Lignin-Based Resins Market Size, Share, & Trends Analysis Report

: By Raw Material, By Product Type, By Application (Adhesives & Binders, Coatings, Composites, and Other Applications), and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5713

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

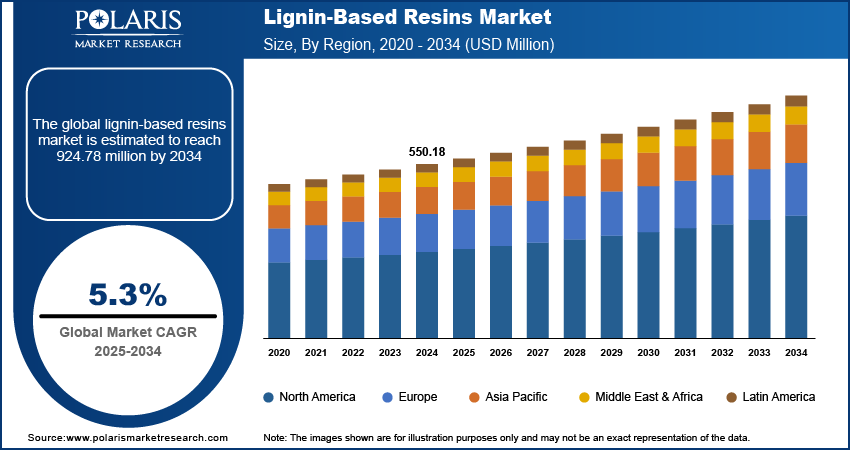

The global lignin-based resins market size was valued at USD 550.18 million in 2024, growing at a CAGR of 5.3% during 2025–2034. The demand for these resins is driven by rising focus on sustainability, expansion of end-use industries, and corporate sustainability goals.

Lignin-based resins are bio-based polymers made by incorporating lignin, a natural aromatic polymer found in plant cell walls, into resin formulations. They are used as sustainable alternatives to petrochemical-based resins in applications such as adhesives, coatings, and composites due to their environmental benefits and cost-effectiveness.

Companies and consumers alike are seeking greener alternatives to traditional materials as concerns about climate change and environmental damage are growing. Petroleum-based resins, which are made from nonrenewable resources and emit harmful substances, are increasingly being replaced by more eco-friendly options such as lignin-based resins. These bio-based resins are made from natural plant materials, making them renewable and less polluting. As a result, industries such as construction, automotive, and packaging are shifting toward using sustainable materials to reduce their environmental footprint, which is helping drive the demand for these resins.

To Understand More About this Research: Request a Free Sample Report

Research and development in the field of bio-based chemistry have significantly improved the quality and usability of lignin-based resins. Modern technologies have helped overcome major barriers such as compatibility and processing. Scientists are developing ways to modify lignin’s structure to enhance its bonding properties, heat resistance, and stability. These advancements have made it easier to incorporate lignin-based resins into a variety of industrial applications. These resins are becoming more competitive with petroleum-based alternatives with continued innovation, which is encouraging manufacturers to make the switch.

Industry Dynamics

Growing Demand from End Use Industries

Major end-use industries of lignin-based resins, such as automotive, construction, packaging, textiles, and electronics, are expanding rapidly. According to the US Bureau of Labor Statistics, the automotive industry in the US alone employed 4,486,300 people in 2024. The end-use industries increasingly adopt lignin-based resins for their applications due to pressure to reduce their environmental impact while maintaining performance and quality. Lignin-based resins offer an eco-friendly alternative without compromising strength, durability, or bonding capabilities. For example, in the automotive industry, these resins are used in lightweight components, while in construction, they serve as adhesives or insulation binders. The demand for sustainable raw materials is rising as these industries continue to grow and evolve toward greener practices. Hence, the growing demand from end-use industries boosts the requirement for lignin-based resins.

