U.S. Chondroitin Sulfate Market Size, Share, Trends, Industry Analysis Report

By Source (Bovine, Swine, Poultry, Shark, Synthetic), By Application – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6110

- Base Year: 2024

- Historical Data: 2020-2023

Overview

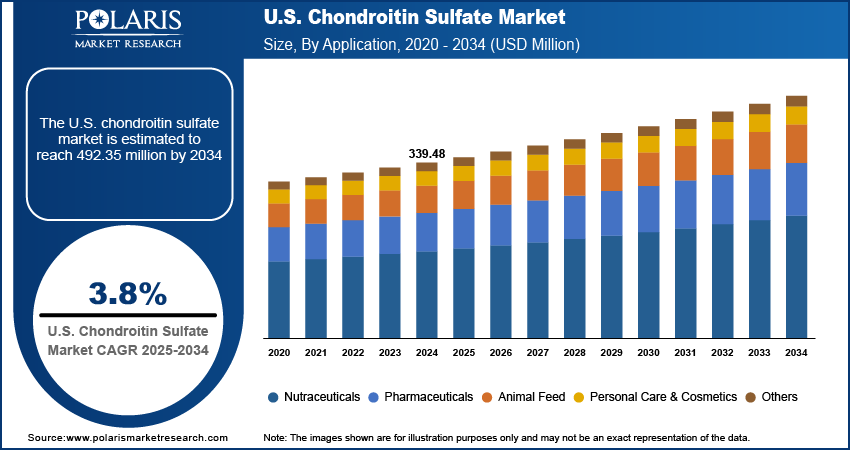

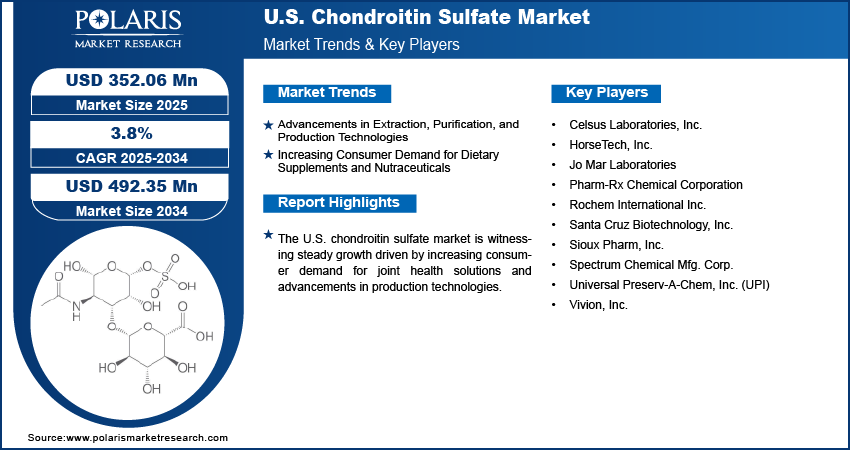

The U.S. chondroitin sulfate market size was valued at USD 339.48 million in 2024, growing at a CAGR of 3.8% from 2025 to 2034. The growing geriatric population and rising prevalence of joint disorders are driving demand for chondroitin sulfate. Technological advancements in extraction and purification enhance production efficiency, while increasing consumer preference for preventive healthcare boosts nutraceutical and supplement applications, which propels industry expansion.

Key Insights

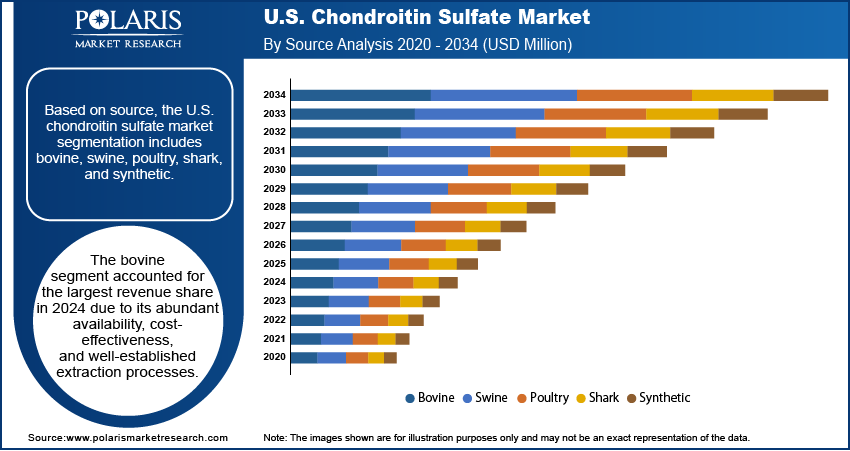

- The bovine segment accounted for the largest revenue share in 2024 due to its abundant availability, cost-effectiveness, and well-established extraction processes.

