Leather Goods Market Size, Share, Trends, Industry Analysis Report

: By Type (Genuine Leather, Synthetic Leather, and Vegan Leather), Product, End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 129

- Format: PDF

- Report ID: PM3235

- Base Year: 2024

- Historical Data: 2020-2024

Leather Goods Market Overview

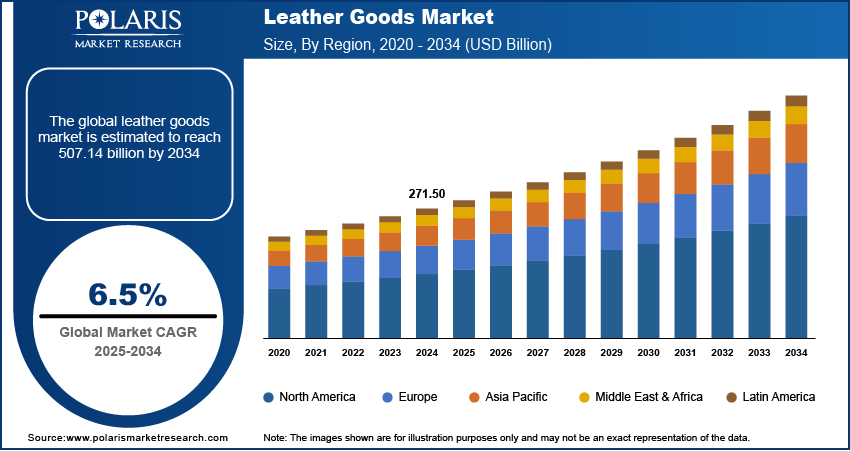

The global leather goods market size was valued at USD 271.50 billion in 2024. It is expected to grow from USD 288.64 billion in 2025 to USD 507.14 billion by 2034, at a CAGR of 6.5% during 2025–2034.

Leather goods refer to products made from tanned animal hides, such as footwear, bags, wallets, belts, and accessories, serving both fashion and functional needs. The global leather goods market demand is rising, driven by evolving consumer preferences and increasing demand for premium and durable products. One of the drivers fueling market expansion is rising disposable incomes, particularly in emerging economies. A February 2024 report from the Ministry of Statistics and Programme Implementation estimated the Gross National Disposable Income (GNDI) at current prices to be 3.30 trillion USD for 2022-23, up from 2.88 trillion USD in 2021-22. Representing a growth of 14.5%, down from 18.8% the previous year. Consumers are more keen to invest in high-quality, stylish leather goods, reflecting their status and lifestyle as purchasing power increases, further driving the leather goods market development. The demand for branded and luxury leather products has surged, with premium offerings gaining traction among affluent consumers seeking exclusivity and craftsmanship. Furthermore, urbanization and evolving fashion trends contribute to the leather goods market growth, as it remains a preferred choice for both personal use and gifting purposes.

Technological advancements have played a crucial role in shaping the leather goods industry by improving product quality, sustainability, and manufacturing efficiency. Innovations in leather processing, such as eco-friendly tanning techniques and bio-based leather, are addressing environmental concerns while maintaining product durability. In May 2024, Tenerias Omega adopted WET GREEN biodegradable tannage technology using olive leaves, promoting sustainable leather production. Recognized by the Leather Working Group (LWG), it showcased innovation and environmental responsibility in eco-friendly leather manufacturing. Additionally, digitalization and automation in manufacturing have streamlined production processes, reducing costs and improving scalability for manufacturers. The integration of smart technologies, such as RFID tagging and AI-driven customization, is further boosting the consumer experience by offering personalized products and improved traceability. Therefore, as technology continues to evolve, the leather goods market is expected to witness greater efficiency, sustainability, and innovation, further strengthening its global presence.

