Legal AI Software Market Size, Share, Trends, Industry Analysis Report

: By Type (Generative AI and Other AI), Deployment, Component, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 125

- Format: PDF

- Report ID: PM5560

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

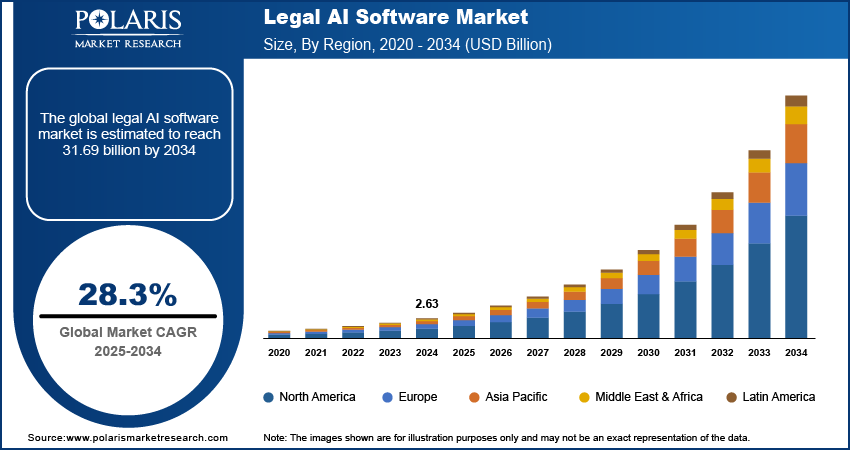

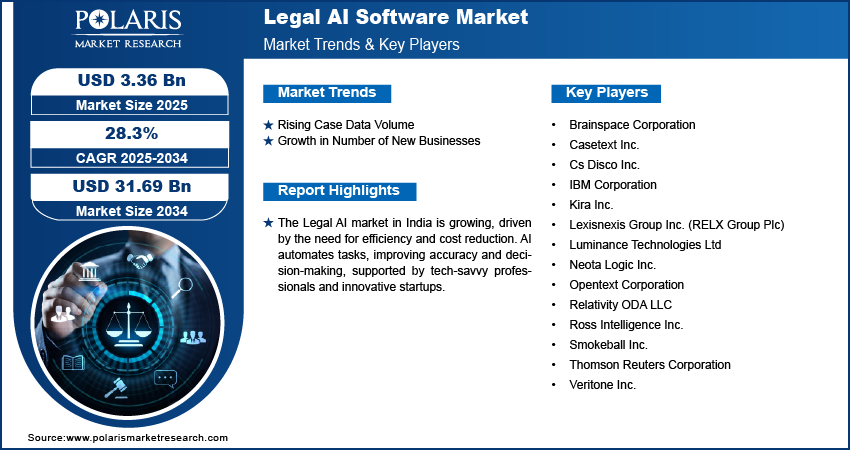

The legal AI software market size was valued at USD 2.63 billion in 2024, growing at a CAGR of 28.3% during the forecast period. The increased demand for automation and rapid advancements in artificial intelligence technologies are a few of the key factors fueling market growth.

Key Insights

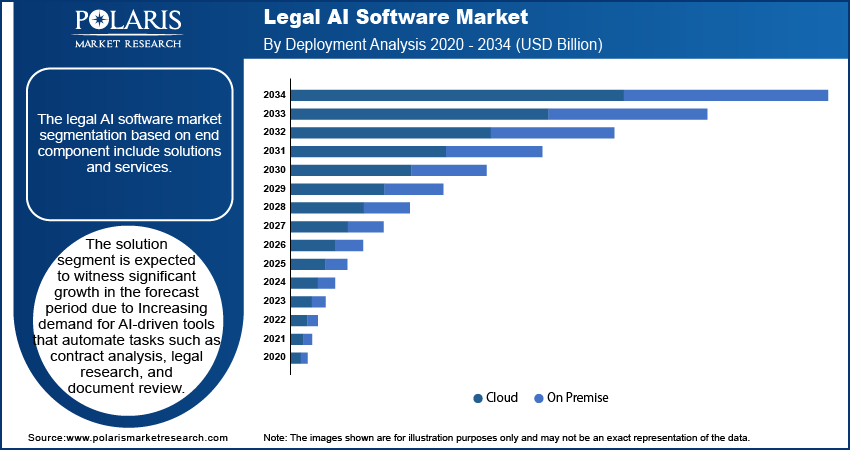

- The solutions segment is projected to witness significant growth, owing to increased demand for AI tools for automating tasks such as legal research and contract analysis.