- The pharmaceuticals segment is expected to witness significant growth during the forecast period, driven by the increasing clinical adoption of in the treatment of osteoarthritis and other joint-related disorders.

Industry Dynamics

- Rising demand for joint health supplements from aging consumers and pet owners offers major revenue opportunities for producers.

- Strict regulations on animal-sourced ingredients raise costs and constrain supply chain agility.

- Technological advancements enhance scalability and cost-efficiency, enabling high-quality chondroitin production for pharmaceutical and nutraceutical uses.

- Rising consumer demand for joint health supplements is driving growth, as health-conscious individuals increasingly seek non-prescription, preventive wellness solutions.

Market Statistics

- 2024 Market Size: USD 339.48 million

- 2034 Projected Market Size: USD 492.35 million

- CAGR (2025–2034): 3.8%

To Understand More About this Research: Request a Free Sample Report

Chondroitin sulfate is a naturally occurring compound found in connective tissues, commonly used in joint health supplements and pharmaceutical formulations. In the U.S., demand for chondroitin sulfate is growing due to the increasing geriatric population and the associated rise in bone and joint-related disorders. According to a June 2024 government Census report, the U.S. population aged 65 and above reached ~59.2 million by 2023, reflecting a 9.4% increase. The prevalence of conditions such as osteoarthritis, osteoporosis, and cartilage degeneration increases as the aging demographic expands. Chondroitin sulfate’s role in maintaining cartilage integrity and reducing inflammation has made it a preferred ingredient in noninvasive therapies aimed at alleviating joint discomfort. This demographic trend is creating sustained demand across nutraceuticals and pharmaceutical applications, reinforcing its market potential.

The U.S. chondroitin sulfate market growth is further driven by the robust expansion of the domestic pharmaceutical industry, coupled with increasing FDA approvals for chondroitin-based formulations. As a hub for pharmaceutical innovation, the U.S. is witnessing a steady increase in the development and commercialization of chondroitin-containing drugs and supplements. Regulatory acceptance and clear approval pathways enhance market confidence, encouraging manufacturers to invest in high-quality chondroitin products. This regulatory backing enhances the credibility of these products and facilitates their integration into mainstream therapeutic protocols, thereby boosting their adoption across the healthcare system.

Drivers and Opportunities

Advancements in Extraction, Purification, and Production Technologies: Advancements in extraction, purification, and production technologies are creating new opportunities for manufacturers by improving product quality, yield, and consistency. Modern processing methods enable the more efficient isolation of chondroitin sulfate from various animal sources, thereby reducing impurities and enhancing its bioavailability. In April 2025, Gnosis by Lesaffre rebranded its fermentation-derived chondroitin sulfate as MyCondro. This sustainable product boasts over 99% purity and offers 45% higher bioavailability than bovine-derived chondroitin, potentially enhancing joint health due to its similarity to human chondroitin. These technological improvements support scalability and also enable cost-effective production, making high-quality chondroitin accessible for both pharmaceutical and nutraceutical applications. Therefore, as regulatory scrutiny increases, advanced purification techniques help ensure compliance with safety and quality standards, further enhancing industry confidence and promoting adoption.

Increasing Consumer Demand for Dietary Supplements and Nutraceuticals: Increasing consumer demand for dietary supplements and nutraceutical excipients is boosting the expansion opportunities. Health-conscious consumers are increasingly seeking non-prescription solutions to support joint health, mobility, and overall well-being, particularly as awareness around preventive healthcare continues to rise. Chondroitin sulfate, often used in combination with glucosamine, is widely recognized for its benefits in managing joint discomfort and slowing cartilage degradation. This trend is fueling the demand for chondroitin-based formulations in capsules, powders, and functional foods, positioning it as a staple ingredient in the expanding U.S. nutraceuticals landscape.

Segmental Insights

Source Analysis

Based on source, the U.S. chondroitin sulfate market segmentation includes bovine, swine, poultry, shark, and synthetic. The bovine segment held the largest revenue share in 2024. This dominance is attributed to the widespread availability of bovine cartilage, cost-efficiency in processing, and mature extraction techniques adopted by U.S.-based manufacturers. Bovine-derived chondroitin is preferred for its consistent quality, high bioavailability, and widespread acceptance across both nutraceutical and pharmaceutical sectors. Additionally, the presence of a well-defined regulatory framework for bovine-sourced raw materials in the U.S. supports its continued leadership.

