LED Oral Care Kits Market Share, Size, Trends, Industry Analysis Report

By Type (Battery, Charge), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Feb-2024

- Pages: 118

- Format: PDF

- Report ID: PM4590

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

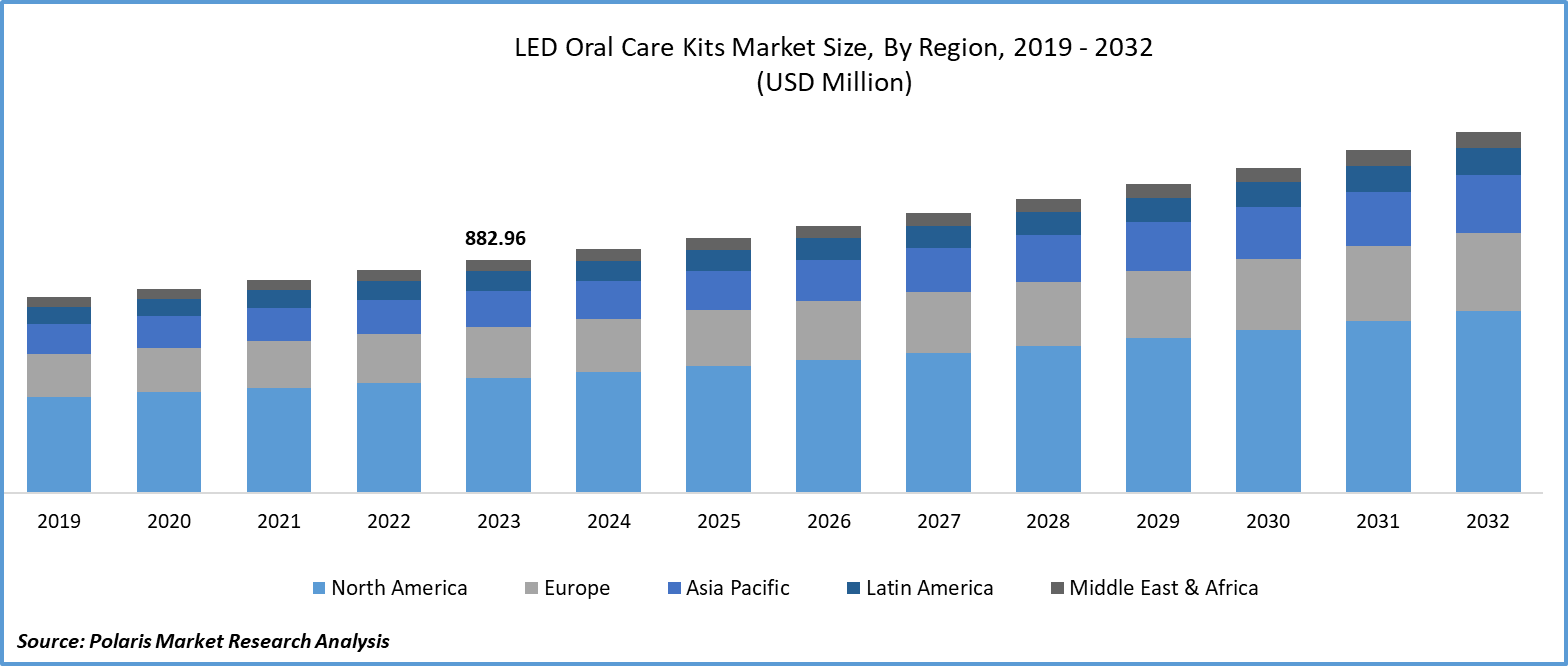

Global led oral care kits market size was valued at USD 882.96 million in 2023. The market is anticipated to grow from USD 923.75 million in 2024 to USD 1,367.39 million by 2032, exhibiting the CAGR of 5.0% during the forecast period.

Market Overview

The increasing incidence of dental caries significantly contributes to the LED oral care kits market demand. Dental decay, often attributed to poor dietary habits and inadequate oral hygiene, is prevalent among children, making them particularly susceptible. Research indicates that nearly half of pre-school-aged children globally experience dental caries. Consequently, there is a growing necessity for efficient oral care solutions tailored to address this issue in children. Seeking guidance from a dentist aid in selecting suitable oral care products, further driving the demand for such solutions.

Ongoing technological advancements and a heightened public awareness of oral care drive market growth in the dental industry. Major industry players have launched various initiatives aimed at educating the public about oral health, targeting both children and adults, resulting in increased demand for LED oral care kits. Furthermore, the rising incidence of dental disorders and a growing consumer demand for dental treatments are additional factors fueling market expansion.

Additionally, the American College of Prosthodontists reports that approximately 15% of edentulous individuals seek dentures annually. Moreover, an estimated 23 million older adults are fully edentulous. Consequently, the aging population serves as another factor driving the demand for oral care products, contributing to market growth.

To Understand More About this Research: Request a Free Sample Report

Furthermore, recent data published by the Australian Dental Association in October 2022 indicates that one-third of children aged 5 to 6 experience tooth decay in a baby tooth by the age of 5. To address the increasing prevalence of oral health issues in the population, the Australian government introduced the "National Oral Health Plan 2015-2024." Consequently, the oral care market is experiencing growth, driven by the escalating incidence of dental issues, evolving parental preferences, and expanding governmental efforts to enhance oral health awareness.

