Legal Marijuana Market Size, Share, Industry Analysis Report

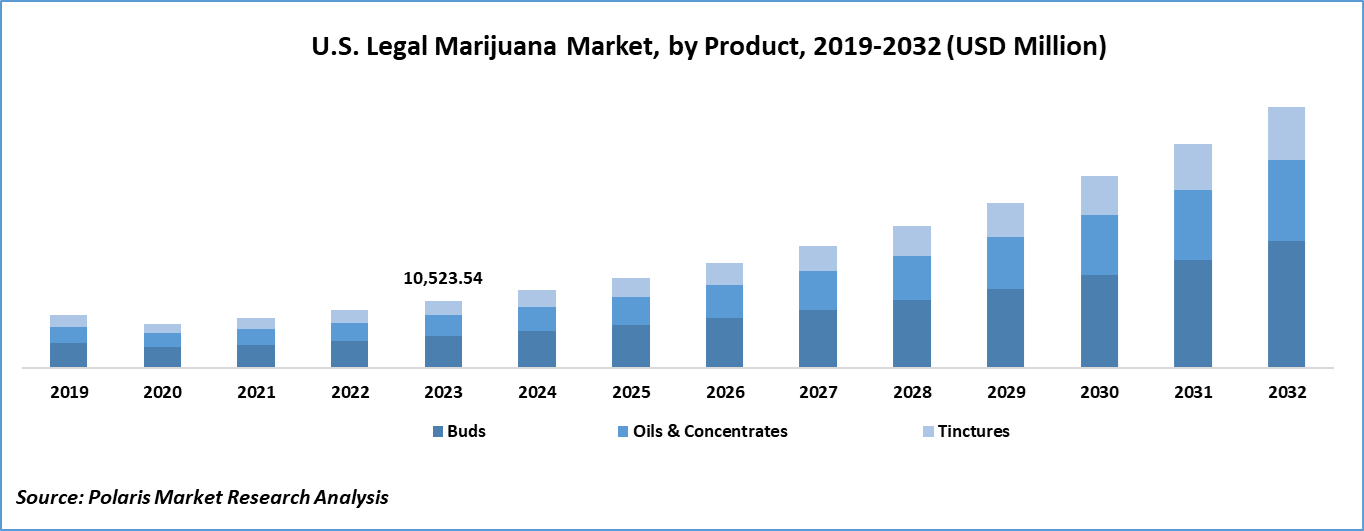

By Product Type (Buds, Oils & Concentrates, Tinctures), By Application, By Medical Application, By Compound, By Mode of Delivery, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 128

- Format: PDF

- Report ID: PM1697

- Base Year: 2024

- Historical Data: 2020-2023

Overview

The global legal marijuana market size was valued at USD 25.52 billion in 2024, growing at a CAGR of 24.8% from 2025 to 2034. Key factors driving demand include increasing medical research and clinical studies, rising tax revenues & eliminating the black-market economy, favorable government initiatives in the U.S. and Europe, and growing prevalence of various chronic diseases.

Key Insights

- In 2024, the buds segment held 64.1% market share, favored for their traditional appeal, accessibility, and consumer familiarity as the most common cannabis consumption method.

- The recreational segment is projected to register a CAGR of 40.0% during the forecast period, driven by expanding adult-use legalization and evolving societal acceptance of recreational cannabis.

- The chronic pain segment captured a 26.1% share in 2024, as patients increasingly prefer cannabis over opioids for long-term pain relief with fewer side effects.

- The CBD segment is expected to register a CAGR of 39.4% during 2025–2034, fueled by rising demand for non-intoxicating wellness products offering therapeutic benefits.

- North America held 69.0% global share in 2024, supported by mature regulations, legal medical/recreational markets, and robust industry infrastructure.

- The U.S. accounted for 94.5% of North America’s market in 2024, reflecting state-level legalization, advanced production, and diverse product offerings.

- The industry in Asia Pacific is forecasted to register a CAGR of 37.6% during the forecast period, propelled by regulatory shifts, higher healthcare spending, and growing medical cannabis adoption.