To Understand More About this Research: Request a Free Sample Report

Leather Goods Market Dynamics

Rising Demand for Leather Goods

Leather goods, such as footwear, handbags, and accessories, are sensed as a symbol of sophistication and craftsmanship, leading to their strong demand across various demographics. Additionally, urbanization and increasing global fashion consciousness have amplified consumer interest in high-quality leather products, particularly in emerging markets with expanding middle-class populations driven by evolving consumer preferences for premium, durable, and stylish products. A January 2025 IBEF report indicated that the Indian textiles and apparel market will register a CAGR of 10%, reaching USD 350 billion by 2030. Exports are expected to hit USD 100 billion, boosting the leather goods market growth. The growing influence of luxury brands and the preference for exclusive, handcrafted leather items further contribute to the market expansion. Moreover, leather goods offer a combination of functionality and aesthetics, making them a preferred choice for both personal use and gifting, which is sustaining consistent demand for leather goods across retail and e-commerce channels.

Increasing Demand for Sustainable Items

There is a rising preference for eco-friendly leather alternatives, such as vegetable-tanned and recycled leather products, with growing awareness of sustainability and ethical sourcing. Brands are investing in sustainable production methods to reduce their environmental footprint, incorporating biodegradable materials and ethical sourcing practices as consumers and manufacturers shift toward environmentally responsible practices. For instance, in August 2023, Bentley Motors launched Olive Tan Leather, a sustainable leather using olive oil industry by-products. This eco-friendly tanning process reduces water use and avoids harmful chemicals, aligning with the strategy for sustainable luxury mobility. Additionally, regulatory policies and corporate sustainability commitments are accelerating the adoption of sustainable leather goods, reinforcing consumer trust in responsible manufacturing. Therefore, as sustainability continues to shape purchasing decisions, the leather goods market is evolving towards more eco-conscious innovations while maintaining product quality and appeal. Hence, increasing demand for sustainable items propels the leather goods market opportunities.

Leather Goods Market Segment Assessment

Leather Goods Market Assessment by Product Outlook

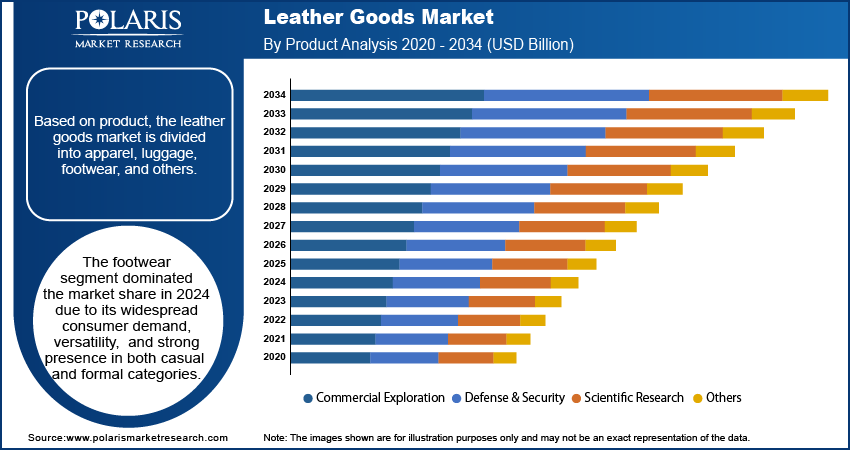

The global leather goods market segmentation, based on product, includes apparel, luggage, footwear, and others. The footwear segment dominated the leather goods market share in 2024 due to its widespread consumer demand, versatility, and strong presence in both casual and formal categories. Leather footwear is highly valued for its durability, comfort, and aesthetic appeal, making it a preferred choice across various demographics. The segment benefits from continuous product innovations, such as ergonomic designs, advanced cushioning, and sustainable leather alternatives, improving consumer interest. Additionally, the growing influence of fashion trends and brand endorsements has driven demand for premium and luxury leather footwear. The expanding e-commerce sector has further contributed to the segment’s growth, offering consumers a wider range of designs and price points. Moreover, the preference for high-quality leather footwear in both professional and casual wear has solidified its dominance in the market.

