. Expansion in Home-based Testing: Rising consumer preference for self-testing kits for various health conditions, including infectious diseases and pregnancy. Technological Advancements: Introduction of more sophisticated materials and reagents, leading to faster and more reliable results.

A new company entering the lateral flow assay market should focus on developing assays with higher sensitivity and broader diagnostic applications to meet the growing demand for accurate and rapid testing. Emphasizing home-based testing kits could offer a competitive edge, especially with the increasing consumer preference for self-monitoring solutions. Investing in digital integration, such as mobile health platforms for result interpretation, can enhance user experience and accessibility. Additionally, targeting emerging markets with affordable, easy-to-use diagnostic solutions could provide substantial growth opportunities, while ensuring compliance with global regulatory standards will be essential for building trust and expanding market reach.

Companies manufacturing, distributing, or purchasing lateral flow assay and related products, and other consulting firms must buy the report