Industry Dynamics

- The U.S. and European legalization efforts and regulatory reforms are creating favorable conditions for cannabis market growth, enabling easier business operations and industry expansion.

- Rising prevalence of chronic diseases such as cancer, and arthritis is boosting medical cannabis demand, as patients seek alternative long-term treatment options.

- Strict and fragmented regulations across regions create compliance hurdles, increasing costs and operational complexity for cannabis businesses.

- Growing medical acceptance and legalization trends open new markets, driving revenue potential for innovative cannabis-based therapies and products.

Market Statistics

- 2024 Market Size: USD 25.52 billion

- 2034 Projected Market Size: USD 233.33 billion

- CAGR (2025–2034): 24.8%

- North America: Largest market in 2024

Legal marijuana refers to cannabis products that are cultivated, distributed, and consumed in compliance with government regulations for medical or recreational purposes. The increasing medical research and clinical studies focused on understanding the therapeutic potential of cannabis are boosting the growth opportunities. In February 2025, the University at Buffalo partnered with Pure Jamaican/Seven-10 Pharmaceuticals and DENT to study therapeutic cannabinoid uses. Research spans Jamaica, the U.S., and Brazil, combining lab work and clinical trials under Gene Morse’s leadership, expanding global pharmaceutical collaboration. Ongoing scientific investigations are expanding knowledge on its efficacy in managing conditions such as chronic pain, epilepsy, and multiple sclerosis, which is promoting greater acceptance among healthcare professionals and policymakers. This growing body of clinical evidence is also driving product innovation, standardized dosing, and quality assurance, leading to higher consumer confidence. They are more inclined to expand legalization frameworks as regulatory bodies observe more substantiated medical benefits, creating a robust foundation for the legal marijuana market.

The increase in tax revenues and the elimination of the black market economy through legalization would contribute to growth opportunities in the coming years. Governments are recognizing that regulated cannabis sales generate substantial fiscal benefits, funding public services such as healthcare, education, and infrastructure. Legalization also channels consumer purchases into monitored and taxed systems, reducing the circulation of unregulated products. Thus, by dismantling the illicit supply chain, authorities enhance product safety, enforce age restrictions, and improve public health outcomes. This shift cuts illegal trade and also strengthens economic transparency and accountability, making the legal marijuana industry an attractive proposition for both investors and policymakers.

Drivers & Opportunities

Favorable Government Initiatives in U.S. and Europe: Favorable government initiatives in the U.S. and Europe are driving the expansion opportunities, as progressive policy reforms, regulatory frameworks, and legalization measures are creating a more supportive business environment. In the U.S., the federal government regulates marijuana cultivation and use through the Controlled Substances Act. This law applies to all narcotic substances and does not differentiate between recreational and medical use of cannabis. In Europe, countries such as the Netherlands, Portugal, Italy, and France have been strong advocates of medical marijuana legalization. These countries have adopted liberal policies favoring the use of marijuana for medical and recreational purposes. In February 2024, the European Commission approved select components of a European Citizens Initiative related to cannabis. The approved provisions address improved access to medical cannabis, regulations governing its transportation, and dedicated funding for research into cannabis-based therapies. These initiatives often include licensing systems, quality control regulations, and research funding that encourage both medical and recreational cannabis use within safe and monitored channels. Governments are reducing legal uncertainties for producers and investors, which fosters industry growth by establishing clear guidelines. Additionally, such initiatives help promote public education and awareness, further normalizing cannabis consumption and encouraging broader market participation.

Growing Prevalence of Various Chronic Diseases: The growing prevalence of various chronic diseases is another driver fueling the demand for legal marijuana, particularly in the medical segment. Conditions such as chronic pain, cancer, arthritis, and neurological disorders often require long-term management, for which cannabis-derived treatments are increasingly being considered. An October 2024 CDC report highlighted that chronic diseases, such as heart disease, cancer, and diabetes, are the primary causes of mortality and disability in the U.S., accounting for USD 4.9 trillion in annual healthcare expenditures. Approximately 60% of Americans have at least one chronic condition, while 40% live with two or more. Its potential for providing symptom relief, reducing reliance on opioids, and improving patient quality of life is making it a valuable therapeutic option. Therefore, as the incidence of these conditions rises, more patients and healthcare providers are turning toward legal cannabis products as part of comprehensive treatment plans, thereby accelerating market expansion.