Corporate Sustainability Goals

Many companies are adopting Environmental, Social, and Governance (ESG) strategies to improve their environmental impact and meet the expectations of consumers, investors, and regulators. According to the Center for Audit Quality, in 2022, 98% of S&P 500 companies have reported ESG activity. One way to achieve these goals is by replacing conventional, fossil-based materials with renewable alternatives such as lignin-based resins. Businesses enhance their brand image, reduce their carbon footprint, and comply with green standards by using sustainable materials, thereby driving the demand for these resins.

Segmental Insights

By Raw Material Analysis

The lignosulfonates segment dominated with the largest share in 2024, as they are the most widely used raw material due to their water solubility, easy availability, and cost-effectiveness. Derived from the sulfite pulping process, they are especially popular in adhesives, binders, and dispersants. Their chemical structure makes them easier to modify and process, making them suitable for resin production. Additionally, the large-scale production of lignosulfonates in the paper & pulp industry is ensuring a consistent and affordable supply, thereby driving the segmental growth.

The Kraft lignin segment is experiencing significant growth due to its higher purity and rich aromatic content, which are valuable in developing high-performance resins. Kraft lignin provides an excellent raw material as industries seek stronger, more thermally stable, and versatile bio-based alternatives. Recent advancements in kraft lignin extraction and purification have made it more accessible for resin manufacturers. Its potential in replacing phenol in phenolic resins, particularly in automotive and construction applications, is driving its demand.

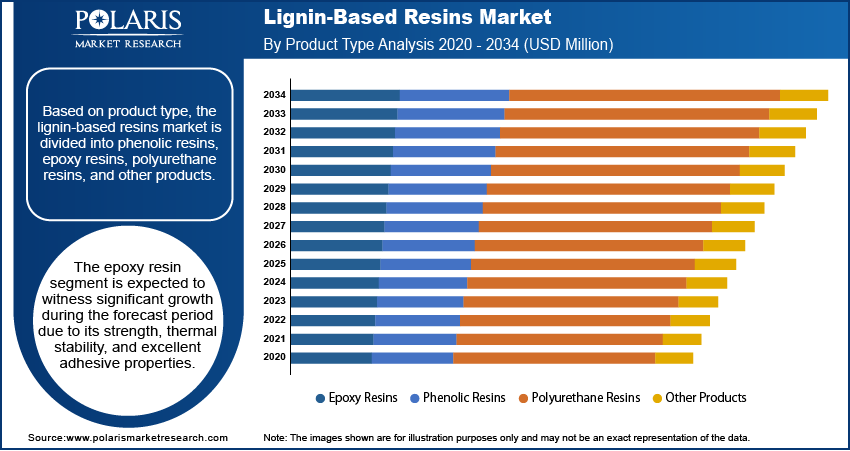

By Product Analysis

The epoxy segment is expected to record the fastest growth during the forecast period due to its strength, thermal stability, and excellent adhesive properties. Traditional epoxy resins are petroleum-based, but rising environmental concerns and regulations are pushing industries to seek greener alternatives. Lignin-based epoxy resins are especially attractive for applications in electronics, automotive, and aerospace due to their comparable performance. Ongoing R&D has improved lignin’s compatibility with epoxy systems, making it easier to replace bisphenol-A (BPA) in formulations. This combination of eco-friendliness and high-performance potential is fueling the rapid growth of the lignin-based epoxy resin segment.

By Application Analysis

The coatings segment is expected to record significant growth during the forecast period, driven by the demand for sustainable, low-VOC (volatile organic compound) alternatives in protective and decorative surfaces. Lignin-based resins provide UV resistance, thermal stability, and anti-oxidation properties, making them suitable for industrial and consumer coatings. Manufacturers are turning to bio-based options such as lignin to meet environmental standards as regulations are getting stricter around solvent-based paints and synthetic additives. Furthermore, the large-scale use of coatings in construction, packaging, and automotive sectors supports consistent demand, thereby driving lignin-based resin’s coating segment demand.

