Linerless Labels Market Size, Share, Trends, & Industry Analysis Report

: By Product Type (Water-Based, Solvent-Based, Hot Melt-Based, UV Curable, and Others), By Printing Technology, By Adhesion, By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 118

- Format: PDF

- Report ID: PM3314

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

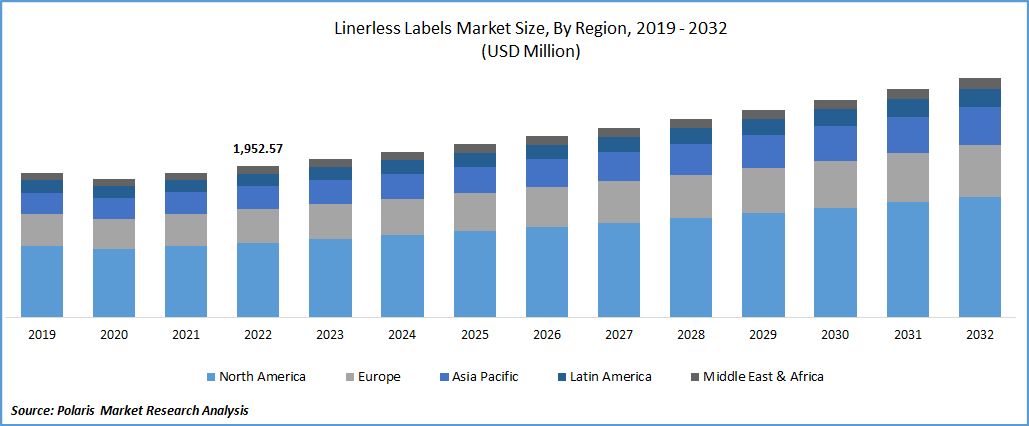

The linerless labels market size was valued at USD 1.90 billion in 2024 and is expected to grow at a CAGR of 4.03% from 2025–2034. Key factors driving the demand for linerless labels include increasing demand for packaged food and beverages, growing focus on sustainability, and cost-efficiency and operational benefits.

To Understand More About this Research: Request a Free Sample Report

Linerless labels use a special adhesive and a silicone release coating, which allows them to stick to products and also peel away easily. This design reduces waste, lowers disposal costs, and positively impacts the environment by decreasing the business's or warehouse's footprint. The rolls of linerless labels contain more labels compared to standard ones, which saves on transportation and storage expenses. The use of linerless labels also improves productivity and manufacturing efficiency as there are fewer media roll changes needed between print runs, leading to less downtime and increased manufacturing efficiency.

Industry Dynamics

Increasing Demand for Packaged Food and Beverages

The escalating demand for packaged food and beverages is a primary driver. This surge is linked to evolving consumer lifestyles, characterized by busier schedules and a preference for convenience foods. This trend necessitates efficient and effective labeling solutions for a wide range of products, where linerless labels offer advantages in terms of application speed and material usage compared to traditional labels. Therefore, the continuous expansion of the packaged food and beverage industry directly fuels the demand trends for linerless labels.

Growing Focus on Sustainability

The increasing global emphasis on sustainability and environmental conservation is another driver. Regulatory bodies and consumers alike are pushing for more eco-friendly packaging options. The United Nations Environment Programme (UNEP) highlighted in a 2022 report the urgent need to reduce plastic waste and promote circular economy principles in packaging. Linerless labels contribute to this goal by eliminating the silicone-coated release liner, thereby reducing waste volume and the environmental footprint associated with label production and disposal. This alignment with sustainability objectives is a key growth factor propelling the adoption of linerless labels across various industries seeking greener alternatives.

Cost-Efficiency and Operational Benefits

The cost-efficiency and operational benefits offered by linerless labels act as a major driver for their increasing penetration. Linearless labels reduce the frequency of roll changes by containing more labels per roll compared to traditional labels, leading to less downtime and increased productivity in labeling processes. A 2021 report by the Bureau of Energy Efficiency (BEE), Government of India, emphasized the importance of energy and material efficiency in industrial processes. Linerless labels contribute to material savings in packaging and potentially lower transportation and storage costs due to the higher label density. These economic and operational advantages make linerless labels an attractive solution for businesses looking to optimize their supply chain and reduce overall expenses, thus driving the adoption.