Growth Factors

Surge in oral diseases

According to the Global Oral Health Status Report published by the World Health Organization in November 2022, there is a significant burden of oral diseases affecting 45% or 3.5 billion people worldwide. Alarmingly, three-quarters of these affected individuals reside in low- and middle-income countries. The report highlights a substantial increase of 1 billion cases of oral diseases over the past 3 decades, indicating a widespread lack of access to preventive and treatment measures. This situation acts as a driving force for the growth of the LED oral care kits market, signaling an increasing demand for oral health solutions to address the expanding global need for effective preventive and treatment interventions.

Un-healthy lifestyles and low awareness

The dynamic shifts in lifestyles and unhealthy dietary habits, such as high sugar intake, alongside increased alcohol and tobacco consumption, have elevated oral health concerns to a significant public health issue. As per the World Health Organization, oral diseases present substantial challenges for numerous nations and impact individuals across all stages of life, leading to pain, discomfort, disfigurement, and, in severe cases, mortality. In China, consumers exhibit prevalent caries and substandard periodontal conditions, with caries prevalence exceeding 50% across all age demographics.

Restraining Factors

Threat of product substitution

LED oral care kits encounter a potential challenge from internal substitution. For example, the superior plaque reduction offered by water flossers compared to traditional floss may drive its adoption and constrain the market for traditional floss. Moreover, consumers in the consumer goods sector have ample alternatives available, making product substitution a straightforward choice for them.

Report Segmentation

The market is primarily segmented based on type, distribution channel, and region.

|

By Type |

By Distribution Channel |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Insights

Battery segment accounted for the largest market share in 2023

The battery segment dominated the global market. Battery-operated LED oral care kits, which are prevalent due to their affordability and the strong presence of key players such as P&G and Colgate Palmolive, held the largest market share. LED oral care kits use the bleaching properties of peroxide teeth whitening agents along with LED light to break down the chemical structure of stains. The LED light accelerates the chemical reactions that remove stains, making the kits highly effective in teeth whitening processes.

The charge segment will grow rapidly. This growth is attributed to heightened demand for rechargeable LED oral care devices, advancements in technology within this sector, greater public awareness regarding LED oral care, prolonged use of rechargeable LED oral care devices, and the expanding impact of social media on consumer behavior. These elements collectively contribute to the market's growth trajectory in the foreseeable future.

By Distribution Channel Insights

Offline segment held the largest share of gummy market

The offline segment dominated the market. LED oral care kits predominantly find their way to consumers through offline channels such as retail stores, thus commanding a significant portion of the market share. Governments have implemented flexible working hours for department stores and supermarkets, allowing them to operate late into the night. This presents a notable growth avenue for companies to position their products in these locations strategically.

The online segment is expected to grow at the fastest rate. This trend is attributed to the advantages that online shopping offers, including comparison shopping, a broader range of options, competitive pricing, and convenience. Sales via online platforms are expanding at a remarkable pace, outpacing traditional retail growth by a factor of six.

Regional Insights

North America dominated the market with largest revenue share in 2023

North America dominated the global market and is likely to continue its dominance throughout the LED oral care kits market forecast period. The region's growth is due to advanced healthcare infrastructure and the widespread adoption of innovative oral care solutions. Initiatives such as community dental health programs underscore the region's strong emphasis on oral health awareness. Moreover, favorable reimbursement policies, as seen in dental insurance plans, contribute significantly to the market's expansion. The increasing incidence of dental conditions, exemplified by a rise in endodontic treatments, further stimulates the demand for LED oral care kits.

Asia Pacific region is expected to expand at the significant CAGR over forecast period

Asia Pacific will grow rapidly with a healthy CAGR during the forecast period. The upsurge in oral diseases coupled with the increasing presence of leading healthcare providers in rapidly developing economies like India and China present promising expansion opportunities. Additionally, the region is experiencing enhancements in healthcare utilization, supported by government initiatives. For instance, the Indian government's launch of the National Oral Health Program (NOHP) acts as a significant catalyst for the market. This program aims to provide integrated and comprehensive oral health services within existing healthcare infrastructure.

Key Market Players & Competitive Insights

In the LED oral care kits market demand and innovation is prominent, with ongoing developments and the introduction of new technologies and methodologies. To meet rising demand, industry participants are proactively investing in innovative products to remain abreast of advancements in the market.

Some of the major players operating in the global market include:

- Active Wow

- Auraglow

- Bright White Smiles

- Colgate-Palmolive

- Glo Science

- MySmile

- P&G

- ShYn

- Snow Cosmetics LLC

- Starlite Smile

Recent Developments in the Industry

- In October 2023, Glo Science introduced the GLO To Go teeth whitening pen, emphasizing innovative dental solutions that deliver safe and effective whitening outcomes.

- In February 2023, Colgate-Palmolive introduced the Colgate Optic White Comfort Fit LED Teeth Whitening Kit alongside the Colgate Optic White Express Whitening Pen. These products promise to eliminate nearly a decade of dental stains within 3 days and achieve whiter teeth in just 1 day.

Report Coverage

The LED oral care kits market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, type, distribution channel, and their futuristic growth opportunities.

LED Oral Care Kits Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 923.75 million |

|

Revenue forecast in 2032 |

USD 1,367.39 million |

|

CAGR |

5.0% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

key companies in LED Oral Care Kits Market are Colgate-Palmolive, Glo Science, MySmile, Starlite Smile

LED oral care kits market exhibiting the CAGR of 5.0% during the forecast period.

The LED Oral Care Kits Market report covering key segments are type, distribution channel, and region.

key driving factors in LED Oral Care Kits Market are Surge in oral diseases

LED Oral Care Kits Market Size Worth $1,367.39 Million By 2032