Regional Analysis

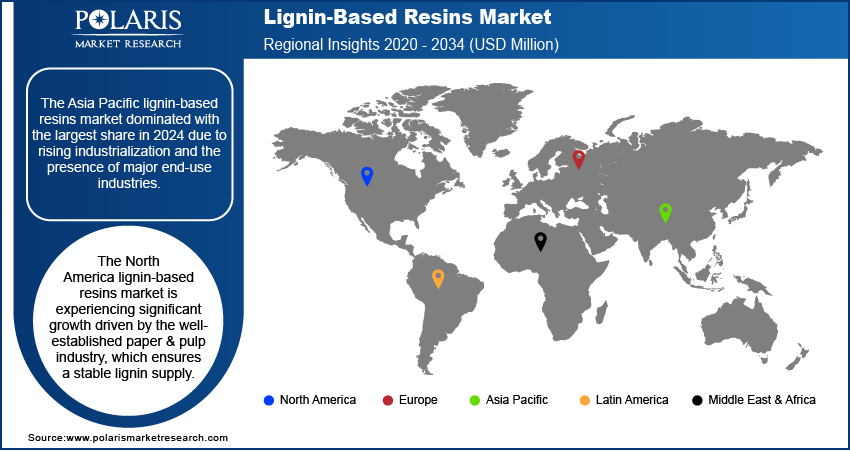

The Asia Pacific lignin-based resins market dominated with the largest share in 2024 due to its fast-growing industrial base, especially in countries such as China, Japan, and South Korea. The region is experiencing rising demand for eco-friendly materials across the construction, automotive, and electronics sectors. Additionally, large-scale paper and pulp production in countries such as China provides a steady supply of lignin. Government initiatives promoting green technologies and increasing environmental awareness are further fueling the adoption of lignin-based resins across the region.

The India lignin-based resins market is driven by rapid industrialization, environmental regulations, and growing awareness of sustainable practices. The country’s large agricultural and forestry base creates potential for lignin production as a byproduct. The demand for bio-based resins is increasing as the government is promoting green construction and eco-friendly manufacturing under initiatives such as “Make in India” and “Smart Cities”. Additionally, the Indian packaging and automotive sectors are seeking cost-effective and sustainable materials, making lignin-based resins an attractive option and thereby driving the market growth in the country.

The North America lignin-based resins market is experiencing significant growth as the region has a well-established paper and pulp industry, which ensures a stable lignin supply. Strong R&D infrastructure, along with government support for bio-based products and strict environmental regulations, are major drivers for market growth. Additionally, key industries such as automotive, aerospace, and construction are adopting sustainable materials to meet carbon reduction targets. The demand for lignin-based resin is rising in the region with increasing investments in green technologies and the presence of leading bio-resin producers, thereby driving the market growth.

The Europe lignin-based resin market is driven by its strong focus on sustainability and circular economy policies. The European Union’s Green Deal and other environmental regulations are pushing industries to reduce reliance on fossil-based materials. Countries such as Germany, Sweden, and Finland are pioneers in using lignin from their advanced pulp and paper industries to produce high-performance bio-resins. The region also benefits from significant R&D funding and strong consumer demand for eco-friendly products. Europe’s proactive stance on green materials and technological advancement boosts the adoption of this resin.

Key Players and Competitive Analysis Report

The lignin-based resins market is highly competitive, with several key players driving innovation and sustainability. Companies such as Borregaard, Domtar Corporation, Ingevity, and Stora Enso are leading with established production capabilities and strong global reach. Lignin Industries AB and Lignolix are emerging players focusing on advanced applications and bio-based alternatives to traditional plastics. MetGen and UPM Biochemicals contribute with specialized enzymes and lignin refining technologies, adding value to the supply chain. West Fraser, a major wood product company, also plays a role in lignin extraction. These companies are shaping a growing market focused on eco-friendly resin solutions.