- The cloud-based segment led the market in 2024, primarily driven by the various benefits associated with cloud-based solutions.

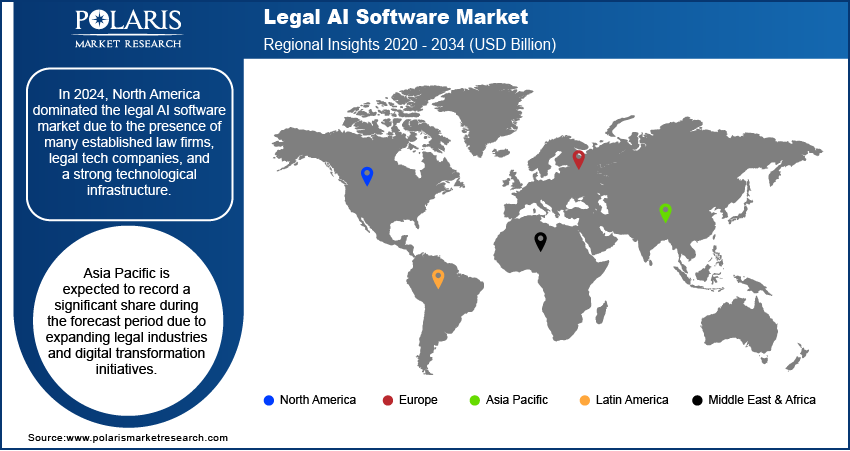

- North America accounted for the largest market share in 2024. The regional market dominance is attributed to its robust technological infrastructure and the presence of many established law firms.

- Asia Pacific is projected to experience significant growth. The expansion of the legal industries and the introduction of digital transformation initiatives are driving the regional market growth.

Industry Dynamics

- The rising complexity of legal cases and transactions has resulted in a significant increase in the amount of data that needs to be processed by law firms, fueling market expansion.

- The growing number of law businesses, along with the increasing complexity of laws, is driving the demand for legal AI software.

- Increased emphasis on the development of AI platforms that offer customized legal advice and services is creating several market opportunities.

- A lack of a skilled workforce is hindering market growth.

Market Statistics

2024 Market Size: USD 2.63 billion

2034 Projected Market Size: USD 31.69 billion

CAGR (2025-2034): 28.3%

North America: Largest Market in 2024

AI Impact on Legal AI Software Market

- The ability of AI to enhance the understanding of natural language enables software to interpret contracts, case law, and compliance documents with greater accuracy.

- Intelligent assistants powered by AI streamline routine tasks such as contract drafting, document review, and due diligence.

- Advanced AI models forecast litigation outcomes and case strategies, supporting informed decision-making.

- AI-driven monitoring ensures adherence to evolving legal frameworks. This helps reduce risks in sensitive domains like privacy and intellectual property.

To Understand More About this Research: Request a Free Sample Report

Legal AI software uses artificial intelligence to streamline legal tasks such as document review, contract analysis, and e-discovery, improving efficiency and accuracy. It helps law firms and legal departments automate routine work, allowing professionals to focus on more complex, strategic tasks.

Legal work involves many repetitive tasks, due to which many law firms and legal departments are seeking ways to automate these processes. Reviewing documents, sorting through contracts, and searching for relevant case laws are time-consuming and mundane. Legal AI software helps automate these activities, enabling professionals to focus on more important tasks such as strategy and client interaction. The growing demand for automation, driven by its ability to accelerate processes and reduce human error, is fueling the growth of the legal AI software market.

Rapid advancements in artificial intelligence technologies, such as machine learning, natural language processing (NLP), and deep learning, have greatly improved the capabilities of Legal AI software. These technologies enable AI systems to understand, interpret, and analyze complex legal language, improving their accuracy and efficiency. Improved algorithms and smarter systems now enable AI to assist in tasks previously challenging for machines, such as understanding legal nuances or predicting case outcomes. These advancements have made AI tools more powerful and accessible, driving more law firms to integrate them into their daily operations. As a result, the legal AI software market demand is expanding.

Market Dynamics

Rising Case Data Volume

Legal cases and transactions are becoming more complex, leading to a significant increase in the amount of data law firms must process. According to the Supreme Court of the United States, the number of civil cases in the US alone increased by 24%, and cases filed in the US bankruptcy courts increased by 13% in 2023 compared to 2022. Manually managing and analyzing this vast amount of data is overwhelming, resulting in errors or missed information. Legal AI software addresses this challenge by efficiently analyzing and organizing large data sets, making it easier for lawyers to find crucial information quickly. AI-driven tools are becoming increasingly essential for managing and extracting valuable insights from this information as legal data volume continues to grow, thereby driving the legal AI software market expansion.