Leather Goods Market Evaluation by Type Outlook

The global leather goods market segmentation, based on type, includes genuine leather, synthetic leather, and vegan leather. The synthetic leather segment is expected to witness the fastest growth during the forecast period, driven by its affordability, versatility, and sustainability. Unlike genuine leather, synthetic leather offers a cost-effective alternative without compromising on aesthetics, making it appealing to a broader consumer base. The rising awareness of ethical and environmental concerns has accelerated the demand for synthetic and vegan leather products, particularly among younger consumers. Advancements in material technology have further improved the durability, texture, and appearance of synthetic leather, closely resembling genuine leather while being eco-friendlier. Additionally, regulatory policies promoting sustainable production and reducing reliance on animal-derived materials have encouraged brands to expand their synthetic leather offerings. The increasing acceptance of cruelty-free fashion, along with innovations in bio-based synthetic leather, is expected to drive significant growth in this segment.

Leather Goods Market Outlook by Region

By region, the report provides the leather goods market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominated the leather goods market share in 2024, primarily due to its strong manufacturing base, high consumer demand, and expanding middle-class population. A July 2020 WEF report estimated that 2 billion Asians were middle class, with projections of 3.5 billion by 2030. This growth is further fueled by increasing urbanization, rising disposable incomes, and a growing preference for premium and sustainable leather products in the region. The region consists of major leather goods manufacturing hubs benefiting from cost-effective labor, abundant raw material availability, and well-established supply chains. Additionally, the rising disposable incomes and increasing fashion consciousness among consumers have fueled demand for premium and luxury leather products. Countries such as China, India, and Japan have witnessed growth in retail and e-commerce sectors, providing greater accessibility to leather goods. In January 2025, the IBEF reported that ready-made garment exports, including accessories, reached USD 2,244 million in FY25. This expansion reflects the region's increasing influence in global fashion and luxury markets, driven by consumer demand and digital transformation. The presence of domestic and international brands serving diverse consumer preferences has further strengthened the leather goods market expansion.

The Europe leather goods market is projected to witness the fastest growth during the forecast period, driven by a strong presence of luxury brands, increasing consumer spending on high-quality products, and a growing focus on sustainability. Europe has long been a global hub for premium leather craftsmanship, with renowned brands continuously innovating and expanding their product portfolios. The demand for high-end leather goods, including designer footwear, handbags, and accessories, remains strong, particularly in countries such as Italy, France, and Germany. Additionally, the shift toward sustainable and ethically sourced leather products has encouraged manufacturers to adopt eco-friendly production practices, attracting environmentally conscious consumers. The region’s well-established retail infrastructure and growing influence of e-commerce platforms have further accelerated market growth. For instance, in July 2024, the Ministry of Foreign Affairs reported that the European leather bags market alone is valued at about USD 4.99 billion. Moreover, increasing tourism and rising preference for luxury goods among international shoppers have contributed to the rapid Europe’s leather goods market expansion.

Leather Goods Market – Key Players & Competitive Analysis Report

The competitive landscape features global leaders and regional players competing for leather goods market share through innovation, strategic alliances, and regional expansion. Global players utilize strong R&D capabilities, technological advancements, and extensive distribution networks to deliver advanced solutions, meeting the growing demand for disruptive technologies and sustainable value chains. Leather goods market trends highlight rising demand for emerging technologies, digitalization, and business transformation driven by economic growth, geopolitical shifts, and macroeconomic trends. Global players focus on strategic investments, mergers and acquisitions, and joint ventures to strengthen their market position. Post-merger integration and strategic alliances are key strategies to improve competitive positioning and expand regional footprints. Regional companies, meanwhile, address localized needs by offering cost-effective solutions and leveraging economic landscapes. Competitive benchmarking includes market entry assessments, expansion opportunities, and partnership ecosystems to meet the demand for innovative products and future-ready solutions. The market is experiencing technological advancements, such as disruptive technologies and digital transformation, reshaping industry ecosystems. Companies are investing in supply chain management, procurement strategies, and sustainability transformations to align with leather goods market demand, trends, and future development strategies. Pricing insights, revenue growth analysis, and competitive intelligence are critical for identifying opportunities and driving long-term profitability. In conclusion, the growth of the leather goods industry is driven by technological innovation, market adaptability, and regional investments. Major players focus on strategic developments, market penetration, and competitive benchmarking to address economic and geopolitical shifts, assuring sustained growth in a hypercompetitive global market. A few key major players are ADIDAS; American Leather Co.; Bata India Ltd; Bhartiya International; CAPRI HOLDINGS LIMITED; Hermès; Kering; LVHM; Mayur Uniquoters Limited; Metro Brands Limited; Prada; Puma SE; Tapestry, Inc.; VIP Industries Ltd; and Woodland (Aero Club) Private Limited.