Borregaard AS is a Norwegian company based in Sarpsborg that operates one of the world’s largest biorefineries. Established in 1889, Borregaard’s operations focus on converting wood and other renewable raw materials into a range of biochemicals and biomaterials. The company is organized into three main business segments: BioSolutions, BioMaterials, and Fine Chemicals. The BioSolutions segment produces biopolymers and biovanillin, which are used in applications such as agrochemicals, batteries, industrial binders, construction, flavors, fragrances, and food products. The BioMaterials segment manufactures specialty cellulose, primarily used as a raw material in the production of cellulose ethers, cellulose acetate, and other specialty items, as well as cellulose fibrils for industrial uses. The Fine Chemicals segment supplies intermediates for pharmaceutical contrast agents and advanced bioethanol, which is used as an alternative to synthetic ethanol. Borregaard’s main products include lignin-based biopolymers, specialty cellulose, cellulose fibrils, biovanillin, and bioethanol. The company employs ∼1,100 people and has a global footprint, with its main production facility in Sarpsborg, Norway, and additional production sites and sales offices in Europe, Asia, and the Americas. Borregaard operates in about 13 countries, with production plants in Norway and the Czech Republic and sales offices in countries such as Poland, Japan, and the US.

Stora Enso Oyj is a Finnish-Swedish company operating in the renewable materials sector, primarily involved in the production of packaging, biomaterials, wood products, and forest management. The company manages ∼1.4 million hectares of forest land, making it one of the largest private forest owners in the world. Its business is organized into several segments: Packaging Materials, Packaging Solutions, Biomaterials, Wood Products, and Forest. The Packaging Materials segment produces various types of packaging boards, including consumer packaging boards, carton boards, container boards, and liquid packaging boards. Packaging Solutions converts these boards into packaging products for food service, retail, and other industries. The Biomaterials segment focuses on materials such as lignin and cellulose, which are used in different industrial applications. Wood Products include sawn timber and engineered wood products intended for construction and other uses. The Forest segment manages the company’s forest assets and supplies raw materials to other business areas. Stora Enso’s operations are mainly concentrated in Europe, with production facilities and sales offices across the Nordic countries, Central Europe, and other parts of the continent. The company also maintains a presence in Asia and the Americas to serve global markets. Key production sites are located in Finland, Sweden, and other European countries. In recent years, the company has restructured its packaging business into four main areas and reorganized its divisions into seven business areas to improve operational focus and customer service. Stora Enso produces lignin, a renewable material derived from wood, used as a natural binder and dispersant in applications such as adhesives, resins, and construction materials, offering an alternative to fossil-based ingredients in various industrial processes.

Key Players

- Borregaard

- Domtar Corporation

- Ingevity

- Lignin Industries AB

- Lignolix

- MetGen

- Stora Enso

- UPM Biochemicals

- West Fraser

Industry Developments

In May 2025, Lignin Industries secured €3.9 million (USD 4.42 million) in funding to scale up its bio-based thermoplastic, Renol. Derived from lignin, Renol aims to replace fossil-based plastics. The company also partnered with Hellyar Plastics to expand into various consumer product sectors.

Lignin-Based Resins Market Segmentation

By Raw Material Outlook (Revenue, USD Million, 2020–2034)

- Kraft Lignin

- Lignosulfonates

- Organosolv Lignin

- Other Materials

By Product Type Outlook (Revenue, USD Million, 2020–2034)

- Phenolic Resins

- Epoxy Resins

- Polyurethane Resins

- Other Products

By Application Outlook (Revenue, USD Million, 2020–2034)

- Adhesives & Binders

- Coatings

- Composites

- Other Applications

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Lignin-Based Resins Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 550.18 Million |

|

Market Size Value in 2025 |

USD 587.87 Million |

|

Revenue Forecast by 2034 |

USD 924.78 Million |

|

CAGR |

5.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 550.18 million in 2024 and is projected to grow to USD 924.78 million by 2034.

The global market is projected to register a CAGR of 5.3% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few of the key players in the market are Borregaard, Domtar Corporation, Ingevity, Lignin Industries AB, Lignolix, MetGen, Stora Enso, UPM Biochemicals, and West Fraser.

The lignosulfonates segment dominated the market share in 2024.

The coating segment is expected to witness a significant growth during the forecast period.