Growth in Number of New Businesses

The growth in the number of new businesses, combined with the rising complexity of laws, is driving the demand for Legal AI software. The number of new businesses is growing; according to the US Chamber of Commerce, in 2023, 5.5 million new businesses were started. New companies face an increasing need to navigate complex legal requirements, regulations, and compliance standards. Legal AI software addresses these challenges by automating tasks such as contract review, legal research, and compliance checks, ensuring businesses remain updated on legal obligations. Additionally, the increasing complexity of laws across various industries and regions is further driving the demand for legal AI software for these businesses, propelling the legal AI software market growth.

Segment Analysis

Market Assessment by Component

The legal AI software market segmentation, based on component, includes solutions and services. The solutions segment is expected to witness significant growth during the forecast period. Increasing demand for AI-driven tools that automate tasks such as contract analysis, legal research, and document review is driving this growth. Legal AI software solutions offer valuable capabilities that improve efficiency, reduce costs, and ensure compliance with complex legal requirements. Businesses and law firms are looking to streamline their operations and reduce manual workload, leading to a rising demand for comprehensive AI solutions, thereby driving the segmental growth in the market.

Market Evaluation by Deployment

The legal AI software market segmentation, based on deployment, includes cloud and on-premise. The cloud segment dominated the legal AI software industry in 2024. Cloud-based solutions offer several advantages, such as scalability, cost-effectiveness, and easy access from anywhere. Law firms and businesses are increasingly adopting cloud deployment to streamline their operations, improve collaboration, and reduce infrastructure costs. Cloud platforms allow for faster implementation and provide secure storage for sensitive legal data. Additionally, cloud solutions are easily updated with the latest AI advancements, ensuring that users have access to the most current technology. This flexibility and efficiency are driving the segmental growth in the market.

Regional Insights

By region, the study provides legal AI software market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America dominated the market due to the presence of many established law firms, legal tech companies, and a strong technological infrastructure. The region is characterized by high adoption rates of innovative technologies and a focus on improving operational efficiency. Legal AI solutions are widely used in contract analysis, e-discovery, and compliance checks, helping businesses and law firms save time and reduce costs. Additionally, the increasing need for data security and regulatory compliance, particularly in industries such as finance and healthcare, has further fueled the demand for AI-driven legal tools in the region, thereby driving the growth of the legal AI software market in North America.

Asia Pacific is expected to record a significant share during the forecast period due to expanding legal industries and digital transformation initiatives. Countries such as China, Japan, and Singapore are leading the adoption of AI technologies in the legal sector. The growing demand for automated solutions in contract management and legal research is driving this demand. The rise of startups and international businesses in the region is also contributing to the demand for AI solutions that streamline legal processes and ensure compliance with local regulations. Increased government investments in AI technology are further driving the demand for legal AI software, thereby driving the legal AI software market in Asia Pacific.

The legal AI software market in India is experiencing substantial growth driven by the increasing demand for efficiency and cost reduction in legal services. AI tools help automate time-consuming tasks such as document review, contract analysis, and legal research, allowing firms to process large volumes of data quickly. This leads to faster decision-making and improved accuracy. The adoption of AI in India is also encouraged by the rise of tech-savvy legal professionals and the increasing need for smart solutions to manage India’s large and complex legal case volumes. The demand for AI software in the legal sector is rising with the support of startups and innovations, driving the regional market.

Key Players & Competitive Analysis Report

The legal AI software market opportunity is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers, acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the industry by introducing innovative products to meet the demand of specific market sectors. According to the legal AI software industry analysis, this competitive trend is amplified by continuous progress in product offerings. Major players in the market include Brainspace Corporation, Casetext Inc., Cs Disco Inc., IBM Corporation, Kira Inc., Lexisnexis Group Inc. (RELX Group Plc), Luminance Technologies Ltd, Neota Logic Inc., Opentext Corporation, Relativity ODA LLC, Ross Intelligence Inc., Smokeball Inc., Thomson Reuters Corporation, and Veritone Inc.

