Latin America Fabry Disease Treatment Market Size, Share, & Industry Analysis Report

By Route of Administration (Intravenous Route, Oral Route), By Therapy, By Distribution Channel, By Country – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 129

- Format: PDF

- Report ID: PM5773

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

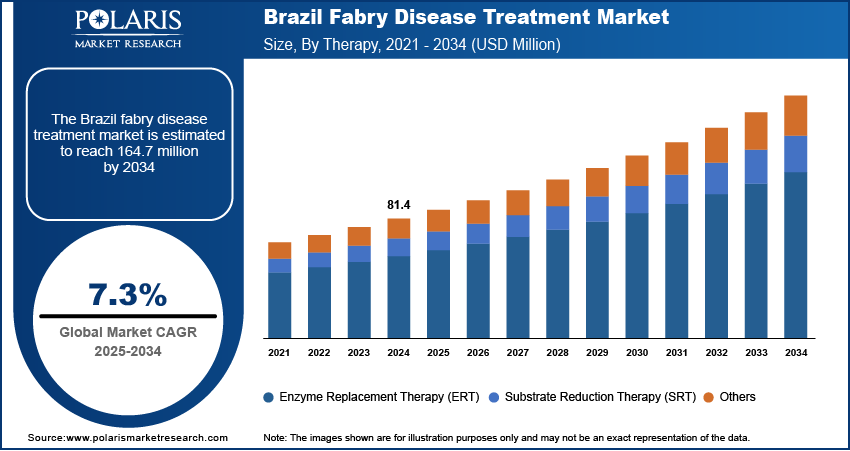

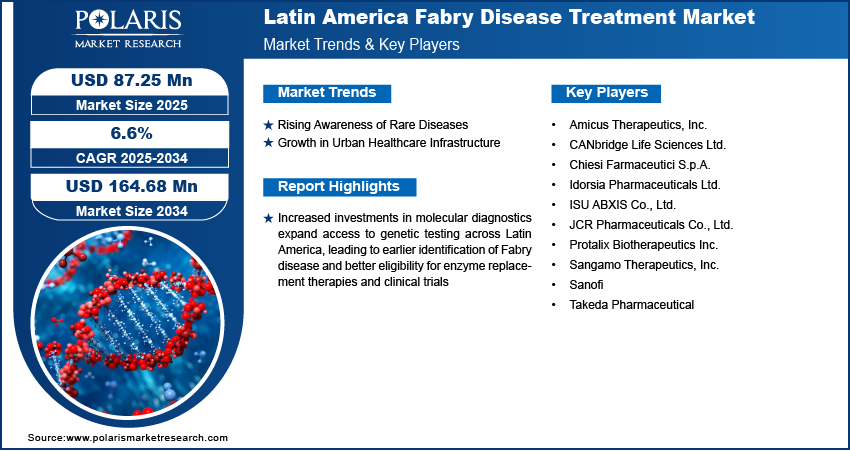

The Latin America Fabry disease treatment market size was valued at USD 81.36 million in 2024 and is projected to register a CAGR of 6.6% from 2025 to 2034. Increased investments in molecular diagnostics are expanding access to genetic testing across Latin America. It is leading to earlier identification of Fabry disease and better eligibility for enzyme replacement therapies and clinical trials. Rising awareness and ongoing clinical research highlighting the effectiveness and tolerability of oral treatments contribute to market expansion.