Segmental Insights

Product Type Analysis

Based on product type, the segmentation includes buds, oils & concentrates, and tinctures. The buds segment accounted for 64.10% revenue share in 2024 due to their widespread consumer familiarity, ease of availability, and established position as the most traditional form of cannabis consumption. Buds are preferred for both medical and recreational use, offering a natural, unprocessed form of the plant that appeals to consumers aiming for authenticity and full-spectrum benefits. Their relatively lower production cost and minimal processing requirements further enhance their accessibility. In addition, advancements in cultivation techniques and strain development have improved potency, aroma, and therapeutic effects, reinforcing the segment’s dominance.

The oils & concentrates segment is expected to witness a significant CAGR of 39.3%% during the forecast period due to rising demand for high-potency, discreet, and versatile cannabis products. Concentrates and oils are valued for their ease of integration into edibles, vaporizers, and medicinal formulations, providing more precise dosing and faster onset of effects. Their longer shelf life and reduced odor compared to raw buds also appeal to a broader consumer base. Additionally, technological innovations in extraction methods have enhanced product purity and consistency, making oils and concentrates an attractive choice for both experienced users and medical patients.

Application Analysis

In terms of application, the segmentation includes medical, industrial hemp, and recreational. The medical segment dominated the market with 69.12% revenue share in 2024 due to the expanding acceptance of cannabis in treatments for conditions such as chronic pain, cancer-related symptoms, neurological disorders, and anxiety. Regulatory approvals for medical cannabis programs in multiple regions, with growing clinical evidence of its efficacy, have fueled adoption among patients and healthcare providers. The medical segment also benefits from higher product standardization and dosing control, which ensures safety and reliability in treatment protocols. Furthermore, the increasing aging population and prevalence of chronic illnesses are sustaining long-term demand in this segment.

The recreational segment is expected to witness the highest CAGR of 40.0% during the forecast period owing to the progressive legalization of adult-use cannabis in several regions and shifting cultural perceptions toward its consumption. Consumers are increasingly exploring cannabis for relaxation, social use, and lifestyle enhancement, supported by a growing variety of strains, flavors, and product formats. Retail expansion and branding strategies are also contributing to its mainstream appeal. In addition, the recreational segment is attracting significant investment from the retail, tourism, and hospitality industries, further accelerating its penetration.

Medical Application Analysis

The segmentation, based on medical application, includes chronic pain, arthritis, migraine, cancer, and other medical applications. The chronic pain segment held 26.10% share of the market in 2024, driven by cannabis’s well-recognized analgesic properties and its ability to provide relief without the severe side effects associated with long-term opioid use. Patients suffering from conditions such as arthritis, neuropathy, and musculoskeletal disorders are increasingly turning to cannabis-based products for sustained pain management. The availability of multiple administration forms, such as smoking, edibles, topicals, and oils, enhances patient compliance. Moreover, medical guidelines in some regions have begun to incorporate cannabis as an alternative or adjunct therapy, further boosting its demand in chronic pain treatment.

The cancer segment is projected to witness a CAGR of 40.2% during 2025–2034, owing to its growing use in managing chemotherapy-induced neutropenia, appetite loss, pain, and fatigue. Cannabis and its derivatives are increasingly considered as part of supportive cancer care, helping to improve patient comfort and quality of life during treatment. Advances in targeted formulations and precise dosing have enhanced its acceptance among oncologists and patients. Additionally, continued research on cannabinoids potential anti-tumor effects is creating optimism for future therapeutic applications in oncology.