Bhartiya International Ltd. specializes in the Indian leather and textile industry, offering a diverse range of products, such as leather outerwear, bags, accessories, belts, wallets, and other small leather goods. The company also provides textile apparel, leather finishing, and design studio services. Established in 1987 and headquartered in Gurugram, India. Initially focused on carpet exports, it diversified into high-fashion leather garments and has since become synonymous with quality leather products. The company operates several production facilities in Bangalore-Chennai and has manufacturing capabilities in China for leather garments. Bhartiya International exports its products globally and is involved in various other sectors such as real estate development, IT parks, and retail spaces. Its subsidiaries include Bhartiya Global Marketing Ltd., J&J Leather Enterprises Ltd., and Bharatiya Fashion Retail Ltd. The company continues to expand its offerings while maintaining a focus on style and finesse in its leather goods with a strong presence in the retail apparel and fashion industry.

Kering is a French multinational luxury goods holding company headquartered in Paris, renowned for its extensive portfolio of high-end brands. Founded in 1962, the company evolved from a timber-trading business to become one of the world's largest luxury goods companies, second only to LVMH in terms of revenue. Kering's transformation into a luxury powerhouse was marked by its rebranding from Pinault-Printemps-Redoute (PPR) to Kering in 2013. The company owns iconic brands such as Gucci, Yves Saint Laurent, Balenciaga, Bottega Veneta, and Alexander McQueen, among others. In the leather goods market, Kering's brands are particularly celebrated for their craftsmanship and style. Gucci, for instance, is a leading brand in luxury leather goods, offering a wide range of handbags, wallets, and belts. Bottega Veneta is also renowned for its high-quality leather products known for its distinctive intrecciato weaving technique. Kering's focus on creative expression and sustainability drives its business model, aiming to be the world's most influential luxury group in terms of creativity, sustainability, and economic performance. The company distributes its products through various channels, such as direct-operated stores, franchise boutiques, and wholesale partners across the globe.

List of Key Companies in Leather Goods Market

- ADIDAS

- American Leather Co.

- Bata India Ltd

- Bhartiya International

- CAPRI HOLDINGS LIMITED

- Hermès

- Kering

- LVHM

- Mayur Uniquoters Limited

- Metro Brands Limited.

- Prada

- Puma SE

- Tapestry, Inc.

- VIP Industries Ltd

- Woodland (Aero Club) Private Limited

Leather Goods Industry Developments

February 2025: SPOOR and OEKO-TEX collaborated to boost leather industry transparency through farm-to-product traceability and MADE IN GREEN certification, assuring supply chain visibility and promoting sustainable, ethically sourced leather to meet consumer demands.

February 2024: Silvateam S.p.A. acquired wet-green GmbH, merging their expertise in plant-based tannins. This partnership improves sustainable leather innovation by combining Ecotan and Olivenleder technologies for eco-friendly production.

Leather Goods Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Genuine Leather

- Vegan Leather

- Synthetic Leather

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Apparel

- Luggage

- Footwear

- Others

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Men

- Women

- Kids

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Leather Goods Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 271.50 billion |

|

Market Size Value in 2025 |

USD 288.64 billion |

|

Revenue Forecast in 2034 |

USD 507.14 billion |

|

CAGR |

6.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global leather goods market size was valued at USD 271.50 billion in 2024 and is projected to grow to USD 507.14 billion by 2034.

The global market is projected to register a CAGR of 6.5% during the forecast period.

Asia Pacific dominated the market revenue in 2024.

A few of the key players in the market are ADIDAS; American Leather Co.; Bata India Ltd; Bhartiya International; CAPRI HOLDINGS LIMITED; Hermès; Kering; LVHM; Mayur Uniquoters Limited; Metro Brands Limited; Prada; Puma SE; Tapestry, Inc.; VIP Industries Ltd; and Woodland (Aero Club) Private Limited.

The footwear segment held the largest market share in 2024.

The synthetic leather segment is expected to witness the fastest growth during the forecast period.