Key Insights

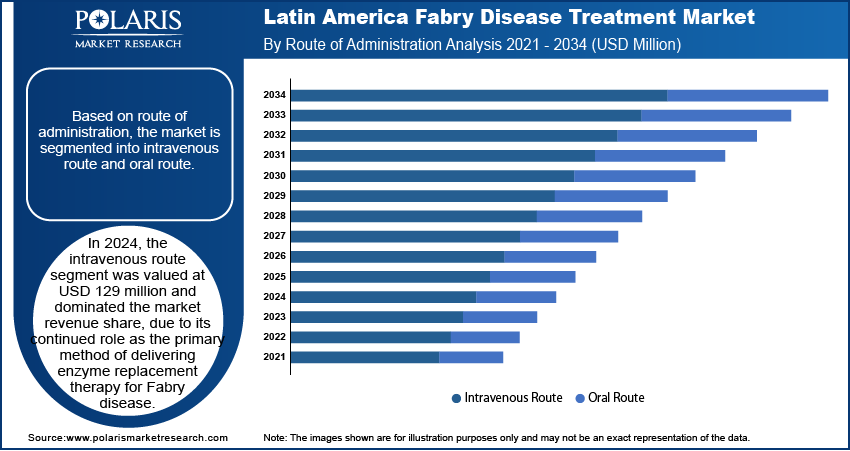

- In 2024, the intravenous route segment dominated the market. It is due to its continued role as the primary method of delivering enzyme replacement therapy for Fabry disease.

- In 2024, the enzyme replacement therapy (ERT) segment led the revenue share. The dominance is driven by its established clinical efficacy and long-standing use in Fabry disease management.

- In 2024, the hospital pharmacies segment was valued at USD 87 million. The central role of hospitals in Fabry disease treatment delivery contributed to the segment growth.

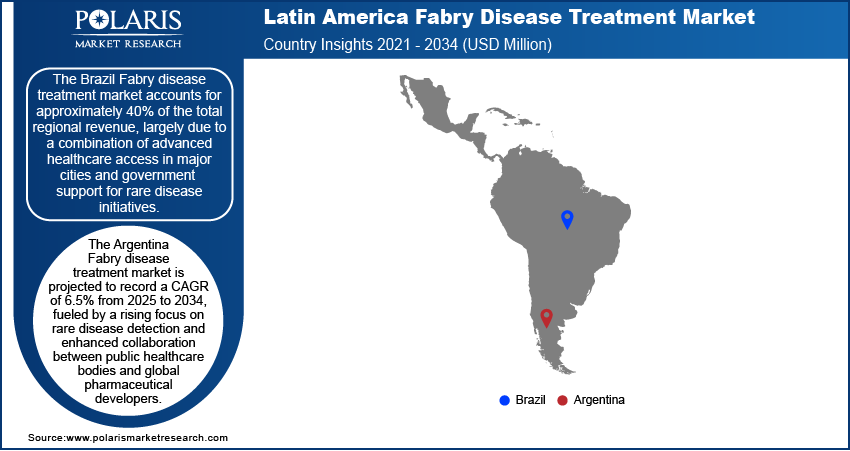

- The Brazil Fabry disease treatment market accounts for approximately 40% of the total regional revenue share. The market growth is largely attributed to a combination of advanced healthcare access in major cities and government initiatives for rare disease management.

- The industry in Argentina is projected to register a CAGR of 6.5% from 2025 to 2034. Rising focus on rare disease detection and enhanced collaboration between public healthcare bodies and global pharmaceutical developers fuel this growth.

Industry Dynamics

- Rising awareness of Fabry disease management across Latin America drives the market expansion.

- Expansion of healthcare infrastructure across major cities in the region contributed to the industry growth.

- Ongoing regulatory improvements focused on orphan drug designation and fast-track approvals are expected to offer lucrative opportunities during the forecast period.

- Shortage of skilled treatment providers hinders the Fabry disease treatment industry growth.

Market Statistics

2024 Market Size: USD 81.36 million

2034 Projected Market Size: USD 164.68 million

CAGR (2025–2034): 6.6%

Brazil: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

Fabry disease is a rare genetic disorder that affects the body's ability to break down specific fatty substances, leading to their expansion in various organs. The demand for Fabry disease treatment has grown in response to the need for managing and slowing the progression of this lifelong condition. The market contains therapies that target the root cause of the disease as well as those that manage its symptoms, such as enzyme replacement therapy, Chaperone Therapy, and others. These treatments aim to improve the quality of life for patients and reduce complications that arise from damage to the heart, kidneys, and nervous system. Collaboration between public health systems and private insurers is improving treatment access, particularly through reimbursement frameworks that cover expensive orphan drugs such as those used in Fabry disease management.