Compound Analysis

In terms of compound, the segmentation includes tetrahydrocannabinol (THC)-dominant, cannabidiol (CBD)-dominant, balanced THC & CBD. The tetrahydrocannabinol (THC)-dominant segment accounted for 54.44% revenue share in 2024 due to THC’s psychoactive properties, which are sought after for both recreational enjoyment and certain medical uses, such as appetite stimulation and pain relief. Products in this segment cater to consumers seeking a more pronounced euphoric experience, and they are available in diverse formats, such as flowers, edibles, and concentrates. The segment also benefits from innovation in strain breeding, offering varying potencies and flavor profiles to meet different consumer preferences. Additionally, THC-dominant products often command premium pricing in recreational markets, contributing to strong revenue generation.

The cannabidiol (CBD)-dominant segment is expected to witness the highest CAGR of 39.4% during the forecast period due to increasing consumer demand for non-psychoactive wellness products with therapeutic benefits. CBD is widely recognized for its potential in reducing anxiety, inflammation, and seizures without inducing a high, making it suitable for a broad demographic, such as pediatric and elderly patients. Its incorporation into a variety of products, such as skincare, beverages, supplements, and pet care, has expanded its market reach. Furthermore, favorable regulatory positioning in several regions has enabled rapid commercialization and acceptance of CBD-based offerings.

Regional Analysis

The North America legal marijuana market accounted for 69.00% of global market share in 2024. This dominance is attributed to its well-established regulatory frameworks, developed cannabis infrastructure, and widespread legalization for both medical and recreational purposes. The region benefits from advanced cultivation technologies, product innovation, and a highly developed distribution network, enabling efficient supply chain management. Strong investment activity, coupled with a broad consumer base familiar with cannabis use, further supports market leadership. In May 2024, Cook County launched cannabis development grant program, which granted USD 3.6 million to 40 social equity cannabis businesses. In April 2025, an additional USD 1.5 million was approved to fund eligible applicants not selected in the initial round, supporting startups and operational costs. Additionally, extensive research, public awareness campaigns, and favorable taxation policies contribute to the region’s sustained dominance in the global legal marijuana landscape.

U.S. Legal Marijuana Market Insights

The U.S. held 94.48% market share in North America legal marijuana landscape in 2024 due to its wide legalization in multiple states, advanced cultivation and processing capabilities, and a diverse product portfolio catering to both medical and recreational consumers. Strong investment inflows, well-developed retail channels, and continuous innovation in cannabis-based products have further reinforced its dominance.

Asia Pacific Legal Marijuana Market Trends

The market in Asia Pacific is projected to register a CAGR of 37.6% from 2025 to 2034, owing to shifting regulatory attitudes, rising healthcare expenditure, and growing interest in cannabis-based medical treatments. The region’s expanding middle-class population and increasing awareness of alternative therapies are driving adoption. Additionally, advancements in cultivation and extraction technologies, along with the emergence of domestic cannabis enterprises, are creating a strong growth foundation. Therefore, as governments gradually relax restrictions and promote research, Asia Pacific is expected to witness robust expansion across both medical and emerging recreational segments.

India Legal Marijuana Market Overview

The market in India is expanding, supported by an increasing focus on research into traditional and medicinal applications. Rising awareness of the economic potential of regulated cannabis cultivation, along with policy discussions on legalization, is boosting industry development and attracting entrepreneurial interest.

Europe Legal Marijuana Market Assessment

Europe held 18.84% global revenue share in 2024 attributed to the steady expansion of medical cannabis programs, harmonization of regulatory frameworks, and increased investments in research and development. The region’s focus on pharmaceutical-grade production standards and quality control is enhancing patient and healthcare provider trust in cannabis-based therapies. Furthermore, consumer interest in wellness-oriented CBD products is broadening the market’s scope beyond strictly medical use. Growing cross-border collaborations and the gradual liberalization of cannabis policies are also contributing to Europe’s strong presence in the global market.

Germany Legal Marijuana Market Outlook

Germany’s growth is driven by a robust medical cannabis framework, stringent quality standards, and increasing patient access through prescription-based programs. Strong government oversight, combined with investment in domestic cultivation and imports, is ensuring a consistent supply and supporting the integration of cannabis into mainstream healthcare practices.