Segmental Insights

Assessment By Product Type

By product type, the segmentation includes water-based, solvent-based, hot melt-based, UV curable, and others. Among these, the hot melt-based segment held the largest revenue share in 2024. This dominance is primarily attributed to the versatility and strong adhesion properties of hot melt adhesives across a wide range of applications. Their ability to bond effectively to various surfaces, coupled with their cost-effectiveness for high-volume applications, makes them a preferred choice for many industries. The robust performance and established infrastructure for hot melt-based linerless labels contributed significantly to their dominant position.

The UV curable segment is anticipated to exhibit the fastest growth rate during the forecast period. This rapid growth is fueled by the increasing demand for high-quality, durable, and visually appealing labels. UV curable adhesives offer excellent resistance to chemicals, abrasion, and environmental factors, making them ideal for applications requiring long-lasting and premium finishes. Furthermore, advancements in UV curing system and technology have led to faster processing speeds and reduced energy consumption, enhancing their appeal and driving their adoption across diverse sectors seeking superior label performance and aesthetics.

Evaluation By Printing Technology

In terms of printing technology, the segmentation includes digital printing, flexo printing, offset printing, letterpress, gravure printing, screen printing, and others. The flexo printing segment dominated the revenue share in 2024 due to its efficiency in handling long print runs and its compatibility with a wide array of substrates, which are crucial for the diverse applications of linerless labels across various industries. The established infrastructure and cost-effectiveness for large-scale production also contributed to the widespread adoption of flexo printing.

Digital printing is projected to be the fastest growing printing technology segment in the coming years. This high growth rate is driven by the increasing demand for customized and short-run label applications, which digital printing efficiently caters to without the need for printing plates. The advantages of digital printing, such as variable data printing, reduced setup times, and the ability to produce intricate designs, are making it an increasingly attractive option for businesses seeking flexibility and personalization in their labeling processes, thus fueling its rapid expansion.

Evaluation By Adhesion

Based on adhesion, the segmentation includes permanent, removable, repositionable, and others. Among these, the permanent adhesion segment accounted for the major revenue share in 2024. This dominance is primarily driven by the extensive need for secure and long-lasting labeling across a multitude of industries, including food and beverage, pharmaceuticals, and logistics. The reliability of permanent adhesives in ensuring that labels remain affixed throughout the product lifecycle contributed significantly to their widespread use and substantial presence.

The repositionable adhesion segment is anticipated to witness the fastest growth rate during the forecast period. This growth is being propelled by the increasing demand for labels that offer flexibility and ease of use, allowing consumers to adjust or remove labels without damaging the product or the label itself. Applications in retail, where price tags or promotional labels may need frequent changes, and in logistics, for temporary identification, are driving the demand for repositionable linerless labels. This need for adaptability and convenience is expected to fuel the rapid expansion of this segment.

Evaluation By End Use

By end use, the segmentation includes retail, food & beverages, home & personal care, logistics, pharmaceuticals, and others. The food & beverages segment held the largest revenue share in 2024 due to the high volume of packaged goods in this sector, where linerless labels are extensively used for product identification, branding, and providing essential consumer information. The continuous demand for packaged food and beverage products globally ensured a substantial and consistent need for linerless labeling solutions, strengthening the segment's leading position.

The logistics segment is projected to demonstrate the fastest growth rate in the coming years. This rapid expansion is driven by the increasing adoption of automation and the need for efficient and sustainable labeling solutions in warehousing, shipping, and inventory management. Linerless labels offer benefits such as reduced waste and increased roll capacity, which are particularly advantageous in streamlining logistics operations. The growing e-commerce sector and the subsequent rise in shipping activities are further contributing to the escalating demand for linerless labels in the logistics industry.

Regional Analysis

Europe linerless labels market accounted for the largest share in 2024. This dominance is attributed to the region's stringent environmental regulations promoting sustainable packaging solutions, the presence of well-established end-use industries such as food & beverage and pharmaceuticals, and a high level of technological adoption in labeling processes. The proactive stance towards sustainability and the mature industrial landscape have propelled a significant demand of linerless label solutions across various applications in Europe.