Ongoing regulatory improvements focused on orphan drug designation and fast-track approvals are helping streamline access to Fabry disease treatments, encouraging more companies to introduce therapies in Latin America. Additionally, specialty pharmacy networks are expanding across the region, improving the availability and distribution of complex therapies such as enzyme replacement and oral formulations tailored for Fabry disease patients.

Market Dynamics

Rising Awareness of Rare Diseases

Educational campaigns focused on rare diseases are playing a vital role in improving awareness of Fabry disease across Latin America. Advocacy groups, in collaboration with medical associations, are conducting outreach programs, workshops, and digital awareness drives that help people recognize early symptoms of the disease. For instance, in April 2024, Ilan Goldfajn, president of the Inter-American Development Bank, and Jarbas Barbosa, director of the Pan-American Health Organization, signed an agreement to accelerate the digital transformation of healthcare services. This partnership aims to strengthen primary healthcare and enhance pandemic preparedness in Latin America. These efforts are also equipping primary care physicians and healthcare professionals with better diagnostic knowledge, enabling quicker referrals to specialists. Families affected by Fabry disease are increasingly turning to support groups and foundations for guidance, which further spreads awareness. Increased patient awareness also encourages participation in clinical trials, further contributing to the development and availability of new treatment options across the region.

Growth in Urban Healthcare Infrastructure

Major cities across Latin America are seeing a steady expansion in healthcare infrastructure, which is improving access to rare disease treatments such as those required for Fabry disease. Hospitals in urban areas of Brazil, Mexico, and Argentina are increasingly equipped with advanced diagnostic technologies and specialized departments for genetic and metabolic disorders. These developments are making it easier for patients to receive a proper diagnosis and consistent treatment. Healthcare professionals in these cities are also more likely to receive ongoing training in rare disease management, which directly improves patient care. Moreover, urban hospitals often act as clinical trial hubs, connecting patients to the latest innovations. These improvements in urban healthcare delivery are translating to better outcomes for Fabry disease patients and strengthening the regional treatment landscape.

Segment Insights

Market Assessment by Route of Administration

By route of administration, the segmentation includes intravenous route and oral route. In 2024, the intravenous route segment was valued at USD 129 million and dominated the market, due to its continued role as the primary method of delivering enzyme replacement therapy for Fabry disease. Hospitals and infusion centers across Latin America remain reliant on intravenous formulations to administer biweekly doses, ensuring accurate dosing and physician oversight. Physicians prefer this method for patients showing advanced symptoms or complications requiring clinical monitoring. Infusion-based treatment also supports better adherence tracking and safety management, especially for those undergoing long-term therapy. The established healthcare protocols and patient familiarity with the infusion process have reinforced the segment's dominance in the treatment landscape.

The oral route segment is projected to register a CAGR of 6.8% from 2025 to 2034, supported by increasing preference for convenience and improved patient compliance. Oral therapies offer a noninvasive alternative that aligns better with daily routines, especially for younger or working-age patients. Recent approvals of oral substrate reduction therapies are also reshaping physician prescribing trends. These medications reduce the burden of frequent hospital visits, making them more attractive in regions where travel to specialty centers is limited. Growing awareness and ongoing clinical research highlighting the effectiveness and tolerability of oral treatments are contributing to market traction. Additionally, payers are recognizing the cost advantages of oral therapies, further supporting adoption.

Market Assessment by Therapy

The segmentation, based on therapy, includes enzyme replacement therapy (ERT), substrate reduction therapy (SRT), and others. In 2024, the enzyme replacement therapy (ERT) segment was valued at approximately USD 135 million, and it led the market revenue share, driven by its established clinical efficacy and long-standing use in Fabry disease management. ERT is often the first line of treatment, particularly for patients showing significant systemic symptoms or organ involvement. The availability of multiple biologic formulations and widespread physician familiarity make it a reliable and trusted option. Hospitals and specialty care centers invest in infusion infrastructure to support ERT, boosting its market position. Continued clinical backing and inclusion in treatment guidelines ensure consistent utilization despite emerging alternatives.