Luminance Technologies Ltd, founded in 2015, is a UK-based company specializing in artificial intelligence (AI) solutions for the legal sector. Headquartered in London, the company develops AI-driven tools to streamline legal processes such as contract analysis, negotiation, document review, and due diligence. Its platform is built using machine learning and natural language processing technologies, enabling organizations to process large volumes of legal documents efficiently. Luminance’s technology was developed by researchers from the University of Cambridge and has been adopted by legal teams across various industries. The company provides several products designed for different aspects of legal work. These include Luminance Corporate for contract lifecycle management, Luminance Diligence for due diligence processes, and Luminance Discovery for eDiscovery tasks. Other tools include Agent Lumi for contract redrafting. Additionally, its self-serve contract review tool is designed for non-legal teams within organizations. The platform supports over 80 languages and is adaptable to different jurisdictions, making it suitable for global operations. Luminance operates internationally with offices in London, Cambridge, Singapore, and Chicago. It serves a wide range of clients, including law firms, multinational corporations, and consultancy firms across more than 70 countries. The company’s technology is used by over 700 organizations to manage legal workflows more effectively.

International Business Machines Corporation (IBM) is an American multinational technology company operating in over 75 countries. It is the largest technology firm in the world and the second most valuable worldwide brand. The company mainly sells software, Infrastructure services, hardware, and IT services. The organization has an extensive network of 80,000 business associates who help it handle 5,200 clients, including 95% of the Fortune 500. Although IBM is a B2B firm, it has a significant external influence. The company provides healthcare and healthcare payer solutions through the IBM Watson Health business. However, as of 2022, the IBM Watson Healthcare business was purchased by Merative. IBM Watson started in 2010, is a supercomputer that uses Digital Workplace (AI) and advanced analytical tools to operate optimally as a "question-answering" machine. For businesses and organizations, IBM Watson uses Digital Workplace to optimize employees' time, automate complex processes, and predict future outcomes. IBM offers LegalMation, built with IBM Watson, to automate early-stage litigation tasks, such as drafting responses, reducing costs by 80%, and freeing legal professionals for higher-value work.

Key Companies

- Brainspace Corporation

- Casetext Inc.

- Cs Disco Inc.

- IBM Corporation

- Kira Inc.

- Lexisnexis Group Inc. (RELX Group Plc)

- Luminance Technologies Ltd

- Neota Logic Inc.

- Opentext Corporation

- Relativity ODA LLC

- Ross Intelligence Inc.

- Smokeball Inc.

- Thomson Reuters Corporation

- Veritone Inc.

Legal AI Software Industry Developments

March 2025: Relativity's announced its acquisition of AI company Text IQ. The acquisition aims to enhance e-discovery and compliance products such as Relativity Trace and RelativityOne.

February 2025: Legora, formerly Leya, was rebranded and launched with new product features, including agentic research tools and a Microsoft Word add-in. These features are aimed at enhancing collaboration and efficiency for legal professionals worldwide.

Legal AI Software Market Segmentation

By Type Outlook (Revenue USD Billion, 2020–2034)

- Generative AI

- Other AI

By Deployment Outlook (Revenue USD Billion, 2020–2034)

- Cloud

- On-Premise

By Component Outlook (Revenue USD Billion, 2020–2034)

- Solutions

- Services

By Application Outlook (Revenue USD Billion, 2020–2034)

- Legal Research and Analytics

- Contract Drafting and Review

- Litigation and Dispute Resolution

- Compliance and Risk Management

- Others

By Regional Outlook (Revenue USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2.63 billion |

|

Market Size Value in 2025 |

USD 3.36 billion |

|

Revenue Forecast in 2034 |

USD 31.69 billion |

|

CAGR |

28.3% from 2025–2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The legal AI software market size was valued at USD 2.63 billion in 2024 and is projected to grow to USD 31.69 billion by 2034.

The global market is projected to register a CAGR of 28.3% during the forecast period, 2025-2034.

North America had the largest share of the global market in 2024.

The key players in the market are Brainspace Corporation, Casetext Inc., Cs Disco Inc., IBM Corporation, Kira Inc., Lexisnexis Group Inc. (RELX Group Plc), Luminance Technologies Ltd, Neota Logic Inc., Opentext Corporation, Relativity ODA LLC, Ross Intelligence Inc., Smokeball Inc., Thomson Reuters Corporation, and Veritone Inc.

The cloud segment dominated the legal AI software market in 2024 due to its flexibility, versatility, and cost-effectiveness, as it does not require infrastructure investment.

The solution segment is expected to witness significant growth in the forecast period due to Increasing demand for AI-driven tools that automate tasks such as contract analysis, legal research, and document review.