Application Analysis

In terms of application, the U.S. chondroitin sulfate market segmentation includes nutraceuticals, pharmaceuticals, animal feed, personal care & cosmetics, and other applications. The pharmaceuticals segment is projected to witness growth during the forecast period, driven by increasing use of chondroitin sulfate in managing osteoarthritis and other degenerative joint conditions. Its anti-inflammatory and cartilage-protective benefits have led to its incorporation into both prescription drugs and over-the-counter medications. Additionally, rising demand for noninvasive, symptom-focused therapies, along with supportive regulatory approvals and its inclusion in U.S. clinical guidelines, further solidify its role in the pharmaceutical landscape.

Key Players and Competitive Analysis

The U.S. chondroitin sulfate market is witnessing increasing competition as revenue opportunities expand due to rising demand for joint health supplements. Major players dominate developed markets, leveraging strategic investments in R&D and sustainable value chains to drive growth. Small and medium-sized businesses are entering the space with innovative formulations, capitalizing on emerging market segments, such as functional foods. Competitive intelligence indicates that leading vendors prioritize growth projections and optimize their supply chains in response to economic and geopolitical shifts. Disruptions and trends, such as clean-label preferences, are reshaping product offerings, while expansion opportunities in e-commerce drive revenue growth. Expert insights highlight latent demand from aging populations, pushing companies to adopt future development strategies for differentiation. Technological advancements further enhance competitive positioning, ensuring a long-term sustainability strategy in this high-growth sector.

A few major companies operating in the U.S. chondroitin sulfate market include Celsus Laboratories, Inc.; HorseTech, Inc.; Jo Mar Laboratories; Pharm-Rx Chemical Corporation; Rochem International Inc.; Santa Cruz Biotechnology, Inc.; Sioux Pharm, Inc.; Spectrum Chemical Mfg. Corp.; Universal Preserv-A-Chem, Inc. (UPI); and Vivion, Inc.

Key Players

- Celsus Laboratories, Inc.

- HorseTech, Inc.

- Jo Mar Laboratories

- Pharm-Rx Chemical Corporation

- Rochem International Inc.

- Santa Cruz Biotechnology, Inc.

- Sioux Pharm, Inc.

- Spectrum Chemical Mfg. Corp.

- Universal Preserv-A-Chem, Inc. (UPI)

- Vivion, Inc.

U.S. Chondroitin Sulfate Industry Developments

- April 2025: Eurofins Nutrition Analysis Center in Des Moines introduced advanced testing methods for glucosamine and chondroitin sulfate in pet food, overcoming analytical challenges to ensure precise measurement in joint health products. This supports quality control in pet supplements and formulations.

- January 2025, Tractor Supply launched 4health Shreds, a new dog food blending kibble with protein shreds. Formulated for adult dogs, it includes joint-supporting glucosamine, skin-nourishing omegas, and digestive probiotics with glucosamine and chondroitin sulfate.

U.S. Chondroitin Sulfate Market Segmentation

By Source Outlook (Volume, Tons; Revenue, USD Million, 2020–2034)

- Bovine

- Swine

- Poultry

- Shark

- Synthetic

By Application Outlook (Volume, Tons; Revenue, USD Million, 2020–2034)

- Nutraceuticals

- Pharmaceuticals

- Animal Feed

- Personal Care & Cosmetics

- Other Applications

U.S. Chondroitin Sulfate Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 339.48 Million |

|

Market Size in 2025 |

USD 352.06 Million |

|

Revenue Forecast by 2034 |

USD 492.35 Million |

|

CAGR |

3.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume, Tons; Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The U.S. market size was valued at USD 339.48 million in 2024 and is projected to grow to USD 492.35 million by 2034.

The U.S. market is projected to register a CAGR of 3.8% during the forecast period.

A few of the key players in the market are Celsus Laboratories, Inc.; HorseTech, Inc.; Jo Mar Laboratories; Pharm-Rx Chemical Corporation; Rochem International Inc.; Santa Cruz Biotechnology, Inc.; Sioux Pharm, Inc.; Spectrum Chemical Mfg. Corp.; Universal Preserv-A-Chem, Inc. (UPI); and Vivion, Inc.

The bovine segment accounted for the largest revenue share in 2024.

The pharmaceuticals segment is expected to witness significant growth during the forecast period.