The substrate reduction therapy segment is expected to register a CAGR of 7.0% from 2025 to 2034, due to increasing clinical acceptance and recent product approvals targeting Fabry disease. SRT offers an oral option that is especially beneficial for patients who are unable to tolerate intravenous enzyme infusions or prefer home-based care. These therapies work by limiting the synthesis of substrate accumulation, addressing disease progression at its source. Emerging clinical evidence supporting the use of SRT in combination or as an alternative to ERT is also influencing prescribing behavior. Advancements in synthetic small molecule API development and improved access in developing regions are expected to boost adoption in the coming years.

Market Evaluation by Distribution Channel

Based on distribution channel, the segmentation includes hospital pharmacies, retail pharmacies, and online pharmacies. In 2024, the hospital pharmacies segment was valued at USD 87 million. The segment expansion is supported by the central role of hospitals in Fabry disease treatment delivery. Most enzyme replacement therapies are administered in clinical settings, requiring storage, handling, and oversight by specialized pharmacy units within hospitals. Hospital pharmacies also streamline access to rare disease treatments through institutional procurement systems, which often negotiate bulk pricing and ensure availability. Moreover, these settings facilitate physician collaboration for managing complex treatment protocols. The presence of diagnostic services within hospitals enhances patient monitoring, making hospital pharmacies the preferred channel for both treatment initiation and continuation.

The retail pharmacies segment is expected to register a CAGR of 6.8% from 2025 to 2034, driven by the rising use of oral therapies and expanded distribution networks. Patients managing Fabry disease with substrate reduction therapy increasingly prefer the accessibility and convenience of local retail pharmacies. Improvements in prescription fulfillment systems and pharmacist education regarding rare disease treatments are further strengthening this segment. Retail pharmacies also benefit from partnerships with specialty drug distributors, ensuring that even high-cost or low-volume medications are available to patients outside major urban centers. This shift reflects broader healthcare trends favoring decentralized, patient-centric treatment models.

Country Analysis

Brazil Fabry Disease Treatment Market

The Brazil Fabry disease treatment market accounts for approximately 40% of the total regional revenue. The market growth is largely attributed to a combination of advanced healthcare access in major cities and government support for rare disease initiatives. The growing investments in healthcare in Brazil also fuel the availability of Fabry disease treatment in the country by expanding access to diagnostics, therapies, and specialized care. Brazil, the largest healthcare market in Latin America, spends 9.47% of its GDP on healthcare, which accounts for USD 161 billion. Furthermore, increasing awareness through national health campaigns and active patient advocacy groups has led to earlier diagnoses and consistent treatment initiation. Public healthcare institutions and private specialty clinics are expanding diagnostic and therapeutic services, particularly enzyme replacement therapy (ERT), which remains the cornerstone of clinical management. In addition, the approval of newer oral therapies is creating more treatment options for patients, especially those seeking home-based care. Improved supply chains and regulatory efficiency in drug approvals are also contributing to better access. Domestic pharmaceutical partnerships are helping reduce costs, enabling broader affordability and availability of treatment, which is expected to strengthen Brazil leadership in the Latin American Fabry disease market.

Argentina Disease Treatment Market

The Argentina Fabry disease treatment market is projected to register a CAGR of 6.5% from 2025 to 2034, fueled by a rising focus on rare disease detection and enhanced collaboration between public healthcare bodies and global pharmaceutical developers. National health programs are investing in rare disease genetic testing infrastructure, which is critical for identifying Fabry disease at earlier stages. Physicians and specialists are receiving targeted training to better recognize and manage symptoms, improving patient outcomes. The presence of treatment guidelines and the increasing availability of both enzyme replacement therapy and substrate reduction therapy support a more structured treatment pathway. Efforts to integrate rare disease care into broader chronic illness management frameworks are also gaining traction. Moreover, partnerships between hospitals and international drug developers are facilitating clinical trial activity, introducing new therapeutic options to the local population. These ongoing efforts are expected to drive both patient access and market growth over the next decade. The investment has also facilitated the development of specialized treatment centers and improved patient registries, further accelerating the diagnosis and management of Fabry disease. For instance, Argentina's healthcare modernization initiative became part of 28 World Bank-funded health projects across Latin America and the Caribbean, which collectively received USD 3.9 billion in funding. This support has played a crucial role in strengthening diagnostic capabilities and expanding access to advanced therapies, reinforcing Argentina position as a growing hub for rare disease treatment in the region.