The Asia Pacific region is anticipated to register the fastest growth during the forecast period. This rapid expansion is fueled by the growing growth of end-use industries, including food processing, retail, and logistics, particularly in rapidly developing economies such as India, Thailand, and others. Increasing investments in manufacturing, rising consumer awareness regarding sustainable packaging, and a growing demand for efficient labeling solutions are key factors propelling the growth of Asia Pacific linerless labels market in the coming years.

Key Players and Competitive Insights

Some of the major active players in the linerless labels market include Avery Dennison Corporation, Multi-Color Corporation, CCL Industries Inc., Constantia Flexibles Group GmbH, Coveris Management GmbH, Mondi Group, UPM Raflatac (UPM), Herma GmbH, SATO Holdings Corporation, Cenveo Corporation, Fort Dearborn Company, andтермоаппликация Ltd. (if applicable, parent organization name would be in brackets). These companies offer a diverse range of linerless label products catering to various end-use industries and applications.

The competitive landscape is characterized by a mix of global and regional players. Competition is driven by factors such as product innovation, material advancements, printing technology integration, and the ability to provide customized solutions that meet specific customer needs. Key strategies adopted by participants include expanding product portfolios, focusing on sustainable and cost-effective solutions, and strengthening their distribution networks to enhance penetration. Collaborations, partnerships, and strategic acquisitions also play a role in shaping the competitive dynamics.

List of Key Companies in Linerless Labels Industry:

- Avery Dennison Corporation

- CCL Industries Inc.

- Cenveo Corporation

- Constantia Flexibles Group GmbH

- Coveris Management GmbH

- Fort Dearborn Company

- Herma GmbH

- Mondi Group

- Multi-Color Corporation

- SATO Holdings Corporation

- UPM Raflatac (UPM)

Linerless Labels Industry Developments

- March 2024: UPM Raflatac, a global supplier of innovative and sustainable self-adhesive paper and film products, opens a new slitting and distribution terminal in Mumbai, India.

- June 2023: CCL Industries Inc. completed the acquisition of a specialty label company, Flexible Pouches, based in Europe. This acquisition broadened CCL's product portfolio and geographical reach, strengthening its position.

Linerless Labels Market Segmentation

By Product Type Outlook (Revenue – USD Billion, 2020–2034)

- Water-Based

- Solvent-Based

- Hot Melt-Based

- UV Curable

- Others

By Printing Technology Outlook (Revenue – USD Billion, 2020–2034)

- Digital Printing

- Flexo Printing

- Offset Printing

- Letterpress

- Gravure Printing

- Screen Printing

- Others

By Adhesion Outlook (Revenue – USD Billion, 2020–2034)

- Permanent

- Removable

- Repositionable

- Others

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- Retail

- Food & Beverages

- Home & personal care

- Logistics

- Pharmaceuticals

- Others

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest f Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest f Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest f Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest f Latin America

Linerless Labels Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.90 billion |

|

Market Size in 2025 |

USD 1.97 billion |

|

Revenue Forecast by 2034 |

USD 2.81 billion |

|

CAGR |

4.03% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The linerless labels market has been segmented into detailed segments of product type, printing technology, adhesion, and end use. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Market Entry Strategies: Growth is significantly driven by emphasizing sustainability and cost-effectiveness to attract environmentally conscious businesses and those seeking operational efficiencies. Marketing strategies should highlight the waste reduction, lower transportation costs, and enhanced productivity benefits of linerless solutions. Collaborations with end-use industries, such as food and beverage and logistics, to showcase successful applications can further drive adoption. Educational campaigns emphasizing the versatility and advancements in linerless label technology will also be crucial. Focusing on customized solutions that address specific industry needs and regulatory requirements will enhance market penetration and foster long-term growth.

FAQ's

The global linerless labels market size is expected to reach USD 3,090.81 million by 2032.

Key players in the linerless labels market are 3M Company, Avery Dennison, Coveris, Cenveo Corporation, Dykam, DuraFast Label, Gipako UAB, Innovia Films, L&N Label Company.

Asia-Pacific contribute notably towards the global linerless labels market.

The global linerless labels market expected to grow at a CAGR of 4.7% during the forecast period.

The linerless labels market report covering key segments are product type, printing technology, adhesion, end-user, and region.