Key Players & Competitive Analysis

The legal marijuana industry is witnessing competition driven by emerging markets adopting progressive policies and developed markets expanding product portfolios. Revenue opportunity is surging as small and medium-sized businesses innovate with CBD-dominant products and craft cultivation, while strategic investments by major players accelerate expansion opportunities. Competitive intelligence reveals that disruptions and trends, such as shifting consumer preferences toward wellness-focused offerings, are reshaping sustainable value chains. Revenue growth is further fueled by latent demand in Asia Pacific, where regulatory reforms and medical applications create new growth projections. Major companies leverage vendor strategies such as mergers and acquisitions to strengthen regional footprints, while technological advancements in extraction and delivery methods enhance product offerings. Economic and geopolitical shifts, including U.S. state-level legalization and European medical cannabis reforms, present both industry trends and challenges such as fragmented regulations. Expert insights highlight untapped potential in emerging market segments, though supply chain disruptions and compliance costs remain hurdles. Overall, the industry’s future development strategies hinge on balancing scalability with regulatory adaptation to capitalize on long-term price outlooks and total addressable market potential.

A few major companies operating in the legal marijuana industry include ABcann Medicinals, Inc.; Aphria Inc.; Aurora Cannabis; Canopy Growth Corporation; Cronos Group; GW Pharmaceuticals, Plc.; Lexaria Corporation; Maricann Inc.; Organigram Holdings Inc.; and Tilray.

Key Players

- ABcann Medicinals, Inc.

- Aphria Inc.

- Aurora Cannabis

- Canopy Growth Corporation

- Cronos Group

- GW Pharmaceuticals, Plc.

- Lexaria Corporation

- Maricann Inc.

- Organigram Holdings Inc.

- Tilray

Legal Marijuana Industry Developments

- August 2025: Metrc and BioTrack formed BT Government, a separate entity handling government cannabis tracking. BioTrack will focus on commercial solutions such as POS systems, while Metrc and BT Government provide regulatory tech. Operations remain unaffected, with both companies maintaining independent roles.

- May 2025: Curaleaf International expanded into Australia’s medical cannabis market, launching four flower strains through local distributor Canngea. The move aligns with its global growth strategy, leveraging partnerships to deliver regulated products in the fast-growing Australian market.

Legal Marijuana Market Segmentation

By Product Type Outlook (Revenue, USD Billion, 2020–2034)

- Buds

- Oils & Concentrates

- Tinctures

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Medical

- Industrial Hemp

- Recreational

By Medical Application Outlook (Revenue, USD Billion, 2020–2034)

- Chronic Pain

- Arthritis

- Migraine

- Cancer

- Other Medical Applications

By Compound Outlook (Revenue, USD Billion, 2020–2034)

- Tetrahydrocannabinol (THC)-Dominant

- Cannabidiol (CBD)-Dominant

- Balanced THC & CBD

By Mode of Delivery Outlook (Revenue, USD Billion, 2020–2034)

- Capsules

- Concentrates

- Edibles

- Other Delivery Methods

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Legal Marijuana Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 25.52 Billion |

|

Market Size in 2025 |

USD 31.71 Billion |

|

Revenue Forecast by 2034 |

USD 233.33 Billion |

|

CAGR |

24.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 25.52 billion in 2024 and is projected to grow to USD 233.33 billion by 2034.

The global market is projected to register a CAGR of 24.8% during the forecast period.

The North America legal marijuana market accounted for 69.00% of global market share in 2024.

A few of the key players in the market are ABcann Medicinals, Inc.; Aphria Inc.; Aurora Cannabis; Canopy Growth Corporation; Cronos Group; GW Pharmaceuticals, Plc.; Lexaria Corporation; Maricann Inc.; Organigram Holdings Inc.; and Tilray.

The medical segment dominated the market with 69.12% revenue share in 2024.

The cancer segment is projected to witness robust growth with a CAGR of 40.2% during the forecast period.