Key Players & Competitive Analysis Report

The competitive landscape of the Latin America Fabry disease treatment market is defined by active market expansion strategies and a rise in cross-border collaborations aimed at strengthening therapeutic outreach. Industry analysis reveals an increasing number of strategic alliances between regional healthcare institutions and global biotech innovators, focused on launching next-generation enzyme replacement therapies and novel oral agents. Companies are pursuing joint ventures to establish localized production and distribution channels, addressing pricing challenges and improving drug accessibility. Mergers and acquisitions are being leveraged to integrate R&D capabilities and streamline regulatory pathways. Technology advancements such as digital health platforms and remote patient monitoring tools are gaining traction, enhancing treatment adherence and outcome tracking. Post-merger integration efforts are also aligning operational synergies to accelerate product rollouts. Competitive intensity is being shaped by a focus on differentiation through patient-centric models, leveraging real-world data, and developing precision medicine approaches tailored to regional genetic profiles and healthcare infrastructures.

List of Key Companies with Approved Drugs

- Chiesi Farmaceutici S.p.A.

- JCR Pharmaceuticals Co., Ltd.

- Protalix BioTherapeutics Inc.

- Sanofi

- Takeda Pharmaceutical

List of Companies with Drugs Under Clinical Trial Phase

- Amicus Therapeutics, Inc.

- Idorsia Pharmaceuticals Ltd.

- Idorsia Pharmaceuticals Ltd.

- ISU ABXIS Co., Ltd.

- Sangamo Therapeutics, Inc.

Latin America Fabry Disease Treatment Industry Developments

In March 2024, CENTOGENE extended its collaboration with Takeda to improve access to genetic testing for patients suffering from lysosomal storage disorders (LSDs). This partnership aims to advance genetic diagnostics, ensuring timely and accurate testing for effective disease management.

In February 2024, mAbxience, part of Fresenius Kabi and Insud Pharma, formed a strategic partnership with Argentine biotechnology firm Biosidus. This collaboration focuses on the CDMO sector, with mAbxience responsible for manufacturing Agalsidase Beta as a biosimilar to Fabrazyme.

Latin America Fabry Disease Treatment Market Segmentation

By Route of Administration Outlook (Revenue USD Million, 2020–2034)

- Intravenous Route

- Oral Route

By Therapy Outlook (Revenue USD Million, 2020–2034)

- Enzyme Replacement Therapy (ERT)

- Substrate Reduction Therapy (SRT)

- Others

By Distribution Channel Outlook (Revenue USD Million, 2020–2034)

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Country Outlook (Revenue USD Million, 2020–2034)

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Ecuador

- Paraguay

- Rest of LATAM

Latin America Fabry Disease Treatment Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 81.36 million |

|

Market Size Value in 2025 |

USD 87.25 million |

|

Revenue Forecast by 2034 |

USD 164.68 million |

|

CAGR |

6.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Country Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The Latin America market size was valued at USD 81.36 million in 2024 and is projected to grow to USD 164.68 million by 2034.

The Latin America market is projected to register a CAGR of 6.6% during the forecast period.

The Brazil Fabry disease treatment market accounts for approximately 40% of the total regional revenue. The market growth is largely driven by a combination of advanced healthcare access in major cities and government support for rare disease initiatives.

A few of the key players are Amicus Therapeutics, Inc.; CANbridge Life Sciences Ltd.; Chiesi Farmaceutici S.p.A.; Idorsia Pharmaceuticals Ltd.; ISU ABXIS Co., Ltd.; JCR Pharmaceuticals Co., Ltd.; Protalix Biotherapeutics Inc.; Sangamo Therapeutics, Inc.; Sanofi; and Takeda Pharmaceutical.

In 2024, the intravenous route segment was valued at USD 129 million of revenue share. The segment dominated the market, due to its continued role as the primary method of delivering enzyme replacement therapy for Fabry disease.

In 2024, the enzyme replacement therapy (ERT) segment was valued at approximately USD 135 million, driven by its established clinical efficacy and long-standing use in Fabry’s disease management.